USDJPY: the US dollar continues to dominate the yen

The increase in the US PPI and the Fed chair’s speech have strengthened the US dollar. Find out more in our analysis for 14 November 2024.

USDJPY forecast: key trading points

- US initial jobless claims: previously at 221,000, projected at 224,000

- The US Producer Price Index (PPI) for October: previously at 0.0%, projected at 0.2%

- A speech by US Federal Reserve Chair Jerome Powell

- USDJPY forecast for 14 November 2024: 156.15

Fundamental analysis

US initial jobless claims reflect the number of people who applied for unemployment benefits for the first time during the previous week. The indicator assesses the state of the labour market, with increased claims typically signalling rising unemployment. The last figure was 221,000, and the fundamental analysis for 14 November 2024 appears somewhat pessimistic, suggesting an increase in claims to 224,000. While this change is not critical, the actual data could have some impact on the USDJPY rate.

The US Producer Price Index (PPI) is a crucial economic indicator that tracks price changes for goods and services sold in bulk, i.e., at the production stage. It highlights how price fluctuations at the production level can impact overall economic spending even before products reach consumers.

The PPI is calculated and published monthly by the Bureau of Labour Statistics (BLS) and covers several vital economic sectors, including agriculture, mining, and construction. It is an essential tool for monitoring inflationary trends, as rising producer prices often lead to higher prices for goods and services in the consumer market. The forecast for 14 November 2024 suggests a potential rise to 0.2%. Under the current economic conditions, this could trigger further upward momentum for the USDJPY pair.

Before the close of the US trading session, US Federal Reserve Chair Jerome Powell will deliver a speech which could significantly impact the USDJPY rate. If investors and traders positively perceive a positive stance from the Federal Reserve on the US dollar, the USDJPY pair could continue its upward trajectory. Powell’s speech and the favourable outlook for the Fed’s monetary policy would support the US dollar’s strength against the yen. The market currently appears to favour positive sentiment towards the USDJPY pair.

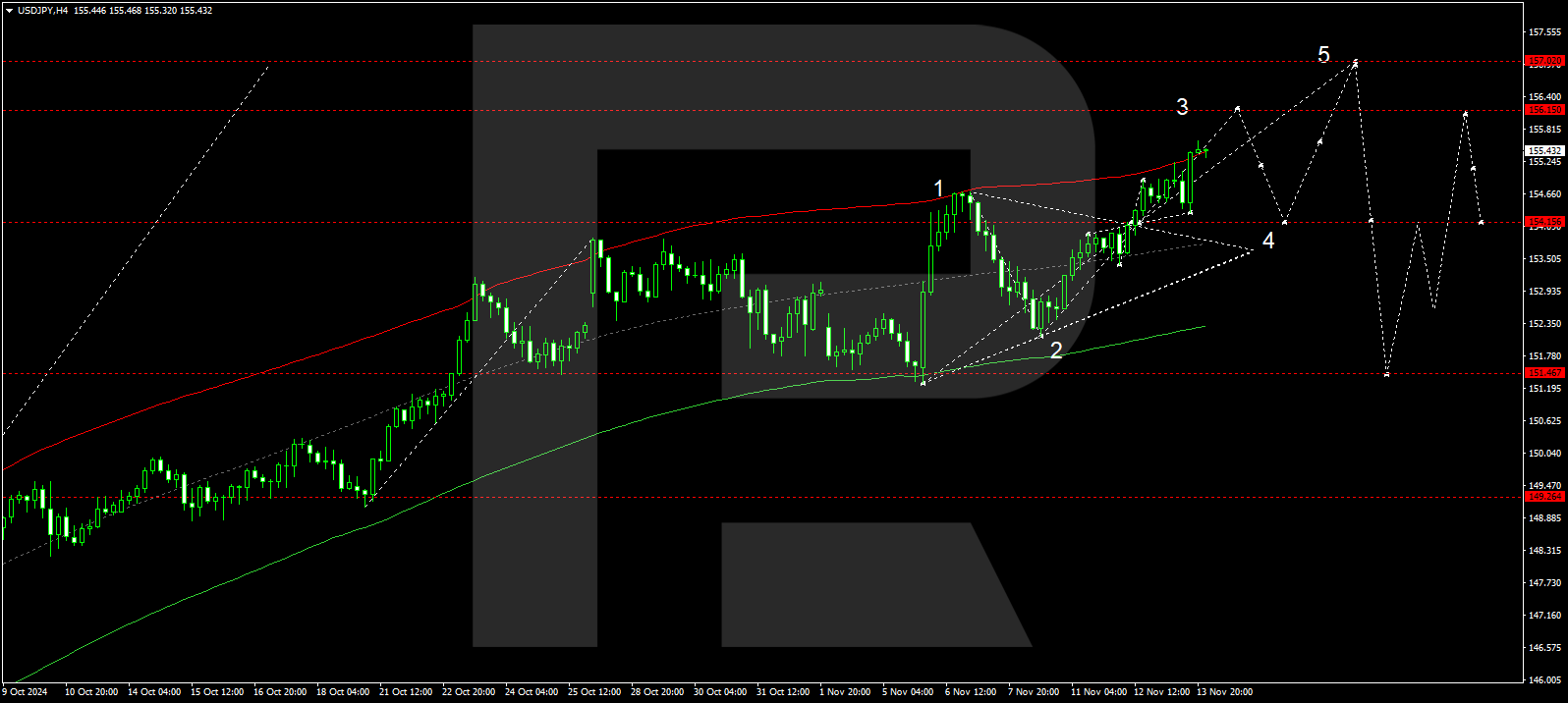

USDJPY technical analysis

The USDJPY H4 chart shows that the market has breached the 155.25 level and is progressing towards 156.15. The price is expected to reach this local target today, 14 November 2024. After this, a correction could develop towards 154.34. Subsequently, the growth wave could continue towards 157.00, the main target.

The Elliott Wave structure and growth wave matrix, with a pivot point at 154.15, technically confirm this scenario for the USDJPY rate. The market is currently at the upper boundary of a price envelope, with the growth wave expected to reach 156.15. If the price rebounds from the envelope’s upper boundary, a corrective matrix could develop, targeting the lower boundary at 154.34. Subsequently, a growth wave may resume, targeting the envelope’s upper boundary at 157.00.

Summary

Together with technical analysis for today’s USDJPY forecast, the growth in the US PPI and the Fed chair’s speech suggest that the growth wave could extend towards the 156.15 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.