USDJPY develops a rally: the yen is again a victim of market developments

The USDJPY pair continues its ascent as investors assess Japan’s GDP data. Discover more in our analysis for 15 November 2024.

USDJPY forecast: key trading points

- The USDJPY pair moves in line with the rally

- Investors assess the latest Japanese GDP statistics

- USDJPY forecast for 15 November 2024: 157.15

Fundamental analysis

The USDJPY rate surged to 156.38 on Friday.

The market is scrutinising today’s statistics. Japan’s economy grew by 0.2% quarter-on-quarter in Q3 2024, a significant slowdown compared to the 0.5% growth in Q2. Nevertheless, this marks the second consecutive quarter of positive growth. On a year-on-year basis, the economy expanded by 0.9%, significantly below the 2.2% level of Q2.

Uncertainty remains high regarding the normalisation of the Bank of Japan’s policy. Mixed statistics and recent political developments suggest an even gloomier outlook. Making critical decisions under such conditions proves challenging.

The USDJPY forecast is so far in favour of the US dollar.

USDJPY technical analysis

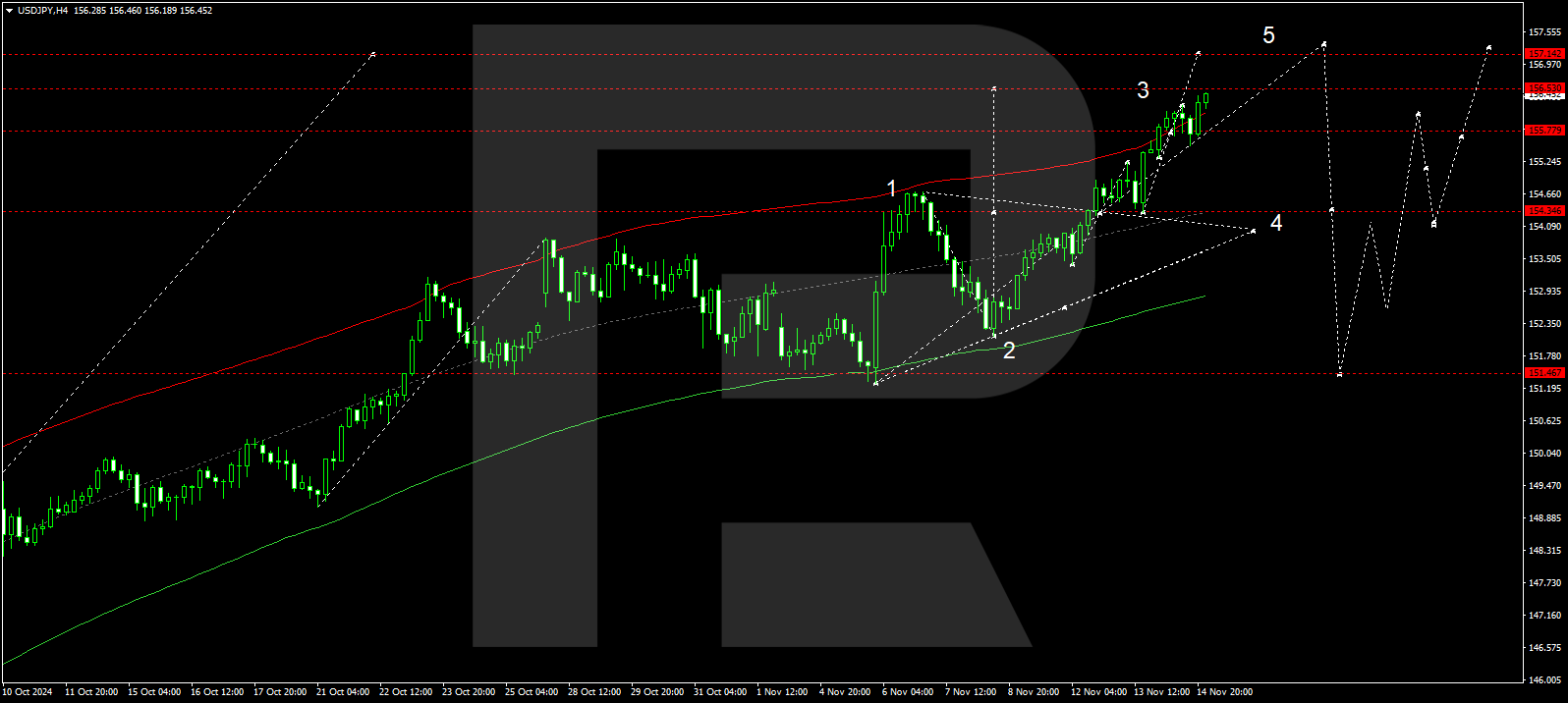

The USDJPY H4 chart shows that the market has found support at 155.77 and is maintaining its upward momentum towards 156.55. Today, 15 November 2024, the growth wave could extend towards the main target of 157.15. Once this level is reached, a consolidation range is expected to form below it. A correction may begin if the price breaks downward from this range, targeting 154.34.

The Elliott Wave structure and growth wave matrix, with a pivot point at 154.34, technically support this scenario for the USDJPY pair. The market is currently at the upper boundary of a price envelope, with the growth wave expected to culminate at 157.15. If the price rebounds downwards from the envelope’s upper boundary, a correction towards its lower boundary at 154.34 is likely.

Summary

The USDJPY pair is rising rapidly, and the market is placing the yen in a highly vulnerable position. Technical indicators for today’s USDJPY forecast suggest that the growth wave could continue towards 157.15.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.