USDJPY: the yen may lose ground against the US dollar again

A decline in Japan’s fundamental indicators and stabilising US inflation may trigger a new growth wave in the USDJPY pair. More details in our analysis for 22 November 2024.

USDJPY forecast: key trading points

- Japan’s nationwide core Consumer Price Index (y/y): previously at 2.4%, currently at 2.3%

- US services PMI: previously at 55.0, projected at 55.2

- University of Michigan US inflation expectations: previously at 2.6%, projected at 2.6%

- USDJPY forecast for 22 November 2024: 156.17 and 157.60

Fundamental analysis

Japan’s nationwide core CPI reflects the price dynamics of goods and services from the consumer perspective. It is a key tool for evaluating changes in consumer preferences and inflation trends. Energy and food prices are excluded from the index due to seasonal fluctuations in these categories.

The impact of CPI on currency rates is not always straightforward. While CPI growth might prompt interest rate hikes, strengthening the national currency, it can also amplify challenges during economic downturns, leading to currency depreciation.

According to the analysis for 22 November 2024, the minor decline from 2.4% to 2.3% has contributed to the correction of the yen.

The US services PMI provides insights into various industries, including transport, communication, financial intermediation, business and consumer services, information technology, and the hotel and restaurant sectors.

The forecast for 22 November 2024 appears somewhat optimistic, suggesting the PMI could rise slightly by 0.2 points to 55.2. As the indicator is still above the 50.0 level, this increase supports optimism for the US dollar against the Japanese yen.

The University of Michigan’s US inflation expectations may decrease to 2.6%. It is worth noting that, contrary to earlier projections, the indicator has remained within the 2.6-2.7% range for several months. The slight decline of 0.1% is insignificant, indicating some stabilisation in the US economy.

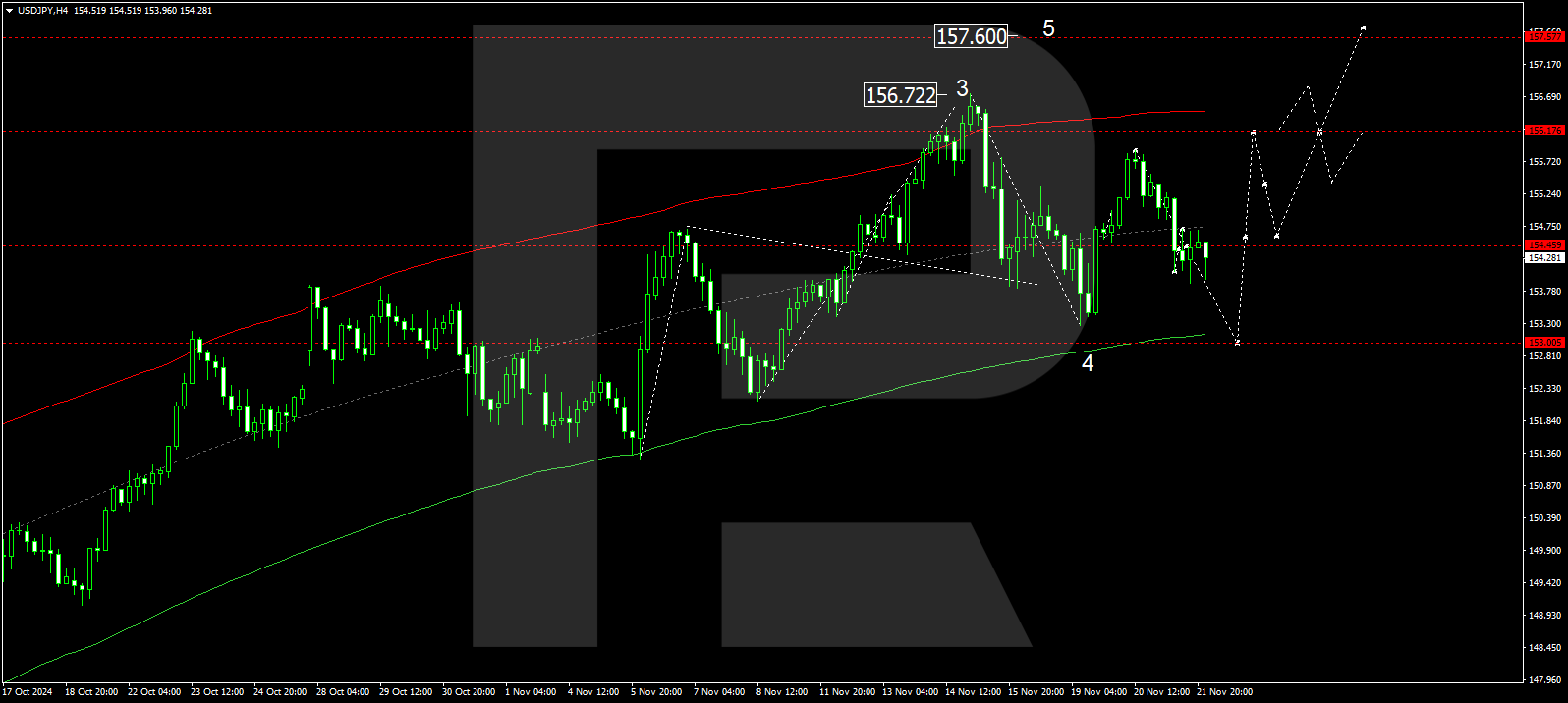

USDJPY technical analysis

The USDJPY H4 chart indicates that the market has formed a narrow consolidation range around the 154.45 level. A downward breakout could lead to the correction continuing to the 153.00 level (testing from above) today, 22 November 2024. Conversely, an upward breakout might lead to a wave towards 156.20, potentially extending to 157.60, the main target.

The Elliott Wave structure and wave growth matrix, with a pivot at 154.45, technically support this scenario for the USDJPY rate. This pivot acts as the central line of a price envelope around which the market is consolidating. A downward breakout could extend the correction towards the envelope’s lower boundary at 153.00. Conversely, an upward breakout may spur a growth wave towards the envelope’s upper boundary at 157.60.

Summary

Coupled with technical analysis for today’s USDJPY forecast, rising US indices suggest that a growth wave could continue towards the 156.17 and 157.60 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.