Daily technical analysis and forecast for 16 January 2026

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 16 January 2026.

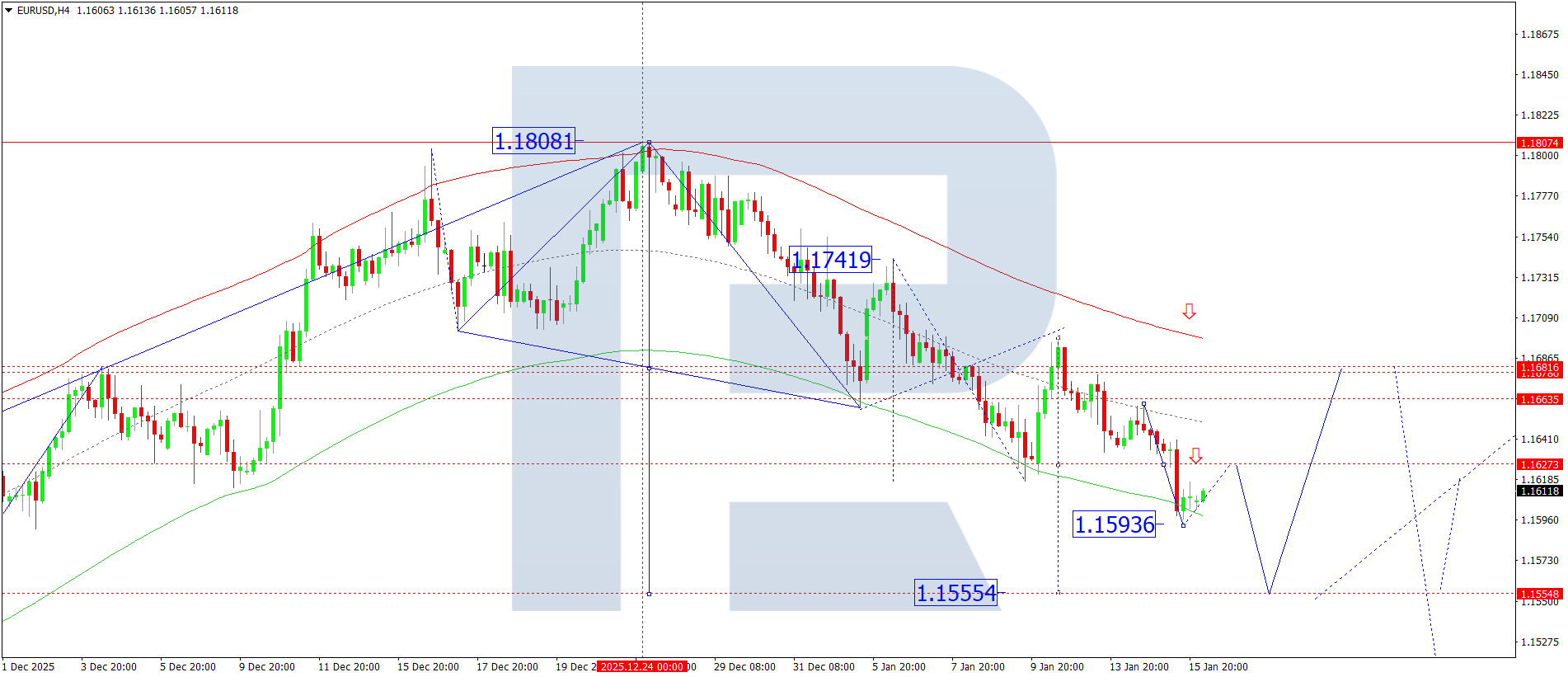

EURUSD forecast

On the H4 chart of EURUSD, the market continues to develop a downward wave towards the 1.1555 level. Today, 16 January 2026, the price broke below the 1.1623 level and reached 1.1594. Subsequently, an upward move towards the 1.1623 level (testing from below) remains possible. In practice, the market may form a trend continuation pattern to the downside, with the target at 1.1555.

Technically, this scenario is confirmed by the indicated Elliott wave structure and the downward wave matrix with a pivot point at the 1.1680 level. This level is considered key in the wave structure for EURUSD. At the moment, the market is forming a downward wave towards the lower boundary of the Price Envelope at 1.1555. It is relevant today to expect this level to be reached and the start of growth towards its upper boundary at 1.1700.

Technical indicators for today’s EURUSD forecast suggest a decline to the 1.1555 level.

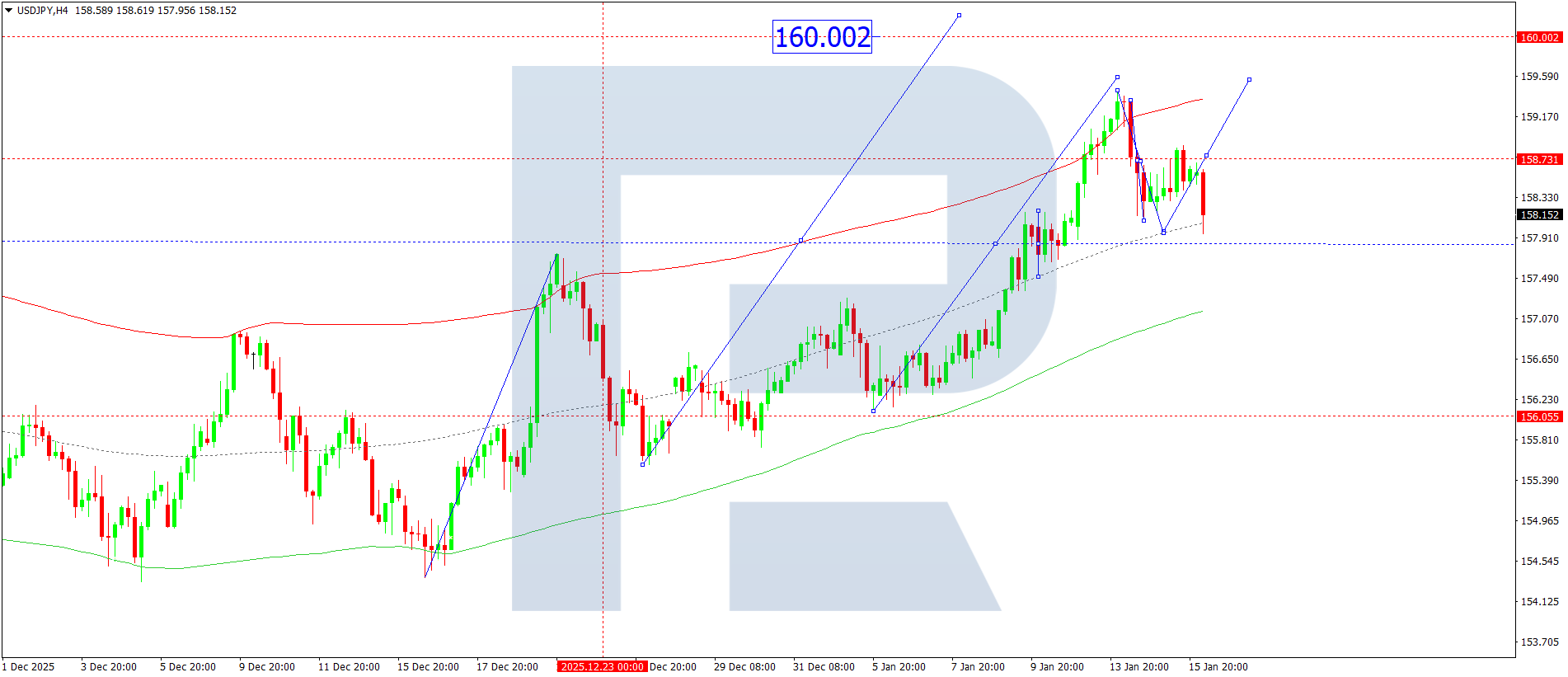

USDJPY forecast

On the H4 chart of USDJPY, the market completed a corrective wave to the 158.00 level. Today, 16 January 2026, an upward wave towards the 159.59 level is expected to start, with the prospect of trend continuation towards 160.00.

Technically, this scenario for USDJPY is confirmed by the indicated Elliott wave structure and the upward wave matrix with a pivot point at the 156.00 level. This level is considered key in the structure of this wave. At the moment, the market completed an upward wave towards the upper boundary of the Price Envelope at 159.33, followed by a corrective move to its central line at 158.09. An upward wave towards 160.00 is expected to begin.

Technical indicators for today’s USDJPY forecast suggest the start of growth towards the 160.00 level.

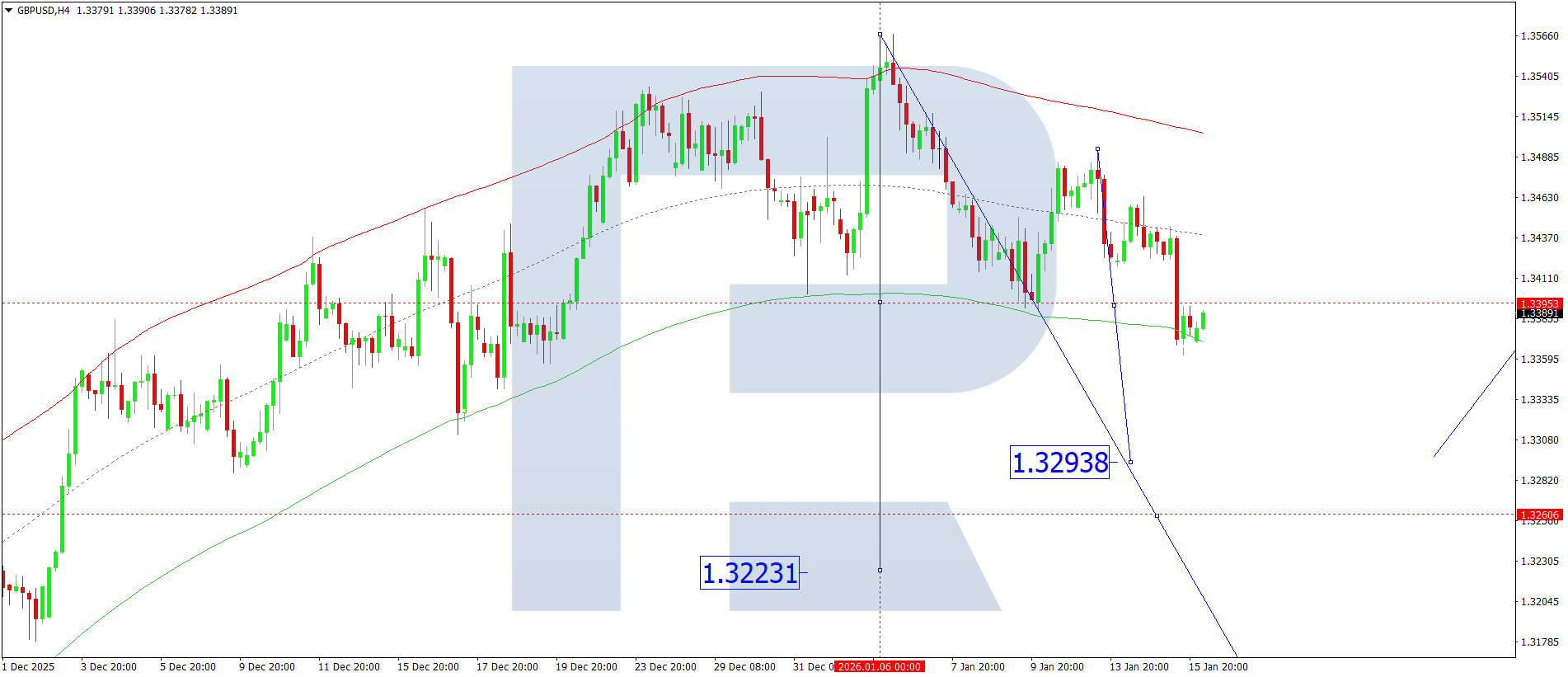

GBPUSD forecast

On the H4 chart of GBPUSD, the market completed a downward wave to the 1.3363 level. Today, 16 January 20256, a consolidation range is expected to develop above this level. In the case of an upward breakout, a corrective move towards the 1.3411 level remains possible. Conversely, a downward breakout would open the door for a wave towards the 1.3293 level.

Technically, this scenario for GBPUSD is confirmed by the indicated Elliott wave structure and the downward wave matrix with a pivot point at the 1.3455 level. This level is considered key in the structure of this wave. Today, the probability of a downward wave developing towards the lower boundary of the Price Envelope at 1.3293 is considered. Further, an upward leg towards the upper boundary at 1.3393 remains possible. After this wave is complete, a new downward wave towards its lower boundary at 1.3260 is expected to start.

Technical indicators for today’s GBPUSD forecast suggest a downward wave towards the 1.3290 level.

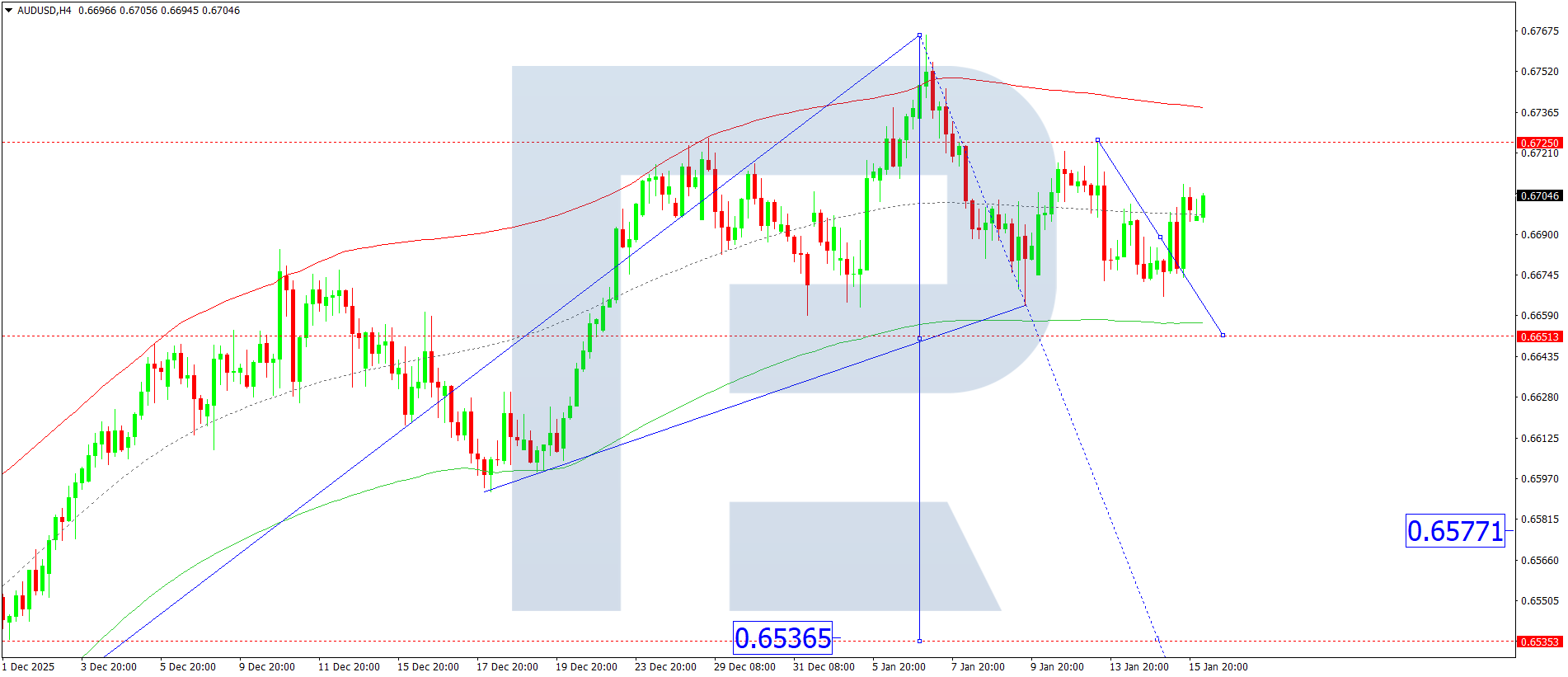

AUDUSD forecast

On the H4 chart of AUDUSD, the market is forming a consolidation range around the 0.6700 level. Today, 16 January 2026, the range expanded downwards to 0.6666 and upwards to 0.6700. After that, a downward wave towards 0.6650 could start. A breakout below this level would open the potential for a wave towards 0.6595.

Technically, this scenario is confirmed by the indicated Elliott wave structure and the downward wave matrix for AUDUSD with a pivot point at the 0.6666 level. This level is considered key in the structure of this wave. At the moment, the market is forming a correction towards the upper boundary of the Price Envelope at 0.6700. Further decline towards its lower boundary at 0.6600 is expected.

Technical indicators for today’s AUDUSD forecast suggest the start of a decline towards the 0.6600 level.

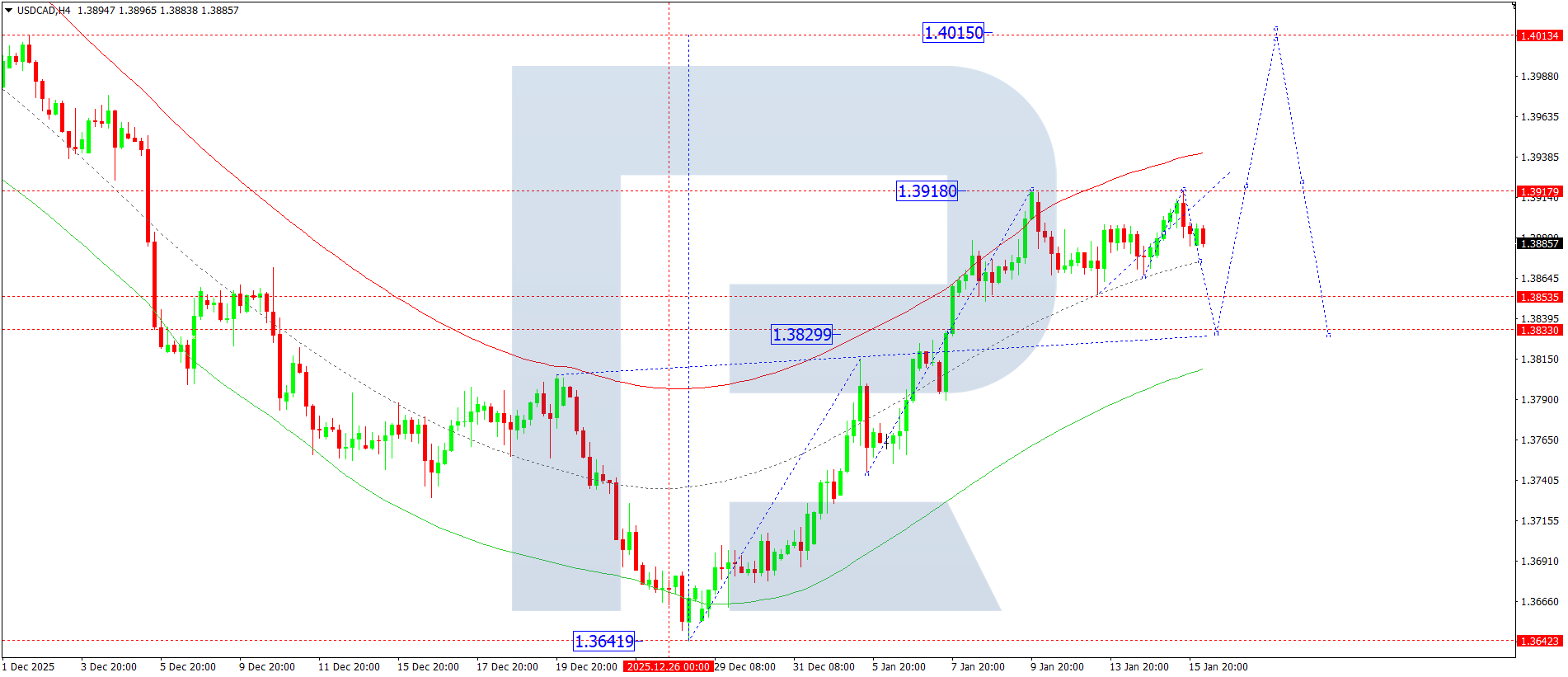

USDCAD forecast

On the H4 chart of USDCAD, the market is forming a consolidation range around the 1.3883 level. Today, 16 January 2026, the range expanded downwards to 1.3855 and upwards to the 1.3890 level. An upward breakout could initiate a new upward wave towards the 1.4010 level, the first target.

Technically, this scenario is confirmed by the indicated Elliott wave structure and the upward wave matrix with a pivot point at the 1.3833 level. This level is considered key for USDCAD in the structure of this wave. At the moment, the market completed a correction to the central line of the Price Envelope at 1.3855. Further growth towards its upper boundary at 1.4010 is expected.

Technical indicators for today’s USDCAD forecast suggest growth towards the 1.4010 level.

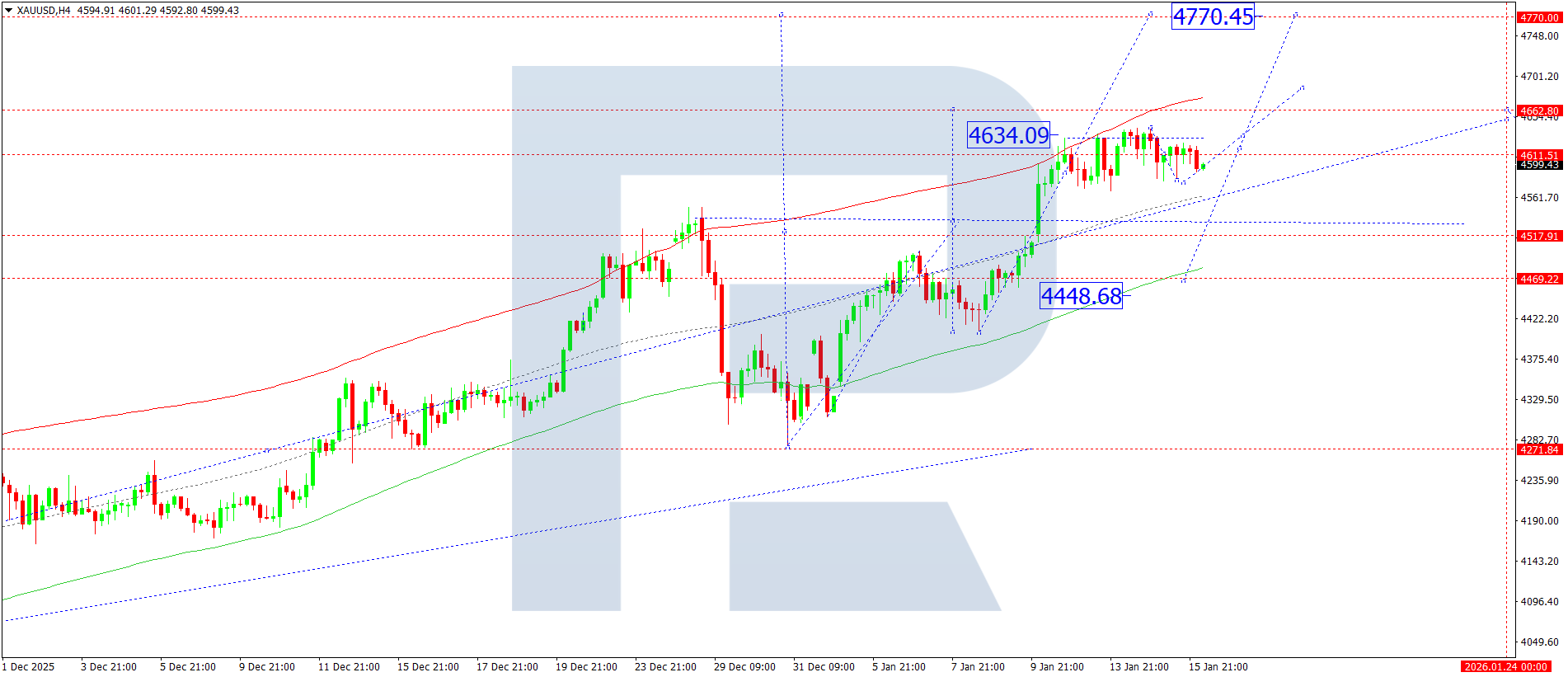

XAUUSD forecast

On the H4 chart of XAUUSD, the market continues to form a consolidation range around the 4,611 level. Today, 16 January 2026, if prices exit the range upwards, potential will open for growth towards 4,770. A downward breakout could lead to a corrective move towards the 4,450 level. Further growth towards 4,770 is then expected.

Technically, this scenario is confirmed by the indicated Elliott wave structure and the upward wave matrix with a pivot point at the 4,500 level. This level is considered key for XAUUSD in this wave. At the moment, the market completed the fifth upward wave towards the upper boundary of the Price Envelope at 4,633. After reaching this level, a corrective move towards its central line at 4,520 is expected.

Technical indicators for today’s XAUUSD forecast suggest growth towards the 4,770 level.

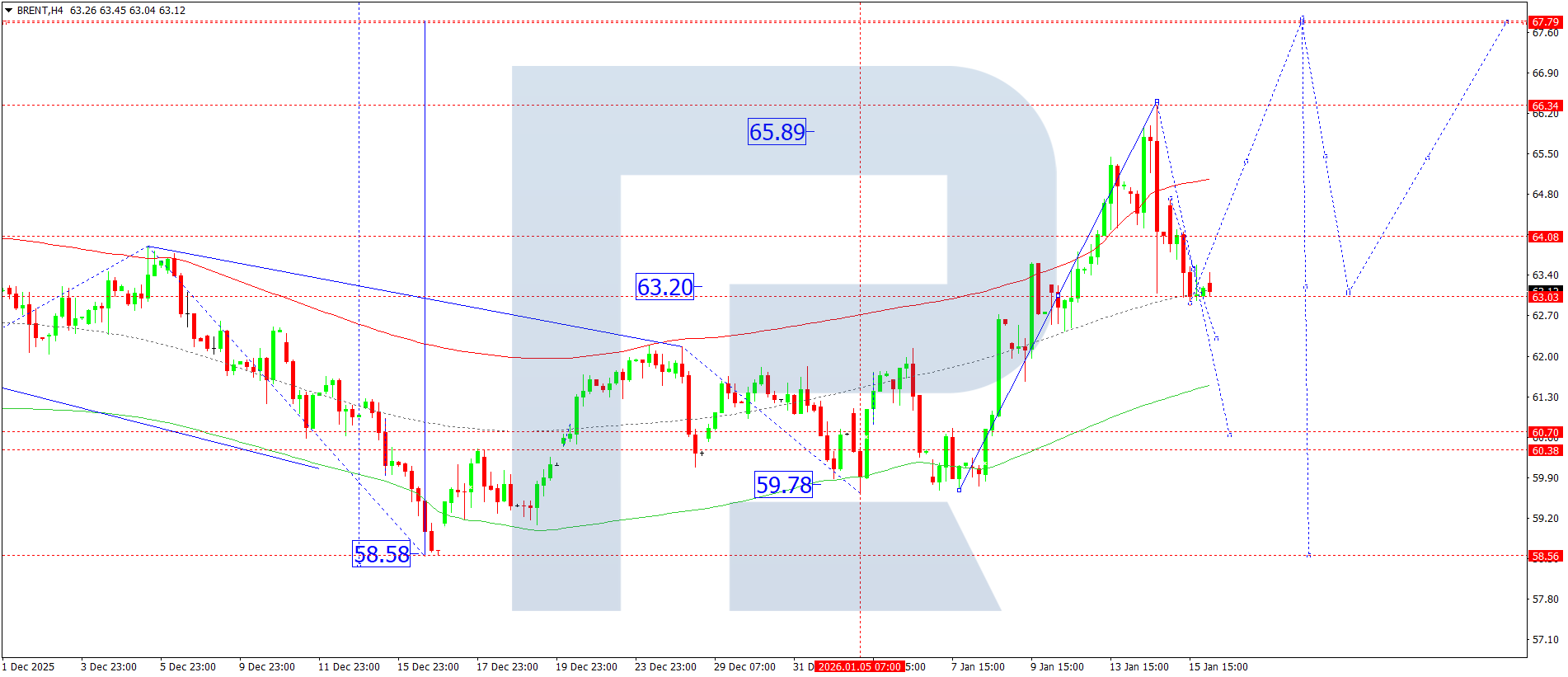

Brent forecast

On the H4 chart of Brent crude oil, the market completed a corrective wave to the 63.00 level. Today, 16 January 2026, the probability of an upward wave developing towards the 66.66 level is considered, with the prospect of continuation towards the 67.76 level.

Technically, this scenario is confirmed by the indicated Elliott wave structure and the upward wave matrix with a pivot point at the 63.20 level. This level is considered key for Brent in this wave. At the moment, the market is forming an upward leg towards the upper boundary of the Price Envelope at 66.66. Further, a corrective move towards its central line at 63.00 is expected, followed by growth towards its upper boundary at 69.00.

Technical indicators for today’s Brent forecast suggest growth towards the 66.66 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.