Daily technical analysis and forecast for 23 January 2026

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 23 January 2026.

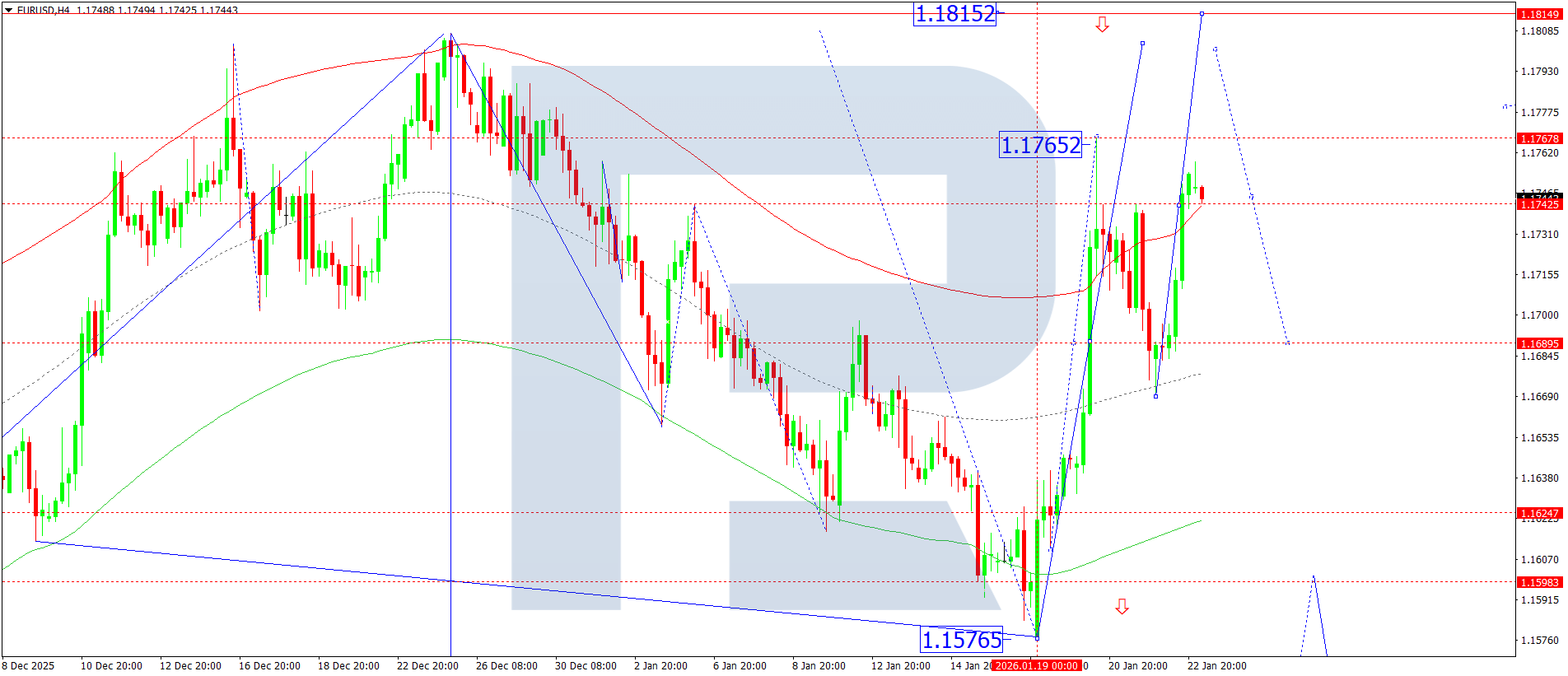

EURUSD forecast

On the EURUSD H4 chart, the market has broken above 1.1745 and is forming a consolidation range around this level. Today, 23 January 2026, growth could continue towards 1.1800, potentially extending to 1.1815.

Technically, this scenario is confirmed by the indicated Elliott wave structure and the upward wave matrix with a pivot point at 1.1680. This level is considered key in the wave structure of EURUSD. At the moment, the market is forming an upward wave towards the upper boundary of the Price Envelope at 1.1800, with the move likely to continue towards 1.1815 today.

Technical indicators for today’s EURUSD forecast suggest the pair could continue its movement to the 1.1815 level.

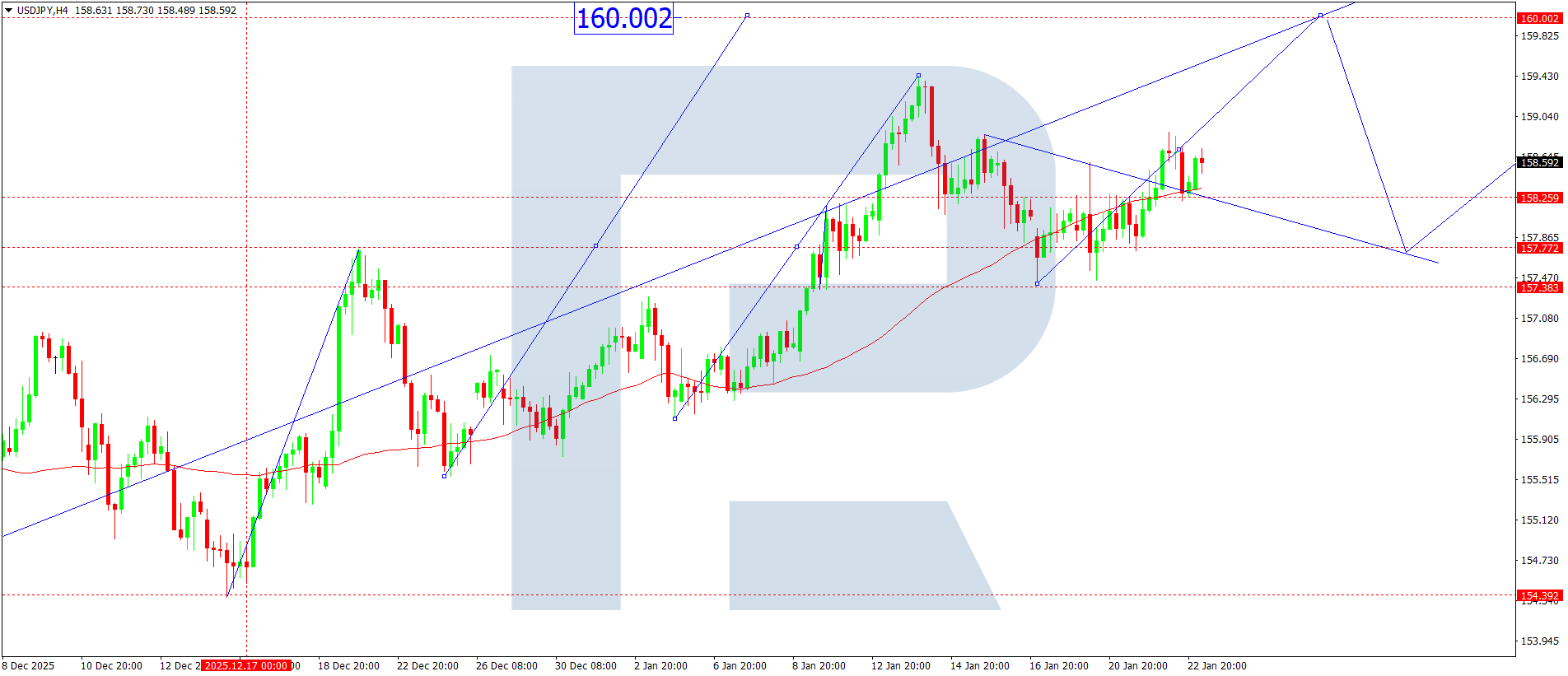

USDJPY forecast

On the USDJPY H4 chart, the market continues to develop a consolidation range around the 158.51 level. Today, 23 January 2026, an upside breakout from the range would open the potential for a wave towards 160.00. Conversely, a downside breakout would trigger a wave towards the 157.77 level.

Technically, this scenario for USDJPY is confirmed by the indicated Elliott wave structure and the upward wave matrix with a pivot point at 158.00. This level is considered key in the structure of this wave. At the moment, the market is forming a consolidation range around the central line of the Price Envelope at 158.51. Growth towards its upper boundary at 160.00 is possible. After that, a decline towards its central line at 158.00 is expected, with the prospect of developing a downward wave towards its lower boundary at 157.77.

Technical indicators for today’s USDJPY forecast suggest growth towards the 160.00 level.

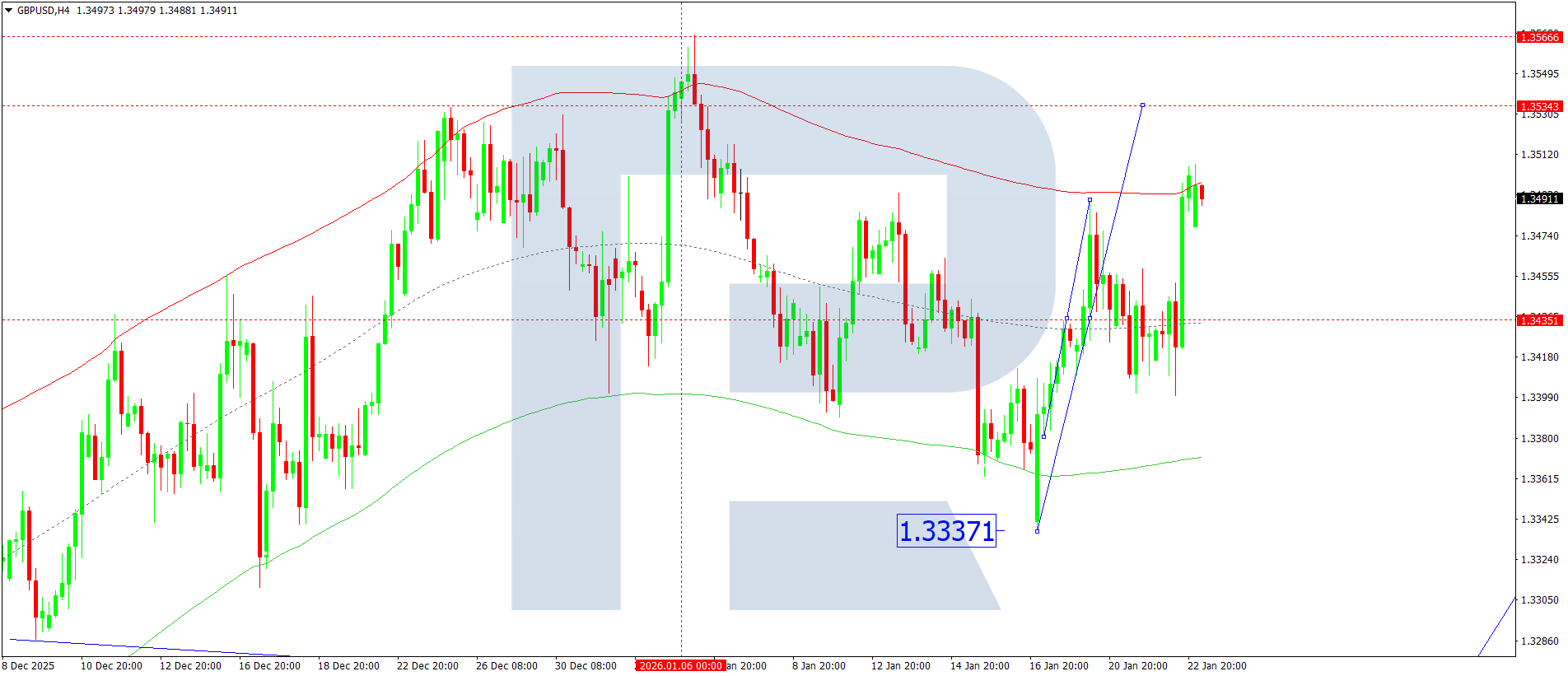

GBPUSD forecast

On the GBPUSD H4 chart, the market is forming a consolidation range around the 1.3490 level. Today, 23 January 20256, an upward wave towards 1.3535 is expected. If this level is broken, potential opens for a wave towards 1.3560.

Technically, this scenario for GBPUSD is confirmed by the indicated Elliott wave structure and the upward wave matrix with a pivot point at 1.3455. This level is considered key in the structure of this wave. Today, an upward wave could develop, aiming for the upper boundary of the Price Envelope at 1.3535. Further, a downward move towards its central line at 1.3490 cannot be ruled out. After this wave is complete, a new upward wave could begin, targeting its upper boundary at 1.3560.

Technical indicators for today’s GBPUSD forecast suggest an upward wave towards the 1.3560 level.

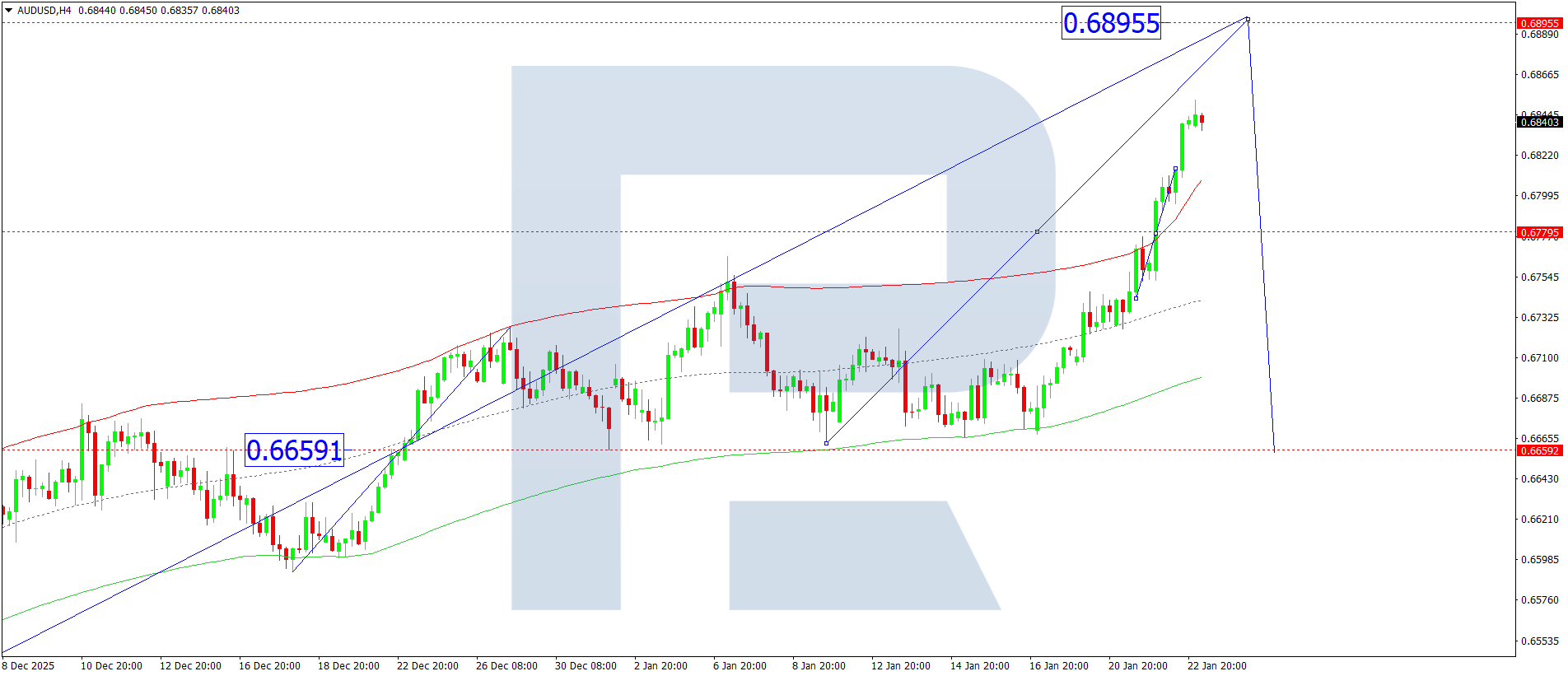

AUDUSD forecast

On the AUDUSD H4 chart, the market continues to rise towards the 0.6890 level. Today, 23 January 2026, the pair is expected to reach this target level. After that, a downward wave towards 0.6777 could begin. Further, growth towards the 0.6900 level is possible.

Technically, this scenario is confirmed by the indicated Elliott wave structure and the upward wave matrix for AUDUSD with a pivot point at 0.6666. This level is considered key in the structure of this wave. At the moment, the market is forming a wave towards the upper boundary of the Price Envelope at 0.6890. Further decline towards its lower boundary at 0.6840 is expected.

Technical indicators for today’s AUDUSD forecast suggest growth towards the 0.6890 level.

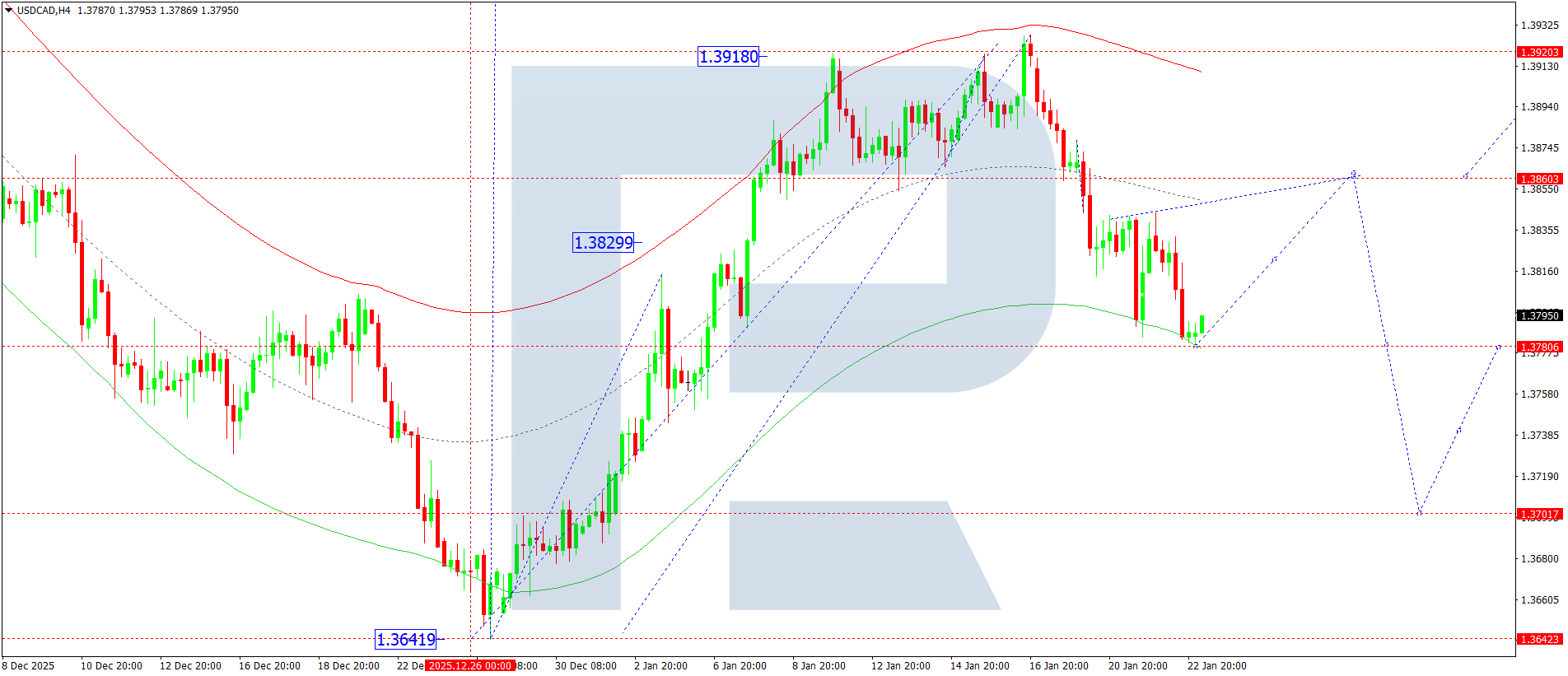

USDCAD forecast

On the USDCAD H4 chart, the market completed a downward wave to the 1.3780 level. Today, 23 January 2026, an upward wave towards the 1.3860 level is expected. Further, the pair could dip to 1.3700.

Technically, this scenario is confirmed by the indicated Elliott wave structure and the downward wave matrix with a pivot point at 1.3833. This level is considered key for USDCAD in the structure of this wave. At the moment, the market completed a correction towards the lower boundary of the Price Envelope at 1.3785. Further growth towards its upper boundary at 1.3860 is expected.

Technical indicators for today’s USDCAD forecast suggest the start of growth towards the 1.3860 level.

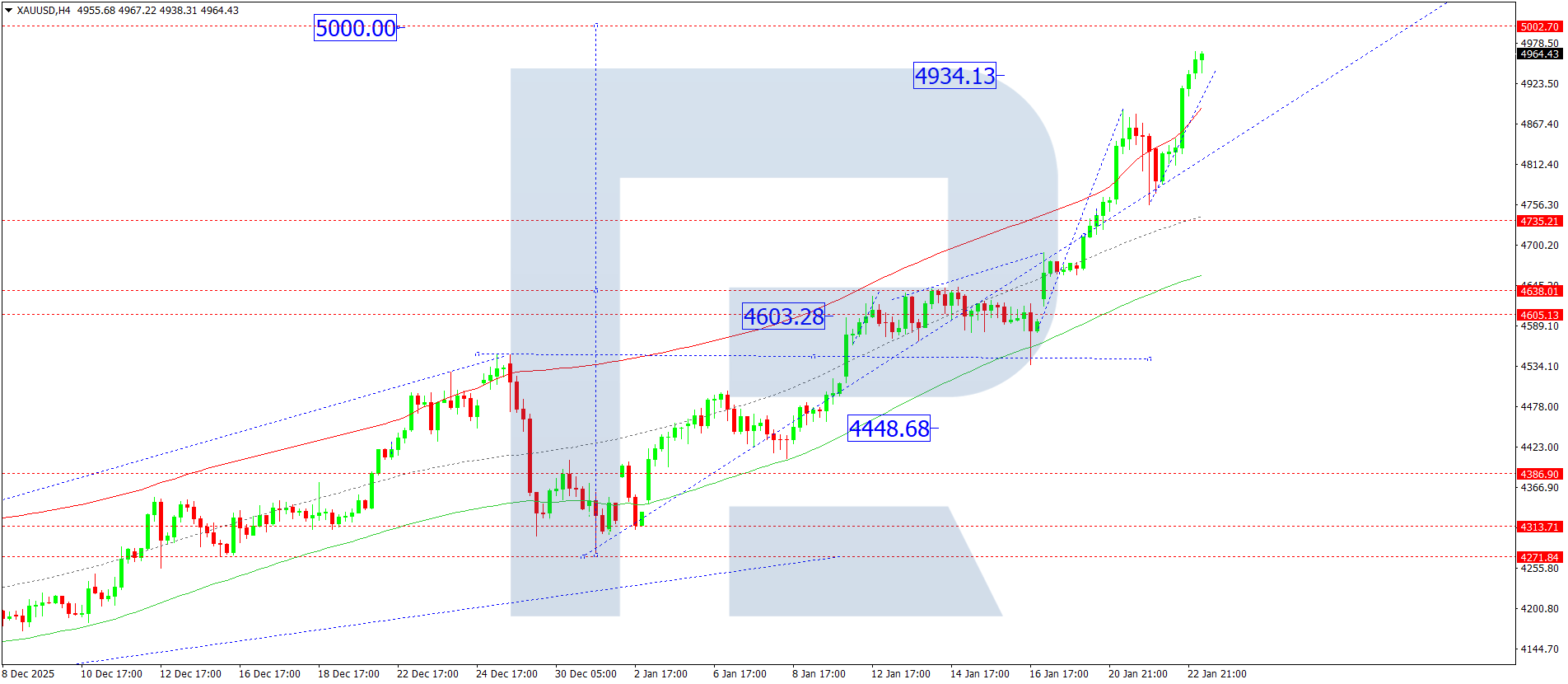

XAUUSD forecast

On the XAUUSD H4 chart, the market is forming an upward wave towards the 5,000 level. Today, 23 January 2026, prices are expected to reach this target level. Further, a corrective move towards the 4,800 level is possible, followed by growth towards the 4,900 level.

Technically, this scenario is confirmed by the indicated Elliott wave structure and the upward wave matrix with a pivot point at 4,500. This level is considered key for XAUUSD in this wave. At the moment, the market is performing the fifth upward wave towards the upper boundary of the Price Envelope at 5,000. After reaching this level, prices are expected to undergo a correction towards its central line at 4,800.

Technical indicators for today’s XAUUSD forecast suggest growth towards the 5,000 level.

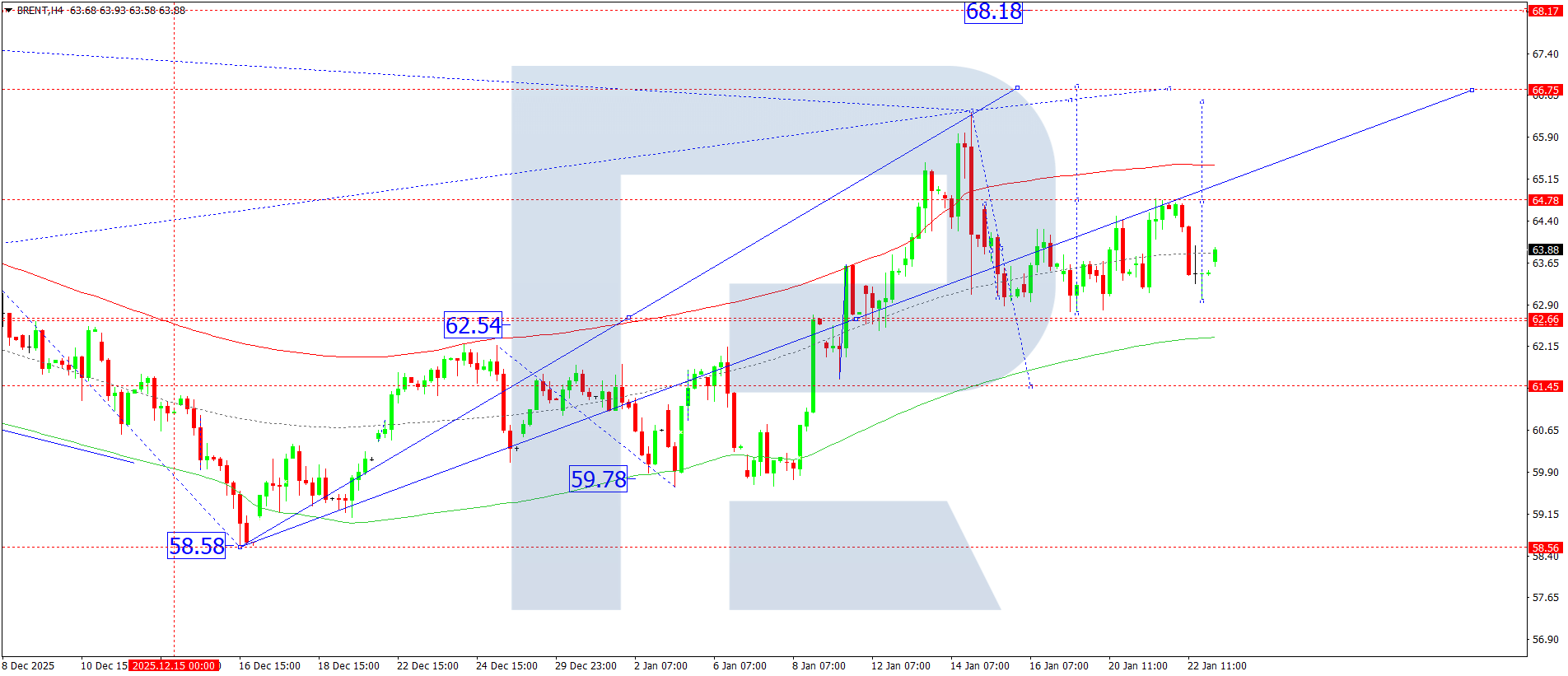

Brent forecast

On the Brent H4 chart, the market is forming a consolidation range around the 63.80 level. Today, 23 January 2026, an upward wave towards the 64.70 level is possible. A breakout above this level would open the door for a continued wave towards the 66.75 level.

Technically, this scenario is confirmed by the indicated Elliott wave structure and the upward wave matrix with a pivot point at the 63.20 level. This level is considered key for Brent in this wave. Currently, the market is forming a corrective move towards the central line of the Price Envelope at 64.44. Further, an upward leg towards its upper boundary at 66.75 is expected, with the prospect of trend continuation towards 69.00.

Technical indicators for today’s Brent forecast suggest growth towards the 66.75 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.