Daily technical analysis and forecast for 16 February 2026

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 16 February 2026.

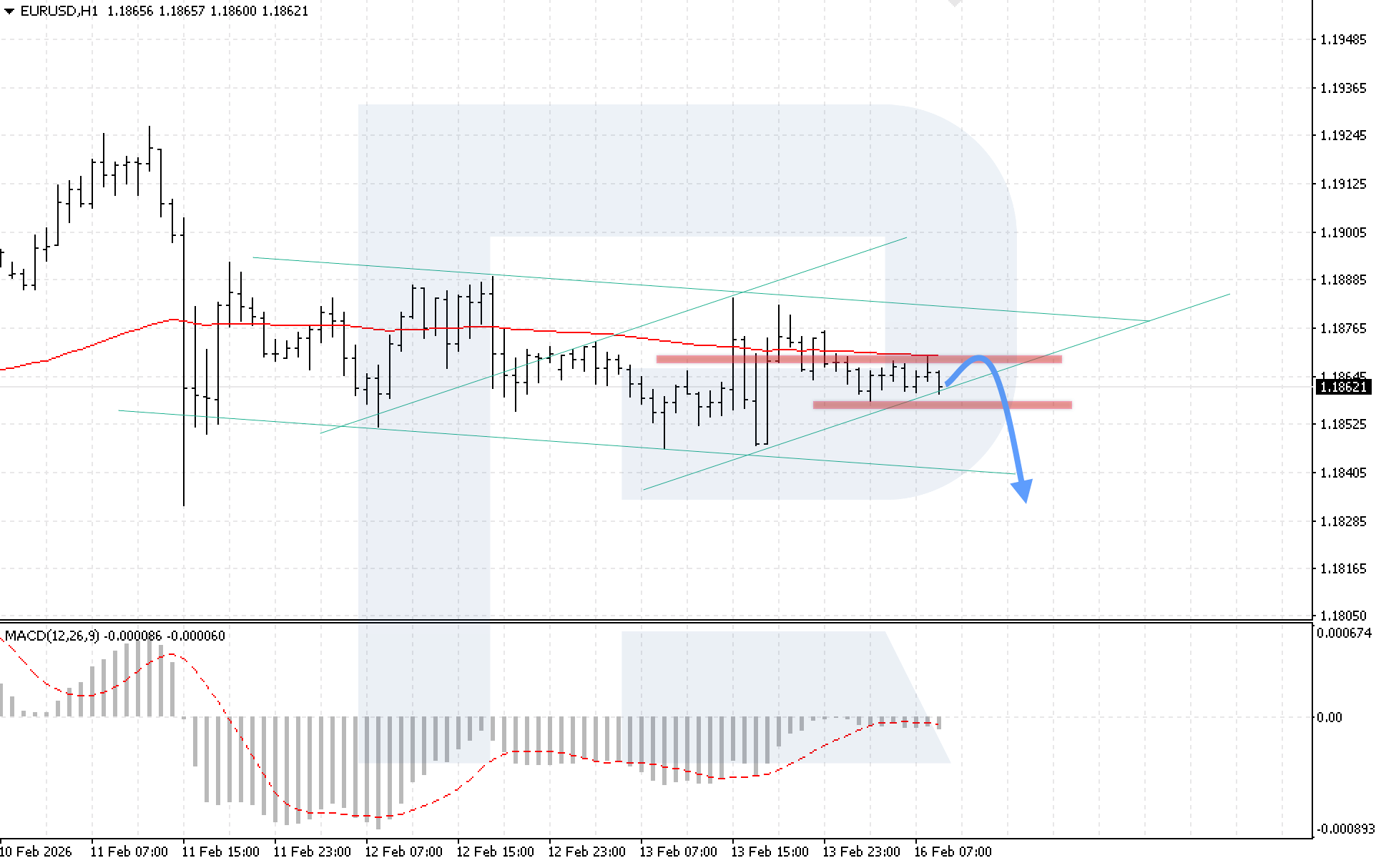

EURUSD forecast

On the H1 chart of the EURUSD currency pair, the market continues to move within consolidation. Quotes are rebounding from the lower boundary of the ascending corrective channel. Sellers are holding the price below the EMA-85, indicating increasing bearish pressure. Today, 16 February 2026, the baseline scenario remains a rebound from the local 1.1875 resistance level, followed by a decline towards 1.1835.

The technical picture confirms this scenario. The MACD histogram is contracting and forming a bearish signal, indicating weakening upward momentum. The key condition for further decline will be firm consolidation below 1.1845. This signal will confirm a move beyond the corrective channel and increase the risk of a deeper downward movement.

The alternative scenario will materialise if the price rises above 1.1885. A breakout above the upper boundary of the descending channel will indicate that buyers have the upper hand and will open the potential for further growth towards 1.1945.

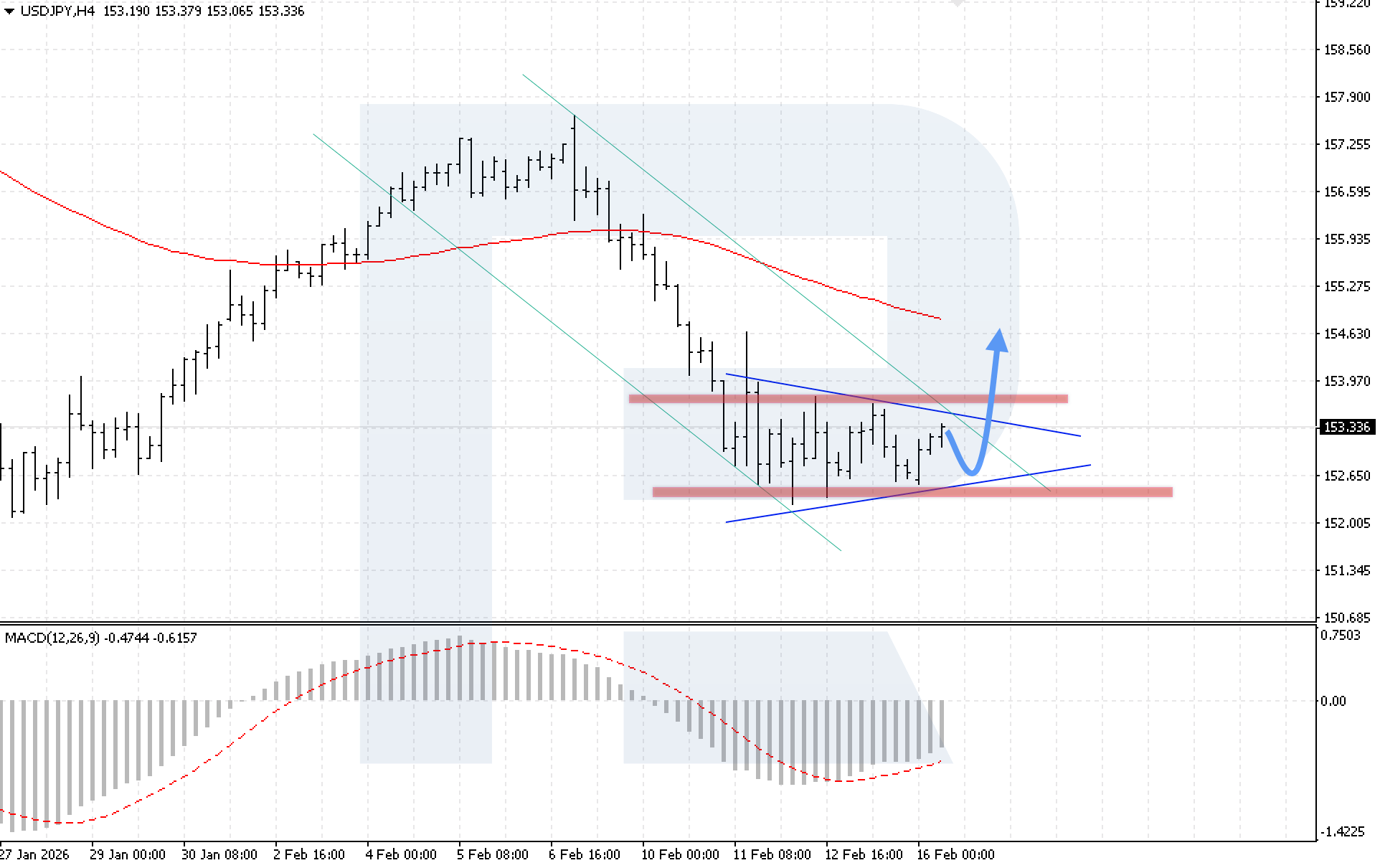

USDJPY forecast

On the H4 chart of the USDJPY currency pair, the market continues to correct within a Triangle pattern. Sellers have failed to secure positions below the pattern’s lower boundary, indicating growing buying pressure and a reduced potential for further decline. Today, 16 February 2026, the baseline scenario suggests an attempt to break the upper boundary of the Triangle, followed by growth towards 154.65.

The technical picture confirms this scenario. The MACD histogram is increasing, and a bullish divergence has formed, significantly limiting the downside potential. The key condition for the upside scenario will be a breakout above the pattern’s upper boundary, followed by consolidation above 153.85.

The alternative scenario will activate if the lower boundary of the formation is broken with consolidation below 152.45. Such a signal will indicate renewed downward momentum in the USDJPY pair.

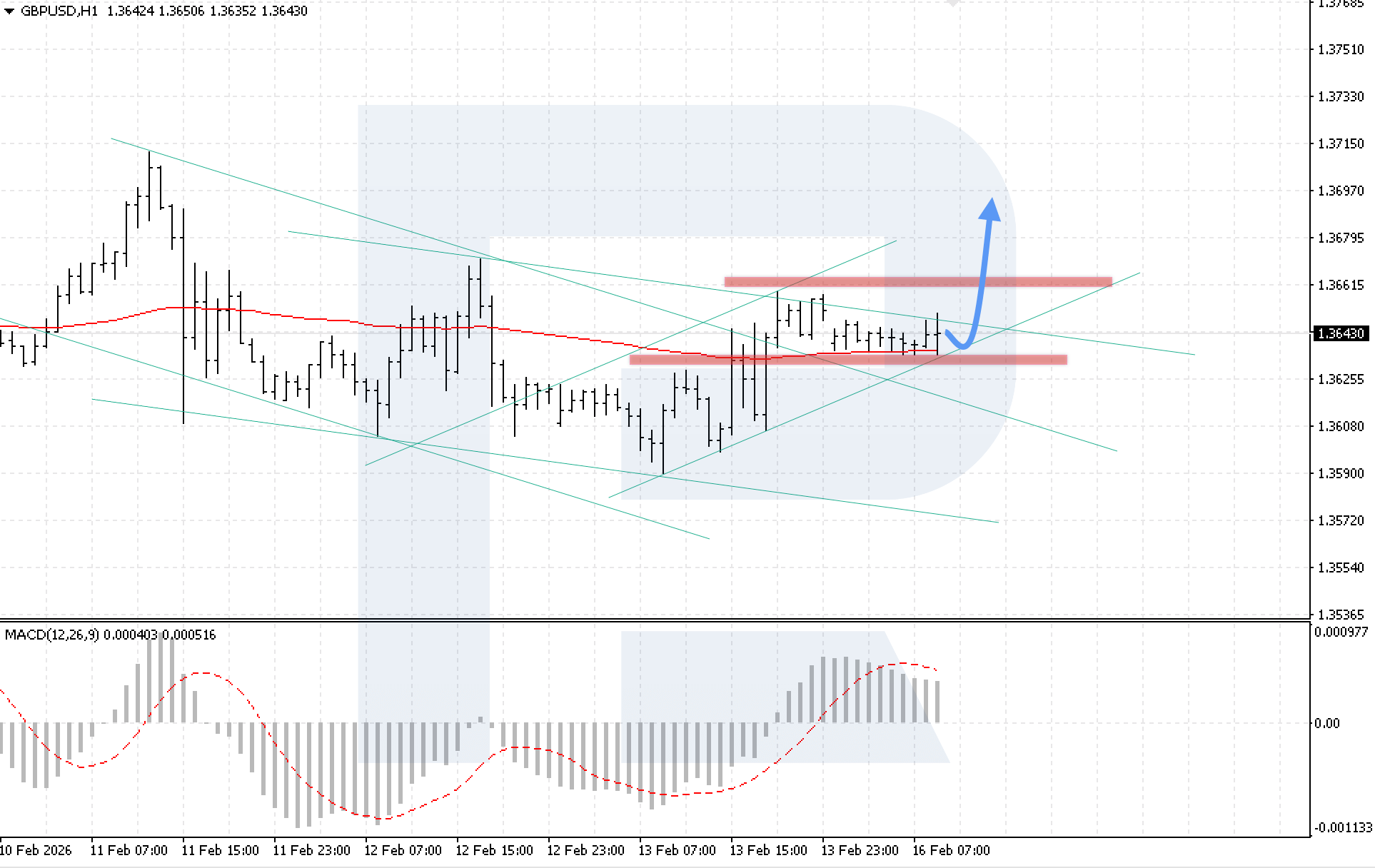

GBPUSD forecast

On the H1 chart of the GBPUSD currency pair, quotes continue to move within a correction. Buyers have secured positions above the EMA-85 line, confirming sustained bullish pressure. The nearest resistance level is located at 1.3660. Today, 16 February 2026, the baseline scenario suggests a rebound from the lower boundary of the descending channel, followed by growth towards 1.3695.

The technical picture confirms this scenario. The MACD histogram is decelerating, indicating weakening bearish momentum. The key condition for continued upward movement will be a breakout above the upper boundary of the descending channel with consolidation above 1.3655.

The alternative scenario will activate if the lower boundary of the corrective channel is broken with consolidation below 1.3625. Such a signal will indicate renewed bearish momentum in the GBPUSD pair.

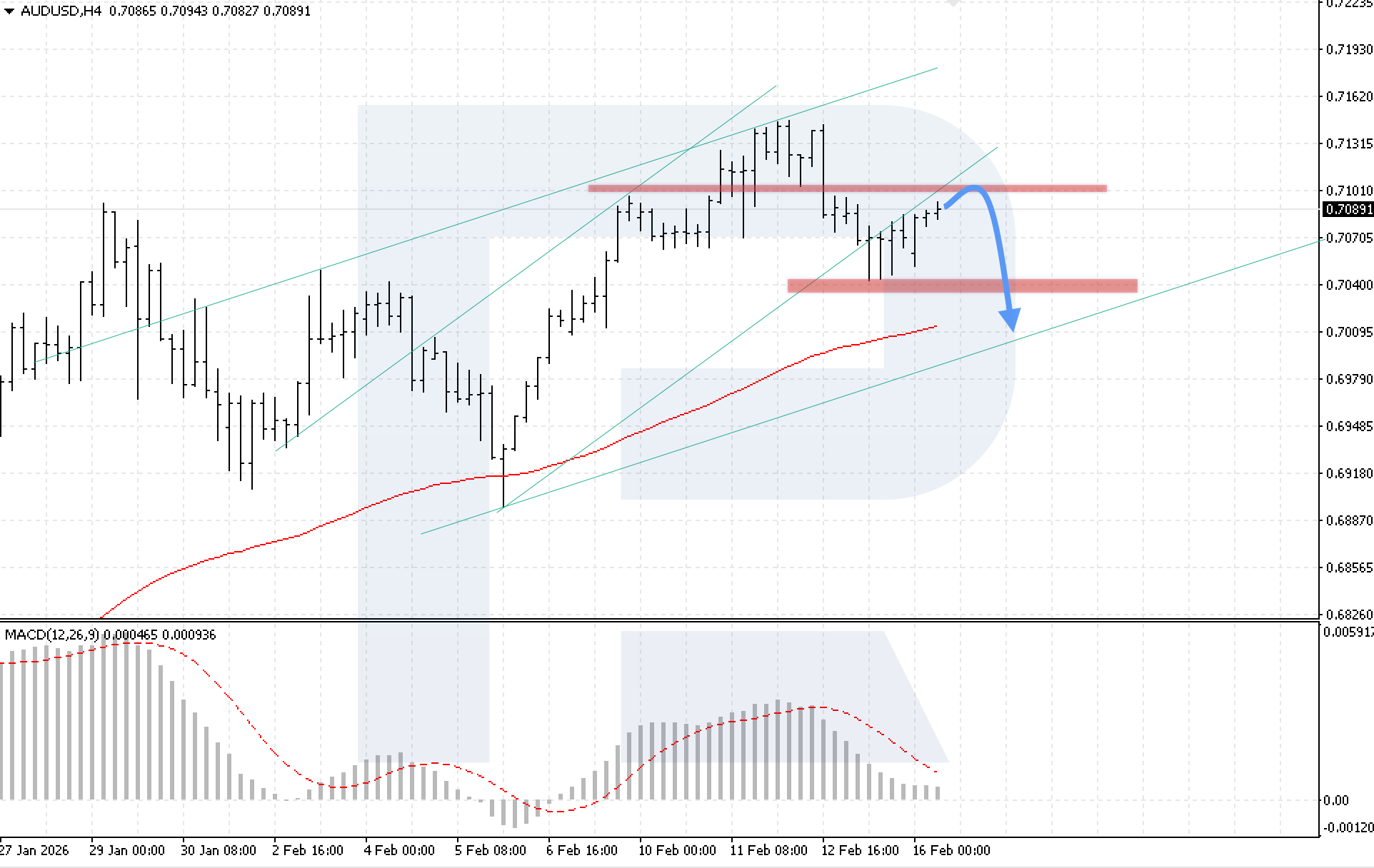

AUDUSD forecast

On the H4 chart of the AUDUSD currency pair, the market continues to form a bullish correction. Sellers are holding the price below the lower boundary of the ascending channel, indicating sustained bearish pressure. Today, 16 February 2026, the baseline scenario suggests downward momentum with a target at 0.7005.

The technical picture confirms this scenario. The MACD histogram is contracting, strengthening the bearish signal. The key condition for the downward movement will be consolidation below the local 0.7040 support level.

The alternative scenario will activate if the price rises and breaks above the resistance level with subsequent consolidation above 0.7105. Such a signal will indicate renewed buying pressure and open the potential for continued growth.

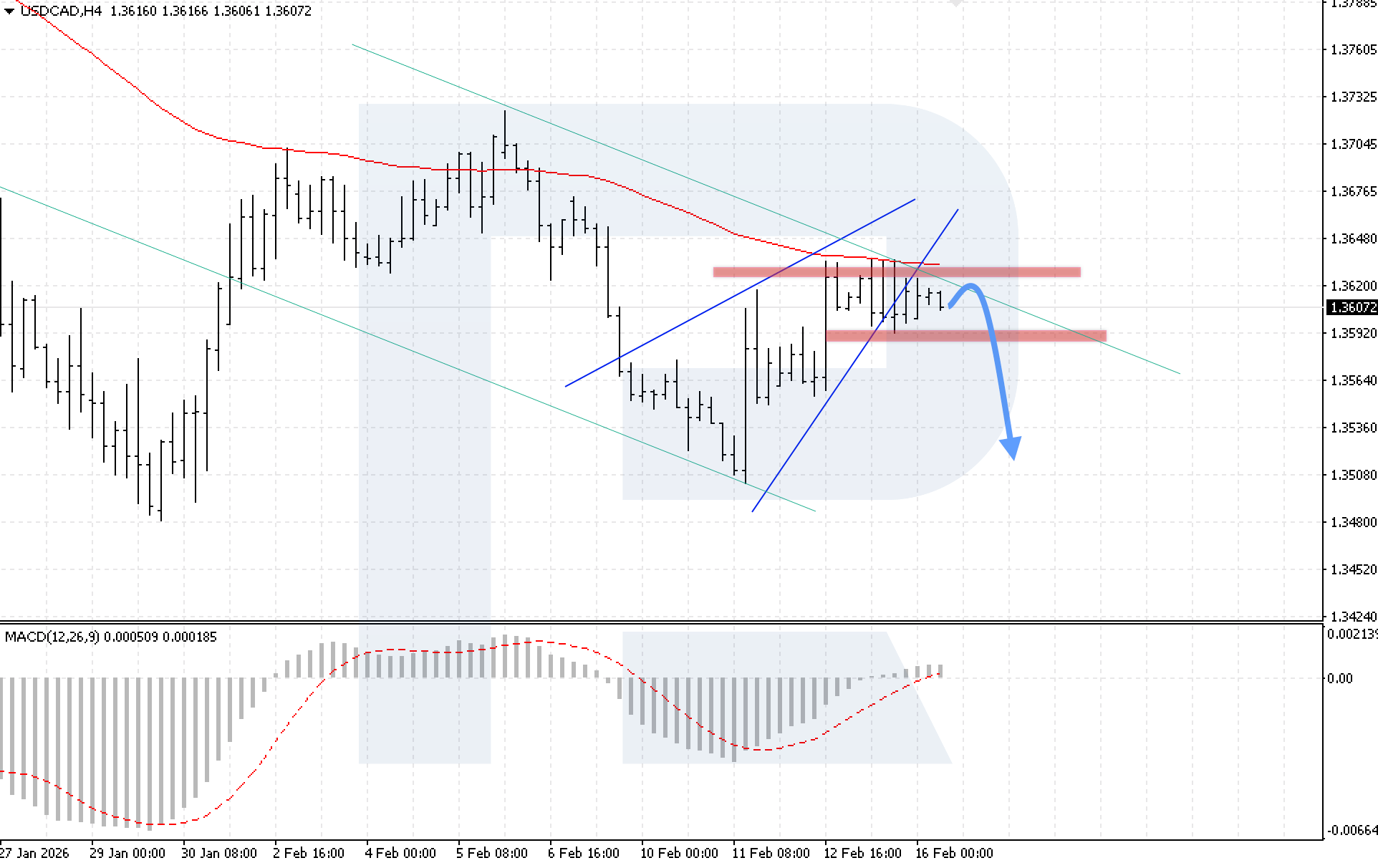

USDCAD forecast

On the H4 chart of the USDCAD currency pair, the market continues to move within a bullish correction, with quotes exiting the Wedge reversal pattern. Today, 16 February 2026, the baseline scenario suggests a decline towards 1.3505 after a rebound from the upper boundary of the descending channel.

The technical picture confirms the bearish scenario. The MACD indicator shows slowing histogram growth, reinforcing the signal for decline. The key condition for the downward movement will be consolidation below the 1.3595 local support level.

The alternative scenario will activate if the local resistance level is broken with subsequent consolidation above 1.3635. Such a signal will indicate renewed upward momentum and the cancellation of the Wedge reversal pattern.

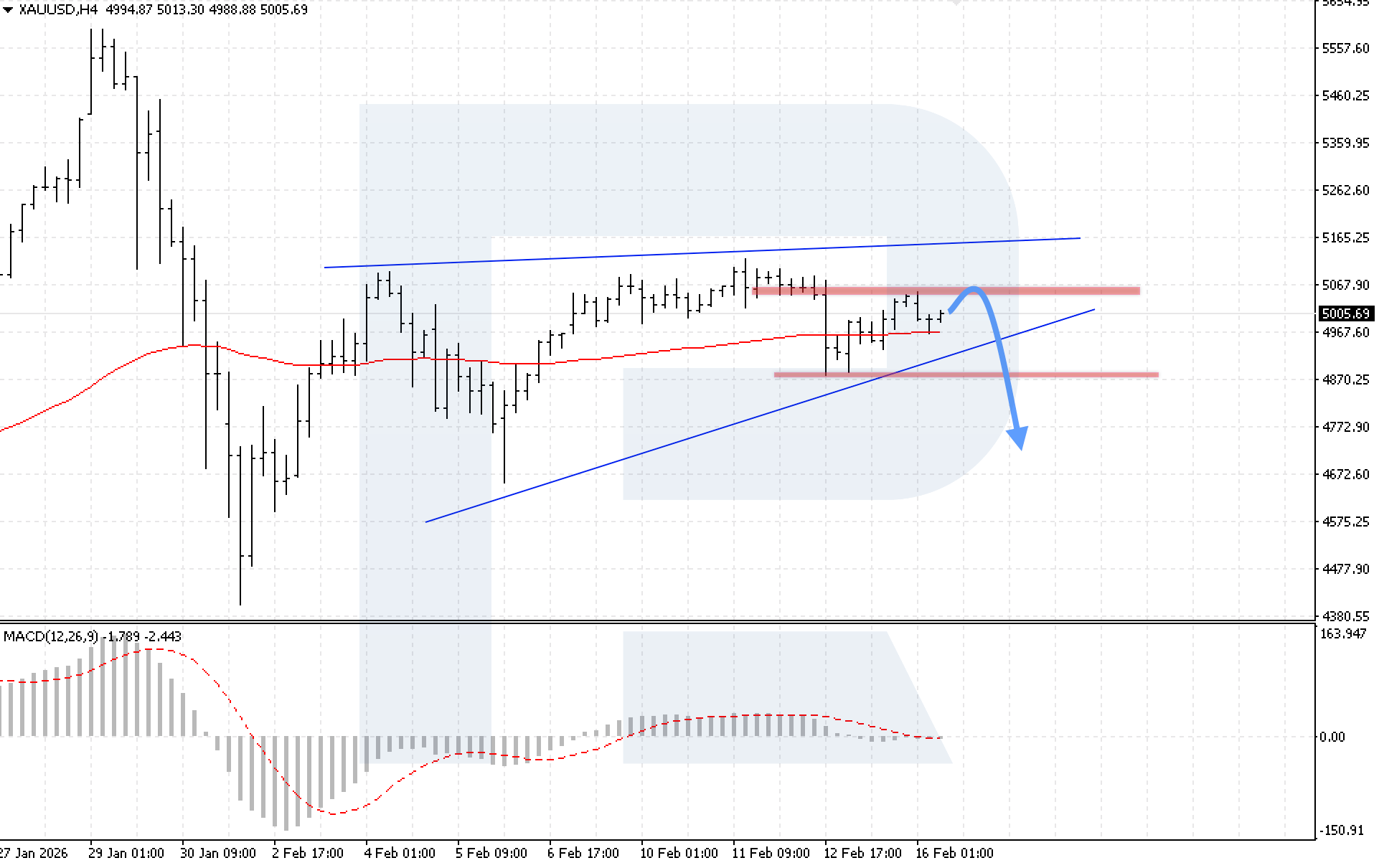

XAUUSD forecast

On the H4 chart of the XAUUSD currency pair, the market has secured positions above the EMA-75; however, risks of forming a Wedge reversal pattern remain. Today, 16 February 2026, the baseline scenario suggests a downward impulse with a target at 4,765.

The technical picture confirms the bearish scenario. The MACD indicator shows a decline and a crossover below the zero line, indicating increasing bearish pressure. The key condition for the downward movement will be consolidation below 4,870, confirming a breakout below the lower boundary of the Wedge reversal pattern.

The alternative scenario will activate if the resistance level is broken with subsequent consolidation above 5,105. Such a signal will indicate a breakout of the pattern’s upper boundary and open the potential for continued growth in XAUUSD quotes.

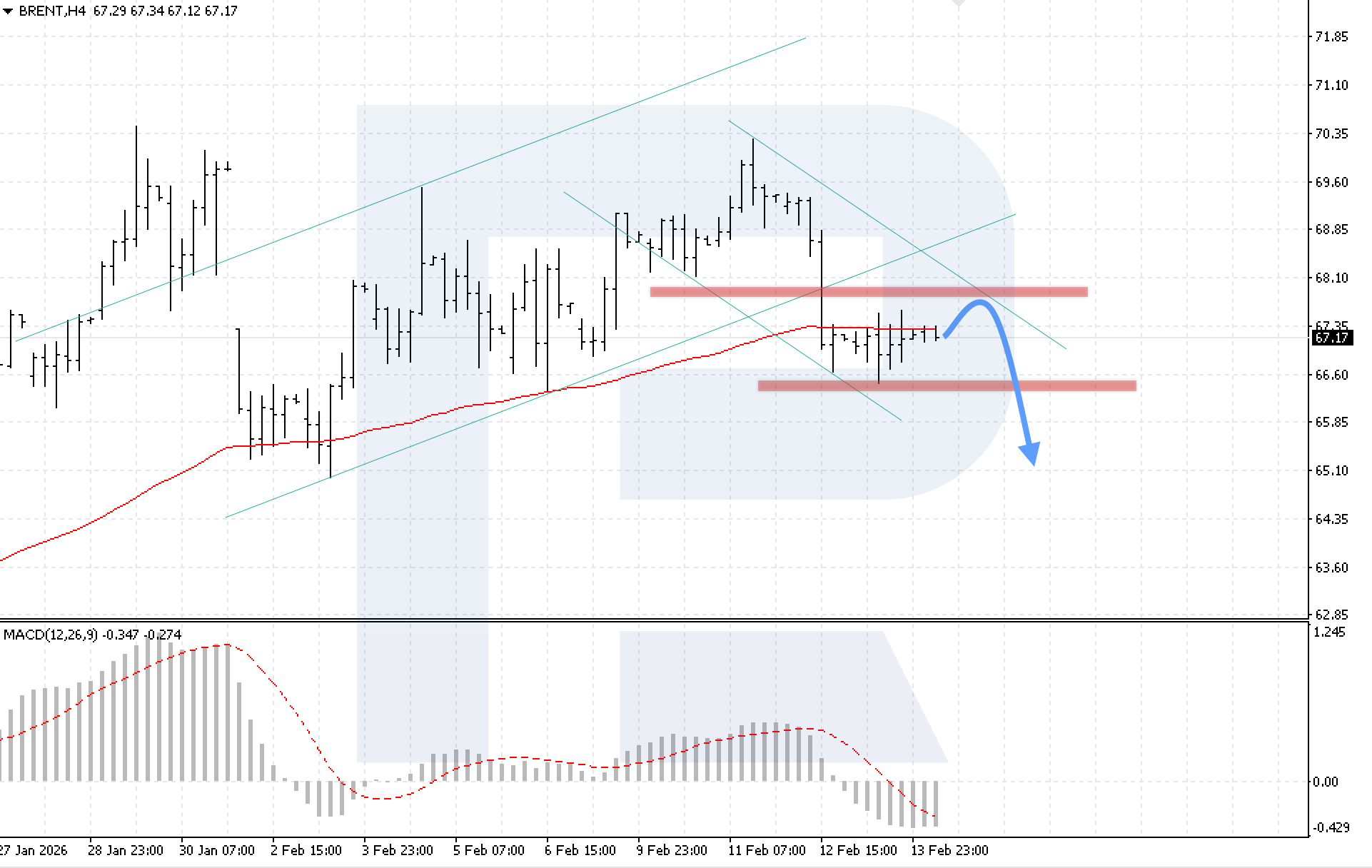

Brent forecast

On the H4 chart of Brent crude oil, the market is correcting within a descending channel. Sellers are holding prices below the EMA-85, indicating mounting bearish pressure. Today, 16 February 2026, the baseline scenario suggests a continued decline after a rebound from the upper boundary of the descending channel, with a target at 65.10.

The technical picture confirms the bearish scenario. The MACD histogram is declining, strengthening the sell signal. The key condition for the downward movement will be consolidation below the local 66.45 support level, confirming continued downward momentum.

The alternative scenario will activate if the local resistance level is broken with subsequent consolidation above 68.05. Such a signal will indicate a breakout beyond the descending channel and open the potential for continued growth in Brent prices.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.