Daily technical analysis and forecast for 17 February 2026

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 17 February 2026.

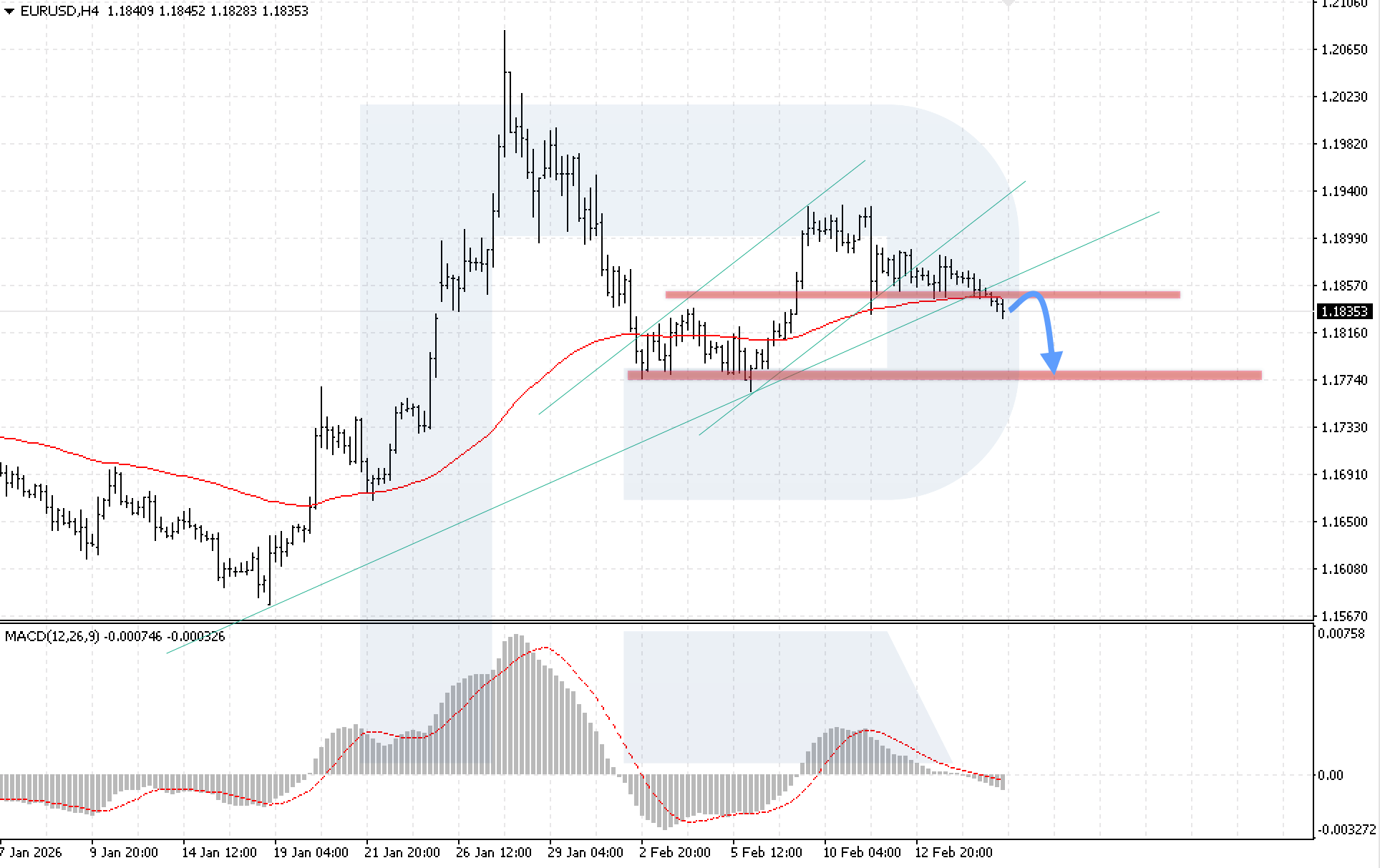

EURUSD forecast

On the H4 chart of the EURUSD currency pair, the market is declining after breaking the ascending trendline. Sellers have secured positions below the EMA-85, indicating growing bearish pressure. Today, 17 February 2026, the baseline scenario remains a rebound from the 1.1845 resistance level, followed by a decline towards 1.1775.

The technical picture confirms this scenario. The MACD histogram is contracting after crossing the zero line, signalling an increase in bearish momentum. The key condition for further decline will be firm consolidation below 1.1815.

The alternative scenario will materialise if the price rises above 1.1875. In this case, a breakout above the EMA-85 would strengthen bullish pressure and open the way for further growth.

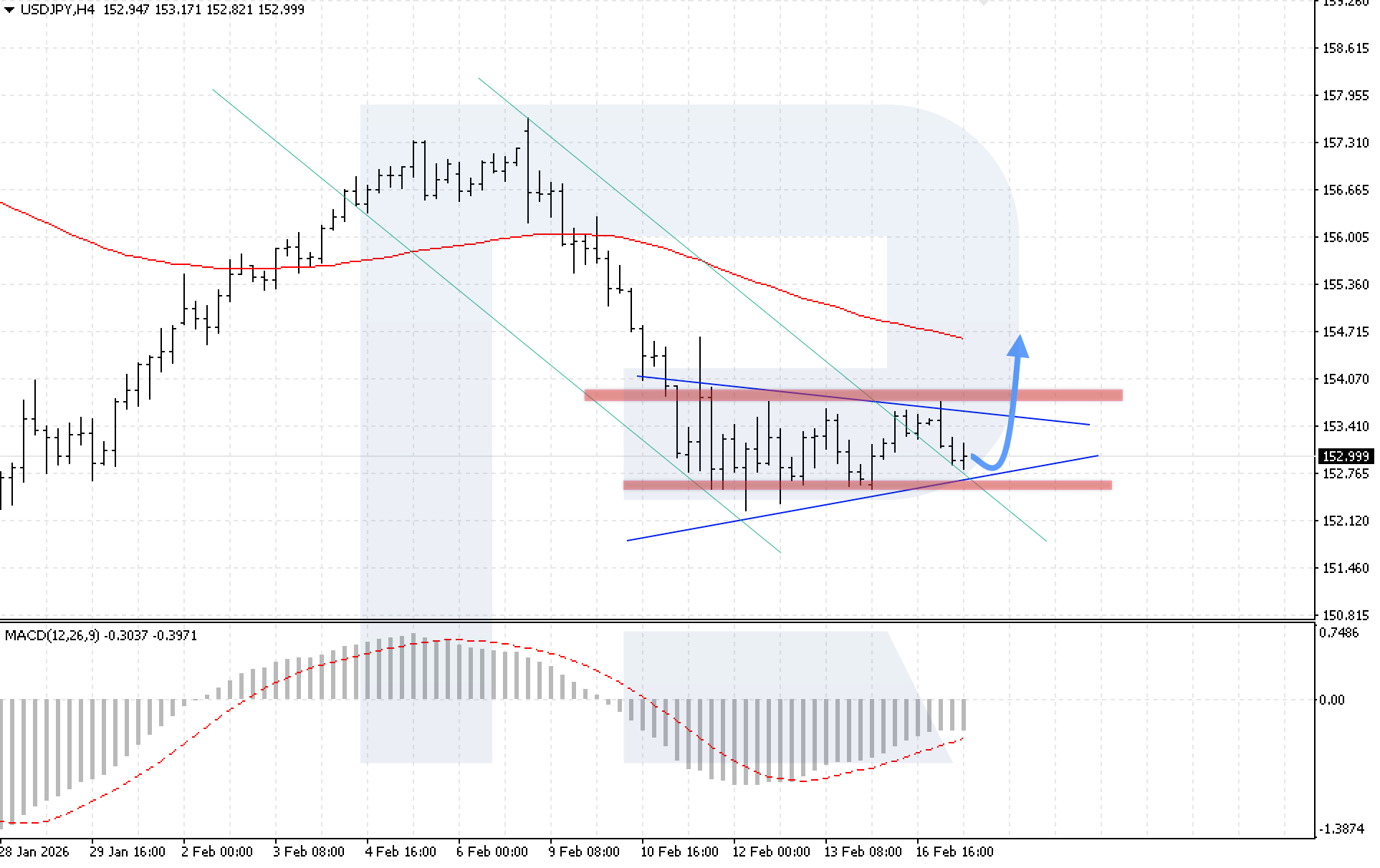

USDJPY forecast

On the H4 chart of the USDJPY currency pair, the market continues to correct within a Triangle pattern. Sellers have retested the lower boundary of the formation, but no breakout has occurred. Today, 17 February 2026, the baseline scenario suggests a rebound from the lower boundary, followed by a bullish impulse towards 154.70.

The technical picture confirms this scenario. The MACD is rising, and a bullish divergence has additionally formed, strengthening the potential for upward movement. The key condition for growth will be a breakout above the upper boundary of the Triangle with consolidation above 153.65.

The alternative scenario will activate if the lower boundary of the pattern is broken with consolidation below 152.45. Such a signal will indicate renewed bearish momentum in USDJPY.

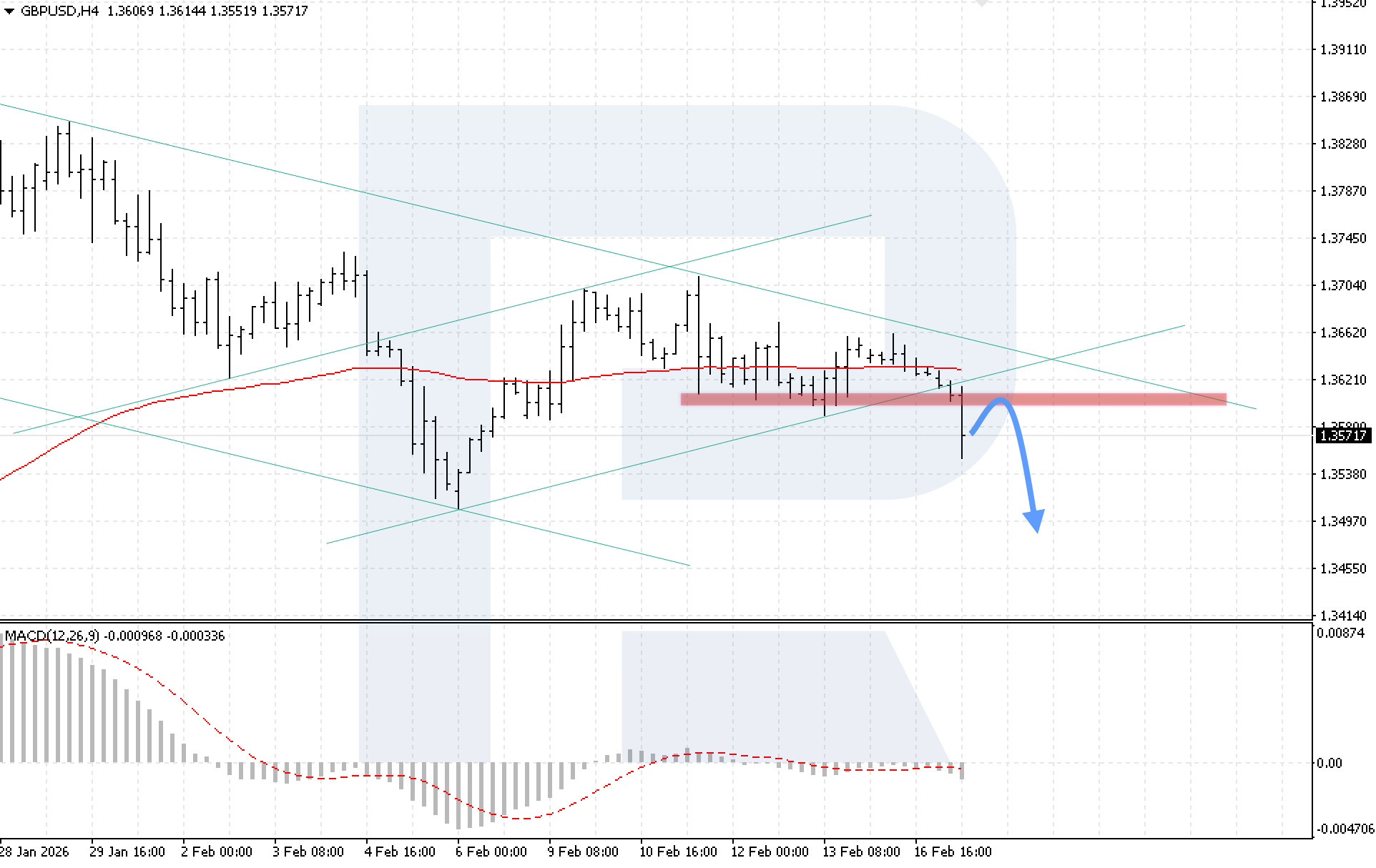

GBPUSD forecast

On the H4 chart of the GBPUSD currency pair, quotes are moving within an aggressive decline after breaking below the local support level at 1.3595. Today, 17 February 2026, the baseline scenario suggests a rebound from the broken resistance line, followed by a decline towards 1.3495.

The technical picture confirms this scenario. The MACD histogram is actively declining, indicating strengthening bearish momentum. The key condition for further decline will be consolidation below 1.3535 after the breakout below the local support level.

The alternative scenario will activate if the upper boundary of the descending channel is broken with consolidation above 1.3655. Such a signal will indicate renewed growth in GBPUSD.

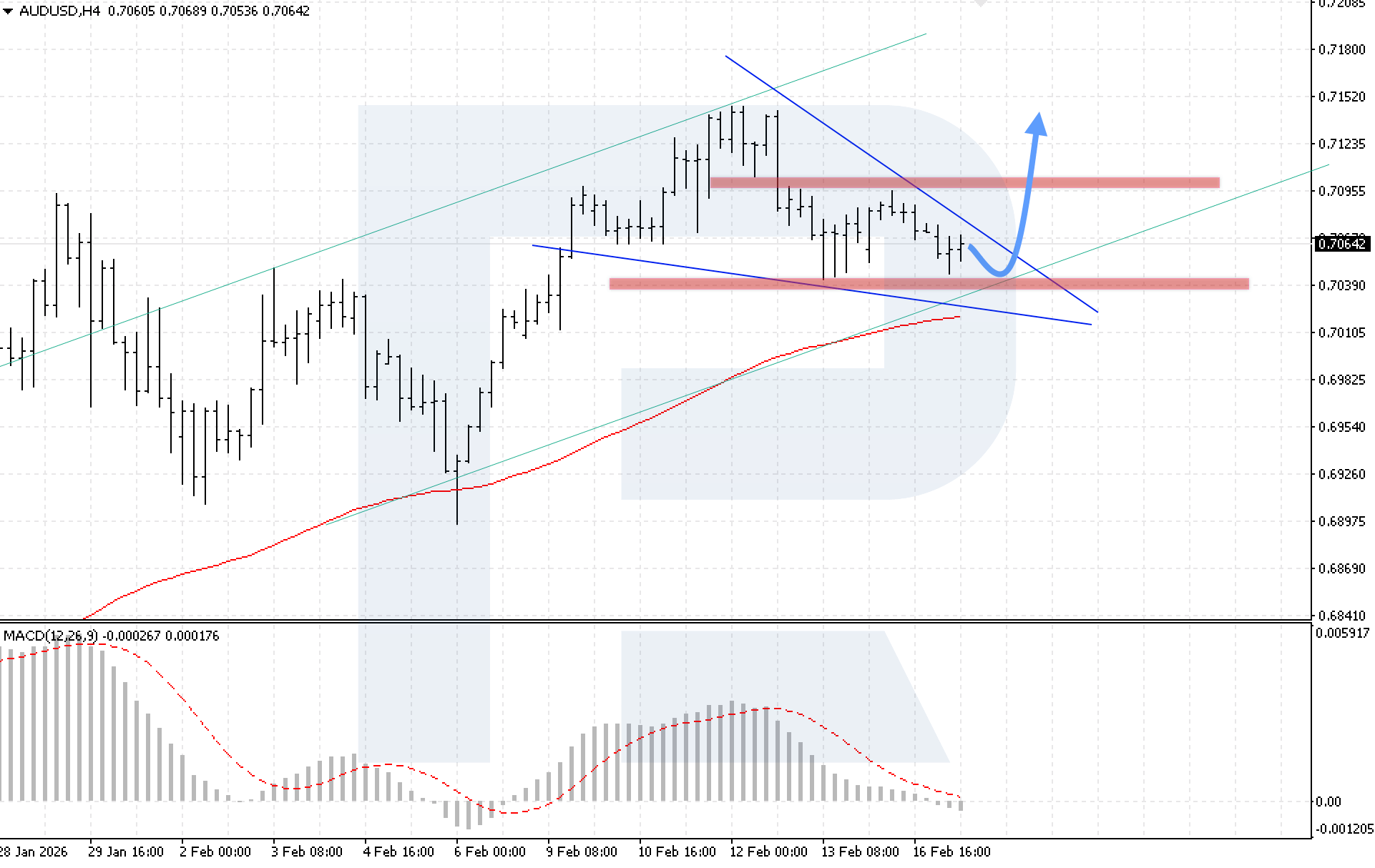

AUDUSD forecast

On the H4 chart of the AUDUSD currency pair, the market continues to form a corrective wave within a Wedge pattern. Buyers are holding quotes above the EMA-85, indicating sustained bullish pressure. Today, 17 February 2026, the baseline scenario suggests growth after a rebound from the lower boundary of the bullish channel, with a target at 0.7145.

The technical picture confirms this scenario. The MACD indicator shows slowing histogram decline, and a Wedge reversal pattern is forming, strengthening the potential for upward movement. The key condition for growth will be consolidation above 0.7085, indicating a breakout above the upper boundary of the formation.

The alternative scenario will activate if the price declines and breaks below 0.7010. Such a signal will indicate continued downward movement in AUDUSD.

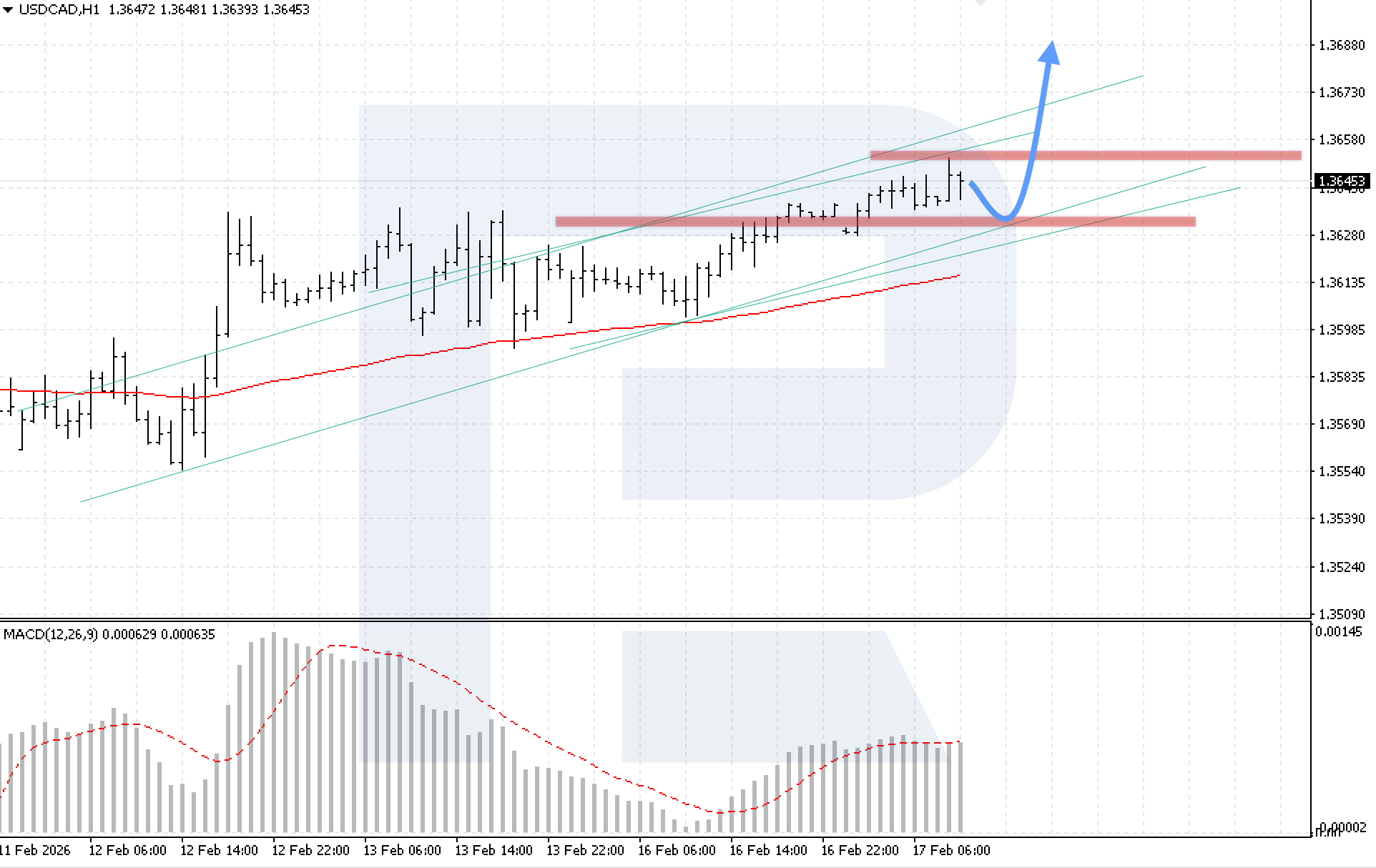

USDCAD forecast

On the H1 chart of the USDCAD currency pair, the market continues its upward movement within a bullish channel. Buyers have confidently overcome local resistance. Today, 17 February 2026, the baseline scenario suggests continued upward movement after a rebound from the lower boundary of the channel, with a target at 1.3685.

The technical picture confirms the bullish scenario. The MACD indicator shows active histogram growth, strengthening the signal for continued upward momentum. The key condition for growth will be consolidation above the local resistance level at 1.3650.

The alternative scenario will activate if the lower boundary of the channel is broken with subsequent consolidation below 1.3615. Such a signal will indicate renewed decline towards the next support level.

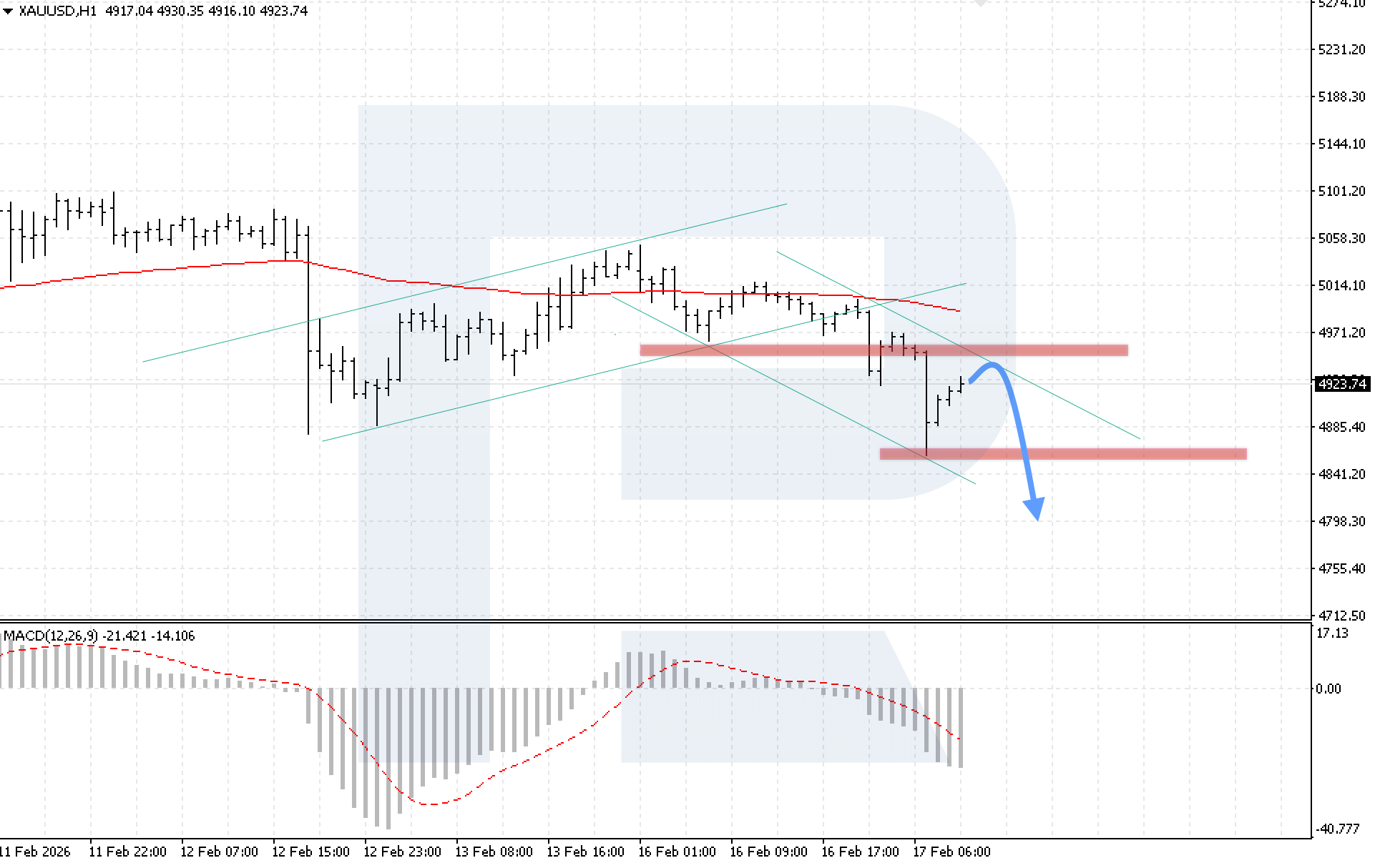

XAUUSD forecast

On the H1 chart of the XAUUSD currency pair, the market is correcting after an aggressive decline while remaining within a descending channel. Today, 17 February 2026, the baseline scenario suggests renewed bearish momentum after a rebound from the upper boundary of the channel, with a target at 4,795.

The technical picture confirms the downward scenario. The MACD indicator shows active pressure, indicating strengthening bearish sentiment. The key condition for continued decline will be consolidation below 4,895.

The alternative scenario will activate if resistance is broken with subsequent consolidation above 4,975. Such a signal will indicate a breakout above the upper boundary of the descending channel and open the potential for continued growth in XAUUSD.

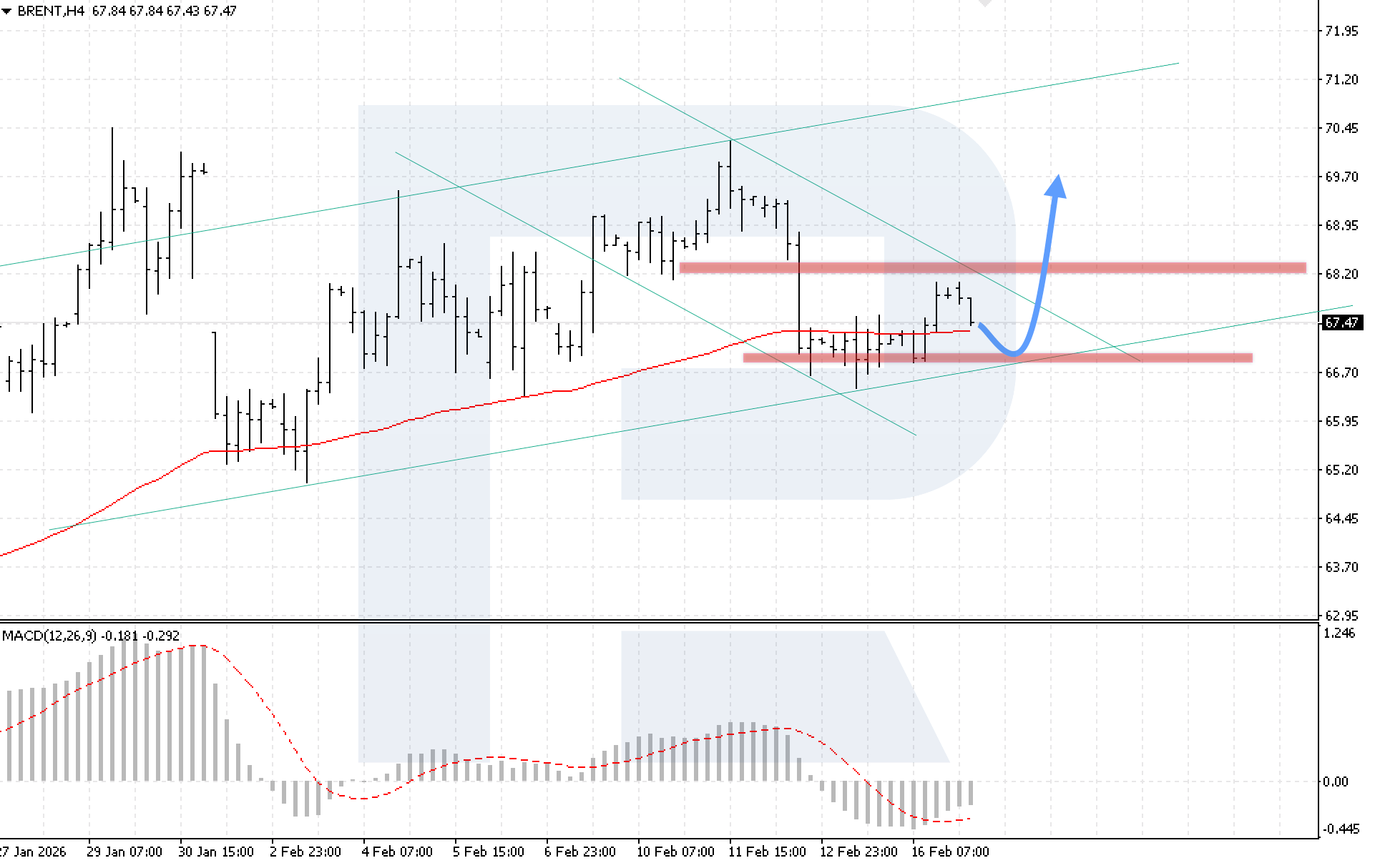

Brent forecast

On the H4 chart of Brent crude oil, the market is correcting after an upward movement, while buyers have managed to return quotes above the EMA-85 line. Today, 17 February 2026, the baseline scenario suggests continued growth after a rebound from the lower boundary of the bullish channel, with a target at 69.70.

The technical picture confirms the bullish scenario. The MACD indicator shows histogram growth, and the signal line has moved out of the histogram area, strengthening the signal for continued upward movement. The key condition for growth will be consolidation above the 68.25 resistance level, confirming a breakout of the upper boundary of the descending channel.

The alternative scenario will activate if local support is broken with subsequent consolidation below 66.05. Such a signal will indicate that quotes have moved beyond the bullish channel and open the potential for continued decline in Brent prices.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.