Ichimoku Cloud Analysis 27.11.2023 (EURUSD, USDJPY, USDCAD)

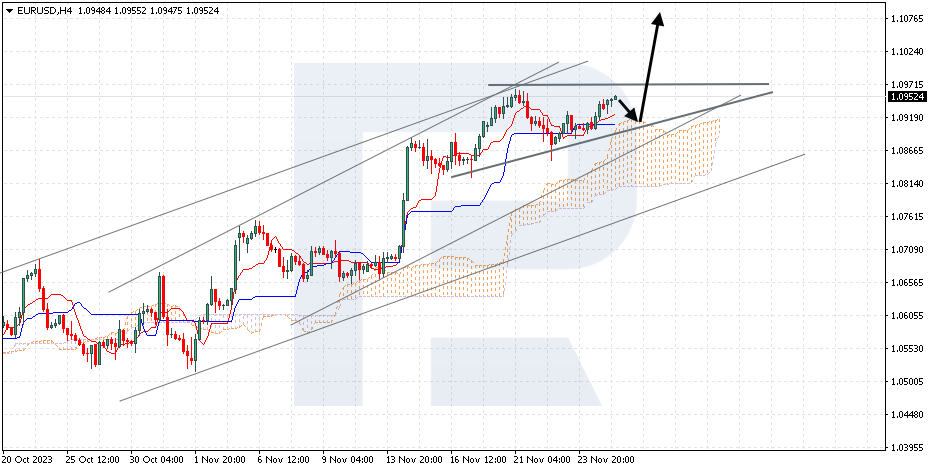

EURUSD, “Euro vs US Dollar”

EURUSD is correcting by a Triangle pattern. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the upper boundary of the Cloud at 1.0920 is expected, followed by a rise to 1.1075. An additional signal confirming the rise will be a rebound from the lower boundary of the Triangle pattern. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 1.0765, which will mean a further decline to 1.0675. Meanwhile, the growth could be confirmed by a breakout of the upper boundary of the Triangle pattern with the price finding a foothold above 1.0995.

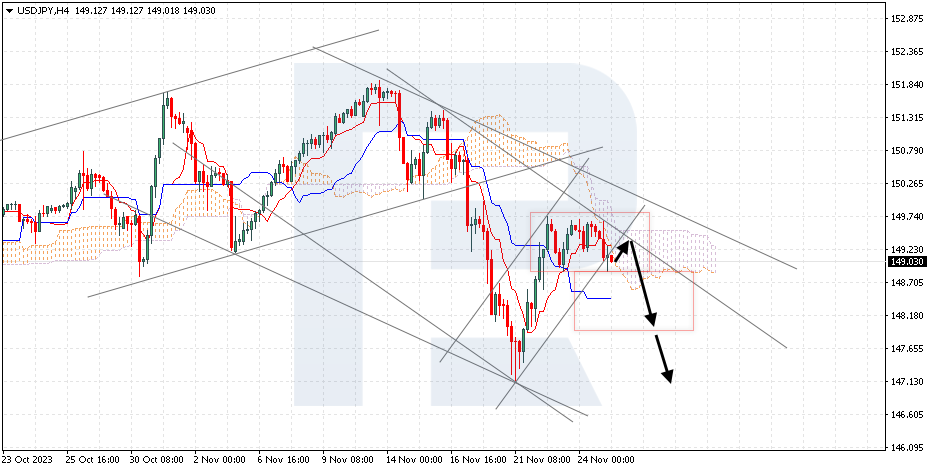

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is pushing off the lower boundary of the Double Top reversal pattern. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Tenkan-Sen line at 149.25 is expected, followed by a decline to 147.15. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 149.85, which will mean further growth to 150.75. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the Double Top pattern with the price finding a foothold under 148.55.

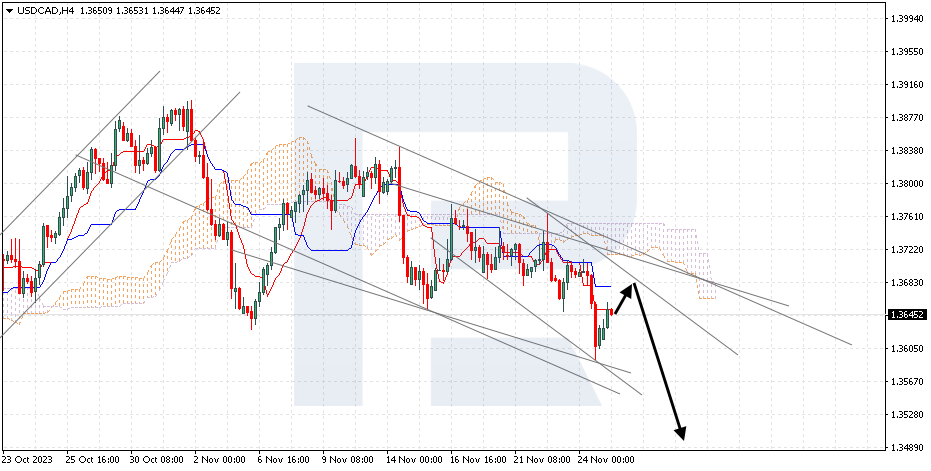

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD has secured under the support level. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Kijun-Sen line at 1.3685 is expected, followed by a decline to 1.3495. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 1.3775, which will mean further growth to 1.3865.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.