DE 40 analysis: the support level was breached, and a downtrend began

The DE 40 stock index has entered a downtrend, which may last for the medium term. The DE 40 forecast for next week is negative.

DE 40 forecast: key trading points

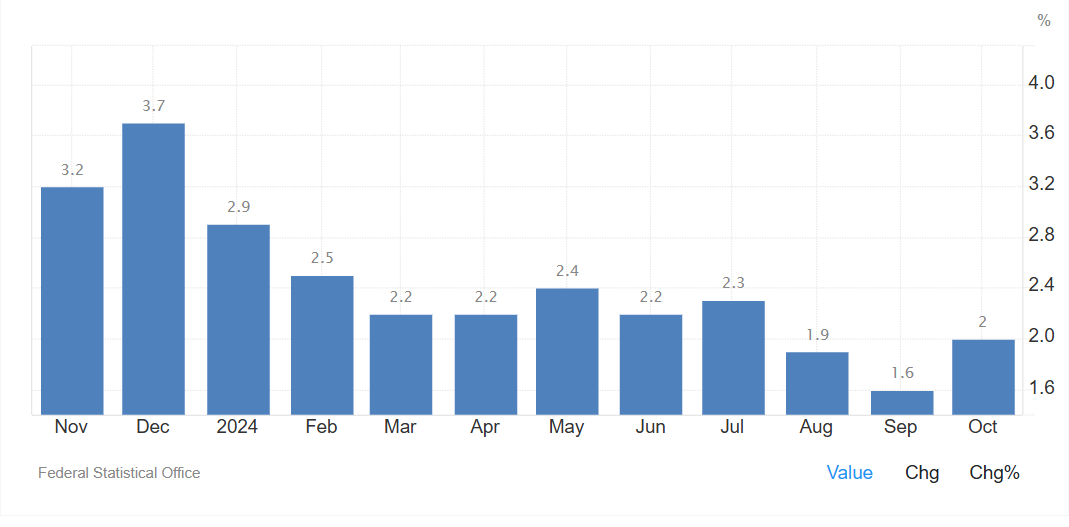

- Recent data: Germany’s preliminary CPI was 2.0% y/y in October

- Economic indicators: inflation in the EU’s leading economy affects the ECB’s monetary policy

- Market impact: accelerating inflation may prompt the ECB to pause rate cuts

- Resistance: 19,595.0, Support: 19,305.0

- DE 40 price forecast: 18,905.0

Fundamental analysis

According to Destatis’ preliminary estimate, Germany’s annual inflation measured by the CPI rose to 2.0% in October from 1.6% in September, exceeding the market forecast of 1.8%. The CPI increased by 0.4% month-on-month, above the 0.2% growth forecast after remaining flat in September.

Source: https://tradingeconomics.com/germany/inflation-cpi

The harmonised CPI used by the European Central Bank as a gauge of inflation increased by 2.4% year-on-year in October, well above the September reading of 1.8%. The regulator may revise its plans to cut interest rates further.

The DE 40 index may come under pressure due to expectations of tighter monetary policy and a potential decline in corporate profits. Companies sensitive to changes in consumer spending and borrowing costs, such as those in retail trade and production, may suffer significantly. The DE 40 index forecast remains negative.

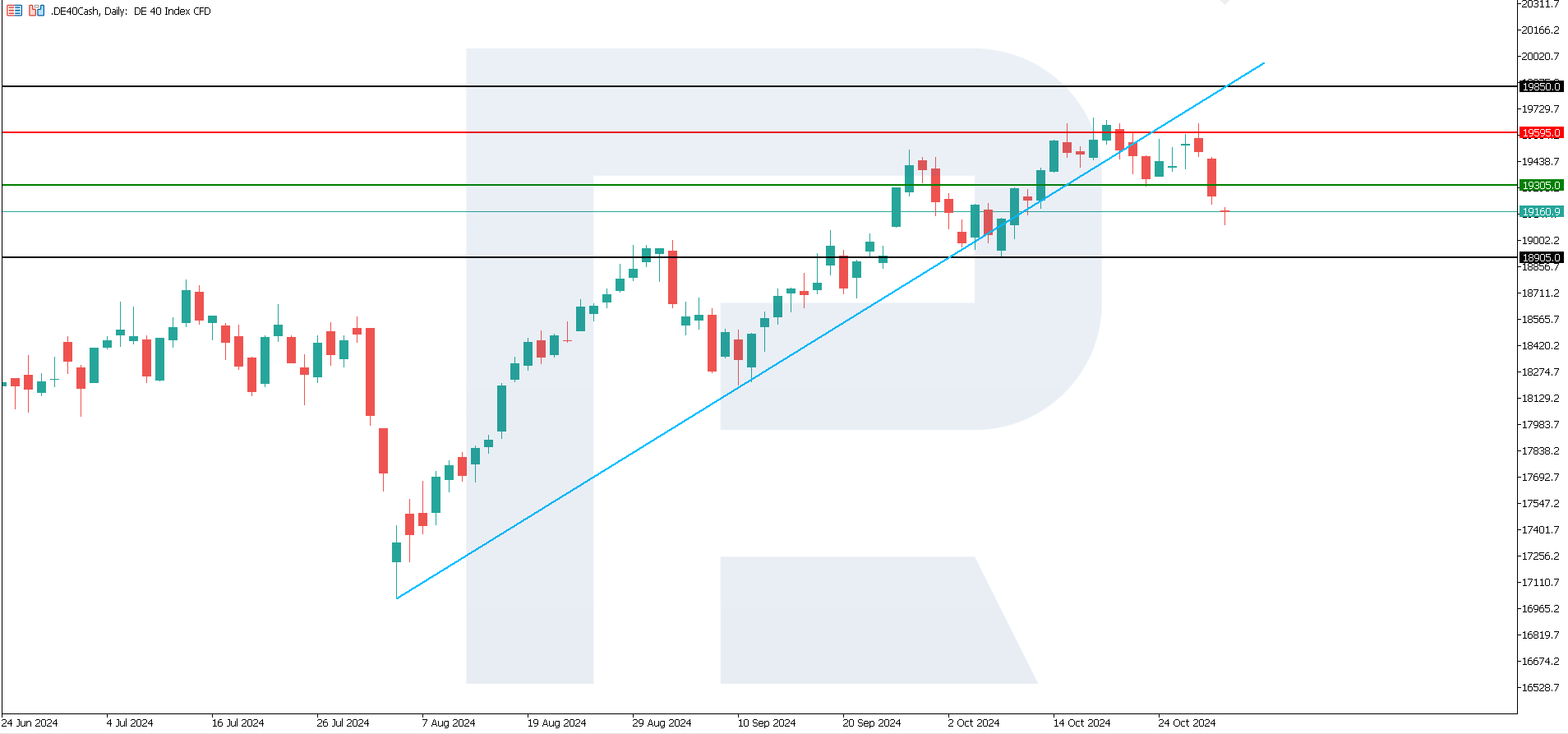

DE 40 technical analysis

The DE 40 stock index has initiated a downtrend after breaching the 19,305.0 support level and securing a position below it. A new support has yet to form. According to the DE 40 technical analysis, the decline will continue, with sideways channels forming occasionally. Only a breakout above the newly formed resistance level may signal a trend reversal.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: if the price secures below the 19,305.0 support level, the index could fall to 18,905.0

- Optimistic DE 40 forecast: a breakout above the 19,595.0 resistance level may propel the price up to 19,850.0

Summary

According to Destatis' preliminary estimate, Germany’s annual inflation measured by the CPI rose to 2.0% in October from 1.6% in September, exceeding the market forecast of 1.8%. Based on the DE 40 technical analysis, the decline will continue towards the 18,905.0 target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.