DE 40 analysis: the index attempts to reverse upwards from 19,000.0

The DE 40 stock index is rising today, aiming to secure above 19,000.0. The DE 40 forecast for next week remains positive.

DE 40 forecast: key trading points

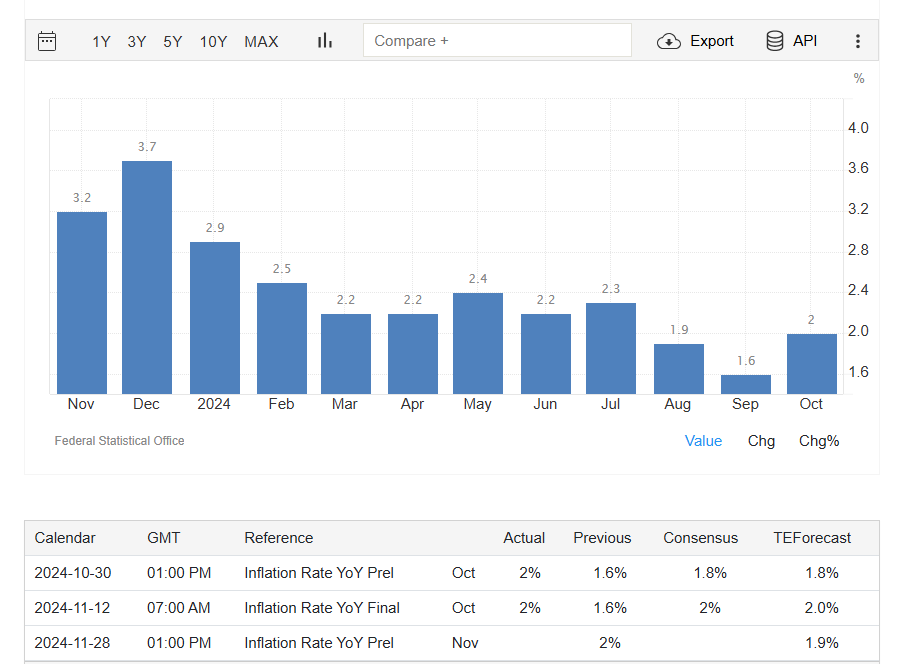

- Recent data: Germany’s consumer inflation rose by 0.4% in October

- Economic indicators: the Consumer Price Index (CPI) is the primary indicator for assessing inflation in the country

- Market impact: the indicator was in line with forecasts, causing no significant reaction

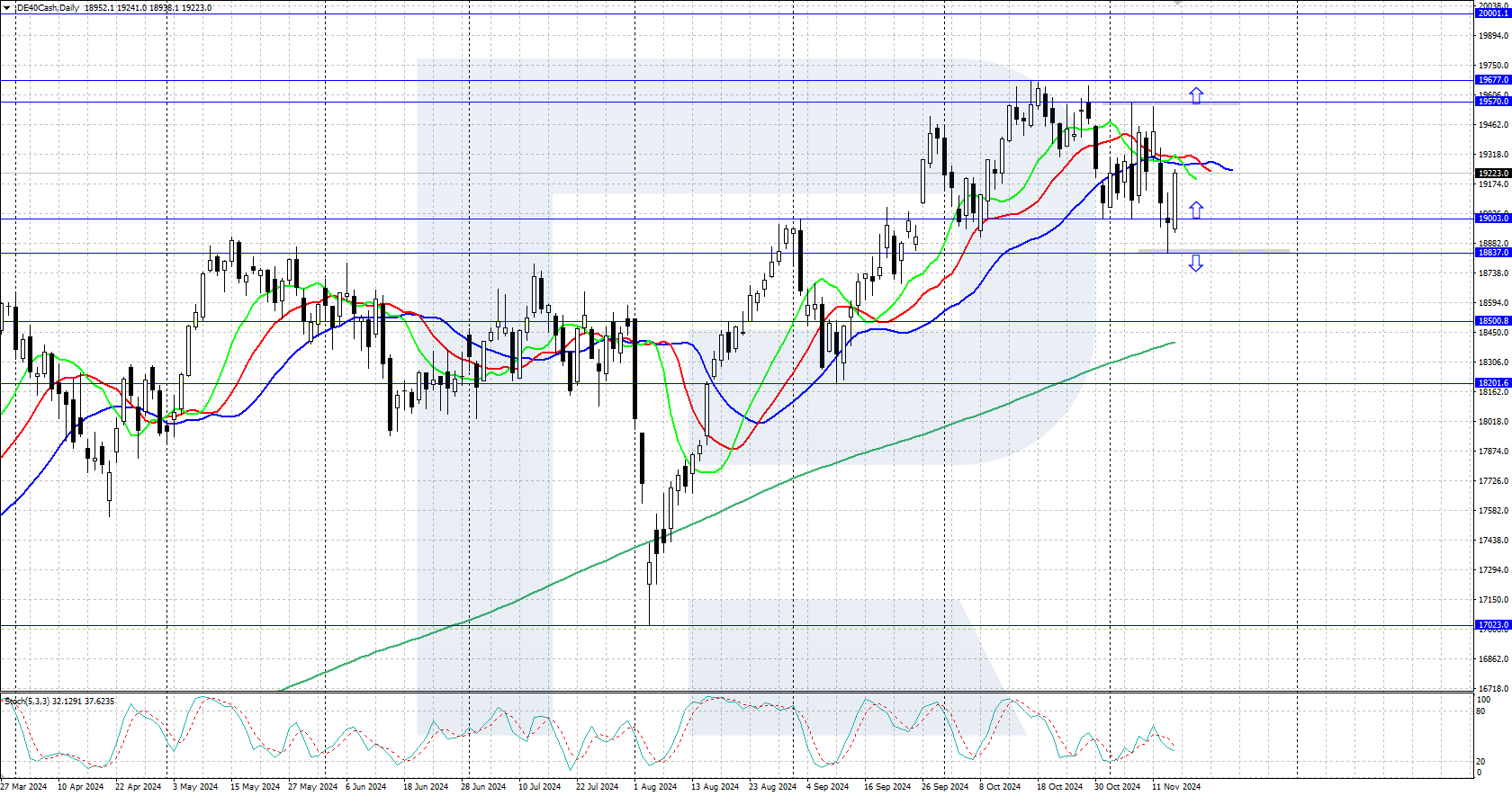

- Resistance: 19,570.0, Support: 18,837.0

- DE 40 price forecast: 19,570.0

Fundamental analysis

According to data released this week, Germany’s CPI increased by 2.0% in October, aligning with preliminary estimates. After remaining flat last month, the indicator increased by 0.4% month-on-month.

Source: https://tradingeconomics.com/germany/inflation-cpi

European stock markets saw moderate gains on Thursday. However, investors remain cautious, rigorously evaluating economic indicators in Europe and globally, particularly focusing on Donald Trump’s plans and the political climate in Germany.

The earnings season continues, with Siemens stock up around 5% after the company reported higher-than-expected profits, though its 2025 sales forecast had been previously revised downward due to geopolitical uncertainty. E.ON shares also rose by about 1% after the company confirmed its economic targets.

DE 40 technical analysis

The DE 40 stock index is rising moderately, attempting to reverse upwards following the US indices. The price may secure a position above 19,000.0, with the next resistance level at 19,570.0. The direction of the price movement outside the 18,837.0-19,570.0 range will determine the prospects of the index.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: if the price secures below the 18,837.0 level, the index could decline to 18,500.0

- Optimistic DE 40 forecast: if the price surpasses the 19,570.0 resistance level, it could reach a new high of 19,677.0, opening the potential for growth to 20,000.0

Summary

The DE 40 stock index is moderately rising, attempting to secure above the 19,000.0 level. Investors remain cautious, carefully assessing Donald Trump’s economic plans and the political climate in Germany.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.