DE 40 forecast: the index has resumed steady growth

The DE 40 stock index has resumed its growth, but is not yet ready to reach a new all-time high. The DE 40 forecast for today is positive.

DE 40 forecast: key trading points

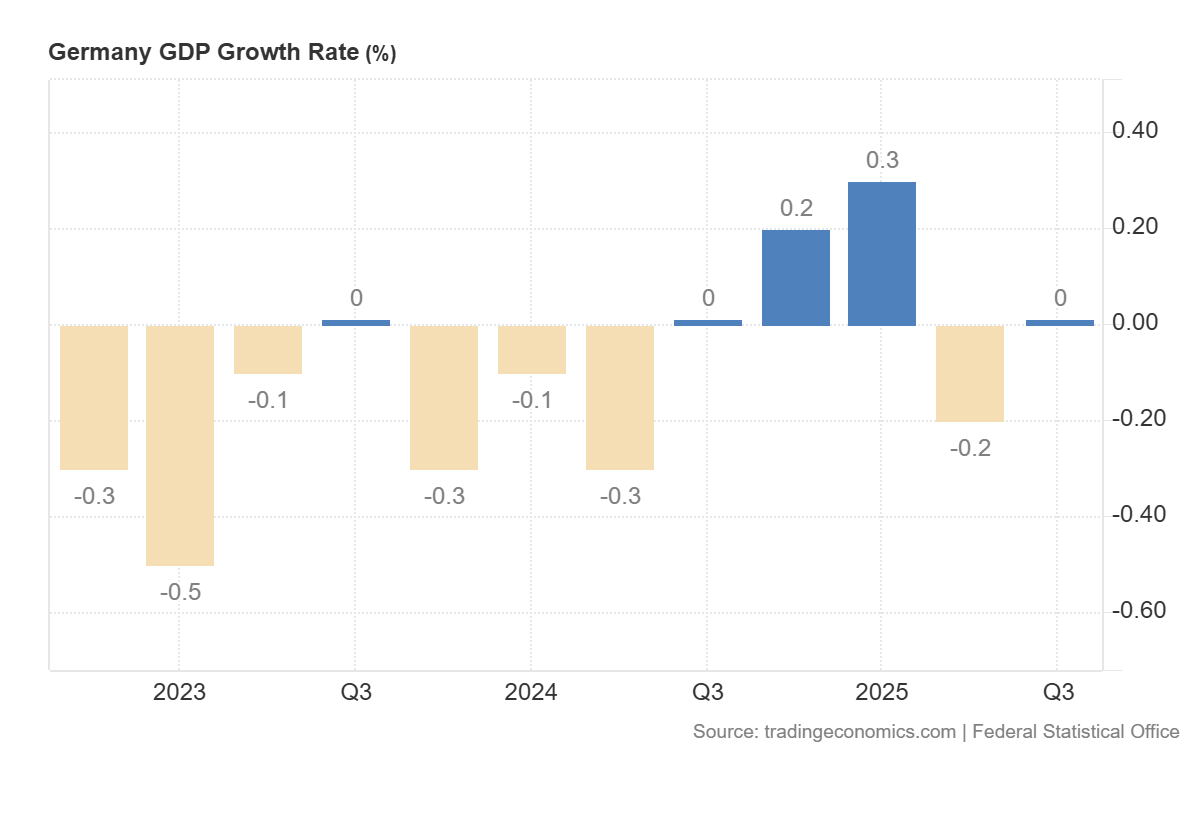

- Recent data: Germany’s GDP growth for Q3 2025 came in at 0.0% y/y

- Market impact: the data creates a mixed backdrop for the German stock market

DE 40 fundamental analysis

Fresh data on Germany’s GDP showed zero quarterly growth: 0.0% q/q, in line with forecasts and up from the previous -0.2%. Formally, the economy has stopped contracting, but it has not entered a clear recovery phase. This is more a signal of stabilisation at a low level: the recessionary trajectory has paused, but there has been no convincing rebound.

For the DE 40 index, such GDP data will likely lead to a restrained, limited market reaction. The absence of another quarter of decline suggests that major German corporations remain capable of maintaining profits at acceptable levels, especially exporters and global players that generate a large portion of their revenues outside Germany. This supports sentiment in automotive, industrial, and chemical stocks, provided that external demand does not deteriorate. At the same time, the lack of growth also reminds investors that the market is unlikely to pay significantly higher multiples for companies dependent on domestic demand.

Germany’s GDP growth rate: https://tradingeconomics.com/germany/gdp-growthDE 40 technical analysis

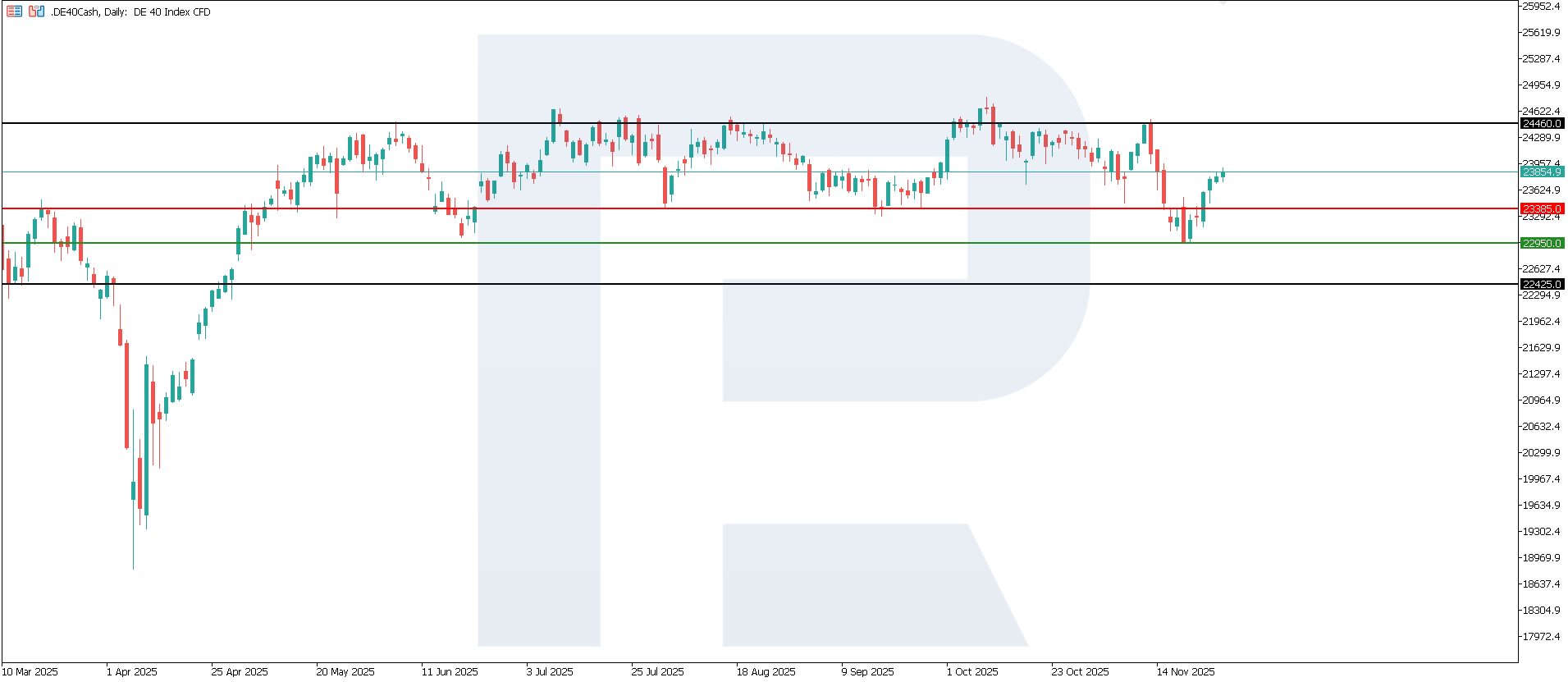

The DE 40 index broke above the key resistance level at 23,385.0, with a new support level formed at 22,950.0. The prevailing trend is upward, and its duration remains uncertain. The next upside target is 24,460.0.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 22,950.0 support level could push the index to 22,425.0

- Optimistic DE 40 scenario: if the price consolidates above the previously breached resistance level at 23,385.0, the index could climb to 24,460.0

Summary

Overall, Germany’s GDP at 0.0% q/q reduces some recession fears but does not justify excessive optimism. For the German equity market and the DE 40 index, this creates a backdrop of cautious optimism: the base case is a slow, uneven recovery driven by exports and global growth, where investors prefer high-quality companies with strong balance sheets and international diversification. The next upside target for the DE 40 could be 24,460.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.