DE 40 forecast: the index resumed growth after correction

The DE 40 stock index continues to recover after the correction, with the uptrend remaining intact. The DE 40 forecast for today is positive.

DE 40 forecast: key takeaways

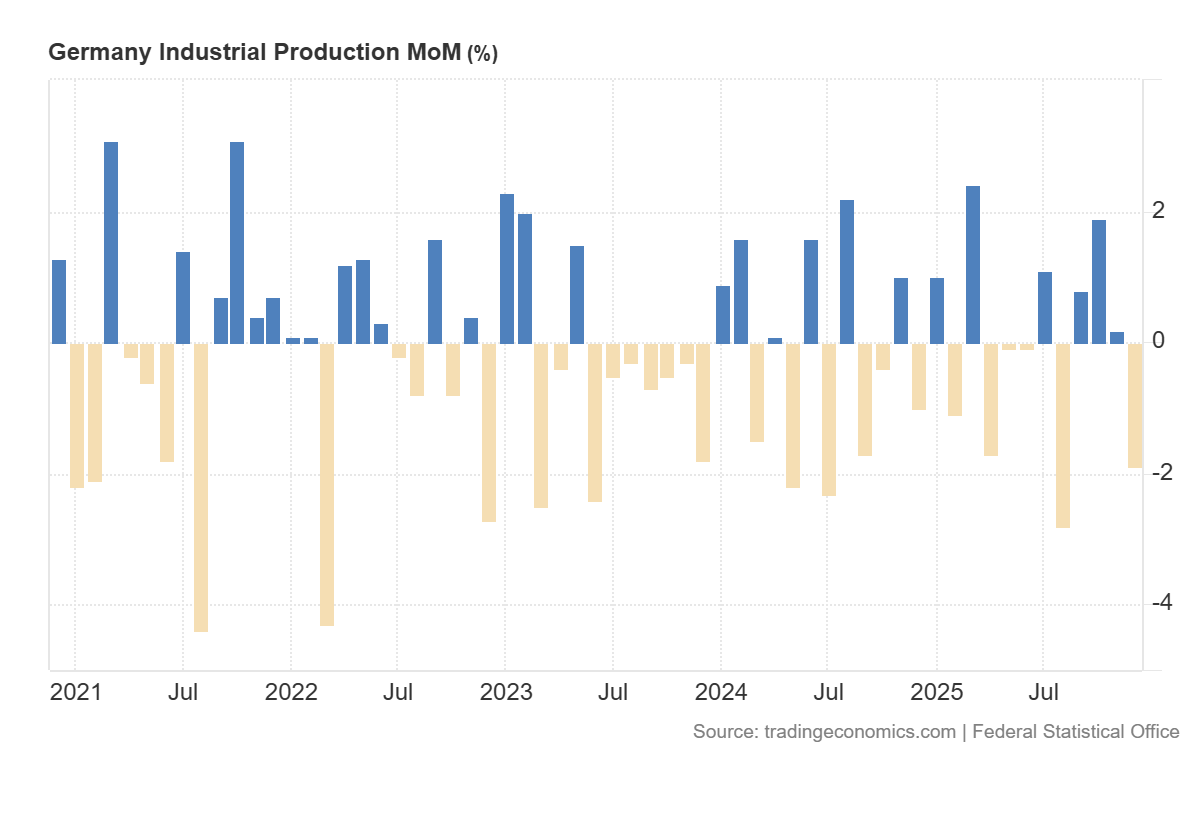

- Recent data: Germany’s industrial production fell by 1.9% in January compared to December last year

- Market impact: the data creates a negative backdrop for the German equity market

DE 40 fundamental analysis

German industrial production data represents a significantly weaker-than-expected result, coming in at −1.9% m/m compared to expectations of −0.2% and the previous reading of +0.2%. For the DE 40 index, this typically implies a short-term deterioration in sentiment, as the indicator is directly linked to business activity, capacity utilisation, and future corporate earnings trends in an industry-oriented economy.

The short-term impact on the DE 40 is likely to be restraining. The index includes large companies that depend on the industrial cycle, external demand, and business investment activity. Weak output data increases the likelihood of downward revisions to profit expectations in cyclical sectors, which is typically reflected in a more cautious valuation of equities. At the same time, the market may partially offset this negative effect through expectations of a more accommodative monetary policy in the eurozone, although such a compensating effect often does not materialise immediately and is not evenly distributed across sectors.

Germany’s industrial production m/m: https://tradingeconomics.com/germany/industrial-production-momDE 40 technical analysis

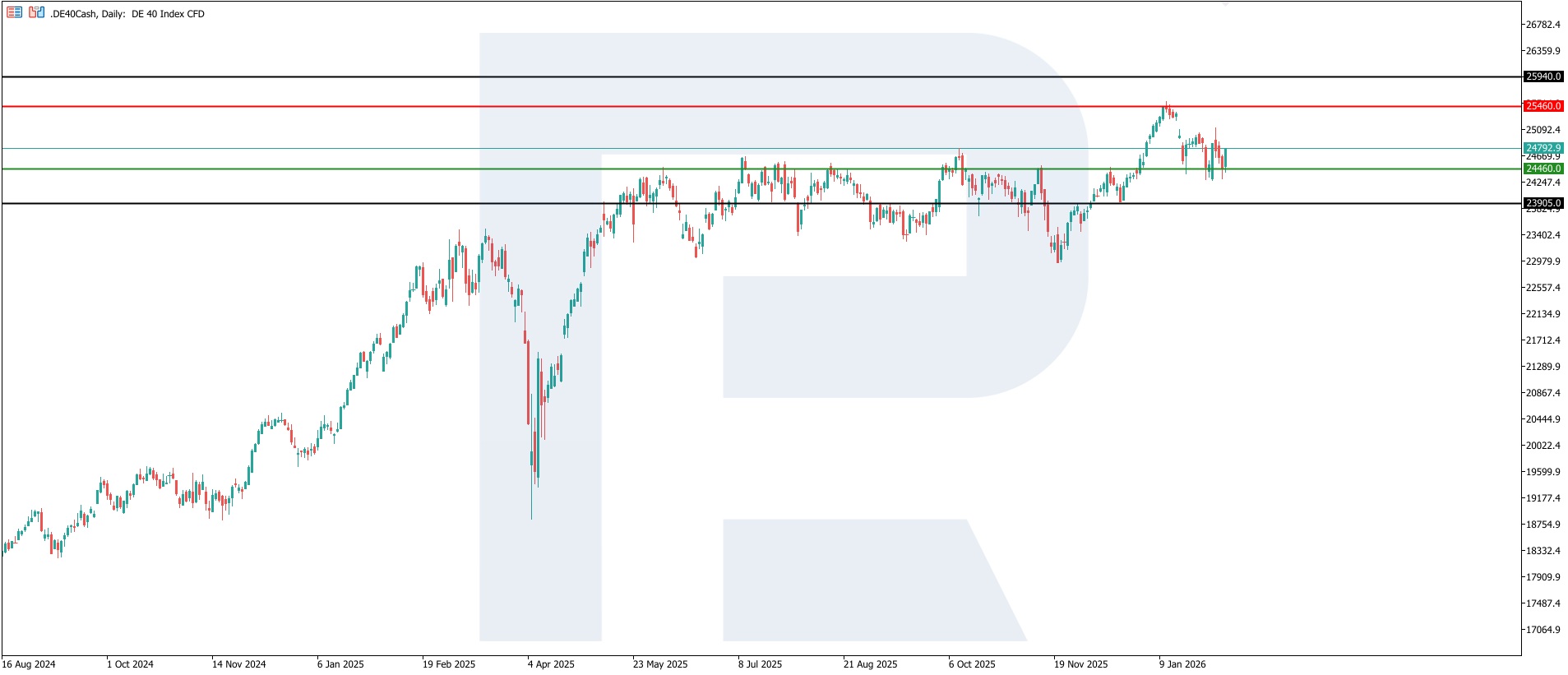

For the DE 40 index, the crucial resistance level is located at 25,460.0, with the key support level around 24,460.0. Recently, the index has been in a correction phase and has tested the support area. In case of a recovery move, the nearest upside target could be 25,940.0.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 24,460.0 support level could send the index down to 23,905.0

- Optimistic DE 40 scenario: a breakout above the 25,460.0 resistance level could propel the index up to 25,940.0

Summary

Overall, the basic conclusion for the DE 40 is as follows: the current release is rather negative in the short term due to the scale of the deviation from the forecast, but the medium-term trajectory will depend on whether weakness is confirmed in subsequent reports or proves to be a temporary setback. Key factors for further assessment will be data on new industrial orders, business expectations, export dynamics, and the European Central Bank’s comments on future policy parameters. The nearest upside target remains the 25,940.0 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.