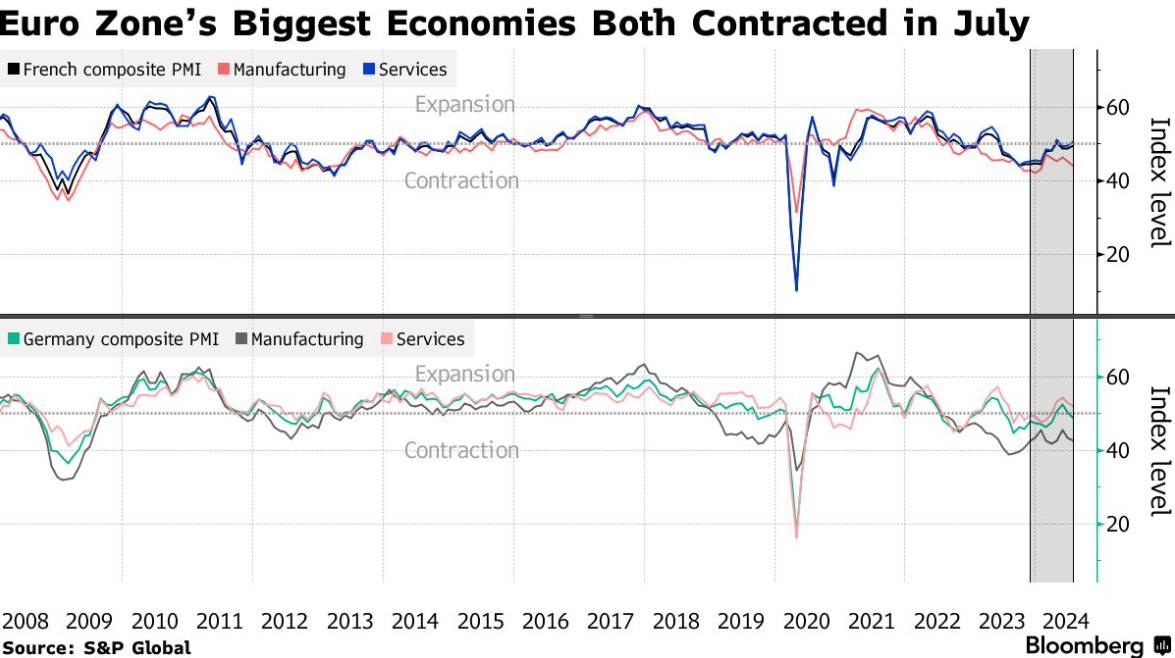

DE 40 analysis: trend absent again amid Germany’s weak manufacturing PMI

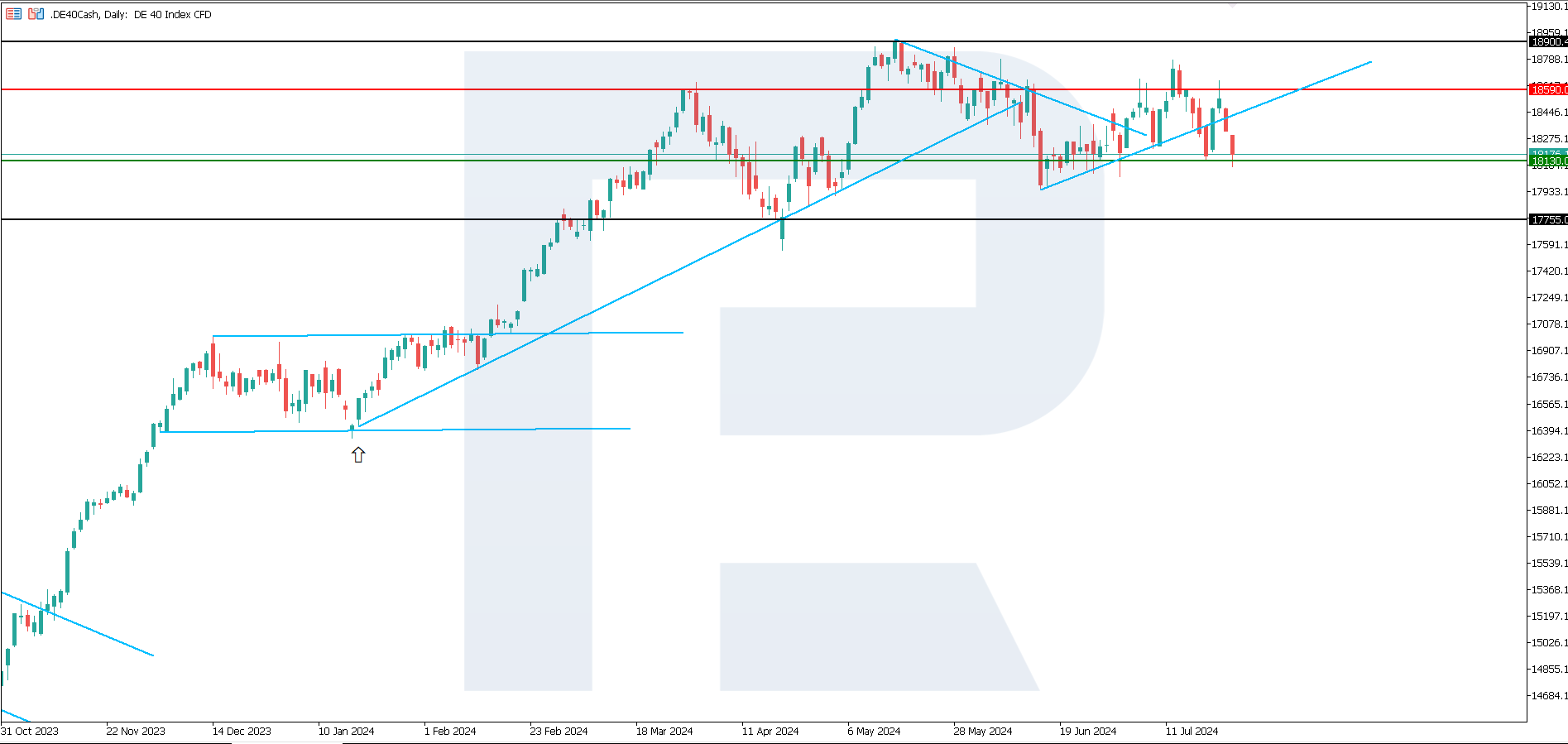

The DE 40 stock index has breached the support level of the uptrend that began last week. A new sideways channel is likely to form.

DE 40 trading key points

- Recent data: Germany’s composite PMI reached 48.7 points, falling short of economists’ forecast of 50.6

- Economic indicators: these indicators show that the German manufacturing sector is still struggling with the consequences of the energy crisis

- Market impact: the negative dynamics in the manufacturing sector may lead to an economic downturn and sell-offs in the German stock market

- Resistance: 18,510.0, Support: 18,130.0

- DE 40 price forecast: 17,755.0

Fundamental analysis

The S&P Global Purchasing Managers’ Index dropped to 48.7 points from 50.4 a month earlier, again falling below the 50.0 threshold that signals a decline. This undermines hopes for economic growth in Germany in the year’s second half.

The Bundesbank warned this week that economic growth in Q2 2024 was likely weaker than expected following the disappointing industry data. The report still indicates that growth rates should accelerate in the three months to September, driven by increasing private consumption. However, it also warned that improvements in the manufacturing sector would be slow.

Based on this, stagnation in the German economy appears likely. Only an ECB interest rate cut could remedy the situation. In such a case, some funds from the debt market might shift to the stock market. However, this would likely only have a short-term effect and is unlikely to result in sustained growth.

DE 40 technical analysis

The DE 40 stock index has breached the uptrend line and is now trading within a sideways channel. Subsequently, a downtrend is likely to form with regular sideways movements. Demand for German shares will likely decrease gradually and with little excitement.

Key levels to watch for the rest of the week and early next week include:

- Resistance level: 18,510.0 – with a breakout above this level, the price could target 18,900.0

- Resistance level: 18,130.0 – a breakout below this level could push the price down to 17,755.0

Summary

The DE 40 stock index has entered the sideways channel with the potential for further decline. The price is unlikely to reach an all-time high by the end of next week. The S&P Global Purchasing Managers’ Index dropped to 48.7 points from 50.4 a month earlier, again falling below the 50.0 threshold that signals a decline. This diminishes prospects for economic growth acceleration by the end of the year.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.