US500 analysis: low inflation pushes the quotes up

The US500 may hit a new all-time high for the 30th time since the beginning of the year, aided by low inflation.

US500 analysis: low inflation pushes the quotes up

The US500Cash stock index has reached a new all-time high for the 29th time since the beginning of 2024, with the current instrument price standing at 5432.4.

US consumer inflation data was released last week, and the Federal Reserve maintained the key rate within the range of 5.25-5.50%. However, the regulator raised its forecast for this indicator.

The markets ignored the harsh rhetoric and continued their growth. Investors will likely be encouraged by an optimistic US inflation report. The consumer price index was 3.30% year-on-year, lower than market analysts expected but still far from the US Federal Reserve’s target of 2.00%.

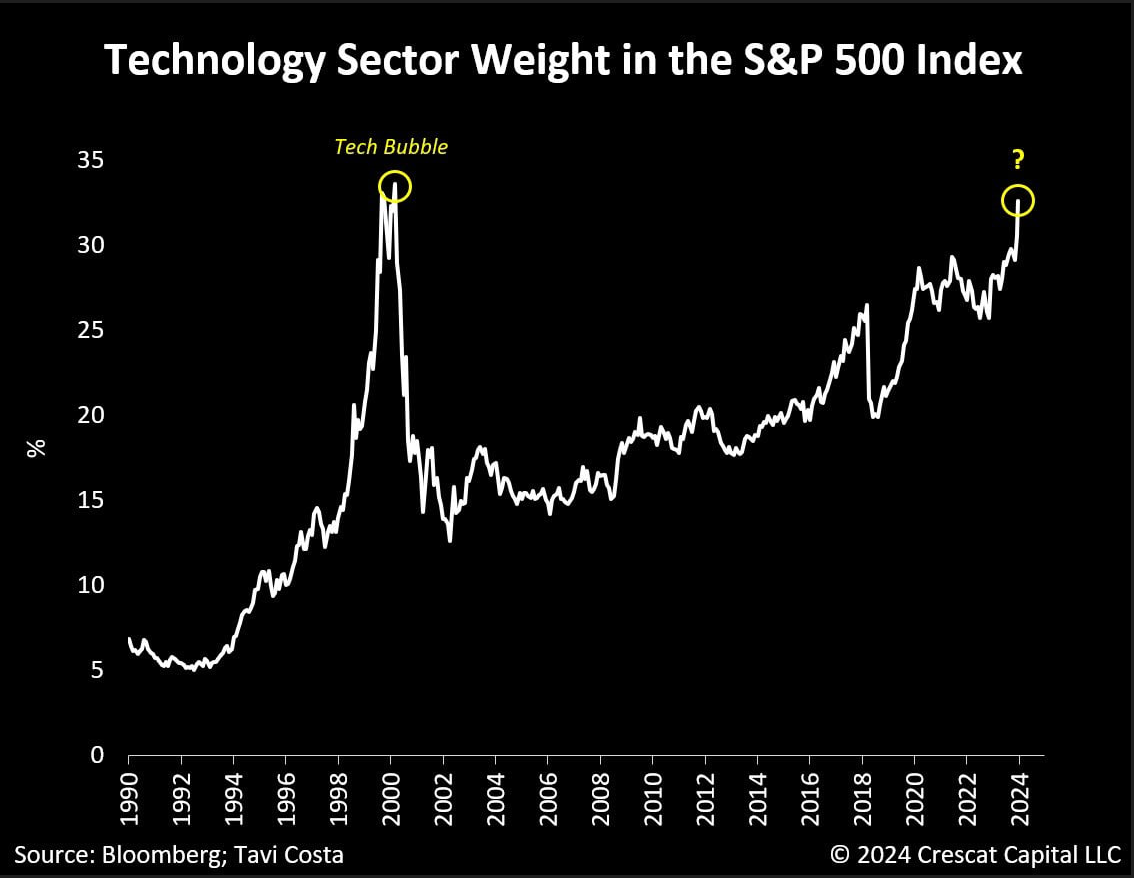

Technology sector weight in the S&P 500 Index.

Source: https://www.instagram.com/tavicostamacro/

The technology sector’s weighting in the US500 index reached 34% at the peak of the dot-com bubble in 2000. Nowadays, this figure stands at 33%. It is enough for a company to announce that it plans to develop in the artificial intelligence sphere for its stock to start rising.

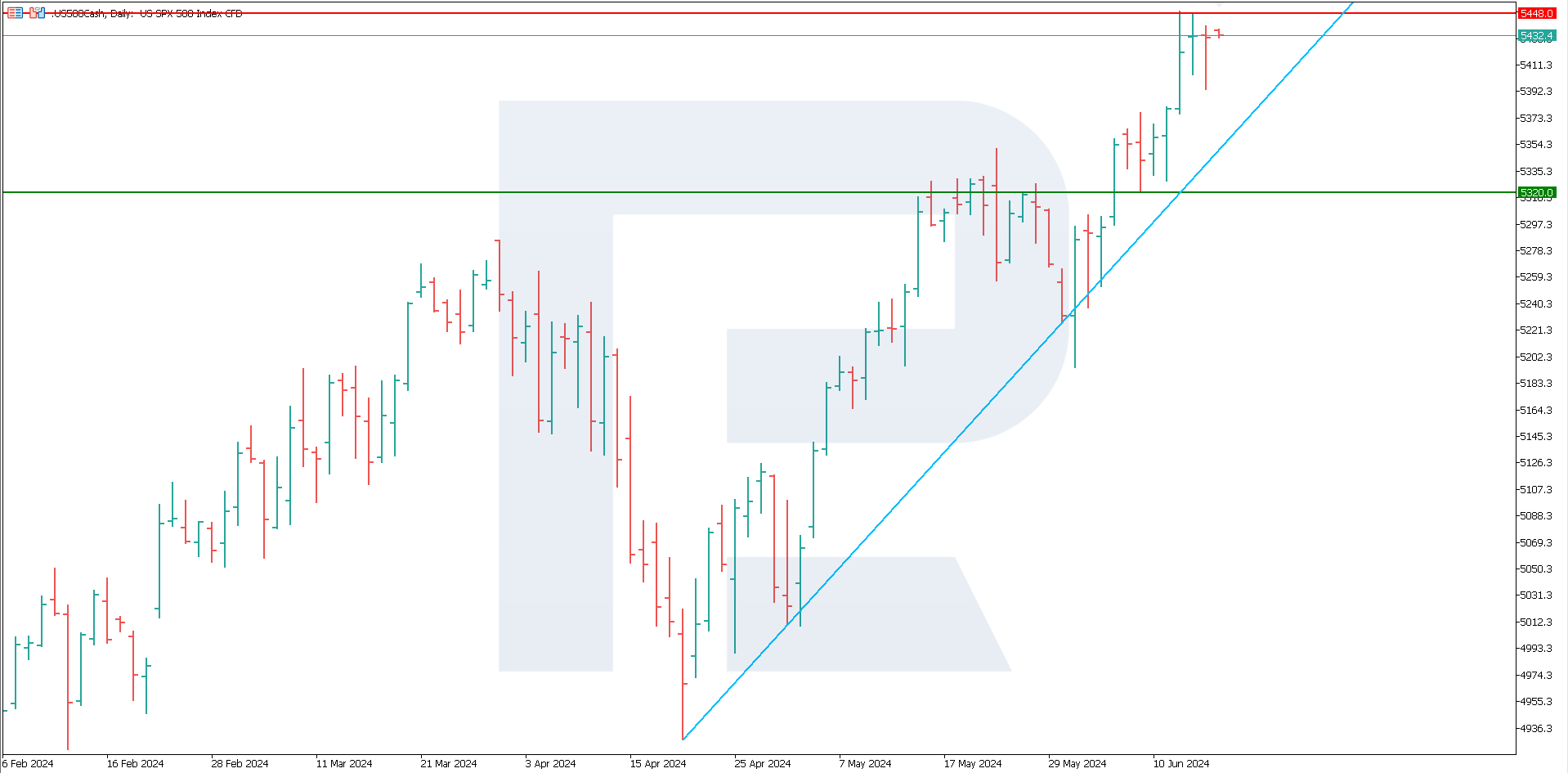

Technical analysis US500

The US500 stock index has increased by 4.08% since early June, reaching a new all-time high. It can be confidently stated that an uptrend started in mid-April 2024. There might still be growth potential even after a corrective decline.

The US500 index chart, D1.

A resistance level formed at 5448.0, with support at 5320.0. If the quotes fail to surpass the resistance, the index rate will likely decline to the support and break below it. In this case, the target might be the 5225.0 mark. Alternatively, the price could break above the resistance with a 5500.0 target and hit a new all-time high.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.