USTECH analysis: technology sector rally continues amid weak US inflation

USTECH reached a new all-time high

USTECH fundamental analysis

The USTECH stock index continues to achieve new historical highs as part of an uptrend. The current price is 19,970.3.

Bloomberg notes that hedge funds are increasingly cautious about US stocks due to the Federal Reserve’s reluctance to lower interest rates and mild economic conditions. According to Goldman Sachs Group Inc.’s Prime Brokerage department, they have reduced their total long-short leverage level, indicating heightened market exposure, a situation not seen since March 2022. This move reflects a more cautious stance of the so-called soft money investors.

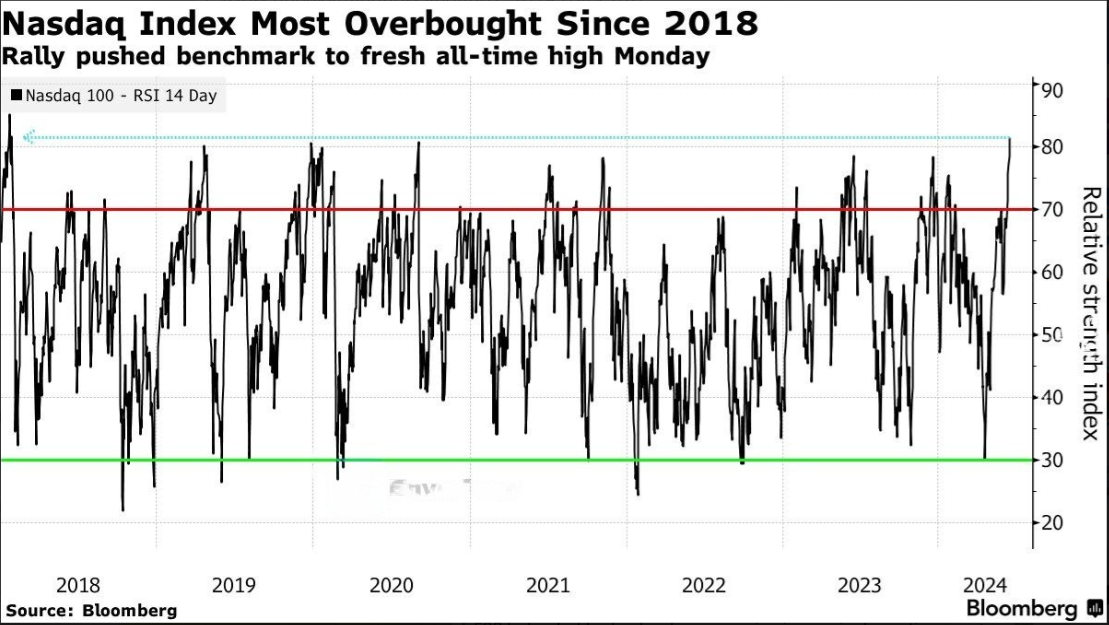

Relative strength index NASDAQ.

An increase in corporate stocks has propelled the NASDAQ index to reach a new record high. Its 14-day Relative Strength Index (a price momentum indicator) is currently at its most overbought level since 2018, suggesting a potential pullback.

USTECH technical analysis

The USTECH stock index has achieved another historical high, primarily driven by the increased market capitalisation of NVIDIA Inc. and Broadcom Inc. The rally in the artificial intelligence sector continues, with US inflation data serving as an additional driver.

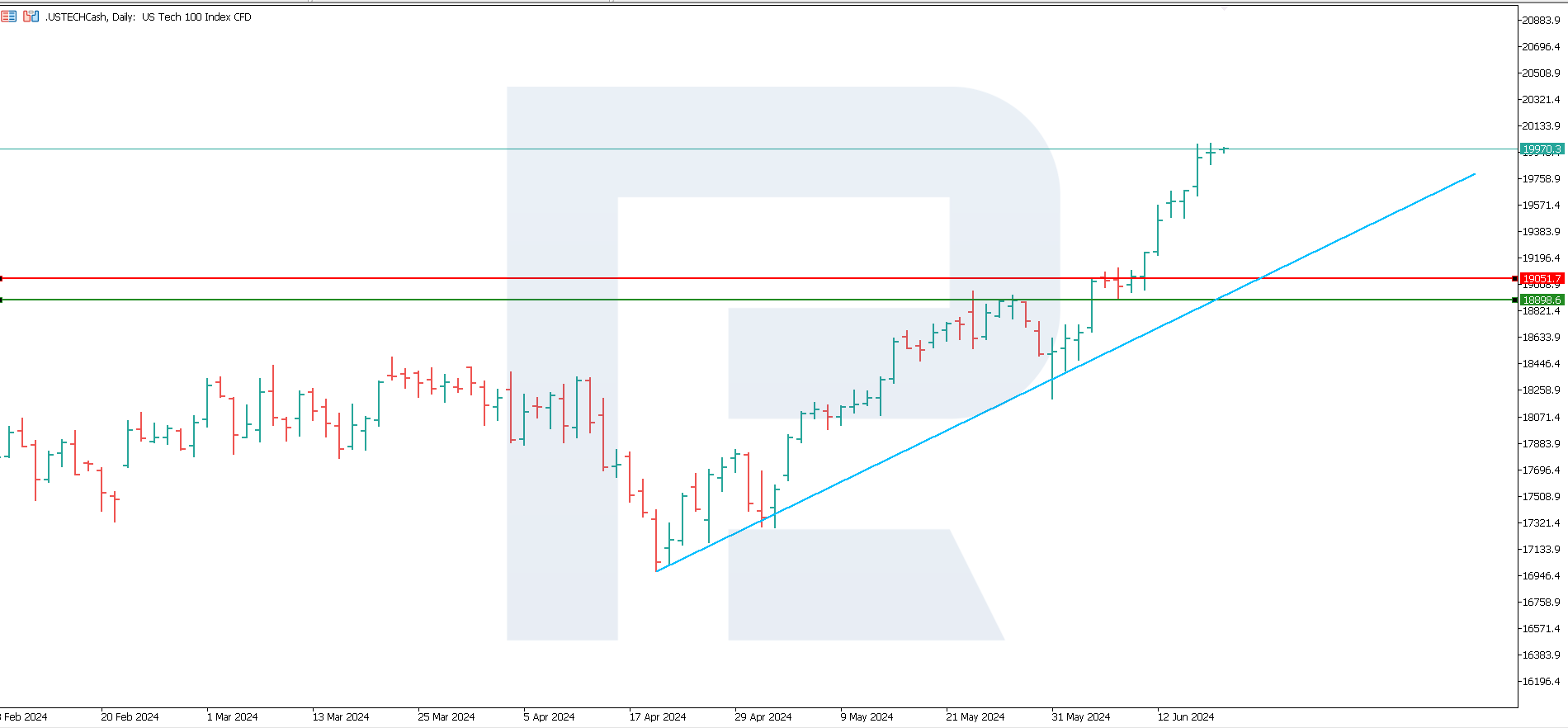

The USTECH index chart, D1.

The resistance level has broken through 19,051.7, with a new one yet to be established, while the support level has changed to 18,898.6. By the end of this week, the index will likely decline as part of a correction, potentially establishing a new resistance level. Nevertheless, the potential for further growth remains, with expectations of reaching new all-time highs. A global trend reversal could be considered only if the price breaches the current 18,898.6 support level, with a potential target of 18,200.0.

Summary

The USTECH stock index continues to set new all-time highs within its uptrend. The 14-day USTECH Relative Strength Index (a price momentum indicator) is currently at the most overbought level since 2018, suggesting a possible pullback. From a technical analysis perspective, the USTECH stock index price is projected to undergo correction by the end of this week.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.