US Tech analysis: the decline in the technology sector may not be over; quotes have not yet found a trough

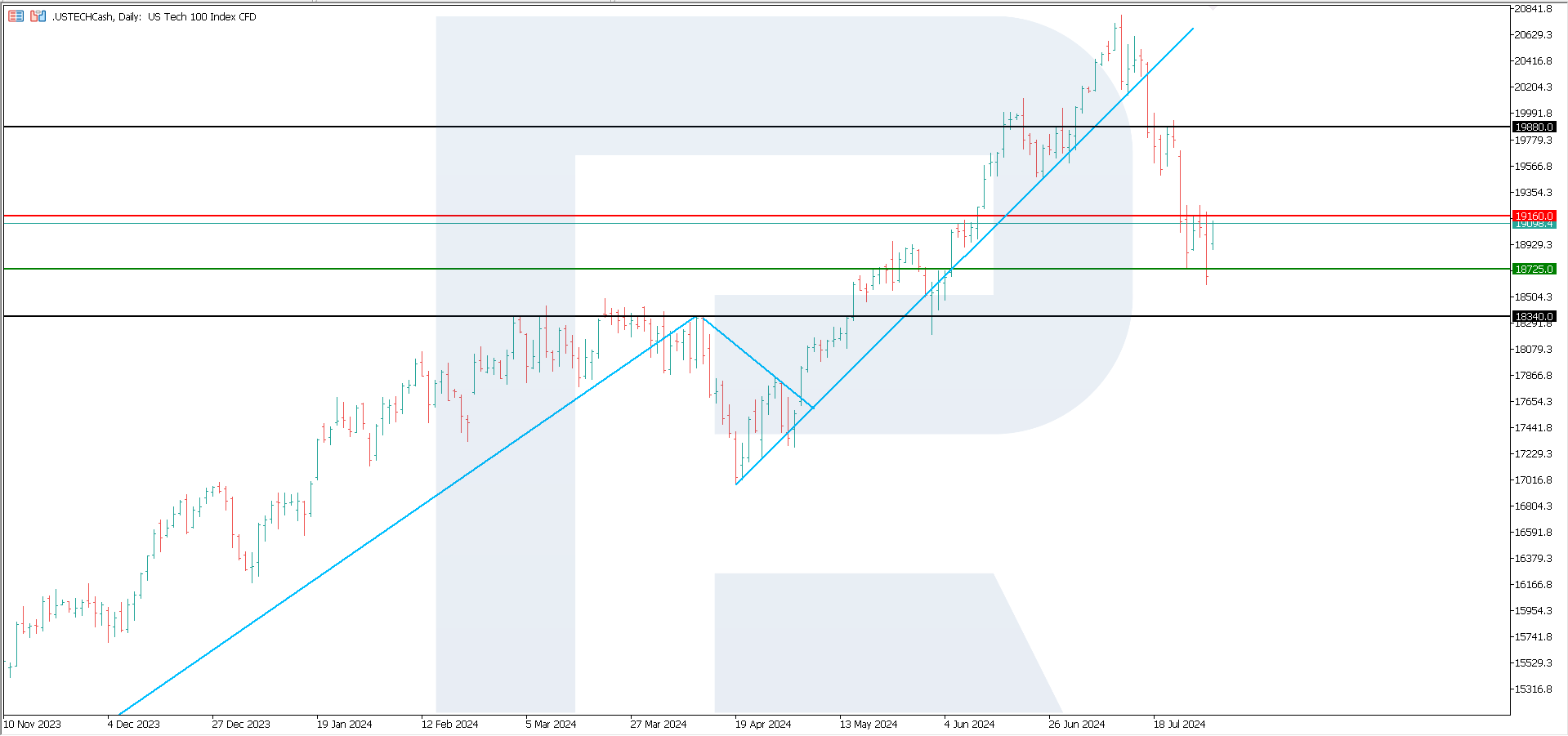

The US Tech stock index plunged by over 10% from its all-time high. The US Tech index forecast suggests a continued decline in line with the downtrend.

US Tech trading key points

- Recent data: US job openings (JOLTS) reached 8.18 million, exceeding analysts’ expectations

- Economic indicators: strong employment market data may lead the US Federal Reserve to keep interest rates unchanged

- Market impact: market participants are sensitive to any news that may prevent the Fed from easing monetary policy

- Resistance: 19,160.0, Support: 18,725.0

- US Tech price forecast: 18,340.0

Fundamental analysis

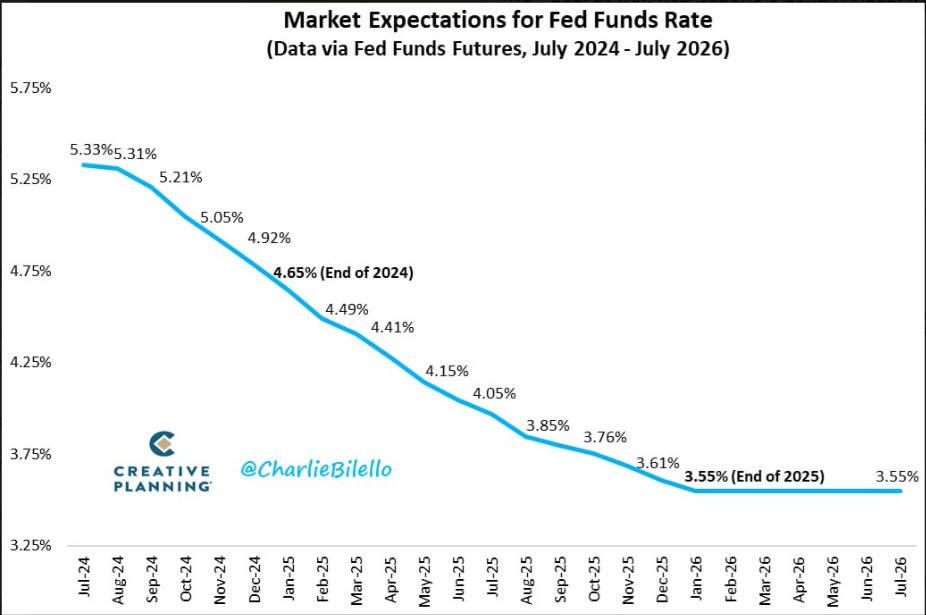

The US Federal Reserve’s meeting on interest rates is scheduled for today. The rate is likely to remain unchanged. However, the statements following the meeting are of great interest, as market participants hope for clear guidance on future key rate cuts.

Source: https://bilello.blog/2024/the-week-in-charts-7-29-24

Since 2009, the Federal Reserve has consistently acted in line with market expectations at FOMC meetings. The Fed will likely signal an imminent rate cut at this week’s meeting, with market participants keen to understand how quickly the Federal Reserve will lower rates again.

The regulator is expected to reduce interest rates further in November and December, resulting in a total of three rate cuts this year. The market currently anticipates an additional four rate reductions in 2025. A September rate cut has already been factored into current market prices.

US Tech technical analysis

The US Tech stock index broke below the 18,725.0 support level yesterday within the current downtrend. Although Wednesday’s trading opened with an upward gap, it is too early to consider a trend reversal until the price breaks above the actual resistance level. Consequently, further declines in the US Tech index are expected.

Key levels in the US Tech analysis to watch until the end of the week include:

- Resistance level: 19,160.0 – if the price breaks above this level, it could target 19,880.0

- Support level: 18,725.0 – if the price breaks below this support could aim for 18,340.0

Summary

The US Tech stock index remains in a downtrend. Consequently, the US Tech forecast for next week suggests a decline to 18,340.0. Today’s US Federal Reserve meeting will be crucial for announcing plans to lower interest rates. The regulator needs to determine how many cuts it is planning. Market analysts forecast three rate cuts this year.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.