JP 225 forecast: the index approached the upper boundary of the ascending channel and hit new all-time high

The JP 225 stock index continues to rise within the ascending channel. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

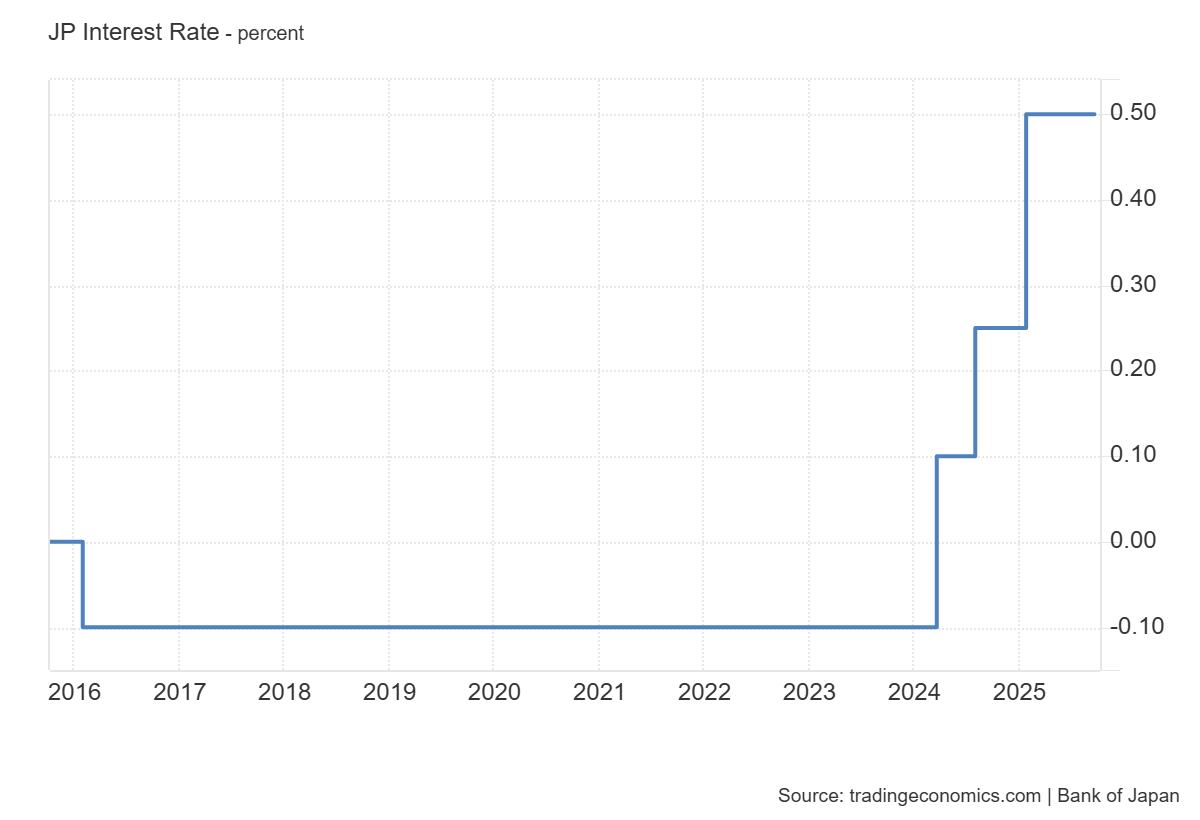

- Recent data: the Bank of Japan policy rate remains at 0.50%

- Market impact: the effect on the Japanese stock market is moderately positive

JP 225 fundamental analysis

The Bank of Japan kept its benchmark interest rate at 0.50%, in line with forecasts and the previous level. This decision signals continued cautious normalisation of monetary conditions without additional tightening that could significantly increase capital costs for corporations. Short-term uncertainty declines, and the risk premium on Japanese equities generally remains stable.

For the JP 225, the impact can be described as neutral to positive. The decision was widely expected, which supports investor appetite for risk assets and allows markets to focus on corporate earnings and global demand. The yen remains a key factor: a stable or weaker currency boosts export revenue conversion, traditionally providing support for the index.

Japan Interest Rate: https://tradingeconomics.com/japan/interest-rateJP 225 technical analysis

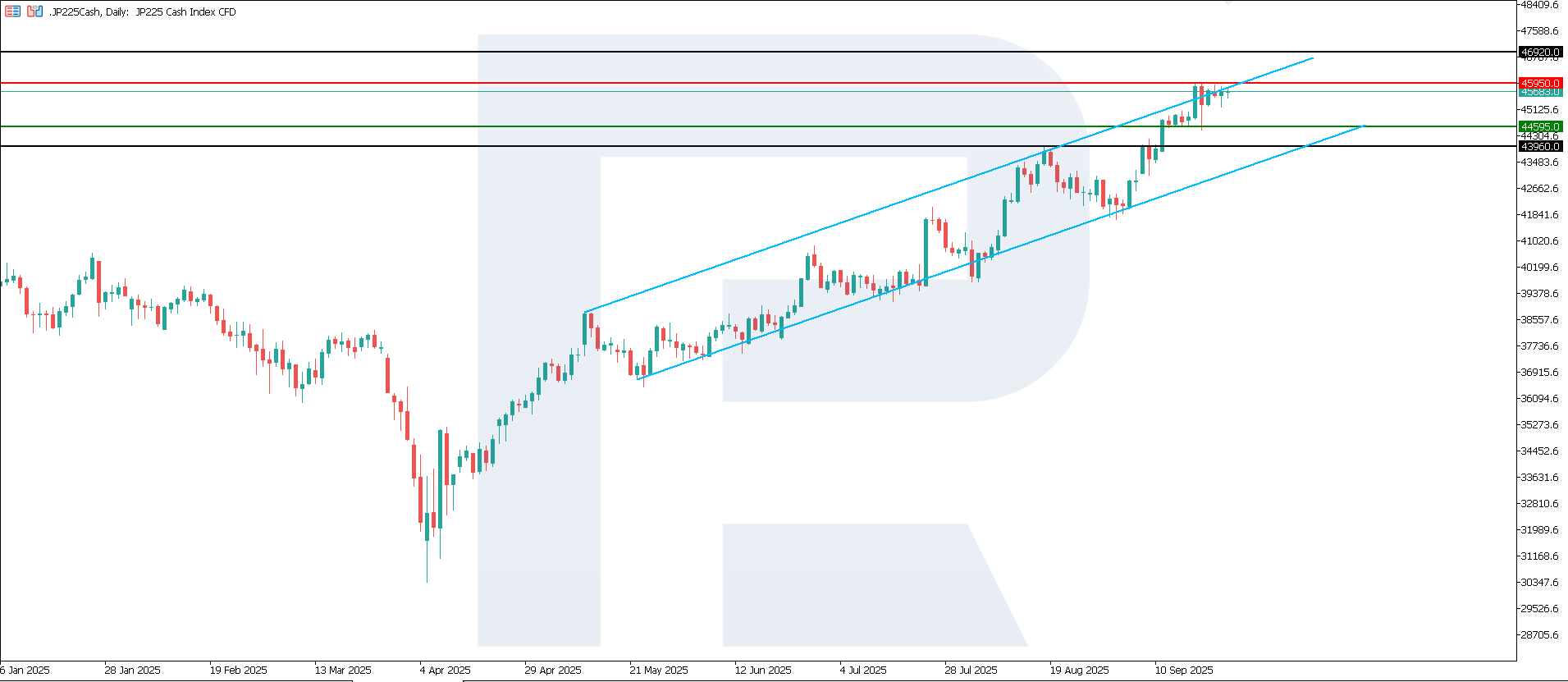

The JP 225 index resumed growth and hit a new all-time high. The support level is located at 44,595.0, with resistance at 45,950.0. Currently, the uptrend is highly likely to continue.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 44,595.0 support level could send the index down to 43,960.0

- Optimistic JP 225 scenario: a breakout above the 45,950.0 resistance level could boost the index to 46,920.0

Summary

The expected decision moderately supports Japanese equities and the JP 225, with exporters and highly leveraged companies benefitting the most. The impact on the financial sector is limited by the absence of further rate hikes. The next upside target for the JP 225 is 46,920.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.