JP 225 forecast: the index continues to reach new all-time highs

The JP 225 stock index has formed a strong uptrend and hit a new all-time high. The JP 225 forecast for today is positive.

JP 225 forecast: key takeaways

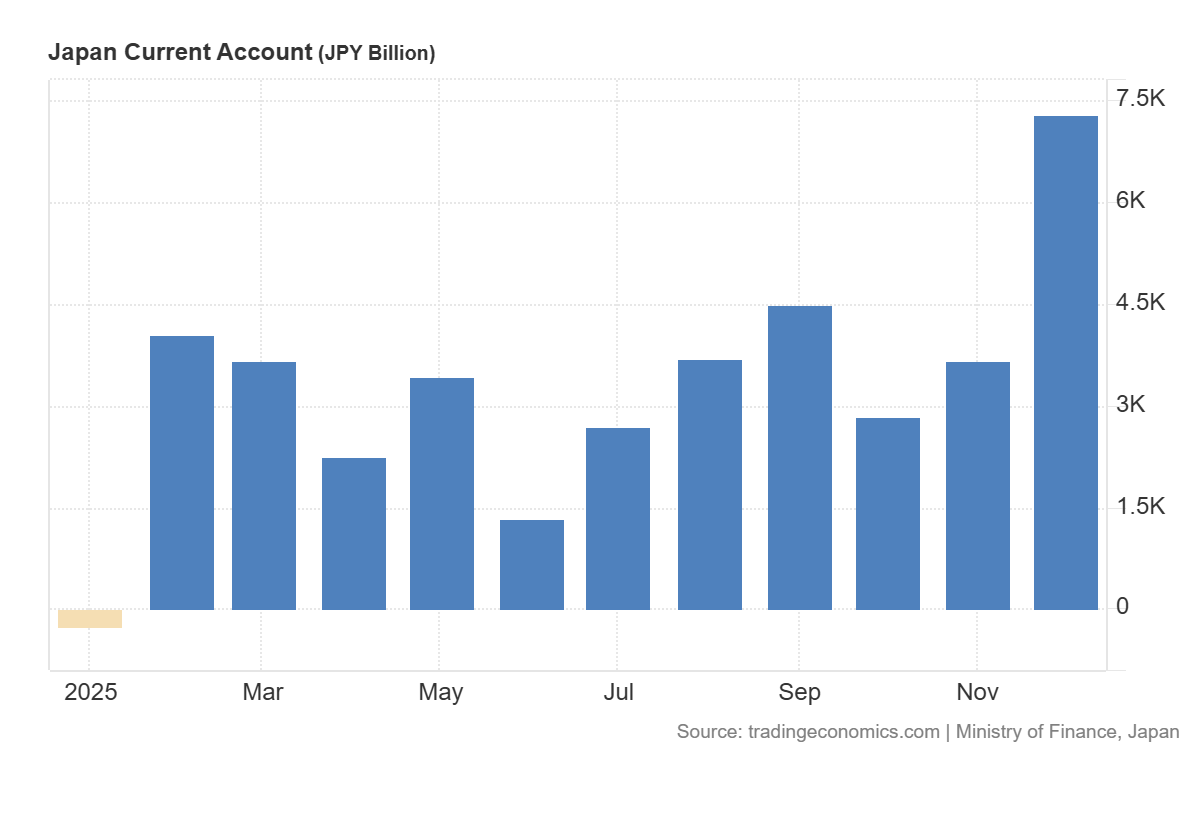

- Recent data: Japan’s current account amounted to 7.28 trillion JPY in December 2025

- Market impact: the effect on the Japanese stock market is moderately positive

JP 225 fundamental analysis

The latest data on Japan’s current account came in significantly stronger than expected, with the actual figure reaching 7.288 trillion JPY versus a forecast of 1.060 trillion JPY, while the previous reading stood at 3.674 trillion JPY. Such a sharp deviation from expectations indicates greater resilience of the country’s external balance than the market had anticipated.

For the JP 225 index, this is a moderately positive factor in the baseline scenario, though with an important adjustment for currency dynamics. A strong current account figure typically creates conditions for yen appreciation. If the national currency strengthens, some export-oriented companies may face more subdued profit expectations when revenues are converted into yen.

Japan’s current account: https://tradingeconomics.com/japan/current-accountJP 225 technical analysis

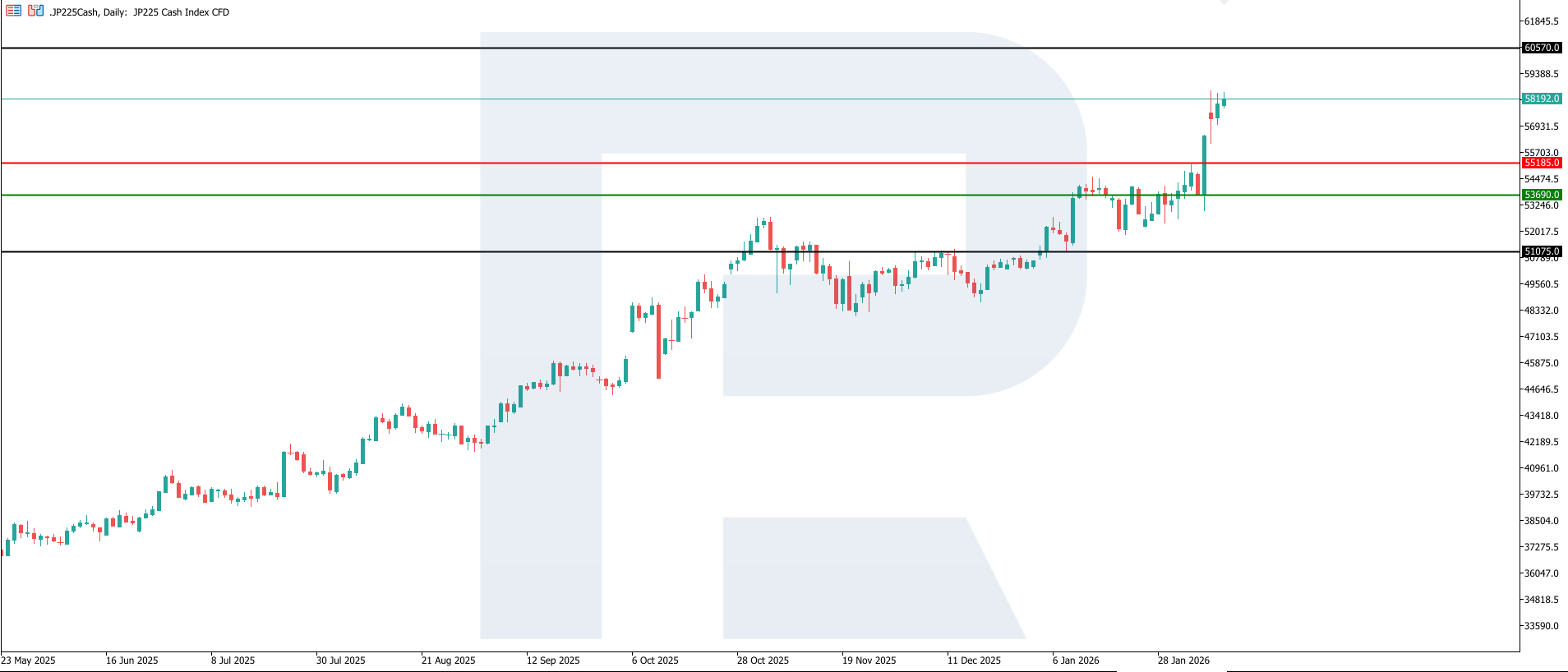

The JP 225 index maintains its upward momentum. The key support level is located at 53,690.0, while the nearest resistance level at 55,185.0 has been broken. The current rise is highly likely to be medium-term, with the next potential target at 60,570.0.

The JP 225 price forecast considers the following scenarios:

- Pessimistic JP 225 scenario: a breakout below the 53,690.0 support level could push the index down to 49,705.0

- Optimistic JP 225 scenario: if the price consolidates above the previously breached resistance level at 55,180.0, the index could climb to 60,570.0

Summary

The figure of 7.288 trillion JPY compared to the forecast of 1.060 trillion JPY and the previous level of 3.674 trillion JPY represents a strong positive signal for assessing Japan’s external economic resilience. At the same time, the impact on the JP 225 is uncertain due to the potential appreciation of the yen and its effect on export-oriented companies. For the Japanese stock market, this suggests a higher likelihood of sectoral differentiation and a more selective revaluation of issuers in the short term. The next upside target for the JP 225 stands at 60,570.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.