US 30 analysis: index growth rates are slowing, while the likelihood of a correction increases

The US 30 index failed to secure above the 45,000.0 level within the current uptrend. Find more in our US 30 price forecast and analysis for next week, 9-13 December 2024.

US 30 forecast: key trading points

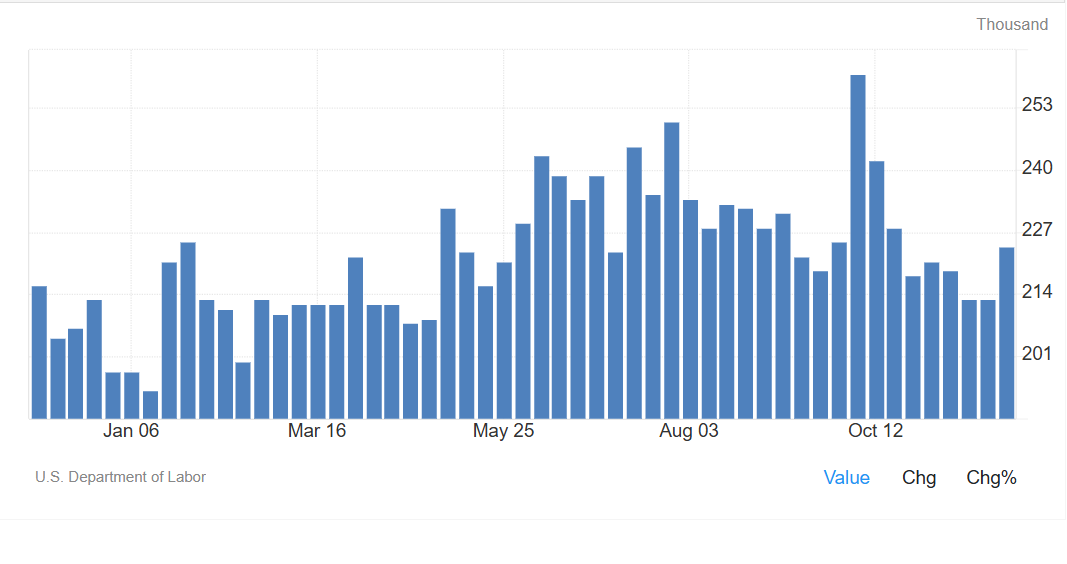

- Recent data: US initial jobless claims came in at 224 thousand

- Economic indicators: initial jobless claims reflect the number of individuals who applied for unemployment benefits last week

- Market impact: a weaker labour market increases the likelihood of further US Federal Reserve key rate cuts, which may positively impact the stock market

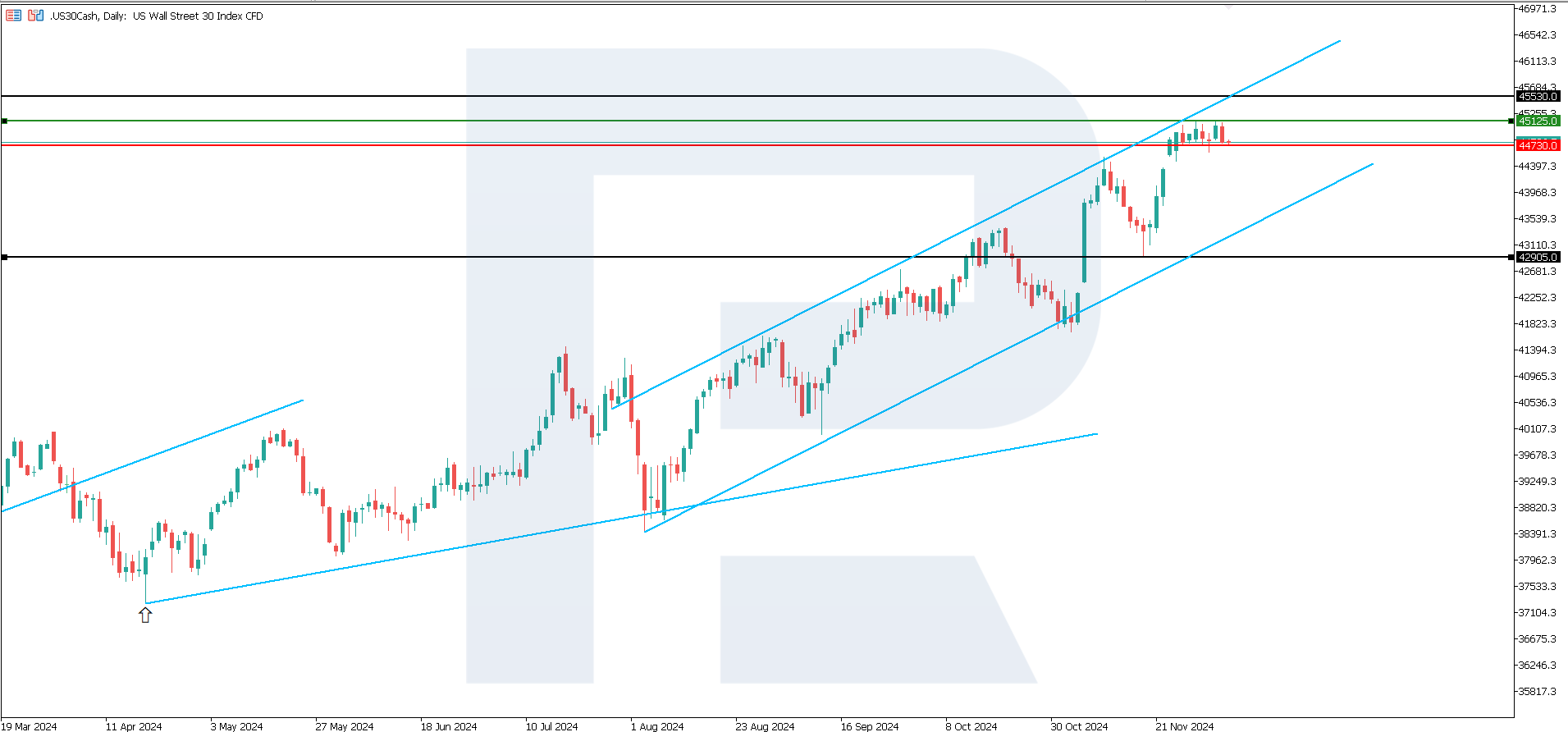

- Resistance: 45,125.0, Support: 44,730.0

- US 30 price forecast: 42,905.0

Fundamental analysis

The indicator came in at 224 thousand, exceeding the forecast of 215 thousand and the previous reading of 215 thousand. This signals a weakening economy, as the number of people who have lost their jobs and are seeking assistance has increased.

Source: https://tradingeconomics.com/united-states/jobless-claims

A higher-than-expected reading may amplify investor concerns about an economic slowdown, potentially driving stock prices lower. However, the market may view this data positively, driven by expectations of further Federal Reserve rate cuts, as lower rates support stock market growth.

The regulator has already cut interest rates twice, signalling a monetary policy easing to sustain the economy. An increase in initial jobless claims could intensify investor anticipation of further rate reductions to stimulate the economy. However, the impact may remain limited if the market perceives the rise in unemployment as a temporary development. The US 30 index forecast is moderately negative.

US 30 technical analysis

The US 30 stock index failed to hold above the 45,000.0 level. According to the US 30 technical analysis, the current uptrend may be followed by a short-term correction. However, there are no preconditions for a longer-term downtrend at this stage. The correction may not occur if the index secures a position above the current resistance level at 45,125.0.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 44,730.0 support level could push the index down to 42,905.0

- Optimistic US 30 forecast: a breakout above the 45,125.0 resistance level could propel the price to 45,530.0

Summary

Initial jobless claims amounted to 224 thousand, exceeding the forecast of 215 thousand and the previous reading of 215 thousand. The current data may heighten investor expectations of further rate cuts to stimulate the economy. However, the impact might remain subdued if the market views rising unemployment as temporary. US 30 growth rates are slowing, raising the likelihood of a correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.