US 500 analysis: the index is again attempting to reach a new all-time high after a minor correction

The US 500 stock index is poised for new highs again after a slight 1.0% decline. Discover more in our US 500 price forecast and analysis for next week, 23-27 December 2024.

US 500 forecast: key trading points

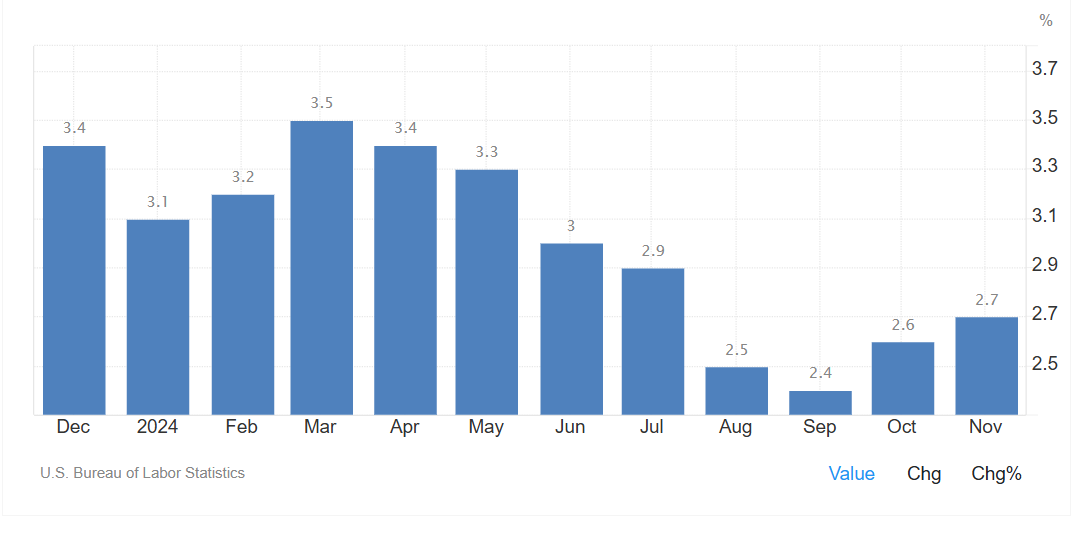

- Recent data: the Consumer Price Index (CPI) came in at 2.7% year-on-year

- Economic indicators: the CPI reflects the change in the cost of a basket of goods and services, showing consumer spending

- Market impact: one of the crucial indicators along with labour market indicators that the US Federal Reserve uses to determine its future monetary policy

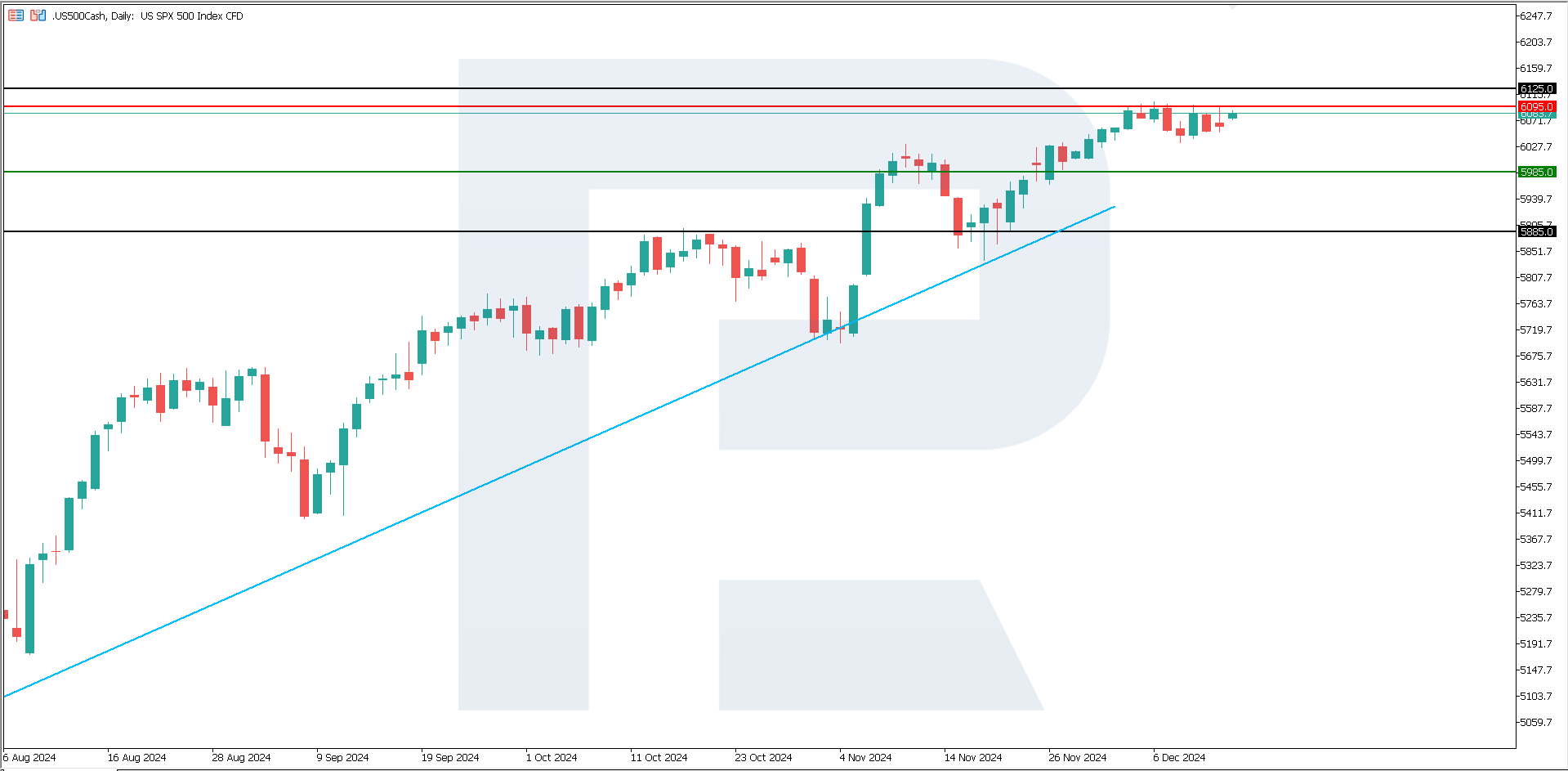

- Resistance: 6,095.0, Support: 5,985.0

- US 500 price forecast: 6,125.0

Fundamental analysis

The CPI is a crucial inflation gauge, which helps assess price growth in the economy. The monthly CPI rose by 0.3% in line with expectations, indicating moderate price growth in November. The annual CPI increased to 2.7%, aligning with forecasts, and points to a minor inflation acceleration as the current reading is slightly above the previous one of 2.6%.

Source: https://tradingeconomics.com/united-states/inflation-cpi

The rise in the overall CPI from 2.6% to 2.7% indicates price pressures. However, the core indicator remains stable, signalling the absence of significant domestic problems. The core CPI remained unchanged from the previous reading at 3.3% year-on-year in line with expectations; the figure shows inflation excluding the volatile components (food and energy).

The markets are currently awaiting the US Federal Reserve's decision on a potential third key rate cut. Moderate inflation data gives arguments in favour of keeping the current rates. However, budget deficit issues and the rising cost of servicing the national debt may push the regulator to lower the interest rate. The US 500 index forecast is moderately positive.

US 500 technical analysis

The US 500 stock index corrected by 1.09% and resumed its ascent. According to the US 500 technical analysis, the index could reach a new all-time high in the short term. Only then could a more significant decline follow without changing the global uptrend. The most likely growth target could be the 6,125.0 level.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,985.0 support level could push the index down to 5,885.0

- Optimistic US 500 forecast: a breakout above the 6,095.0 resistance level could drive the index to 6,125.0

Summary

The rise in the overall CPI from 2.6% to 2.7% indicates some price pressures, which could slow down the pace of the US Federal Reserve rate cuts. However, the regulator could neglect this fact and take a pause already next year. The US 500 index forecast is cautiously optimistic.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.