US 30 analysis: the support level is breached; the decline is likely to continue

The US 30 stock index is declining after reaching an all-time high, as indicated by the breach of the support level. The US 30 forecast for next week is negative.

US 30 forecast: key trading points

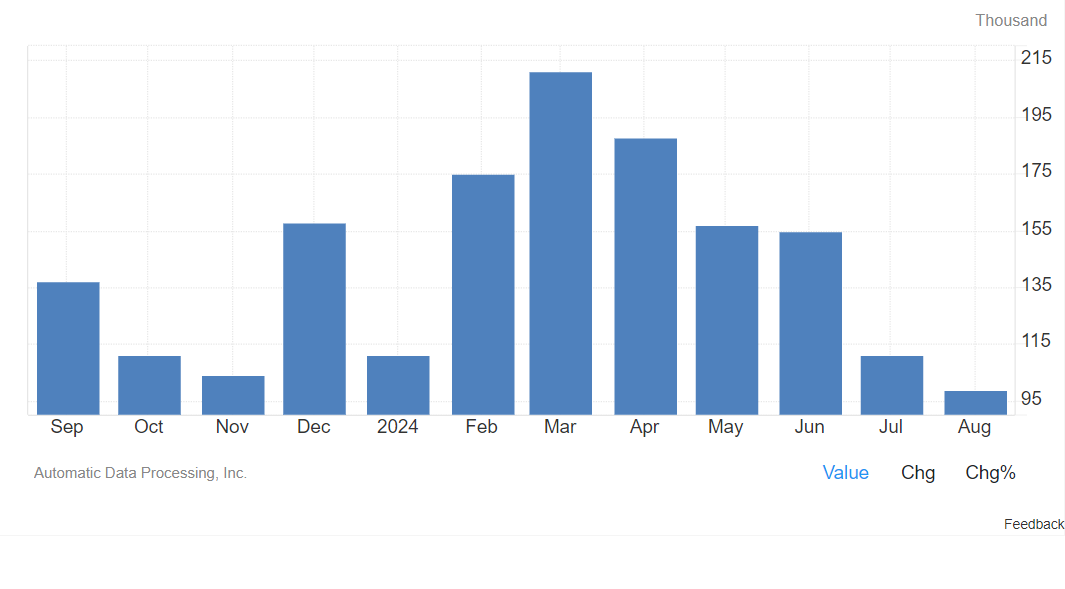

- Recent data: The ADP reports that the number of jobs in the US private sector increased by 99,000 in August

- Economic indicators: the ADP figures precede the release of official US employment market data

- Market impact: investors evaluate the potential of the US employment market, and the US Federal Reserve’s further actions based on the ADP data

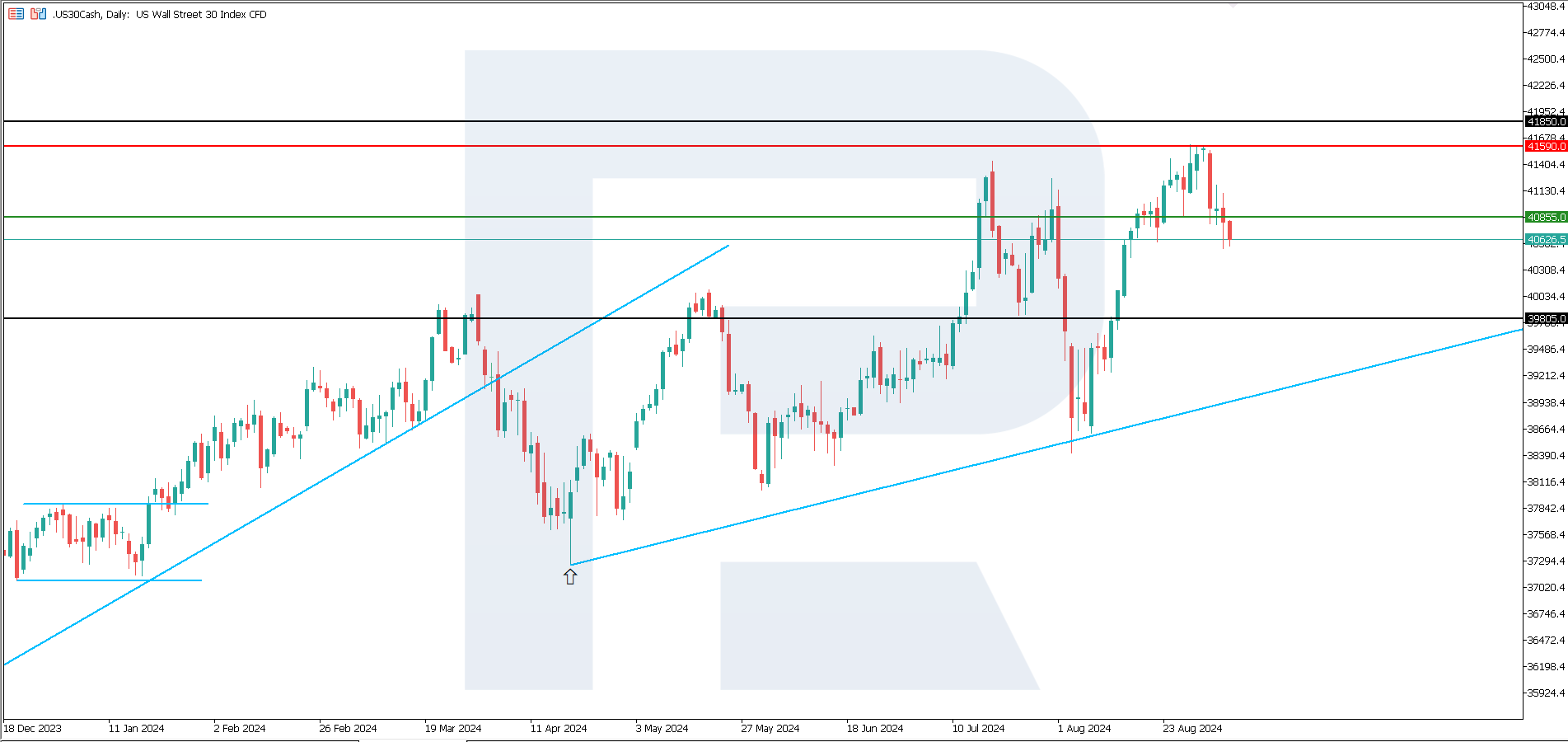

- Resistance: 41,590.0, Support: 40,855.0

- US 30 price forecast: 39,805.0

Fundamental analysis

Job growth in the US private sector was below expectations in August. The number of jobs in the US private sector, calculated by ADP, increased by only 99,000 in August, marking the lowest reading since January 2021. Growth was expected to reach 140,000. Last month’s figure was revised to 111,000.

Source: https://tradingeconomics.com/united-states/adp-employment-change

This negative data provides further indirect evidence of deteriorating conditions in the US employment market. As a result, mounting pressure is on the Federal Reserve to urgently reduce interest rates without waiting for inflation to meet its target levels.

Billionaire John Paulson stated that the Federal Reserve has delayed rate cuts for too long and expects the Fed to lower rates in the coming months. He predicts the federal funds rate will be around 3%, possibly 2.5%, by the end of next year. This aligns with market expectations as the federal budget faces difficulties servicing the national debt under the current elevated Federal Reserve rates. As national debt holders look to increase their investments in government debt while reducing investments in the stock market, the US 30 forecast is negative.

US 30 technical analysis

The US 30 technical analysis shows that a downtrend is resuming after reaching a new all-time high. This decline was confirmed by a breakout below the 40,855.0 support level. The new support level is yet to form, with the free fall continuing. Even if a minor correction occurs, it is unlikely to be considered a trend reversal. For all these reasons, the US 30 index forecast remains negative.

Key levels to watch in the US 30 price forecast include:

- Resistance level: 41,590.0 – a breakout above this level could drive the price to 41,850.0

- Support level: 40,855.0 – a breakout below the support level may push the price down to 39,805.0

Summary

As calculated by ADP for August, the increase of 99,000 jobs in the US private sector represents the lowest growth since the beginning of 2021. This lower-than-expected number increases the likelihood of a US Federal Reserve interest rate cut, which many, including large businesses, anticipate. Nevertheless, the stock market will still weaken, pressured by investors seeking to increase their investments in the national debt at the current yield rates.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.