US 30 analysis: the trend in the index could shift to a downtrend

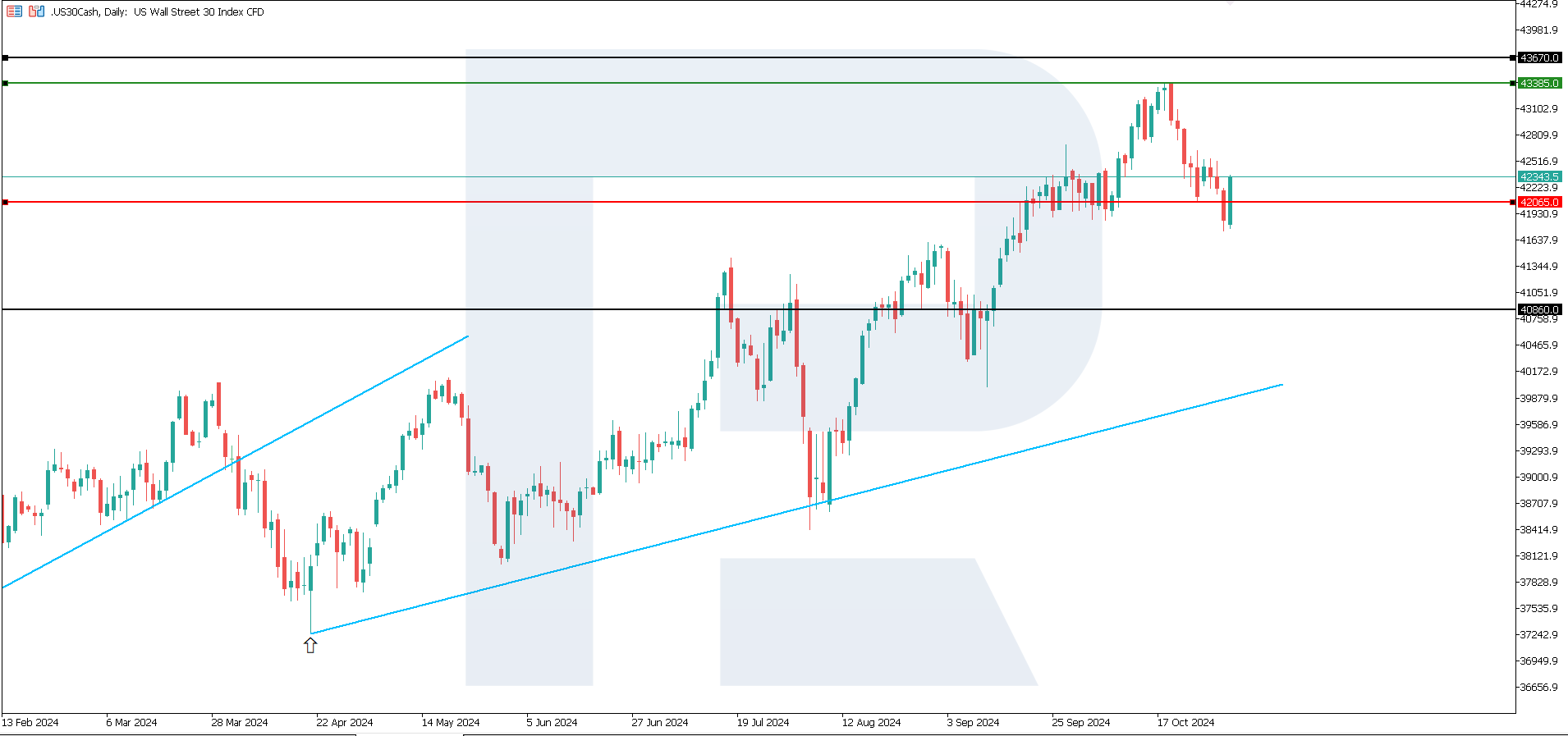

The US 30 stock index has broken below the support level and is likely to decline further. The US 30 forecast for next week is moderately negative.

US 30 forecast: key trading points

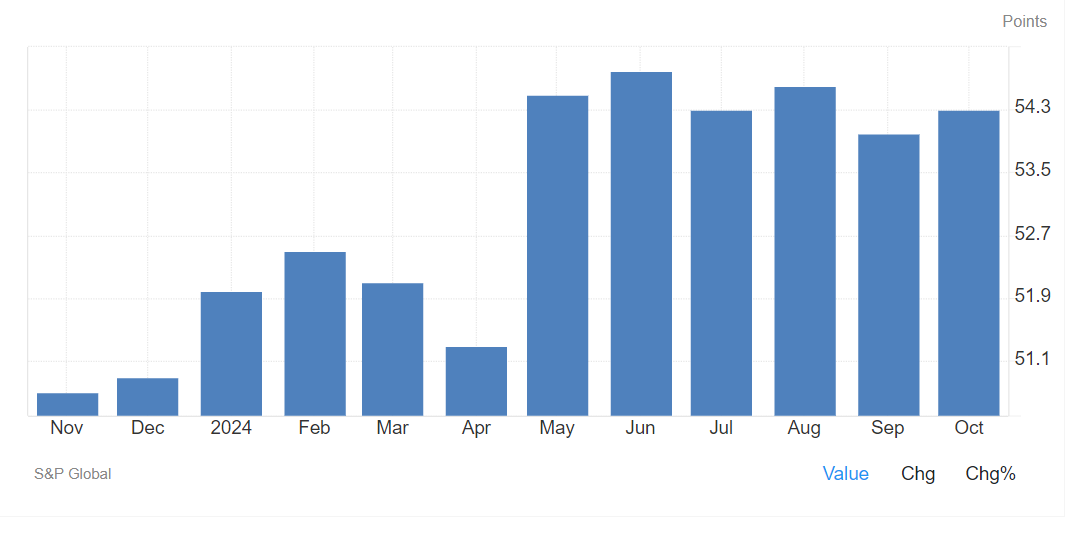

- Recent data: the composite PMI reached 54.3 points in October based on the preliminary data

- Economic indicators: the indicator shows overall business activity in the US economy

- Market impact: the improved PMI positively affects the stock market. However, sector-specific factors must be taken into account

- Resistance: 43,385.0, Support: 42,065.0

- US 30 price forecast: 40,860.0

Fundamental analysis

The composite PMI (54.3) is above 50.0 points, slightly up from the previous reading of 54, indicating positive changes in business activity. However, the situation in the manufacturing sector remains tense.

Source: https://tradingeconomics.com/united-states/composite-pmi

The manufacturing PMI (47.8) remains below 50.0, indicating a downturn in the manufacturing sector, although the rate of decline has slightly slowed. This may signal supply chain disruptions or lower demand for industrial goods. The services PMI (55.3) shows increased activity in the services sector, confirming its stable growth and role as a leading force in the US economy.

Positive composite and services PMI data may support shares of the US 30 companies, which span various segments, including manufacturing and services. Since many of these companies carry substantial weight, steady growth in the services sector may bolster the US 30 index. However, the continued downturn in the manufacturing and industrial sectors may affect companies operating in these areas. The US 30 index forecast remains moderately negative.

US 30 technical analysis

The US 30 stock index slowed after breaking below the support level. According to the US 30 technical analysis, a further decline and a deeper correction are highly likely. The nearest target for the decline could be the 18,980.0 level. A breakout below the 19,305.0 support level would reinforce this scenario.

The following scenarios are considered for the US 30 price forecast:

Pessimistic US 30 forecast: a breakout below the 42,065.0 support level could send the index down to 40,860.0

Optimistic US 30 forecast: a breakout above the 43,385.0 resistance level could drive the price to 43,670.0

Summary

The composite PMI indicates positive changes in overall US business activity. However, the manufacturing PMI (47.8) remaining below 50.0 points suggests a downturn in the manufacturing sector. These indicators combined may adversely impact manufacturing and industrial companies.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.