US 30 analysis: the growth rate has slowed, but the uptrend remains strong

The US 30 stock index corrected by 2.30% after reaching an all-time high. However, it is too early to consider a trend reversal. Discover more in our US 30 price forecast and analysis for next week, 18-22 November 2024.

US 30 forecast: key trading points

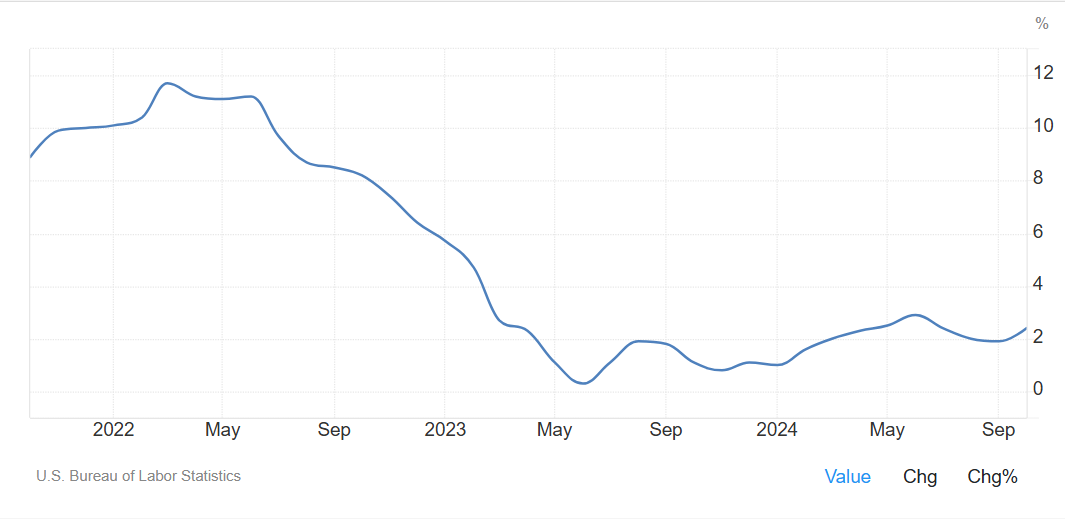

- Recent data: the Producer Price Index (PPI) was 2.4% year-on-year in October

- Economic indicators: the PPI reflects changes in producer prices for goods and services

- Market impact: the indicator is a crucial tool for analysing inflation trends, which are critical for the US Federal Reserve in determining monetary policy parameters

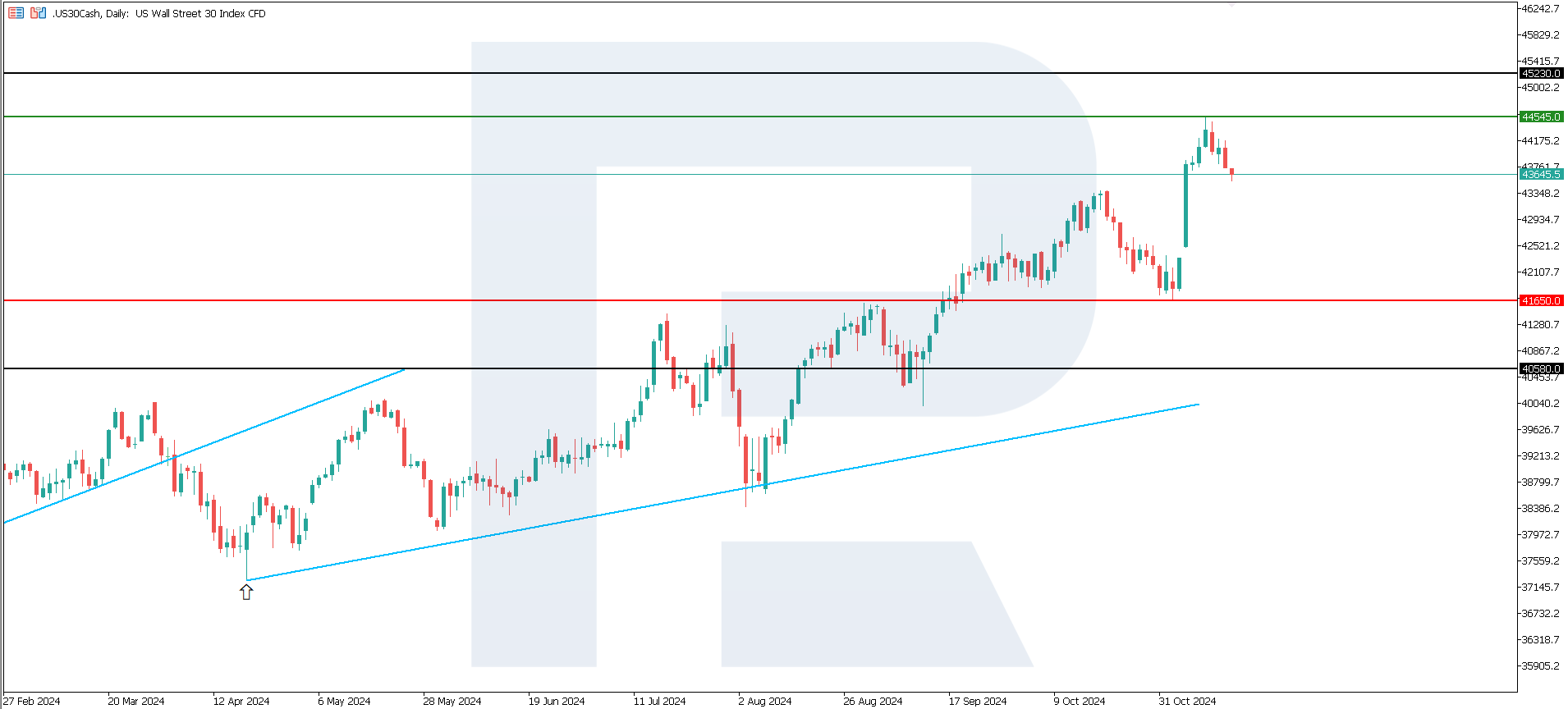

- Resistance: 44,545.0, Support: 41,650.0

- US 30 price forecast: 45,230.0

Fundamental analysis

The Producer Price Index is a significant gauge of inflation in the production chain. Rising inflation increases the likelihood of a stricter US Federal Reserve policy, negatively impacting borrowing costs and corporate earnings. This could lower stock prices, especially in rate-sensitive sectors, including technology and real estate.

Source: https://tradingeconomics.com/united-states/producer-prices-change

US Federal Reserve Chair Jerome Powell noted that the US economy has recently been “performing remarkably well”, enabling cautious interest rate cuts. However, he allowed for the possibility of more aggressive cuts.

Investors continue to anticipate that the regulator will maintain a soft monetary policy. The overall situation with the national debt and increasing household arrears limit the US Federal Reserve’s manoeuvring room. At its next meeting, the Federal Reserve may keep the key rate unchanged or lower it by 0.25%. An increase in the indicator will inevitably lead to significant consequences for the economy and stock market. The US 30 index forecast is moderately optimistic.

US 30 technical analysis

The US 30 stock index decreased by 2.30% after reaching a new all-time high. This can be considered a minor correction after a sharp surge. According to the US 30 technical analysis, the uptrend is medium-term, and a reversal is unlikely in the short term.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 41,650.0 support level could send the index down to 40,580.0

- Optimistic US 30 forecast: a breakout above the 44,545.0 resistance level could drive the price up to 45,230.0

Summary

The PPI, a crucial gauge of inflation in the production chain, reached 2.4% year-on-year in October. Investors expect the US Federal Reserve to implement one more key rate cut before the end of the year. The regulator likely has no choice but to continue lowering interest rates due to pressure from national debt issues and a downturn in the real estate market.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.