US 500 analysis: the index continues to rise steadily to new all-time highs

The US 500 stock index has completed a correction and is again poised for another high. More details in our US 500 price forecast and analysis for next week, 2-6 December 2024.

US 500 forecast: key trading points

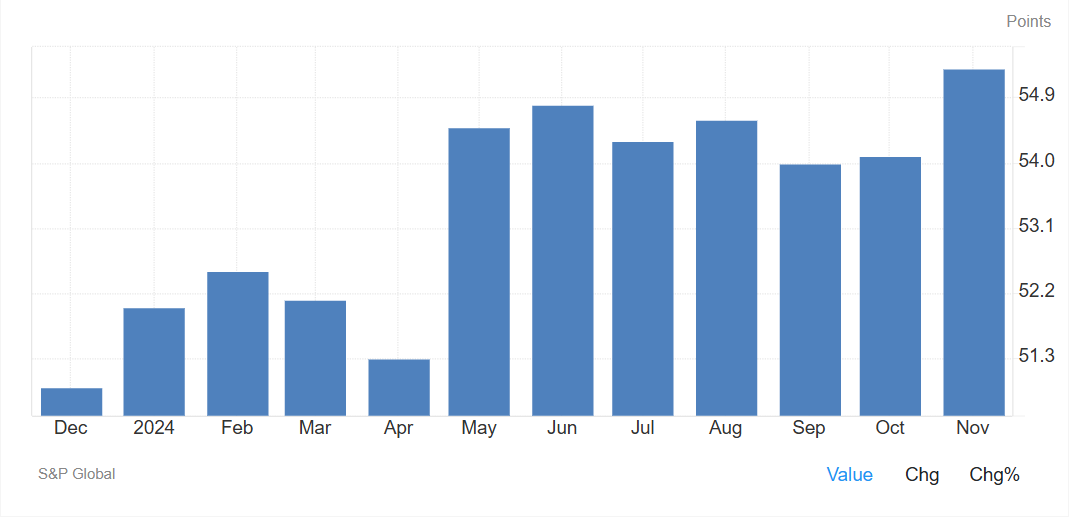

- Recent data: the US PMI is projected to reach 55.3 in November

- Economic indicators: the PMI reflects the current state of the economy, with a reading above 50 indicating economic growth, while a reading below 50 points to a contraction

- Market impact: economic activity serves as a reference for investors and influences the US Federal Reserve's key rate decisions

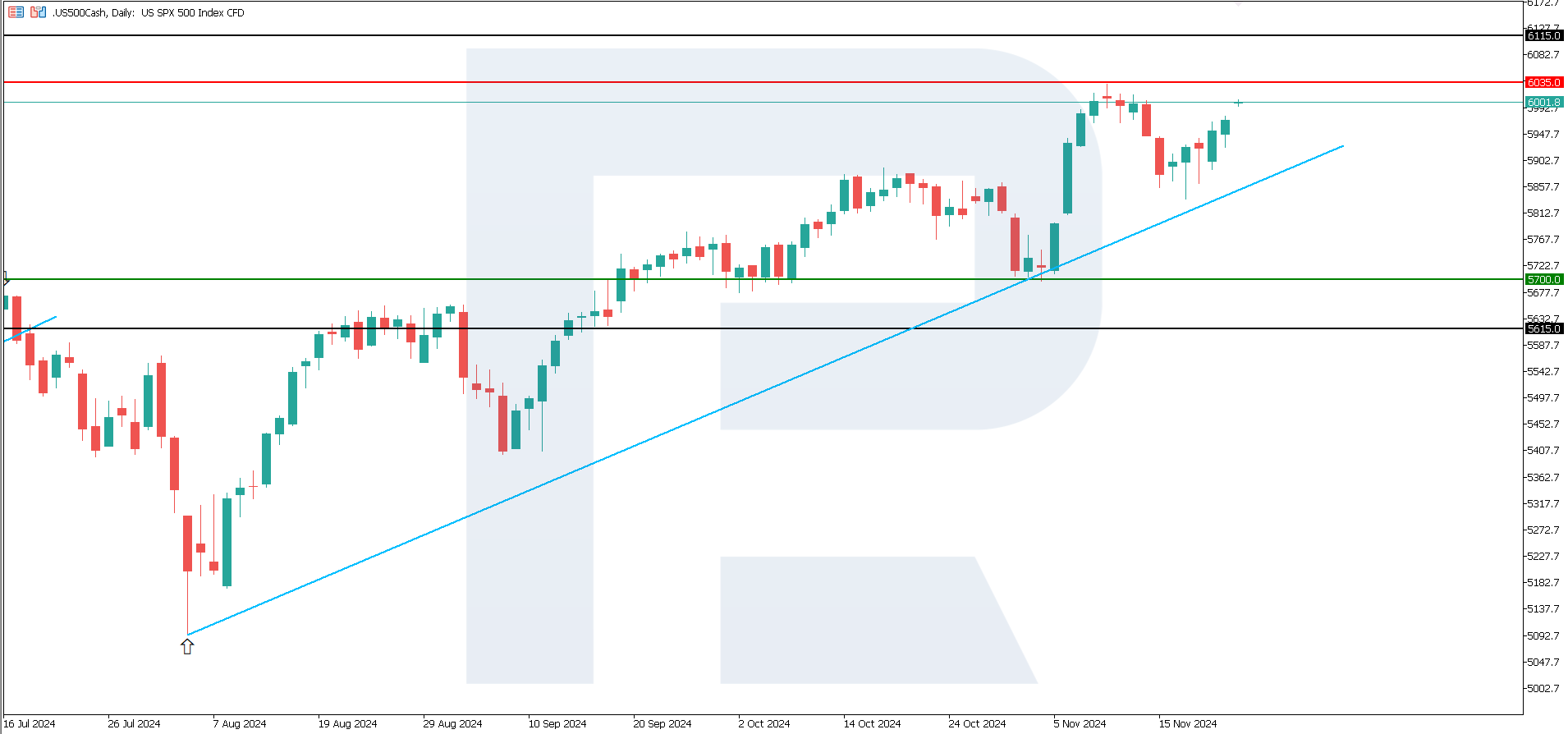

- Resistance: 6,035.0, Support: 5,700.0

- US 500 price forecast: 6,115.0

Fundamental analysis

The composite Purchasing Managers' Index for all sectors of the US economy is projected to reach 55.3 in November, up from 54.1 in the previous period, demonstrating increased business activity in the US.

Source: https://tradingeconomics.com/united-states/composite-pmi

The manufacturing PMI came in at 48.8, slightly above the previous 48.5, indicating a continued contraction but with signs of a slowdown. The services PMI rose to 57.0 from 55.0, showing a significant increase in activity. This growth in the services sector supports expectations of economic stabilisation. All these factors are likely to impact the US 500 index positively.

The low manufacturing PMI could limit gains in industrial and commodity stocks. Since the Federal Reserve has lowered the key rate twice, financial markets expect cheaper lending. However, the strength of the services sector may reduce the likelihood of further monetary policy easing, restraining the growth potential for rate-sensitive stocks, such as those in the real estate sector. The US 500 index forecast is moderately optimistic.

US 500 technical analysis

The US 500 stock index has resumed its steady growth after correcting by 3.30%. According to the US 500 technical analysis, the quotes must surpass and consolidate above the 6,035.0 resistance level to achieve a new all-time high. The nearest growth target for the index could be 6,115.0. There are no signs of a trend reversal so far.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,700.0 support level could push the index down to 5,615.0

- Optimistic US 500 forecast: a breakout above the 6,035.0 resistance level could propel the index to 6,115.0

Summary

The composite PMI for all sectors of the US economy is projected to reach 55.3 in November, an increase from the previous period. This improvement is driven by rising activity in the services sector and a slowdown in the manufacturing downturn. For this reason, the stock market will highly likely rise.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.