US 500 forecast: after rebounding from support, the index aims to renew its all-time high

The US 500 once again hit a new all-time high within the ongoing uptrend. The US 500 forecast for today is positive.

US 500 forecast: key trading points

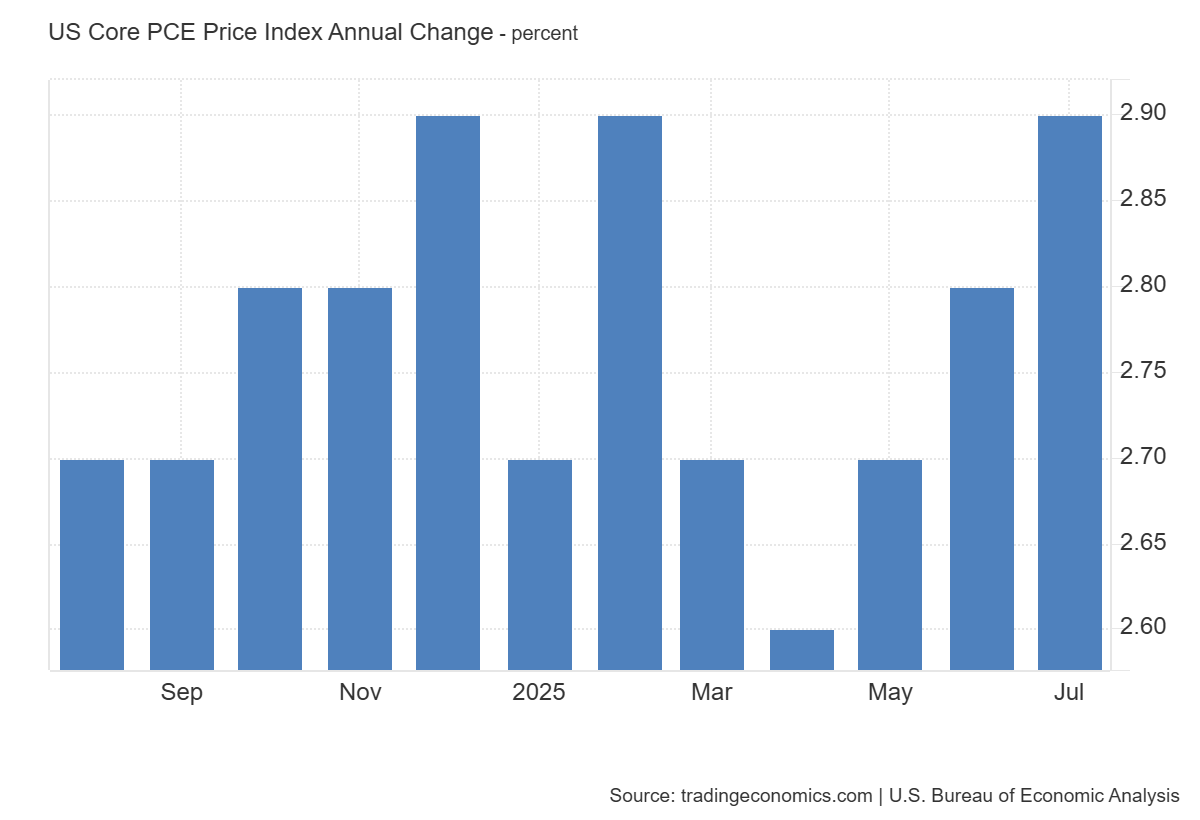

- Recent data: The US core PCE price index came in at 2.9% in July

- Market impact: for the US stock market, this has a mixed effect in the medium term

US 500 fundamental analysis

The latest figures for the core PCE price index in the US show a yearly increase of 2.9%, in line with forecasts and slightly above the previous 2.8%. This index excludes food and energy components and serves as the Federal Reserve’s preferred inflation gauge when assessing inflation risks and shaping monetary policy.

Meanwhile, the cash allocation of US mutual funds has dropped to a record low of 1.4%, below the 1.5% level seen before the 2022 bear market. After a short-lived rise in April, fund cash positions resumed their more than three-year downtrend. For context, between 2008 and 2020, the average cash share was roughly twice as high. With funds almost fully invested and lacking significant reserves to buy on potential pullbacks, the market remains vulnerable if sudden volatility spikes occur.

US Core PCE Price Index Annual Change: https://tradingeconomics.com/united-states/core-pce-price-index-annual-changeUS 500 technical analysis

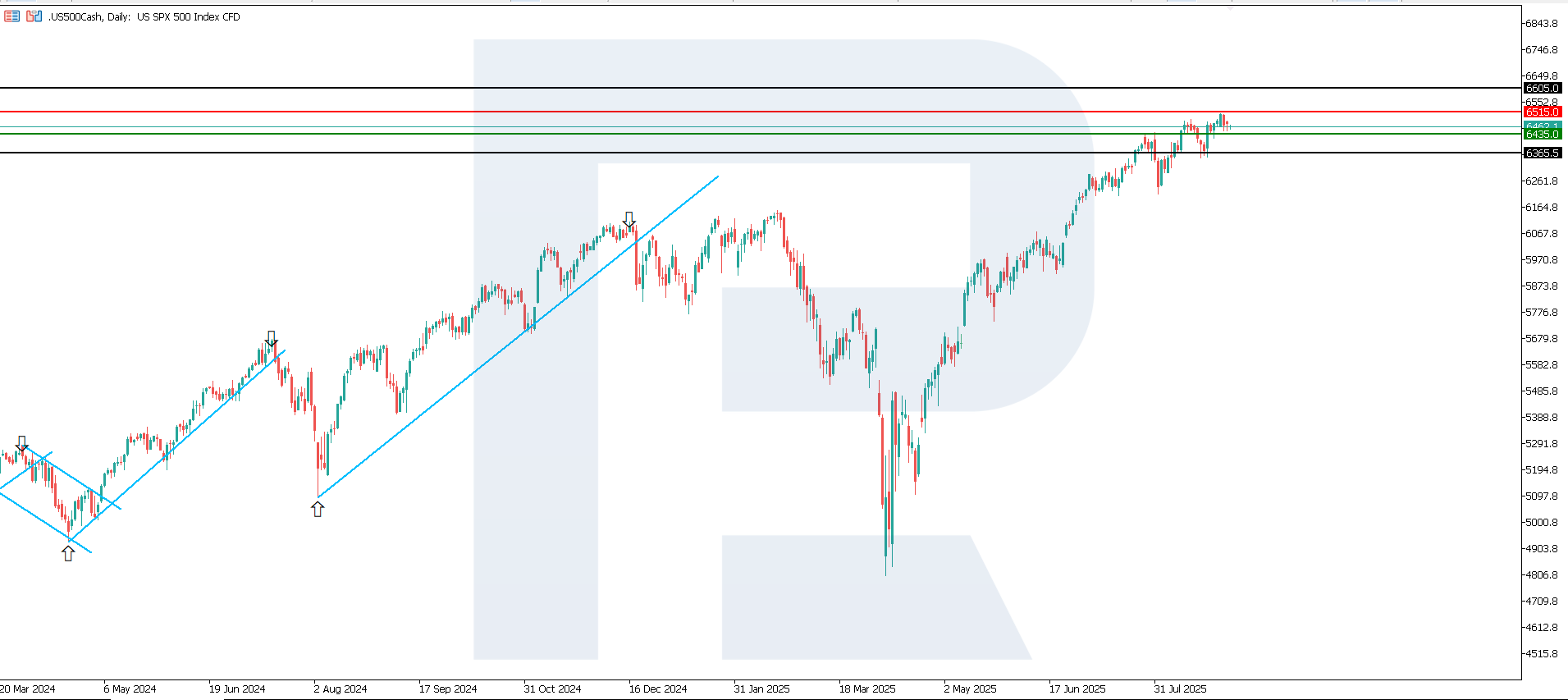

After reaching an all-time high, the US 500 continued to strengthen, forming a solid uptrend. The current support zone is at 6,435.0, while the nearest resistance level is at 6,515.0. The most likely scenario remains further growth, with a target near 6,605.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,435.0 support level could send the index down to 6,210.0

- Optimistic US 500 scenario: a breakout above the 6,515.0 resistance level could drive the index to 6,605.0

Summary

For the US stock market, this data has a dual effect. On the one hand, alignment with forecasts lowers the risk of unexpected Fed action, supports investor confidence, and sustains market sentiment. On the other hand, the reading above the prior level indicates persistent inflationary pressure, limiting room for policy easing and suggesting rates may stay elevated longer than markets would prefer. From a technical perspective, the US 500 index is set to extend its gains towards 6,605.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.