US 500 forecast: the index resumed growth but correction risk remains high

US 500 has shifted into an uptrend, but the likelihood of a slight pullback remains high. The US 500 forecast for today is negative.

US 500 forecast: key trading points

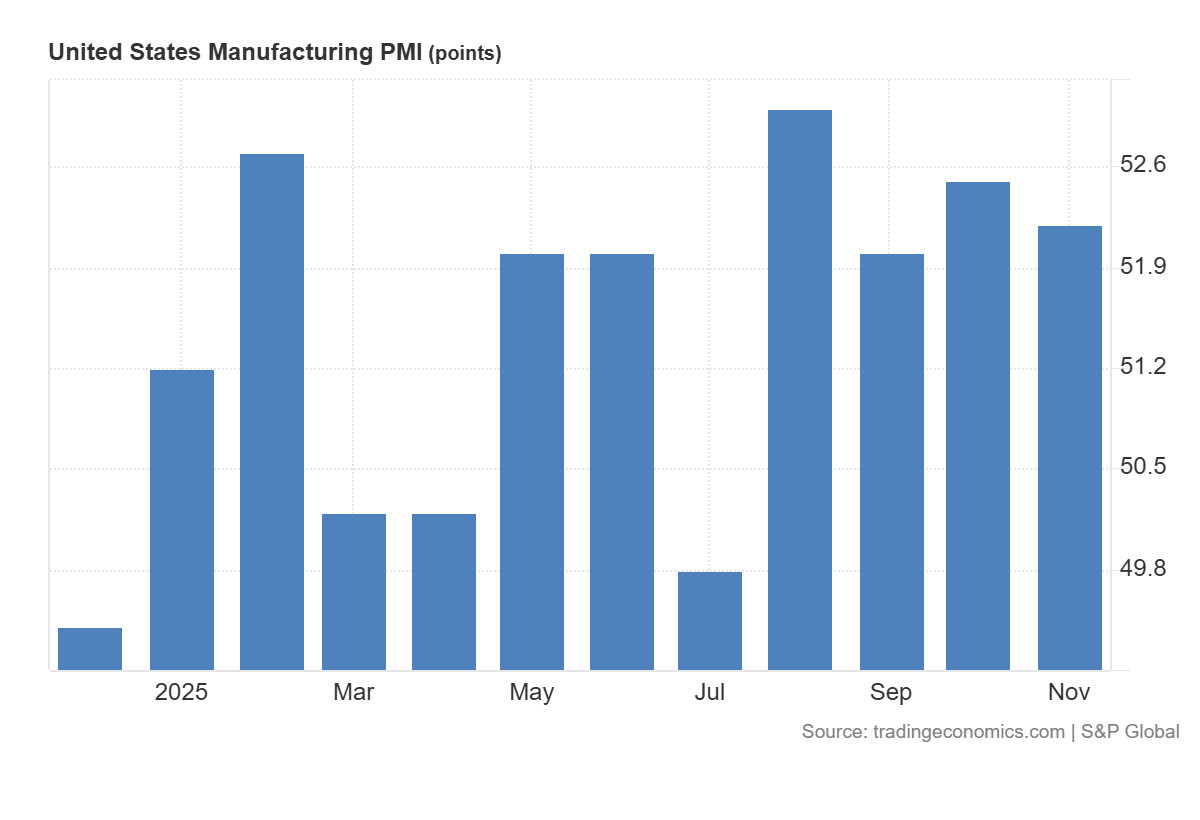

- Recent data: US manufacturing PMI for November came in at 52.2

- Market impact: these figures are generally positive for the equity market

US 500 fundamental analysis

The US manufacturing PMI in the latest release came in at 52.2 points versus a forecast of 51.9 and the previous reading of 52.5. This means the manufacturing sector remains in expansion territory (readings above 50.0 indicate growth), but the pace of expansion slowed slightly compared to the previous month. At the same time, the higher-than-expected reading suggests that business conditions are somewhat better than the market anticipated.

For the US 500, the impact is cautiously positive. Since the index includes industrial, technology, and consumer companies, a moderately strong PMI supports the soft landing narrative: the economy continues to grow, but without excessive acceleration that could force the Fed back into tightening. Within the index, stocks of real-sector companies sensitive to manufacturing activity may perform slightly better under such conditions.

US manufacturing PMI: https://tradingeconomics.com/united-states/manufacturing-pmiUS 500 technical analysis

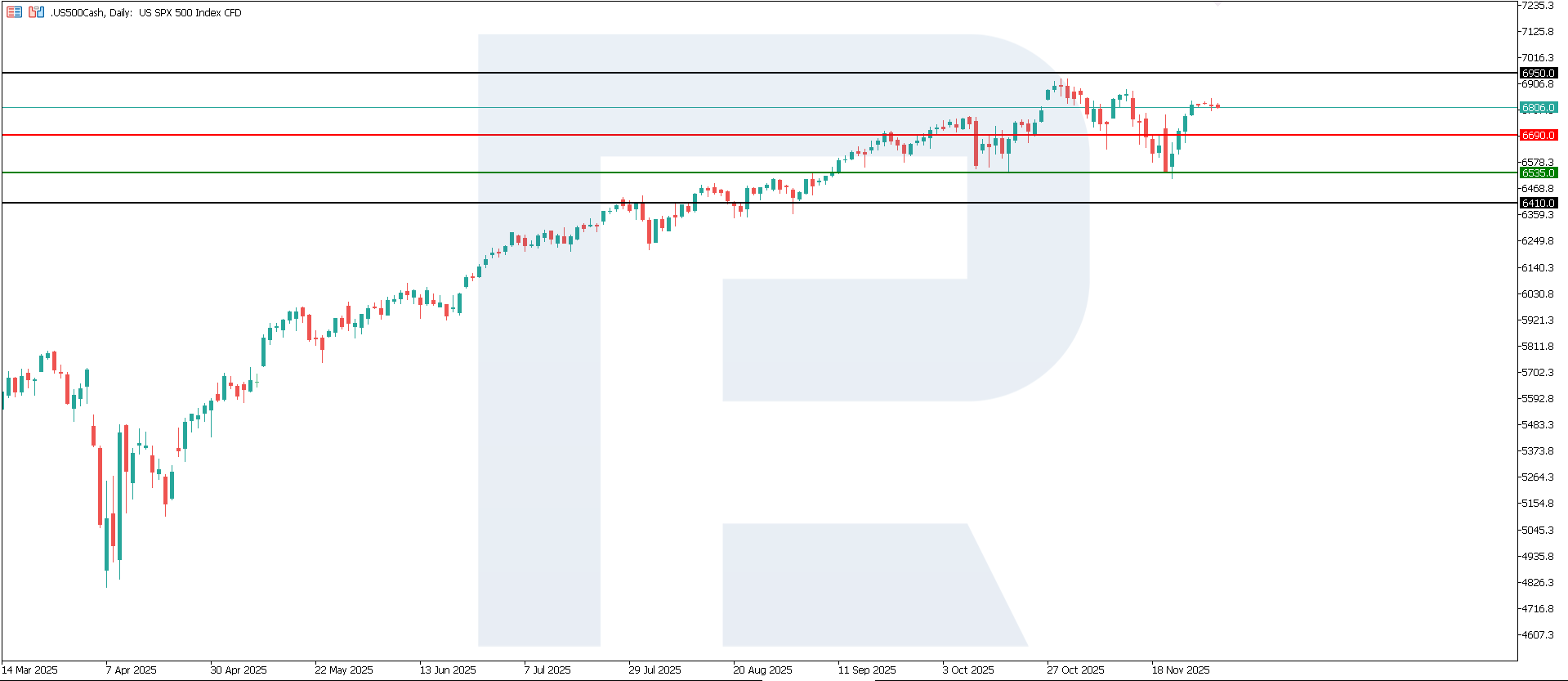

The US 500 index broke above the 6,690.0 resistance level, with a new one yet to form. The support level is located at 6,535.0. The potential upside target could be near 6,950.0.

The US 500 price forecast considers the following scenarios:

- Pessimistic US 500 forecast: a breakout below the 6,535.0 support level could push the index down to 6,410.0

- Optimistic US 500 forecast: if the price consolidates above the previously breached resistance level at 6,690.0, the index could climb to 6,950.0

Summary

Overall, this combination appears moderately positive for the US equity market. On the one hand, investors receive confirmation that the manufacturing sector is not slipping into recession: companies still have orders, capacity utilisation remains stable, and demand holds up. This supports revenue and earnings expectations in cyclical sectors such as industrials, machinery, commodity companies, and parts of the transport sector. On the other hand, the slight decline in the PMI compared to the previous month reminds markets that the economy is gradually cooling. From a technical perspective, the US 500 index may rise towards 6,950.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.