US Tech analysis: end of election uncertainty boosts investor sentiment

The US Tech stock index is actively rising on news of Donald Trump’s victory, fuelled by hopes that he will encourage the US Federal Reserve to implement more decisive interest rate cuts. Find out more in our US Tech price forecast and analysis for next week – 11-17 November 2024.

US Tech forecast: key trading points

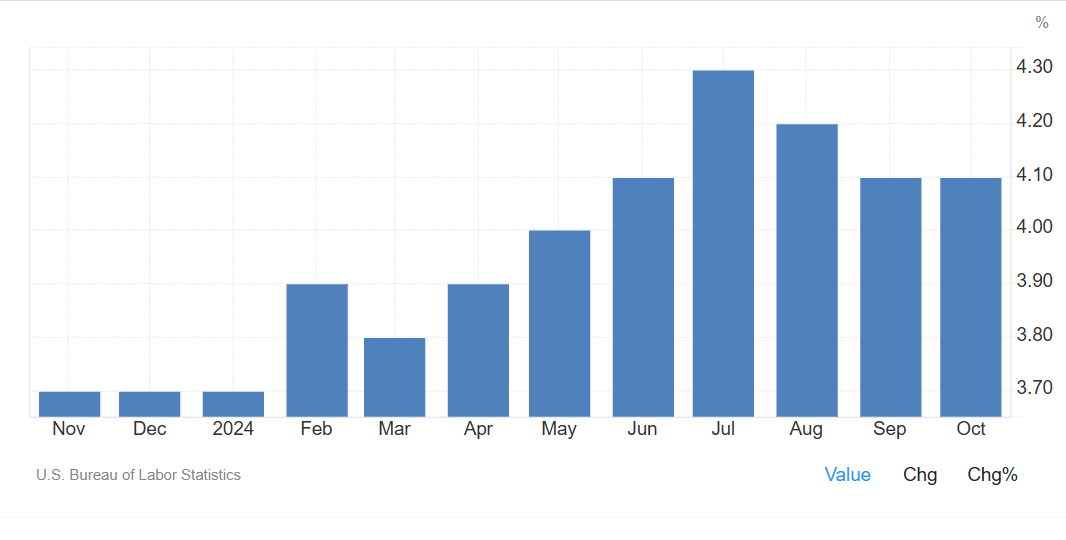

- Recent data: the US unemployment rate remained at 4.1%

- Economic indicators: alongside other labour market metrics, the unemployment rate is one of the main indicators for the US Federal Reserve’s monetary policy decisions

- Market impact: a softening labour market could lead the regulator to lower the key rate more aggressively

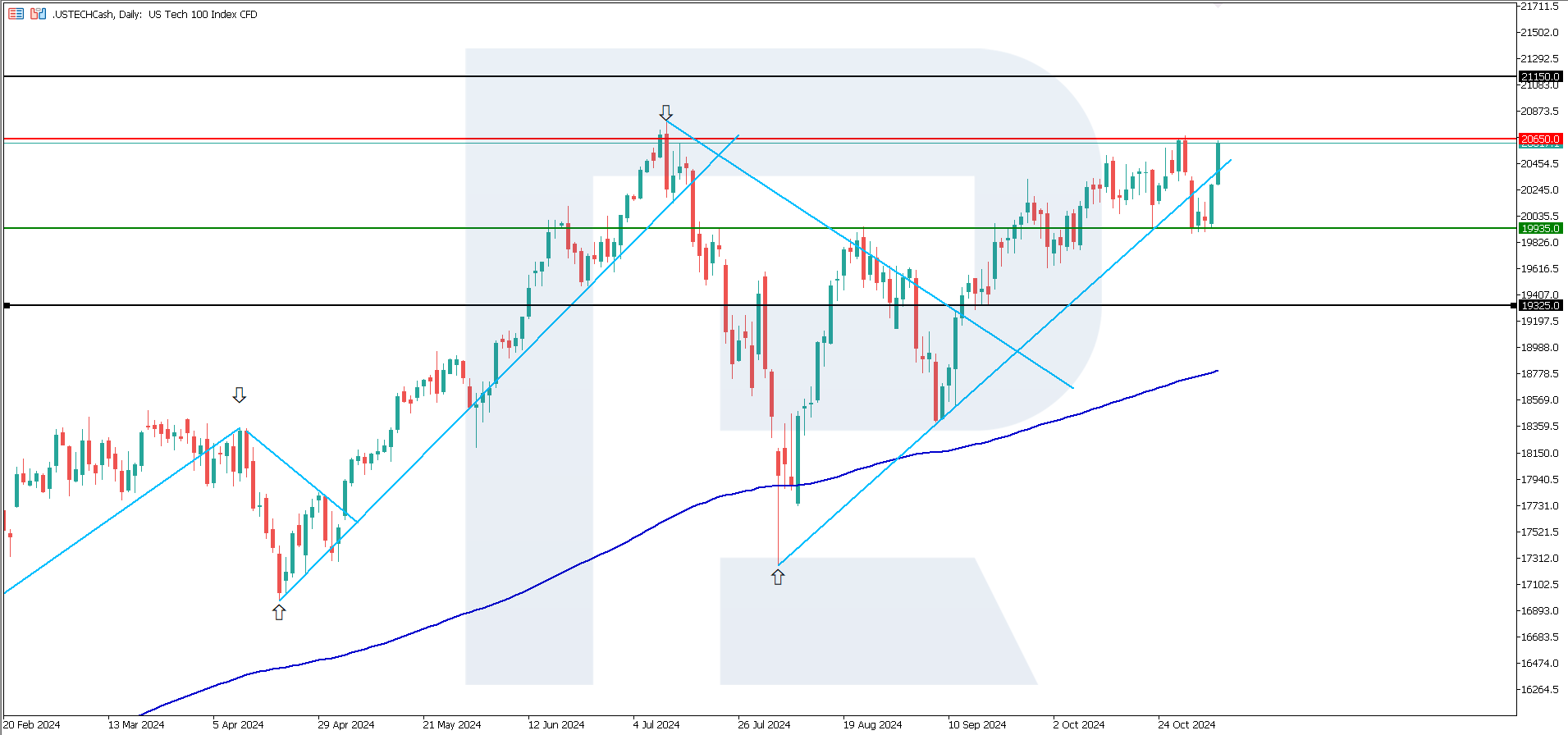

- Resistance: 20,650.0, Support: 19,935.0

- US Tech price forecast: 21,150.0

Fundamental analysis

NFP gains amounted to only 12,000 jobs (well below the anticipated 106,000 and the previous reading of 223,000), indicating a significant slowdown in job growth compared to previous months and market predictions. As expected, the unemployment rate remained at 4.1%, unchanged from the previous month.

Source: https://tradingeconomics.com/united-states/unemployment-rate

Slowing job growth may signal potential economic weakening or a saturated labour market. The reading of 12,000 represents a significant deviation from forecasts and past readings, suggesting companies are becoming more cautious about hiring. Comments from the US Federal Reserve will be essential in understanding how they interpret the released data.

When investors’ emotional reaction to the election outcome subsides, the focus will shift to consumer inflation data. A decline in inflation would signal an emerging economic slowdown, which could prompt the Fed to lower the key rate twice before year-end, positively impacting the stock market. The US Tech index forecast remains moderately positive.

US Tech technical analysis

The US Tech quotes have rebounded from the 19,935.0 support level, poised for a reversal to an uptrend. Technical analysis indicates that the US Tech index still holds potential for a new all-time high. A breakout above the 20,650.0 resistance level would confirm this movement, with the initial growth target at 21,150.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 19,935.0 support level could push the index down to 19,325.0

- Optimistic US Tech forecast: a breakout above the 20,650.0 resistance level could propel the index up to 21,150.0

Summary

The conclusion of the US election, marked by Donald Trump’s victory, has emerged as the primary driver for growth in the US Tech index. Investors are optimistic about his prospective economic policies. However, market participants will soon shift to upcoming data releases, particularly the labour market and inflation. They may increase the likelihood that the US Federal Reserve will adopt more aggressive interest rate cuts, positively impacting the stock market.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.