US Tech forecast: the index continues its recovery

The US Tech index continues to rise toward the resistance level with the potential to reverse the trend. The US Tech forecast for next week is positive.

US Tech forecast: key takeaways

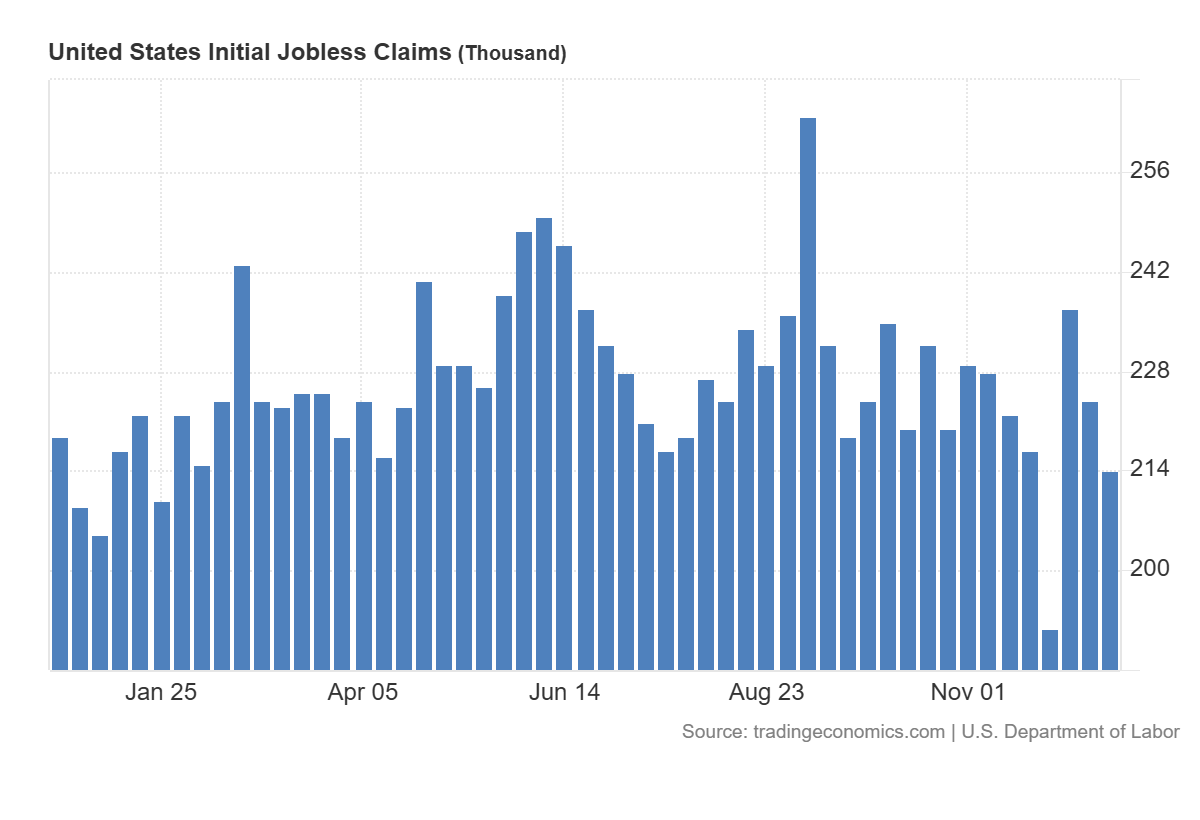

- Recent data: U.S. Initial Jobless Claims for last week came in at 214K

- Market impact: the data has a moderately negative impact on the technology sector

US Tech fundamental analysis

Initial Jobless Claims measure how many people filed for unemployment benefits for the first time during the past week. This is one of the most timely indicators of labor market conditions: the lower the reading, the more stable employment is and the fewer signs there are of economic deterioration. Claims came in at 214K, compared with a forecast of 224K and the previous reading of 224K. In other words, the figure was better than expected and declined from the prior week. This signals that the labor market remains resilient: companies are generally not accelerating layoffs, and consumer demand is typically supported by more stable household incomes.

United States Initial Jobless Claims: https://tradingeconomics.com/united-states/jobless-claimsFor the U.S. equity market, the effect is twofold. On the one hand, a strong labor market is positive for corporate revenues, as employment supports consumption and reduces the risk of a sharp economic slowdown. On the other hand, such data can reduce the likelihood of a rapid interest rate cut, since solid employment makes it harder for the central bank to justify policy easing. If bond yields rise and the U.S. dollar strengthens as a result, this may restrain equity market gains.

US Tech technical analysis

For the US Tech index (the technology sector), the second channel is usually more important. Technology companies tend to be more sensitive to interest rate and yield dynamics: when the cost of money rises, the market becomes more cautious in valuing future earnings. As a result, in the short term, lower jobless claims can lead to a mixed reaction — fundamentally positive for the economy, but potentially limiting upside for the technology index through interest rate expectations. The final outcome will depend on how rate expectations and U.S. Treasury yields react after the release.

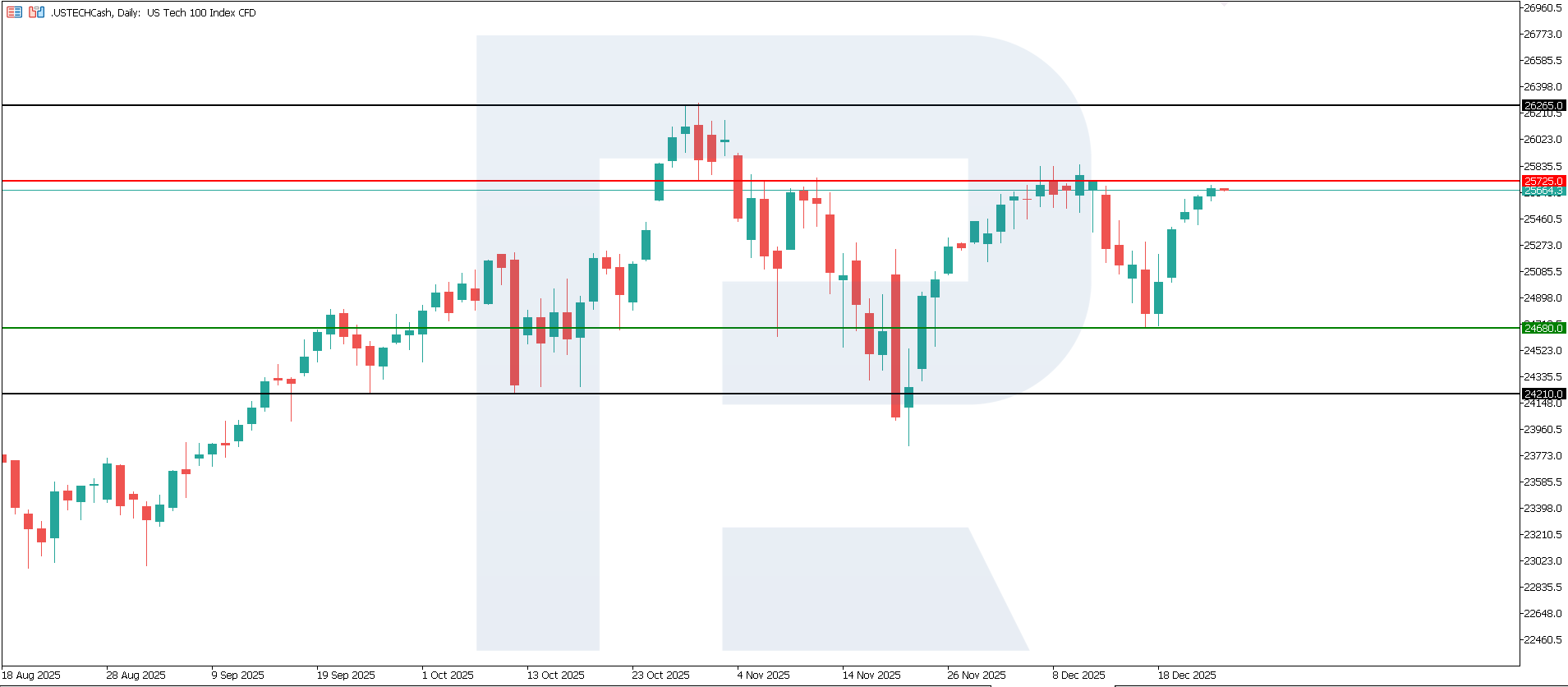

US Tech technical analysis for 26 December 2025The US Tech index remains in a downtrend. The nearest resistance level is located at 25,725.0, while support has shifted to 24,680.0. However, prices are moving higher toward resistance, with a high probability of a breakout. If resistance is breached, the trend is likely to turn upward again. The upside target is 26,265.0.

US Tech price forecast scenarios:

- Bearish scenario: if support at 24,680.0 is broken, prices may fall to 24,210.0

- Bullish scenario: if resistance at 25,725.0 is broken, prices may rise to 26,265.0

Summary

Overall, the labor market data confirm the resilience of the U.S. economy: Initial Jobless Claims came in below expectations, indicating stable employment and no signs of a sharp slowdown. For the stock market, this is a moderately positive signal, as it supports consumer demand and corporate earnings. However, for the technology sector, the effect is more restrained. Strong labor market data reduce the likelihood of near-term monetary policy easing, which may keep bond yields elevated. The nearest upside target for the US Tech index is 26,265.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.