Netflix Inc. stock forecast: a correction needed for sustainable growth

On 21 January 2025, Netflix Inc. (NASDAQ: NFLX) published its Q4 2024 earnings results, revealing that its financial performance had exceeded expectations. This announcement drove a 15% increase in its share price, reaching 999 USD on the day of the report’s release.

This article provides an overview of Netflix Inc., analyses its Q2, Q3, and Q4 2024 earnings reports, and offers insights through a technical analysis of NFLX stock, which serves as the foundation for Netflix Inc.’s stock forecast for 2025.

About Netflix Inc.

Netflix Inc. was founded on 29 August 1997 by Reed Hastings and Mark Randolph. The company was initially in the business of delivering DVDs on a subscription basis. Clients could order a film through the website and receive it by post. In 2007, Netflix launched a streaming service, allowing users to watch movies and TV shows online via the internet.

The transition to live streaming was pivotal in the company’s history. Netflix began actively expanding its content library to include licensed films, series, and original projects. By July 2024, Netflix had 277 million subscribers worldwide, making it the largest streaming platform.

Netflix Inc.’s main financial flows

Netflix’s revenue mainly comes from streaming services, advertising, and other sources. The main components are outlined below:

- Subscription fees: this is Netflix’s primary revenue stream, which is divided into ad-supported and ad-free subscriptions

- Advertising revenue: payments from companies for placing advertisements

- Content licensing and distribution: revenue is generated from providing paid licences for Netflix’s original and purchased content to other platforms and TV channels. This segment also includes income from partnerships with telecommunication providers, cable companies, and other distributors that offer Netflix as part of their packages

- Other revenue streams: sales of merchandise related to Netflix series and films (e.g. toys, apparel, and collectables). The company has also started investing in the gaming industry by offering mobile games based on its intellectual property, creating additional opportunities for revenue growth

Most of Netflix’s revenue is derived from streaming subscriptions, while advertising, licensing, and other business segments offer additional potential for income growth.

Netflix Inc.’s Q2 2024 report

Netflix released its Q2 2024 report on 18 July. Below is a comparison of its results with the same period in 2023:

- Revenue: 9.56 billion USD (+17%)

- Net income: 2.15 billion USD (+44%)

- Earnings per share: 4.88 USD (+48%)

- Operating profit: 2.60 billion USD (+44%)

- Operating margin: 27.2% (+490 basis points)

- Total subscribers: 277.65 million (+16%)

Although the company continues to increase the number of subscribers quarter over quarter, this growth is gradually slowing. The increase in memberships in Q4 2023 surpassed previous figures by 13.13 million, followed by 9.32 million in Q1 2024 and 8.05 million in Q2 2024. Netflix is facing challenges in identifying new catalysts for subscriber growth. The company is now attracting new subscribers by addressing password sharing and reducing the cost of ad-supported subscription plans. Market participants are sensitive to these statistics; a look at the stock behaviour when Netflix reported a loss of 200 thousand subscribers in Q1 2022 reflects this, causing the share price to fall by over 30%, continuing its decline.

Netflix’s management plans to stop publishing subscriber statistics from 2025 onwards to mitigate these challenges and focus investors’ attention on revenue per user, total revenue, and operating margin.

Amid slowing membership growth, the company is exploring new growth drivers, with advertising viewed as a potential source. Netflix’s management has noted that advertising is becoming increasingly significant to the company’s operations. However, building this business from scratch will take time, meaning it will unlikely become the primary driver of revenue growth in 2024 and 2025.

Netflix forecasts a 14% year-on-year revenue growth in Q3 2024, though a lower increase in paying users is expected compared to the same period in 2023. At the same time, no changes are anticipated for the global average revenue per user.

Based on the 2024 results, revenue may rise by 14-15% compared to the previously forecasted 13-15%, while the operating margin is projected to reach 26%, up from the earlier forecast of 25%. The company’s goal remains to increase operating profit.

Netflix Inc.’s Q3 2024 report

On 17 October, Netflix published its Q3 2024 report. Below is a comparison of its data with the corresponding period in 2023:

- Revenue: 9.82 billion USD (+15%)

- Net income: 2.36 billion USD (+41%)

- Earnings per share: 5.40 USD (+20%)

- Operating profit: 2.94 billion USD (+25%)

- Operating margin: 29.6% (+720 basis points)

- Total subscribers: 282.7 million (+14%)

Co-CEO Theodore Sarandos noted that content production is recovering after last year’s strikes in Hollywood, with series rebounding more rapidly than films. The company’s advertising business showed significant growth, with the number of subscribers to ad-supported plans increasing by 35% from the previous quarter. More than half of new users in regions with ad services chose this package option. However, the company emphasised that effective ad monetisation will take time, and this segment will not become a primary revenue stream in the near term.

In Q4 2024, Netflix forecasts EPS of 4.20 USD and revenue of 10.12 billion USD, with total annual revenue growth expected to reach 15%. The total number of subscribers is projected to increase by 8.2 million, reaching approximately 290.9 million.

The company’s ad revenue is expected to double in 2025, driven by a 150% increase in liabilities for ad contracts concluded in 2024. Despite this optimistic outlook, Netflix notes that advertising will not become a key revenue driver in the near term. This data emphasises Netflix’s efforts to strengthen its position in the streaming market and diversify its revenue streams.

Netflix Inc.’s Q4 2024 report

On 21 January, Netflix released a strong Q4 2024 report. Below is a comparison of its results with the corresponding period in 2023:

- Revenue: 10.24 billion USD (+16%)

- Net income: 1.87 billion USD (+99%)

- Earnings per share: 4.27 USD (+102%)

- Operating profit: 2.27 billion USD (+51%)

- Operating margin: 22.2% (+530 basis points)

- Total subscribers: 301.6 million (+15%)

In its commentary on the Q4 2024 report, Netflix’s management expressed satisfaction with its strong financial performance and strategic achievements. They highlighted a 16% revenue increase from last year and a 102% surge in EPS, exceeding market expectations. They also noted significant membership growth to 301.6 million, driven by compelling content, including major releases such as Jake Paul vs Michael Tyson and NFL games).

Management emphasised the importance of continued investment in original content, which helped increase user engagement and reduce subscriber churn. Additionally, they announced plans to expand the proprietary ad platform into 12 more countries, which will help improve margins and monetisation by reducing reliance on intermediaries. Netflix’s management reiterated confidence in the company’s strategic direction, underlining that investment in content and ad technology development are key drivers of growth and long-term success.

Netflix provided guidance for 2025, indicating continued optimism. The annual revenue forecast was raised to approximately 44.00 billion USD (an increase of 0.50 billion from previous estimates). The operating margin is expected to reach 29%, up 1% from earlier projections. The company’s management also mentioned plans for further investment and business expansion in gaming, advertising, and live streaming to enhance appeal to subscribers.

Expert forecasts for Netflix Inc.’s stock for 2025

- Barchart: 25 out of 41 analysts rated Netflix stock as a Strong Buy, two as a Buy, 13 as a Hold, and one as a Sell. The growth price target is 1,100 USD, while the sell price target is 650 USD

- MarketBeat: 26 out of 35 specialists assigned a Buy rating to the shares, while nine gave a Hold recommendation. The growth price target is 1,490 USD

- TipRanks: 20 out of 29 professionals recommend the stock as a Buy, seven as a Hold, and two as a Sell. The growth price target is 1,250 USD, while the sell price target is 715 USD

- Stock Analysis: 13 out of 31 experts rated the shares as a Strong Buy, 11 as a Buy, six as a Hold, and one as a Strong Sell, with a price target of 600 USD. The growth price target is 1,494 USD

Netflix Inc.’s stock price forecast for 2025

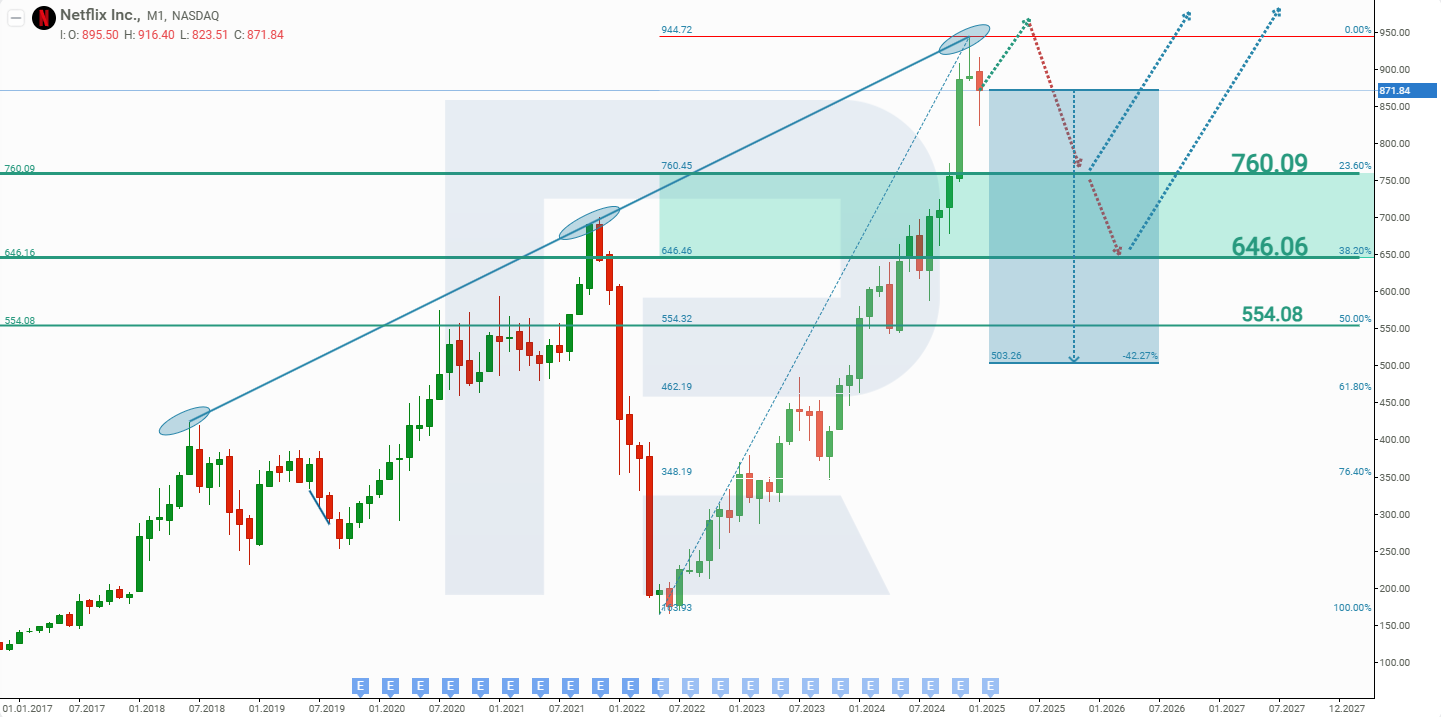

On the monthly timeframe, Netflix Inc.’s stock reached the 999 USD resistance level. Over the past two years, the company’s shares have skyrocketed 500%, with no significant corrections observed. Starting in November 2024, price growth accelerated, as typically seen at the final stage of an uptrend. Based on the current performance of Netflix Inc.’s stock, two potential scenarios are considered for 2025.

The primary forecast for Netflix Inc.’s stock suggests a decline to the nearest support level at 802 USD, followed by a rebound and growth to the first target of 1,215 USD and a second target of 1,469 USD (in the event of continued growth). The 802 USD support level and price growth targets were determined using Fibonacci levels. A breakout below the 802 USD support level could push the price towards 680 USD. In this scenario, the growth targets would be the resistance levels at 1,100 and 1,347 USD.

The alternative forecast for Netflix Inc.’s stock predicts further price rises from the current level to the nearest resistance at 1,180 USD and potentially to 1,400 USD should the growth continue.

Given Netflix Inc.’s high stock price, it may split its shares to reduce their value and attract a broader range of investors. News of an upcoming stock split could increase demand for the shares.

Netflix Inc.’s stock analysis and forecast for Q1 2025Risks of investing in Netflix Inc.’s stock

Investing in Netflix stock carries risks and potential challenges for the company. These include:

- Competition: major competitors with streaming services such as Disney+, Amazon Prime Video, HBO Max, and Apple TV+ are expanding their content libraries and subscriber bases. The company also faces competition from local market players who may offer more relevant content to regional viewers

- Content costs: producing high-quality original content requires significant investment. Inflated costs may impact the company’s profitability

Market saturation - growth in subscriber numbers may slow down in countries with high streaming service penetration

- User reaction to ads: although users are currently accepting of ads and subscribing to the ad-supported plan, a shift in user sentiment could significantly harm the company’s financial position

- Advertising model efficiency: it remains unclear whether Netflix’s advertising model will be successful and capable of compensating for the lost income from traditional subscriptions

Despite considerable growth opportunities and innovations, investments in Netflix involve multiple risks. Therefore, all the relevant factors should be considered when making investment decisions.

Summary

Fundamental analysis of Netflix points to the potential for further price growth. Most experts also forecast a rise in share value, while those predicting a price decline estimate a fall of 20% to 30%. As a result, investors now face a difficult decision: either buy at an all-time high and hope for continued growth or wait for a correction and buy at a lower price, with the risk of missing out on the opportunity if the correction does not occur. Technical analysis suggests correction, forecasting a 15% price decline. Given the information above, investing in Netflix stock at a price above 1,000 USD per share should be considered high risk.

Things could change if the company announces a stock split, as this would likely increase demand for the shares and significantly improve the chances of stock price growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.