Bank of America Q4 2025 results: revenue and profit beat expectations, but the market is concerned about the 2026 forecast

Bank of America exceeded market expectations in Q4 2025; however, its 2026 net interest income forecast was more modest, leading to a decline in stock prices.

For Q4 2025, Bank of America Corporation (NYSE: BAC) exceeded market expectations, reporting revenue of 28.4 billion USD, earnings per share of 0.98 USD, and net income of 7.6 billion USD, reflecting a 12% increase compared with the same period last year. The primary drivers of growth were net interest income, which increased by 10% to 15.9 billion USD, and strong growth in trading operations and investment banking. Compared with Q3 2025, profit increased by 10%, further confirming the resilience of the business model in a high-interest-rate environment.

The bank’s management forecasts net interest income growth of 5-7% for 2026, alongside stable expense management and continued capital returns to shareholders through dividends and share repurchases.

Despite exceeding analyst expectations for both profitability and revenue, BAC shares declined following the quarterly report. The negative market reaction was primarily due to the bank’s 2026 net interest income forecast, which was seen as relatively modest. Market participants had anticipated a more aggressive growth forecast, but given macroeconomic uncertainty and the Federal Reserve’s policy, the outlook was viewed as less optimistic. Specifically, the shift in expectations regarding a potential Federal Reserve rate cut affected the entire banking sector, putting pressure on bank stocks.

This article provides a detailed review of Bank of America Corporation, a fundamental analysis of its quarterly reports, a technical analysis of BAC shares based on their recent performance, and a stock forecast for BAC in 2026.

About Bank of America Corporation

Bank of America Corporation is one of the world’s largest financial institutions, offering a broad range of banking and related services. Amadeo Giannini founded the bank in 1904 in San Francisco, US, under the name Bank of Italy, which was rebranded as Bank of America in 1930. The modern corporation emerged in 1998 following a merger with NationsBank.

Bank of America offers a broad range of services, including retail and corporate banking, investment and insurance products, asset management, and mortgage and lending services. Its headquarters are in Charlotte, North Carolina, US.

The bank’s IPO occurred in 1957 when its shares began trading on the New York Stock Exchange under the ticker BAC. Bank of America is among the largest banks in the US and worldwide, serving clients in more than 35 countries and managing assets exceeding 2.4 trillion USD.

Image of the Bank of America Corporation’s nameBank of America Corporation’s main revenue streams

Bank of America’s key areas of financial interest, which generate revenue, span various business lines, including retail, corporate, and investment services. These are divided into the following categories:

- Net interest income: generated from the difference between interest received on issued loans and interest paid to clients on deposits and other borrowed funds. Bank of America offers a broad range of financial products, including mortgages, commercial and auto loans, and credit cards.

- Commission income: revenue from client transaction fees, including charges for account maintenance, payment and transfer processing, and asset management.

- Investment banking income: fees for advisory services on mergers and acquisitions, revenue from equity and bond issuance, and earnings from trading financial instruments such as securities, currencies, and derivatives.

- Asset management and insurance income: fees for asset management services, insurance premiums, and returns on investments in insurance-related products.

- Trading and market operations: profits from transactions involving securities, currencies, and derivatives.

- Other income sources: fees for safe deposit box rentals, returns on investments in sustainable development and infrastructure projects, and profits from holdings of government and corporate bonds.

These areas diversify the bank’s revenue streams, making them more resilient to economic crises, and enable Bank of America to compete effectively in the global market.

Bank of America Corporation’s strengths and weaknesses

Bank of America’s strengths include:

- Diversified revenue streams: the bank offers a broad range of financial services, including retail banking, investment services, asset management, corporate banking, and insurance. This diversity strengthens Bank of America’s resilience to market fluctuations across multiple segments and allows it to generate revenue from various sources.

- Digital innovation: the bank is actively implementing digital technologies, including mobile apps and the virtual assistant Erica. These innovations enhance service quality, improve operational efficiency, and help attract new clients.

- Strong position in investment banking and asset management: the bank’s competitive advantages in investment and private banking, alongside effective asset management, ensure its leadership in both the US and internationally. As a result, it can offer high-quality services to high-net-worth clients and large international corporations worldwide.

- Wide network and global presence: the bank has representative offices in more than 35 countries, enabling it to serve clients regardless of location. The bank holds a leading position in both domestic and international markets.

- Substantial capital and liquidity reserves: with extensive financial resources and highly liquid assets, the bank is well-equipped to manage risks and maintain stability during economic downturns effectively.

Bank of America’s weaknesses include:

- Dependence on interest rates: the bank’s primary revenue stream is derived from the spread between interest earned on loans and interest paid on deposits. This makes it sensitive to changes in financial regulators’ monetary policy and fluctuations in interest rates. During periods of low rates, profitability typically declines.

- High operating costs: despite the scale of the corporation and its elevated level of digitalisation, the bank incurs more substantial costs compared to its competitors, including JPMorgan Chase (NYSE: JPM) and Wells Fargo (NYSE: WFC). These costs affect the overall profitability of the transactions.

- Weakness in certain retail banking segments: although the bank holds a significant market share in the US, it lags behind competitors such as JPMorgan Chase and Wells Fargo in the retail banking and credit card segments. These banks have a larger client base and more developed service networks.

Overall, Bank of America is a strong player in the financial market thanks to its diversification and innovation. However, it faces challenges, including sensitivity to macroeconomic factors and elevated operating expenses.

Bank of America Corporation Q3 2024 results

In October, Bank of America published its results for Q3 2024, which ended on 30 September. The key data from the report is outlined below:

- Revenue: 25.30 billion USD (+1%)

- Net income: 6.90 billion USD (–12%)

- Earnings per share: 0.81 USD (–10%)

- Net Interest income: 14.0 billion USD (–3%)

Revenue by segment:

- Consumer Banking: 10.40 billion USD (–1%)

- Global Wealth and Investment Management: 5.80 billion USD (+8%)

- Global Banking: 5.83 billion USD (–6%)

- Global Markets: 5.60 billion USD (+14%)

Net income by segment:

- Consumer Banking: 2.70 billion USD (–6%)

- Global Wealth and Investment Management: 1.10 billion USD (+1%)

- Global Banking: 1.90 billion USD (–27%)

- Global Markets: 1.50 billion USD (+25%)

Shareholders received nearly 5.60 billion USD, including 2.00 billion in dividends and 3.50 billion through share buybacks.

Despite a 1% increase in total revenue, the bank’s net income declined by 12%, with profits from banking operations in both the global and US consumer markets falling. However, as in the previous quarter, the investment segment continued to show positive momentum, helping to offset the negative impact of the banking services sector.

Bank of America Corporation Q4 2024 results

Bank of America Corporation released its Q4 2024 results on 16 January 2025. The key report highlights, compared to the corresponding period of 2023, are outlined below:

- Revenue: 25.3 billion USD (+15%)

- Net income: 6.7 billion USD (+112%)

- Earnings per share: 0.82 USD (+134%)

- Net interest income: 14.4 billion USD (+3%)

Revenue by segment:

- Consumer Banking: 10.6 billion USD (+3%)

- Global Wealth and Investment Management: 6.0 billion USD (+15%)

- Global Banking: 6.1 billion USD (+3%)

- Global Markets: 4.8 billion USD (+20%)

Net income by segment:

- Consumer Banking: 2.8 billion USD (+2%)

- Global Wealth and Investment Management: 1.2 billion USD (+14%)

- Global Banking: 2.1 billion USD (–13%)

- Global Markets: 941 million USD (+27%)

In the Q4 2025 earnings report, Bank of America’s management expressed optimism about the company’s performance and outlook. It was noted that each business line contributed more to revenue, and there was a noticeable increase in deposits and loans granted, surpassing the industry average. Net interest income was projected to range between 14.5 and 14.6 billion USD in Q1 2025, with steady growth expected to bring it to approximately 15.5-15.7 billion USD by Q4 2025. The second half of 2025 was expected to show stronger growth than the first, ensuring an operational advantage throughout 2025.

Bank of America Corporation Q1 2025 results

On 15 April, Bank of America released its report for Q1 2025, which ended on 31 March. Its key highlights are provided below:

- Revenue: 27.37 billion USD (+6%)

- Net income: 7.40 billion USD (+11%)

- Earnings per share: 0.90 USD (+18%)

- Net interest income: 14.44 billion USD (+3%)

Revenue by segment:

- Consumer Banking: 10.49 billion USD (+3%)

- Global Wealth and Investment Management: 6.02 billion USD (+7%)

- Global Banking: 5.97 billion USD (0%)

- Global Markets: 6.58 billion USD (+12%)

Net income by segment:

- Consumer Banking: 2.53 billion USD (–4%)

- Global Wealth and Investment Management: 1.00 billion USD (0%)

- Global Banking: 1.91 billion USD (–3%)

- Global Markets: 1.94 billion USD (+13%)

Bank of America’s Q1 2025 report showed strong results, exceeding Wall Street expectations and instilling cautious optimism in investors. Income growth was primarily driven by trading revenues, especially in the stock sector, which saw a 17% increase amid a general surge in market activity across leading US banks.

Despite the positive results, Bank of America remains cautious about the economic situation. CEO Brian Moynihan noted potential risks associated with new tariffs and global uncertainty. However, he did not expect a recession in the US economy in 2025, with CFO Alastair Borthwick describing the economy as one that is slowly growing.

In Q1 2025, Bank of America increased provisions for possible loan losses from 1.3 to 1.5 billion USD, indicating the bank’s cautious approach to credit risks amid economic uncertainty.

For income-focused investors, the bank maintained its quarterly dividend at 0.26 USD per share, confirming its commitment to returning capital to its shareholders.

For Q2 2025, Bank of America’s management did not issue a specific forecast. However, the bank expects net interest income to grow by 6–7% in 2025 and to reach between 15.5 and 15.7 billion USD by Q4 2025, reiterating the guidance provided in the commentary to the Q4 2024 report. The primary driver of interest income was the consumer services sector.

Bank of America Corporation Q2 2025 earnings results

On 16 July, Bank of America released its Q2 2025 earnings report for the period ended 30 June. The key results are outlined below, compared with the same quarter a year earlier:

- Revenue: 27.51 billion USD (+4%)

- Net income: 7.11 billion USD (+3%)

- Earnings per share: 0.89 USD (+7%)

- Net Interest income: 14.67 billion USD (+7%)

Revenue by segment:

- Consumer Banking: 10.81 billion USD (+6%)

- Global Wealth and Investment Management: 5.93 billion USD (+7%)

- Global Banking: 5.69 billion USD (–7%)

- Global Markets: 6.01 billion USD (+10%)

Net income by segment:

- Consumer Banking: 2.97 billion USD (+14%)

- Global Wealth and Investment Management: 0.99 billion USD (–3%)

- Global Banking: 1.70 billion USD (–19%)

- Global Markets: 1.56 billion USD (+10%)

Bank of America delivered solid quarterly results, with net income in Q2 2025 rising to 7.1 billion USD (89 cents per share), beating analyst expectations and marking a 3% year-on-year increase, even though total revenue came in slightly below forecasts. The main growth drivers were the record net interest income of 14.7 billion USD (+7%) and a sharp rise in trading revenue to 5.3 billion USD (+14%), amid heightened market volatility and geopolitical uncertainty.

Management struck a confident tone. CEO Brian Moynihan noted stable consumer spending, high credit quality, and organic growth in both loans and deposits. The bank has now reported growth in current account numbers for 26 consecutive quarters, while total loan volume rose by 6-8%. The CFO emphasised that net interest income is expected to continue rising and could reach 15.5-15.7 billion USD by Q4, with loan growth projected in the mid-single digits (approximately 4-6%) and operating expenses expected to remain stable or even decline by year-end. Trading income is also expected to grow in the mid-single digits, extending the current 13-quarter streak of positive performance.

The investment banking division remains the main weak point, with fee income down approximately 9% year-on-year, although management expects deal activity to recover towards the end of the year.

In addition, the bank reaffirmed its strategy in the stablecoin segment, outlining plans either to develop its own platform or form a partnership to create institutional-grade digital payments infrastructure.

Bank of America Corporation Q3 2025 results

On 15 October, Bank of America released its Q3 2025 results for the calendar quarter ended 30 September. The key figures compared with those from the same period a year earlier are as follows:

- Revenue: 28.08 billion USD (+11%)

- Net income: 8.46 billion USD (+23%)

- Earnings per share (EPS): 1.06 USD (+31%)

- Net interest income: 15.23 billion USD (+9%)

Revenue by segment:

- Consumer Banking: 11.16 billion USD (+7%)

- Global Wealth and Investment Management: 6.31 billion USD (+10%)

- Global Banking: 6.26 billion USD (+7%)

- Global Markets: 6.22 billion USD (+10%)

Net income by segment:

- Consumer Banking: 3.44 billion USD (+28%)

- Global Wealth and Investment Management: 1.27 billion USD (+20%)

- Global Banking: 2.13 billion USD (+11%)

- Global Markets: 1.65 billion USD (+4%)

For Q3 2025, Bank of America reported results ahead of expectations. Revenue totalled 28.1 billion USD, net income 8.5 billion USD, and earnings per share 1.06 USD. Return on equity reached 15.4%, exceeding analyst forecasts. The main drivers were the record growth in net interest income and a notable rebound in investment banking fees.

Compared with Q2 2025, the bank’s performance improved. Provisions for potential credit losses fell to 1.3 billion USD (from 1.6 billion USD previously), while loan charge-offs declined by around 10%, indicating stabilisation in the quality of the loan portfolio.

Year-on-year results also showed solid improvement: revenue rose 11%, and earnings per share increased from 0.81 USD to 1.06 USD. Net interest income reached 15.2 billion USD (+9%), supported by higher loan and deposit volumes. Investment banking fees grew 43% to 2.0 billion USD, while trading income rose 9%. Card spending by clients increased 6%, reflecting healthy consumer activity.

Expenses rose moderately – by about 5% – while profit grew at a faster pace. Capital remained strong, with the CET1 ratio at 11.6%. During the quarter, shareholders received a total of 7.4 billion USD: 2.1 billion USD through dividends and 5.3 billion USD via share repurchases.

Management forecasted Q4 2025 net interest income to reach 15.6–15.7 billion USD, up 8% year-on-year. The bank planned to keep expenses under control and continue shareholder distributions while maintaining strong capitalisation.

Bank of America Corporation Q4 2025 results

On 14 January 2026, Bank of America released its Q4 2025 results for the calendar year, ending 31 December. Below are the key figures compared with the same period last year:

- Revenue: 28.39 billion USD (+7%)

- Net income: 7.60 billion USD (+12%)

- Earnings per share: 0.98 USD (+18%)

- Net interest income: 15.89 billion USD (+9%)

Revenue by segment:

- Consumer Banking: 12.53 billion USD (+7%)

- Global Wealth and Investment Management: 6.73 billion USD (+9%)

- Global Banking: 6.18 billion USD (+7%)

- Global Markets: 5.64 billion USD (+8%)

Net income by segment:

- Consumer Banking: 3.24 billion USD (+14%)

- Global Wealth and Investment Management: 1.49 billion USD (+20%)

- Global Banking: 2.00 billion USD (+5%)

- Global Markets: 1.33 billion USD (+9%)

For Q4 2025, Bank of America demonstrated strong results, surpassing market expectations for both revenue and profit. Revenue amounted to 28.4 billion USD, slightly above analysts’ consensus forecast (27.5–27.8 billion USD), and net income reached 7.6 billion USD, reflecting a 12% year-on-year increase. Earnings per share were 0.98 USD, also exceeding expectations (0.96 USD). The main driver of growth was strong net interest income, which increased by 10% to 15.8 billion USD, highlighting the bank’s ability to generate profits in a high-interest-rate environment.

Markets and trading operations also contributed significantly to profitability. The investment and trading business showed strong growth: trading in securities and foreign currencies saw a marked rise in profit, with increases in fees and asset management adding further resilience to the results. However, despite strong non-interest income, the banking margin contracted slightly due to the increased costs of servicing higher loan volumes.

Credit quality remained stable, despite the economic slowdown and high rates. Another positive signal for the company’s financial stability is the fact that the bank managed to reduce provisions for potential loan losses, despite rising interest rates and expectations of potential credit quality issues. Loan growth averaged 8%, reflecting ongoing demand for credit from both consumers and businesses.

Management raised the forecast for net interest income in 2026, expecting growth of 5–7%. High interest rates are expected to continue supporting results in this category. However, given the potential for economic slowdown and rising expenses, the bank could face long-term profit limitations. Forecasts for the upcoming quarters are moderately positive, with the bank aiming to control costs while continuing to return capital to shareholders, including dividends and share buybacks.

Fundamental analysis for Bank of America Corporation

Below is a fundamental analysis for BAC based on the Q3 2026 financial results:

- Capital and resilience: Bank of America’s capital and resilience remain high. The Common Equity Tier 1 (CET1) ratio stands at 11.4%, 23 basis points lower than the previous quarter, but still significantly above the regulatory minimum of 10%. CET1 capital remains stable at 201 billion USD. The supplementary leverage ratio stands at 5.7%, also above the required level. At the same time, risk-weighted assets increased by 22 billion USD, driven by growth in the loan portfolio and asset base. The bank maintains robust capitalisation with a sufficient buffer above the regulatory requirements. The decline in CET1 mainly reflects the increase in risk-weighted assets, but the capital level remains strong enough to support business growth. Overall, the bank’s capital meets Basel III standards, ensuring the necessary resilience for lending activity.

- Liquidity and funding: the average deposit volume at Bank of America increased to 2.01 trillion USD (+3% year-on-year) for the quarter, marking the 10th consecutive quarter of growth. Global liquidity sources totalled 975 billion USD, indicating a strong liquidity buffer. The bank used deposit growth to reduce reliance on wholesale funding, improving its balance sheet.

- Dividends and share buybacks: in Q4 2025, the bank returned 8.4 billion USD in capital to shareholders. Of this, 2.1 billion USD was allocated to dividends on common stock (quarterly dividend of 0.28 USD per share), and 6.3 billion USD was used for share repurchases, resulting in a 4% reduction in shares outstanding year-on-year.

- Profit and efficiency: the bank’s net income increased by 12% year-on-year, and earnings per share grew by 18%. Quarterly revenue reached 28.4 billion USD (+7% year-on-year). Net interest income rose by 10%, driven by loan growth and asset revaluation. Non-interest income increased by 4% to 12.6 billion USD, thanks to higher asset management fees and strong trading performance. The efficiency ratio improved to 61%, compared with 63% a year earlier.

- Loans and risks: the average loan and lease volume increased by 8% year-on-year to 1.17 trillion USD. Provisions for credit losses in the consumer segment decreased by 15% to 1.1 billion USD, with net charge-offs also falling. Asset quality remains stable, as noted by management. A 100-basis-point decrease in interest rates could reduce net interest income by 2 billion USD, while a 100-basis-point increase would add approximately 700 million USD.

Fundamental analysis for BAC – conclusion

Bank of America ended 2025 with strong financial resilience, demonstrating organic growth in deposits and loans, high operational efficiency, and a significant capital buffer for shareholder returns. The main risk for the bank in 2026 remains the potential interest rate reductions, which could pressure net interest income.

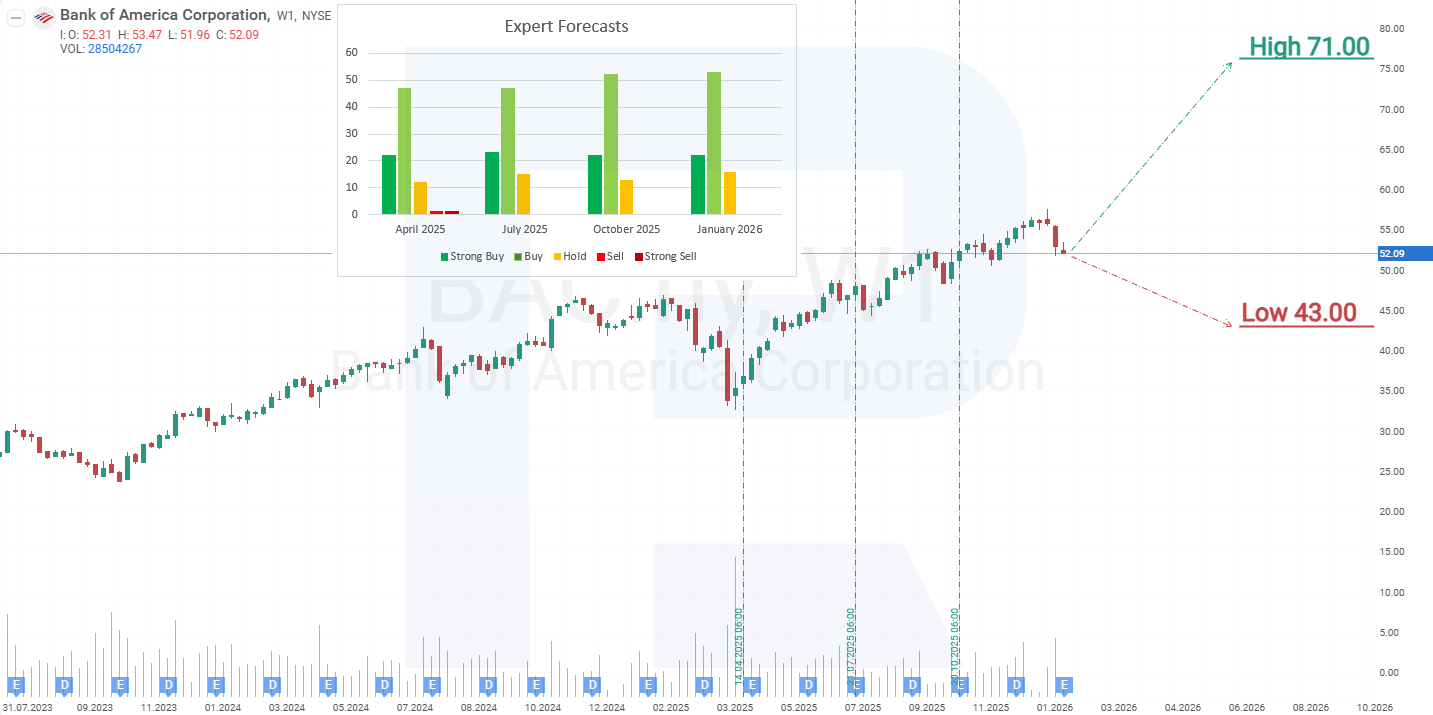

Expert forecasts for Bank of America Corp stock in 2025

- Barchart: 16 of 27 analysts rated Bank of America shares as Strong Buy, 6 as Moderate Buy, and 5 as Hold. The upper price target is 71 USD, and the lower bound is 47 USD.

- MarketBeat: 24 of 27 analysts assigned a Buy rating to the shares, with 3 issuing Hold recommendations. The upper price target is 71 USD, and the lower bound is 47 USD.

- TipRanks: 14 of 18 professionals recommended Buy, and 4 rated them Hold. The upper price target is 71 USD, and the lower bound is 55 USD.

- Stock Analysis: 6 of 19 experts rated the shares as Strong Buy, 9 as Buy, and 4 as Hold. The upper price target is 71 USD, and the lower bound is 43 USD.

Bank of America Corporation stock price forecast for 2026

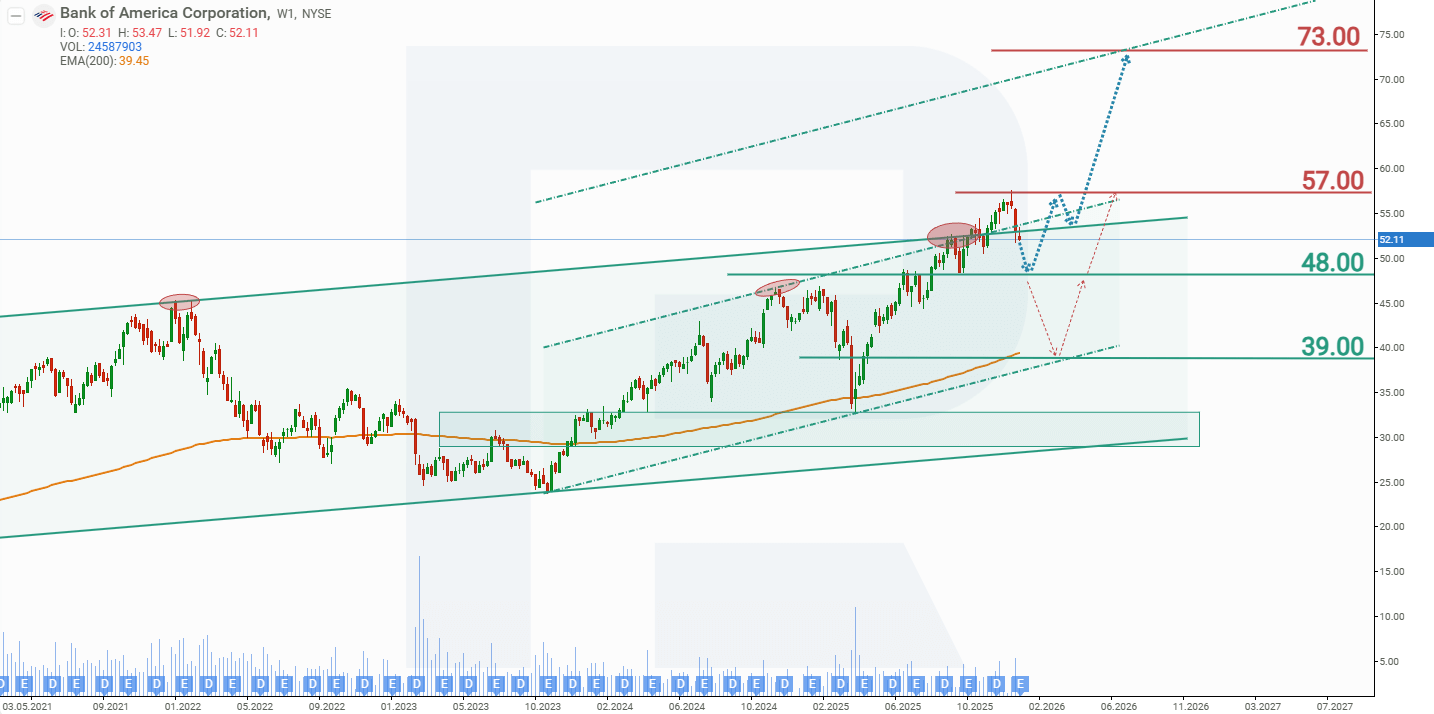

On the weekly chart, Bank of America shares are trading in an upward channel and have reached the upper boundary, which acts as resistance. The attempt to break through and hold above this level was unsuccessful, and even the quarterly report, which exceeded expectations, did not catalyse growth. This suggests the need for a correction before the upward trend can continue. Based on the current performance of BAC shares, the potential price scenarios for BAC in 2026 are as follows:

The base-case forecast for BAC shares suggests testing support at 48 USD, followed by a rebound and price growth towards resistance at 57 USD. If this level is breached, the share price could rise to 73 USD.

The alternative forecast for BAC stock suggests a price decline to the trendline at 39 USD. Although this scenario implies a 25% drop in BAC shares from the current price, it would still be considered a correction within the context of the upward trend. A rebound from the 39 USD level would signal the resumption of the price increase, with a target level of 57 USD.

Bank of America Corporation stock analysis and forecast for 2026Risks of investing in Bank of America Corporation

stock

Risks of investing in Bank of America Corporation shares include several factors:

- Interest rate sensitivity: Bank of America’s profitability is closely tied to interest rates. Rate hikes boost asset returns but also increase the cost of raised deposits, potentially reducing net interest income. If the Federal Reserve begins to lower rates, as some analysts predict, this could negatively impact interest income and BAC stock valuation.

- Economic and political uncertainty: a return to the tariff policy under the Trump administration caused market volatility, temporarily increasing trading revenues but also raising uncertainty. Issues in international relations, particularly with China, may affect global markets and reduce BAC’s revenues from international operations.

- Lower investment banking revenues: amid uncertainty, market activity in the mergers and acquisitions sector and IPOs has slowed, leading to lower fee income.

- Credit risks: increased loan loss provisions suggest the bank expects a possible rise in defaults, particularly on commercial loans. The share of overdue loans is increasing, which could result in write-offs and lower fee income.

Although the Bank of America shows resilience across several areas, investors should consider the above risks as they may exert pressure on the company’s future financial performance.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.