Boeing stock forecast: end of multi-year consolidation and new targets

Boeing’s strong Q4 2025 report confirmed the company’s shift from crisis to recovery, though its high valuation and debt load continue to present risks. The technical outlook suggests potentially significant momentum for BA shares in 2026, should key levels be breached.

The Boeing Company’s (NYSE: BA) report exceeded expectations, with revenue rising by 57% to 23.95 billion USD, marking the highest quarterly revenue since 2018. The company returned to profitability after several years of losses, posting a profit exceeding 8 billion USD and non-GAAP EPS of around 9.92 USD. In contrast, analysts had expected a loss per share.

This growth was driven by a significant increase in commercial aircraft deliveries – 160 units in the quarter and 600 for the year. Boeing also received a substantial one-off contribution to profit from the sale of part of its Digital Aviation Solutions business, which boosted the overall results, alongside positive free cash flow – a first in a long time.

The management is focused on further strengthening operational resilience in 2026, expecting positive free cash flow of 1–3 billion USD, continued growth in deliveries, and the completion of new model certification programs, which should help the company fully complete its recovery.

This article reviews The Boeing Company, outlining its revenue sources and summarising its quarterly performance. Additionally, it provides both technical and fundamental analysis of BA, which forms the basis of the Boeing stock forecast for the 2026 calendar year.

About The Boeing Company

The Boeing Company is one of the world’s largest aerospace and defence firms. It was founded on 15 July 1916 by William Boeing in Seattle, Washington. The company is engaged in designing, manufacturing, and selling commercial aircraft, military equipment, satellites, missile systems, and space technology. Additionally, Boeing offers both support services and financial solutions.

Boeing’s IPO took place in 1962, and the company is listed on the NYSE under the ticker BA.

Image of The Boeing Company nameThe Boeing Company’s key revenue streams

The Boeing Company generates revenue from the following sources:

- Commercial Airplanes (BCA): the manufacture and sale of commercial airliners, including the 737, 767, 777 and 787 Dreamliner models. This is the company’s largest segment by revenue, but also the most sensitive to market demand fluctuations, regulatory scrutiny, and technical risks. Boeing is actively working to regain ground following the earlier suspension of 737 MAX deliveries.

- Defense, Space & Security (BDS): covers military aircraft, drones, satellite systems, missiles, and equipment for NASA. This segment delivers stable revenues through long-term contracts with the US government and allied nations.

- Global Services (BGS): aftermarket services, maintenance, personnel training, spare parts supply, digital solutions, and logistics. This division supports Boeing’s customer base in both civil and defence sectors, generating steady profits and high margins.

- Boeing Capital Corporation (BCC): financial services, including leasing and customer financing. This segment helps Boeing clients fund aircraft purchases, particularly during periods of economic uncertainty.

The Boeing Company’s financial position and key risk factors

Boeing ended 2024 with revenues of 66.5 billion USD, down 14% from the previous year. Its net loss reached 11.8 billion USD, significantly higher than the 2.2 billion USD loss recorded in 2023. Negative operating cash flow totalled 12.1 billion USD, underscoring severe financial strain. Despite this, the company’s order backlog remains substantial – around 521 billion USD, including more than 5,500 commercial aircraft orders, which signals sustained long-term demand.

A series of negative factors weighed on Boeing’s 2024 financial performance. Chief among them was a strike by the International Association of Machinists and Aerospace Workers (IAM), which halted production of the 737, 767, and 777/777X models, significantly impacting delivery volumes. The company also incurred substantial restructuring costs, including staff reductions and internal restructuring. In the defence segment, additional expenses across several contracts further reduced profitability and eroded this division’s margins.

At the end of 2024, Boeing held approximately 26.3 billion USD in cash and marketable securities. However, high debt levels and negative free cash flow pose a risk to the company’s financial stability. Should these figures persist, they could affect Boeing’s credit ratings and its ability to fund future programs.

Despite the challenging situation, Boeing’s management is taking active steps to stabilise operations. Production of key aircraft models resumed after the strike ended. Efforts are underway to reduce costs and improve operational efficiency, with a focus on enhancing quality control and ensuring product safety – critical factors in regaining the trust of both customers and aviation regulators.

At the same time, Boeing’s large order book, government contracts, and the potential recovery of its commercial division offer a foundation for a gradual return to stability.

The Boeing Company Q1 2025 financial results

On April 23, The Boeing Company published its Q1 2025 earnings report, which exceeded analysts’ expectations. Below are the key figures:

- Total revenue: 19.49 billion USD (+18%)

- Loss: 31 million USD (compared to 355 million USD in Q1 2024)

- Loss per share: 0.49 USD (compared to 1.13 USD in Q1 2024)

- Operating margin: 2.4% (compared to –0.5% in Q1 2024)

- Free cash flow: -2.3 billion USD (compared to –3.9 billion USD in Q1 2024)

- Aircraft deliveries: 130 units (+57%)

Revenue by segment:

- Aircraft sales revenue: 16.14 billion USD (+21%)

- Service revenue: 3.34 billion USD (+1%)

- Commercial Airplanes: 8.14 billion USD (+75%)

- Defense, Space & Security: 6.26 billion USD (–9%)

- Global Services: 5.06 billion USD (no change)

Boeing’s Q1 2025 report reflected cautious optimism regarding the aviation giant’s recovery. The company reported an adjusted loss per share of 0.49 USD – significantly better than analysts’ forecasts of a loss of 1.24 USD, highlighting the effectiveness of the measures introduced by CEO Kelly Ortberg.

The substantial 57% year-on-year increase in commercial aircraft deliveries, including the 737 MAX, demonstrated operational resilience despite the 2024 challenges related to strikes and regulatory issues. The 737 MAX program gradually ramped up production, with plans to reach 38 aircraft per month by year-end.

The order book grew to 545 billion USD, covering over 5,600 aircraft, providing a solid foundation for future revenue. Regarding cash flow, Boeing showed a smaller outflow than expected, and Ortberg’s forecast of positive cash flow in Q2 2025 reflected ambitious targets. The sale of its Jeppesen division to Thoma Bravo for 10.55 billion USD demonstrated a strategic approach to asset optimisation and strengthening the company’s financial position.

Despite this progress, Boeing continued to face several challenges. Trade tensions between the US and China led Chinese airlines to suspend acceptance of Boeing aircraft, forcing the company to redirect deliveries to other markets. A court hearing was also expected in June over fraud charges relating to the US government and the 737 MAX crashes.

Following the earnings release, Boeing’s share price rose by 6%, despite having remained down 9% since the beginning of the year due to regulatory and geopolitical pressures.

The key factor remained Ortberg’s ability to implement internal reforms and restore investor confidence.

The Boeing Company Q2 2025 financial results

The Boeing Company published its Q2 2025 results on 29 July, once again exceeding analysts’ expectations. Key figures are as follows:

- Revenue: 22.75 billion USD (+35%)

- Net loss: 612 million USD (vs. 1.4 billion USD loss in Q2 2024)

- Loss per share: 1.24 USD (vs. 2.90 USD loss in Q2 2024)

- Operating margin: –0.8% (vs. –6.5% in Q2 2024)

- Free cash flow: –200 million USD (vs. –4.3 billion USD in Q2 2024)

- Aircraft deliveries: 150 units (+63%)

Revenue by segment:

- Commercial aircraft sales: 19.12 billion USD (+41%)

- Services revenue: 3.62 billion USD (+8%)

- Commercial Airplanes: 10.87 billion USD (+81%)

- Defense, Space & Security: 6.61 billion USD (+10%)

- Global Services: 5.28 billion USD (+8%)

In Q2 2025, Boeing demonstrated a significant improvement in its financial performance. Revenue rose by 35% year-on-year to 22.75 billion USD, exceeding market forecasts. The adjusted loss per share narrowed to 1.24 USD from 2.90 USD the previous year. Free cash flow remained negative at 200 million USD, while operating cash flow turned positive at 200 million USD. The total order book expanded to approximately 619 billion USD, covering more than 5,900 commercial aircraft.

The commercial segment was the main growth driver, with Boeing delivering 150 aircraft, up 63% year-on-year. Revenue from this division jumped 81% to 10.87 billion USD. However, the operating loss stood at 557 million USD, and the operating margin remained negative at –5.1%.

In the Defense, Space & Security division, revenue increased by 10% to 6.61 billion USD. The segment posted a positive operating profit of around 110 million USD, with a 1.7% margin.

Global Services revenue rose by 8% to 5.28 billion USD. Operating profit reached 1.05 billion USD, with a margin just below 20%.

The company not only improved its financial results but also outlined forward-looking guidance. Boeing expects free cash flow to turn positive by Q4 2025 and strengthen significantly in 2026. Its outlook for 2026 includes delivering more than 700 aircraft, revenue of approximately 80 billion USD, earnings per share of around 3.50 USD, and free cash flow of approximately 5.6 billion USD. A full return to profitability is projected for 2026, as operating losses are expected to persist through 2025 despite ongoing improvement.

Investor response was mixed. Boeing’s share price hit a 52-week high before the report but dropped by 4.4% after the results, despite beating expectations. This may reflect profit-taking following an 88% surge in the share price since April 2025 and caution amid lingering risks.

While Boeing is expected to return to profitability and positive cash flow in 2026, losses and operational challenges persist in 2025. Investors should take a balanced view when considering Boeing shares, especially following the recent 88% rally. The stock may offer medium- to long-term potential tied to the company’s recovery, particularly if free cash flow turns positive as forecast.

The Boeing Company Q3 2025 financial results

On 29 October, The Boeing Company published its Q3 2025 financial results. The key figures, compared with the same period in 2024, are as follows:

- Revenue: 23.27 billion USD (+30%)

- Net loss: 5.34 billion USD (versus a loss of 6.17 billion USD in Q3 2024)

- Loss per share: 7.47 USD (versus a loss of 10.44 USD in Q3 2024)

- Operating margin: –21.7% (versus –33.6% in Q3 2024)

- Free cash flow: 240 million USD (versus –1.96 billion USD in Q3 2024)

- Aircraft deliveries: 160 units (+38%)

Revenue by segment:

- Commercial aircraft sales: 19.64 billion USD (+35%)

- Services revenue: 3.63 billion USD (+10%)

- Commercial Airplanes: 11.09 billion USD (+49%)

- Defense, Space & Security: 6.90 billion USD (+25%)

- Global Services: 5.37 billion USD (+10%)

Boeing’s Q3 2025 report was mixed. The company exceeded expectations on revenue but fell well short on profit. Revenue rose 30% year-on-year to 23.3 billion USD, driven by an increase in deliveries to 160 aircraft – the highest level since 2018. However, the loss per share widened to 7.47 USD due to a one-off charge of almost 4.9 billion USD related to the 777X program. The delay of this aircraft’s deliveries to 2027 hit profitability, although cash flow improved: free cash flow turned positive for the first time in years at 240 million USD, compared with a loss of nearly 2 billion USD a year earlier.

Management did not provide a detailed outlook for 2026 but warned that the coming year would be difficult, as the 777X program will continue to consume cash, with improvement expected no earlier than 2027–2028. At the same time, the core programs – 737, 787, Defense and Services – are showing steady growth, supported by a record order backlog exceeding 600 billion USD.

The main issue of the quarter was the 777X delay and the associated 4.9 billion USD provision, which weighed heavily on earnings. In other areas, the company continues to show gradual recovery: 737 production has stabilised at around 38 aircraft per month, 787 output at about seven, the Defence business has returned to profit, and the Services segment delivered double-digit growth. However, challenges remain – labour strikes at certain plants continue, and legacy losses on the 777X program persist.

Production quality is improving: the number of manufacturing errors and rework has fallen by 60–75%, fuselages from Spirit AeroSystems have become more consistent, and the company has completed modifications on older 737 MAX aircraft. Nevertheless, regulators remain vigilant. The FAA has only partially restored its trust and continues to maintain strict oversight following past violations.

Overall, Boeing is indeed taking steps toward stabilisation, but confidence among markets and regulators remains limited. Any new quality issue or delay could quickly undermine the positive effects of rising revenue and improving cash flow.

The Boeing Company Q4 2025 financial results

The Boeing Company released its Q4 2025 results on 27 January. Below are the key figures compared to the same period in 2024:

- Revenue: 23.95 billion USD (+57%)

- Net earnings: 8.22 billion USD (compared to a loss of 3.86 billion USD in Q4 2024)

- Earnings per share (non-GAAP): 9.92 USD (compared to a loss of 10.44 USD in Q3 2024)

- Operating margins: 35.6% (compared to -26.5% in Q4 2024)

- Free cash flow: 375 million USD (compared to -4.10 billion USD in Q3 2024)

- Deliveries: 160 units (+181%)

Revenue by segment:

- Sales of products: 20.44 billion USD (+72%)

- Sales of services: 3.50 billion USD (+5%)

- Commercial Airplanes: 11.38 billion USD (+139%)

- Defense, Space & Security: 7.42 billion USD (+37%)

- Global Services: 5.21 billion USD (+2%)

Boeing exceeded market expectations, posting significant revenue and profit growth. Revenue reached 23.95 billion USD, a 57% increase compared to the same quarter last year, far surpassing analysts’ forecast of around 22.40 billion USD. The company also reported non-GAAP earnings per share of 9.92 USD, whereas a loss had been expected. Additionally, free cash flow amounted to 0.38 billion USD, turning positive for the first time in a long period, which also surprised analysts.

The main driver of growth was an increase in aircraft deliveries to 160 units, the best result for Boeing since 2018, which significantly contributed to a 139% year-on-year increase in commercial airplane revenue compared to Q4 2024. Additionally, the successful sale of the company’s digital business contributed significantly to the bottom line. This helped improve operational results despite ongoing profitability challenges in some of the business segments.

However, despite these successes, the results remain partially dependent on one-off income from the digital asset sales. Excluding this deal, operating profit would have been lower. Boeing still faces issues with operating margins in its commercial and defense segments, which remain a significant challenge for the company.

Boeing’s management forecasts continued improvement in 2026, expecting free cash flow in the 1–3 billion USD range, indicating ongoing recovery. The focus will be on strengthening production of the 737 MAX, certifying, and launching new models such as the 777X. The company also plans to continue reducing its debt load and improving operational efficiency, which should contribute to future stability.

Fundamental analysis for The Boeing Company

Below is the fundamental analysis for Boeing (BA) based on Q4 2025 results:

- Balance and liquidity: as of Q4 2025, Boeing had cash and cash equivalents of 10.92 billion USD, which is lower than at the beginning of the year (13.80 billion USD). This decrease was due to debt repayments and the acquisition of Spirit AeroSystems. Short-term liabilities total 8.46 billion USD, and with improved liquidity and cash flows, the company has sufficient funds to cover these obligations.

- Cash flow and use of funds: in Q4 2025, operating cash flow totalled 1.33 billion USD, a significant improvement from the 3.45 billion USD loss in Q4 2024. Free cash flow (non-GAAP) was 0.38 billion USD, a positive figure for the company after significant losses in previous periods. This free cash flow profit also contributed to the increase in cash.

- Debt burden and capital structure: the company’s total debt at the end of Q4 2025 stood at 54.10 billion USD, slightly higher than the level at the beginning of the quarter (53.40 billion USD). This increase was driven by the acquisition of Spirit AeroSystems. Despite the rise in debt, Boeing continues to maintain access to credit lines totalling 10 billion USD, which have not yet been utilised. Net debt (net obligations after deducting cash) at the time of the report was 45.90 billion USD, reflecting more stable debt management compared to previous periods.

Fundamental analysis for Boeing – conclusion

Boeing reported impressive financial results in Q4 2025, with a 57% increase in revenue and a return to profitability, which is particularly significant after several years of losses. However, the results were partially dependent on one-off profit from the sale of its digital business. The company has high debt, but under current conditions, it is generating positive cash flows and continuing to improve liquidity. Issues with operating margins in certain segments, such as Commercial Airplanes and Defense, require attention, but overall, Boeing’s strategy of increasing aircraft deliveries and restoring production appears to be successful.

The main risks remain tied to high debt obligations and instability in some programs, such as the KC-46A and 777X. Nevertheless, the company shows positive momentum in its recovery, which should drive future growth.

Analysis of key multiples for The Boeing Company

Below are the key valuation multiples for The Boeing Company based on Q4 2025 results, calculated with a share price of 245 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 205 | ⬤ The company has just returned to profitability, and the high valuation reflects expectations for a return to profitability, which is why it remains high. |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 2.15 | ⬤ Moderate valuation for a mature company. Boeing has a moderate market capitalisation relative to its revenue, indicating normal market expectations for growth. |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 2.29 | ⬤ Similar to P/S. A moderately high valuation for a mature company, but it is important to track how revenue and profitability continue to grow. |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 512 | ⬤ Very high valuation against a backdrop of weak free cash flow. |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 0.2% | ⬤ Very low FCF yield. |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 27.9 | ⬤ High valuation, but within reason for large companies with positive prospects. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 36 | ⬤ High valuation, suggesting that the market has strong expectations for operating profit. Risks include the absence of EBIT growth. |

| P/B | Price to book value | 35 | ⬤ Very high premium for a company with low equity, which signals high growth expectations. |

| Net Debt/EBITDA | Debt burden relative to EBITDA | 5.9 | ⬤ High debt burden. |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | 5.2 | ⬤ The ratio is in a safe zone, but ongoing monitoring EBIT levels and interest expenses is required. A reduction in EBIT or an increase in rates could worsen the company’s position. |

Boeing Company’s valuation multiples analysis – conclusion

Boeing shares are trading at high multiples, signalling strong expectations for the company’s profitability and growth. However, weak free cash flow and high debt levels introduce additional risks.

The shares of the aerospace giant could appeal to investors willing to take on these risks and who believe in the continued growth of the aviation industry and Boeing’s financial recovery. However, for medium-term investors, the current metrics may suggest overvaluation and a potential correction risk if growth slows or cash flow issues intensify.

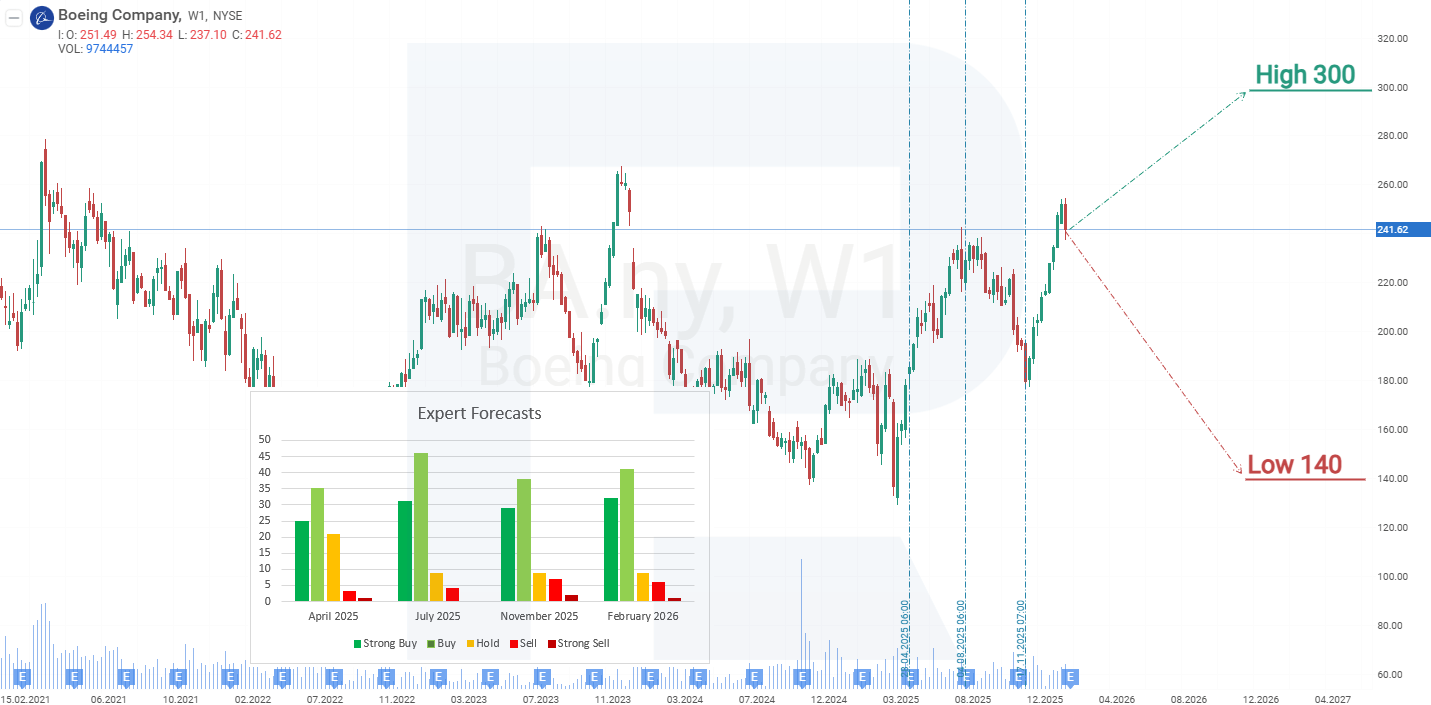

Expert forecasts for The Boeing Company shares

- Barchart: 20 out of 28 analysts rated Boeing Holdings shares as Strong Buy, 3 as Moderate Buy, 4 as Hold, and 1 as Strong Sell. The upper price target is 300 USD, with the lower bound at 204 USD.

- MarketBeat: 19 out of 26 analysts gave the shares a Buy rating, 3 recommended Hold, and 4 rated Sell. The upper price target is 298 USD, with the lower bound at 140 USD.

- TipRanks: 14 out of 17 professionals rated the shares Buy, 1 recommended Hold, and 1 rated Sell. The upper price target is 298 USD, with the lower bound at 150 USD.

- Stock Analysis: 12 out of 19 experts rated the shares as Strong Buy, 5 as Buy, 1 as Hold, and 1 as Sell. The upper price target is 298 USD, with the lower bound at 140 USD.

The Boeing Company stock price forecast for 2026

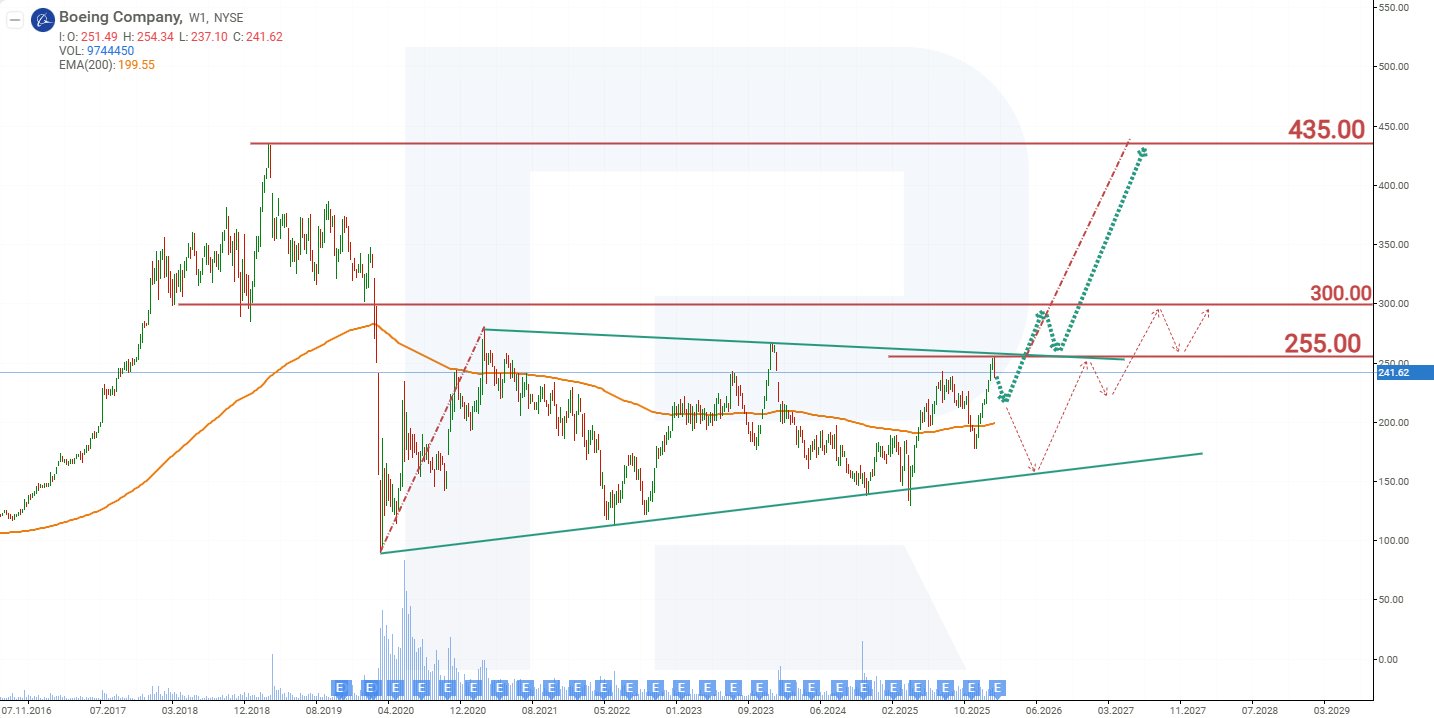

From 2020 to 2026, Boeing’s stock chart has formed a Triangle pattern. If there is a breakout above its upper boundary, the likelihood of further price growth increases by an amount roughly equal to the height of the pattern. Based on the current performance of Boeing shares, the potential price scenarios for 2026 are as follows:

The base-case forecast for BA shares suggests a breakout above the 255 USD resistance level, signalling a breakout above the upper boundary of the Triangle. In this case, further price growth is expected towards a target of 435 USD.

The alternative forecast for BA stock suggests a test of the Triangle’s lower boundary at 160 USD. A rebound from this level would act as a catalyst for price growth to 255 USD. If this resistance level is breached, the next growth target would be 300 USD.

The Boeing Company stock analysis and forecast for 2026Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.