Ford strengthens its business and prepares for sustained growth in 2026

In Q3 2025, Ford reported record revenue and earnings that exceeded market expectations, with the Ford Pro segment remaining the driver of growth. F shares are trading near a key resistance level.

Ford reports record Q3 2025 revenue of 50.5 billion USD, with adjusted EPS of 0.45 USD. Revenue and earnings exceeded market expectations. The main driver of growth continues to be Ford Pro, which generated 17.4 billion USD in revenue and almost 2.0 billion USD in EBIT, with an 11.4% margin. The number of paid software subscriptions for commercial clients rose to 818,000.

Ford Blue posted 28.0 billion USD in revenue and 1.54 billion USD in EBIT, while Model e increased revenue to 1.8 billion USD but reported an EBIT loss of 1.41 billion USD. Ford Credit contributed 631 million USD in pre-tax profit.

A key challenge in the previous quarter was a fire at the aluminium supplier Novelis, which prompted Ford to lower its full-year guidance: adjusted EBIT is now expected to be in the range of 6.0–6.5 billion USD and adjusted free cash flow in the range of 2.0–3.0 billion USD. The company anticipates mitigating at least 1.0 billion USD of this impact in 2026.

Management emphasised plans to increase F-Series production to offset losses, create up to 1,000 jobs at US plants, expand the Ford Pro ecosystem and subscription services, and invest more selectively in EVs. Together, these initiatives form a set of potential drivers for revenue recovery and sustained cash generation in 2026.

This article reviews Ford Motor Company, outlining its revenue structure and quarterly results, and provides a fundamental analysis of Ford under the ticker F. It also presents expert forecasts for Ford shares in 2025, examines the company’s share-price performance, and offers a 2025 forecast for Ford Motor Company stock based on this analysis.

About Ford Motor Company

Ford Motor Company was founded by Henry Ford in 1903 in the US. The company’s primary business activities involve designing, manufacturing, and marketing a wide range of vehicles, including passenger cars, trucks, SUVs, and commercial vehicles. Additionally, Ford is actively involved in the financial sector through its subsidiary, Ford Motor Credit Company, which offers car buyers leasing, lending, and other financial products.

The IPO took place in 1956, making Ford the first automaker to be listed on the New York Stock Exchange under the ticker symbol “F.” This opened new opportunities for investors and supported the company’s continued growth and development.

Today, Ford continues to innovate in the automotive industry, focusing on electric vehicles and autonomous technologies while improving the environmental performance of its products in response to evolving market demands and existing trends.

Image of the Ford Motor Company nameFord Motor Company’s main revenue streams

Ford divides its operations into key divisions and publishes financial results for each, except Ford Next, which has not yet generated income. Below are Ford’s main divisions and business areas:

- Ford Blue: traditional production of internal combustion engine vehicles (ICE) and hybrid vehicles. This represents the core of Ford’s business and includes the production and sale of classic models such as the Ford F-150, Ford Explorer, and Mustang.

- Ford Pro: production of commercial vehicles and provision of related services. This division serves clients who use vehicles for business purposes.

- Ford E: development and sale of electric vehicles (EVs) and innovative technologies. This department oversees models such as the Ford Mustang Mach-E and F-150 Lightning, as well as the development and promotion of new electric vehicle platforms.

- Ford Next: developing new business models and innovative solutions beyond traditional automobile production. This unit is responsible for the research and development of autonomous driving technologies, new mobility formats, and other promising projects that may lay the foundation for the company’s further growth.

- Ford Credit: the company’s financial division, which offers loan facilities to retail vehicle buyers and company dealers. The division’s operations include leasing, vehicle financing, and dealer financing for inventory replenishment.

Ford Motor Company Q2 2024 report

Ford released the Q2 2024 financial results on 4 July 2024. Below are the report’s financial indicators:

- Revenue: 47.8 billion USD (+6%)

- Net profit: 1.8 billion USD (–6%)

- Earnings per share: 0.47 USD (–35%)

- Ford Blue revenue: 26.7 billion USD (+7%)

- EBIT: 1.2 billion USD (–48%)

- Ford Pro revenue: 17.0 billion USD (+9%)

- EBIT: 2.6 billion USD (+8%)

- Ford Model e revenue: 1.1 billion USD (–37%)

- EBIT: -1.1 billion USD (unchanged)

- Ford Credit revenue: 3.0 billion USD (+20%)

- EBIT: 0.3 billion USD (–25%)

- Total vehicle sales: 536,050 pcs (+0.8%)

- Electric vehicles: 23,957 pcs (+61%)

- Hybrids: 53,822 pcs (+55%)

- ICE: 458,271 pcs (–0.5%)

The report shows that revenue growth was primarily driven by the Ford Pro division, which recorded a 9% increase and achieved the highest margins among all business units. Ford ranked second in US electric vehicle sales, behind Tesla (NASDAQ: TSLA), outperforming GM with 21,930 vehicles sold. However, unlike Tesla, Ford’s electric cars are not yet profitable, as reflected by the Ford E division’s loss of 1.1 billion USD. Consequently, Ford’s management decided to cut production of the F-150 Lightning pickup truck and postpone 12.0 billion USD in planned investments for electric vehicle development. Instead, the company is focusing on compact electric vehicles with higher margins. In this segment, Ford aims to compete with Tesla and the Chinese company BYD, which produces low-cost electric cars.

Ford Motor Company Q3 2024 report

Ford released its financial results for Q3 2024 on 29 October 2024. Below are the report’s key financial indicators:

- Revenue: 46.2 billion USD (+5%)

- Net profit: 0.9 billion USD (–25%)

- Earnings per share: 0.47 USD (–26%)

- Ford Blue revenue: 26.2 billion USD (+3%)

- EBIT: 1.6 billion USD (–5%)

- Ford Pro revenue: 15.7 billion USD (+13%)

- EBIT: 1.8 billion USD (+9%)

- Ford E revenue: 1.2 billion USD (–33%)

- EBIT: –1.2 billion USD (compared to a loss of 1.3 billion USD a year earlier)

- Ford Credit revenue: 3.1 billion USD (+19%)

- EBIT: 0.5 billion USD (+25%)

- Total vehicle sales: 504,039 pcs (+1%)

- Electric vehicles: 23,509 pcs (+12%)

- Hybrids: 48,101 pcs (+38%)

- ICE: 432,429 pcs (–3%)

The report data shows that the company continues to face challenges with electric vehicle margins. Despite growth in EV sales, this segment remains unprofitable and requires ongoing investment, which has negatively affected net income, resulting in a 25% decline. However, the Ford Blue and Pro segments, which focus on internal combustion engine (ICE) cars and serve the commercial sector with after-sales service, are helping to mitigate these challenges. Ford Credit is another crucial division that supports the company during difficult times.

Ford Motor Company Q4 2024 report

Ford delivered its Q4 2024 financial results on 5 February 2025. Below are the report’s financial indicators:

- Revenue: 48.2 billion USD (+5%)

- Net profit: 1.8 billion USD (versus a loss of 0.5 billion USD a year earlier)

- Earnings per share: 0.45 USD (versus a loss of 0.13 USD a year earlier)

- Ford Blue revenue: 27.3 billion USD (+4%)

- EBIT: 1.6 billion USD (+100%)

- Ford Pro revenue: 16.2 billion USD (+5%)

- EBIT: 1.6 billion USD (–11%)

- Ford E revenue: 1.4 billion USD (–12%)

- EBIT: –1.4 billion USD (versus a loss of 1.6 billion USD a year earlier)

- Ford Credit revenue: 3.3 billion USD (+6%)

- EBIT: 0.4 billion USD (+33%)

- Total vehicle sales: 530,660 pcs (+1%)

- Electric vehicles: 30,176 pcs (+16%)

- Hybrids: 47,082 pcs (+26%)

- ICE: 453,402 pcs (+7%)

The report reaffirmed that Ford continues to face challenges with electric vehicle margins, with the Ford E segment remaining unprofitable. However, the traditional business of selling internal combustion engine (ICE) vehicles continues to provide support.

Investors reacted negatively to the report, sending the stock price down by 7.5% after its release. The losses in the Ford E division were not a factor, as market participants have already accounted for its weak financial performance. Instead, concerns centred on the company’s 2025 outlook. Despite revenue growth to 48.2 billion USD and net income of 1.8 billion USD, Ford warned of a potential decline in adjusted EBIT to 7.0–8.5 billion USD in 2025, down from 10.2 billion USD in 2024. Another key concern was the possibility of a 25% import tariff on cars from Mexico and Canada, which could adversely affect Ford’s financial results, given the company’s reliance on Mexican plants for low-cost production.

Ford Motor Company Q1 2025 results

Ford released its financial results for Q1 2025 on 5 May. The key financial indicators from the report are as follows:

- Revenue: 40.7 billion USD (–5%)

- Net profit: 471 million USD (–65%)

- Earnings per share: 0.12 USD (–64%)

- Ford Blue revenue: 21.0 billion USD (–3%)

- EBIT: 96 million USD (-90%)

- Ford Pro revenue: 15.2 billion USD (+5%)

- EBIT: 1.3 billion USD (–57%)

- Ford E revenue: 1.2 billion USD (+5%)

- EBIT: -849 million USD (compared to a loss of 1.3 billion USD a year earlier)

- Ford Credit revenue: 3.2 billion USD (+6%)

- EBIT: 580 million USD (+78%)

- Total vehicle sales: 501,291 units (–2%)

- Electric vehicles: 22,550 units (+11%)

- Hybrids: 51,073 units (+33%)

- ICE: 427,668 units (–5%)

The Ford Q1 2025 report was mixed, reflecting the increasingly challenging macroeconomic environment for the automaker. Although the company exceeded analysts’ expectations, earning 471 million USD on revenue of 40.7 billion USD, this still represents a 65% decline in net profit compared with the previous year. The 5% drop in revenue and supply chain constraints, exacerbated by new US tariffs, have significantly impacted the final results. In response, Ford has suspended the publication of its annual forecast, warning of potential losses of up to 1.5 billion USD due to tariff-related costs. This is a concerning signal, particularly for investors who had counted on stable dividend yields. Amid the uncertainty, Ford may temporarily reduce or even suspend payouts.

Nevertheless, investors reacted moderately positively to the report – following its release, shares rose by 2.7%. This indicates confidence in the company’s ability to adapt, particularly as over 80% of vehicles sold in the US are assembled domestically, which mitigates the impact of tariffs.

Ford’s management expected the first half of the year to be challenging, with EBIT potentially close to zero. An improvement was anticipated in the second half driven by cost reductions and the launch of new models. However, the EV division remains unprofitable, with a loss of 5 to 5.5 billion USD expected for the full year 2025.

Overall, Ford demonstrated operational resilience, but investors face a choice: either to support the company’s long-term recovery or to wait for greater clarity on tariffs and the outlook for the EV segment.

Ford Motor Company Q2 2025 financial results

Ford released its financial results for Q2 2025 on 30 July 2025. Key figures from the report are as follows:

- Revenue: 50.18 billion USD (+5%)

- Net income: 1.50 billion USD (–21%)

- Earnings per share: 0.37 USD (–-21%)

- Ford Blue revenue: 25.8 billion USD (–3%)

- EBIT: 661 million USD (–43%)

- Ford Pro revenue: 18.8 billion USD (+11%)

- EBIT: 2.31 billion USD (–10%)

- Ford Model e revenue: 2.4 billion USD (+100%)

- EBIT: –1.3 billion USD (compared with a loss of 1.15 billion USD a year earlier)

- Ford Credit revenue: 3.2 billion USD (+7%)

- EBIT: 645 million USD (+88%)

- Total vehicle sales: 612,095 units (+14%)

- Electric vehicles: 16,438 units (–31%)

- Hybrids: 66,438 units (+23%)

- Internal combustion engine (ICE) vehicles: 529,209 units (+15%)

Ford posted its Q2 2025 financial results with record revenue of 50.2 billion USD and adjusted EBIT of 2.1 billion USD, despite the adverse impact of tariffs amounting to 0.8 billion USD. On a GAAP basis, the company reported a net loss of 36 million USD, driven by special charges related to a 570 million USD vehicle recall and the cancellation of an electric vehicle program. Operating cash flow reached 6.3 billion USD, while adjusted free cash flow was 2.8 billion USD. The Board of Directors confirmed a quarterly dividend of 0.15 USD per share, payable on 2 September.

Management reinstated its full-year guidance, projecting adjusted EBIT to range from 6.5 to 7.5 billion USD and adjusted free cash flow between 3.5 and 4.5 billion USD, with capital expenditures of around 9 billion USD. The net adverse tariff impact was estimated at approximately 2 billion USD, reflecting a total effect of 3 billion USD, partially offset by 1 billion USD in cost-reduction measures.

By segment: Ford Pro reported revenue of 18.8 billion USD with an EBIT margin of 12.3%, while the number of paid software and service subscriptions increased by 24% year-on-year to 757,000. Ford Model e revenue doubled to 2.4 billion USD, though the segment incurred an EBIT loss of 1.3 billion USD. Ford Blue reported EBIT of 661 million USD despite a 3% decline in revenue.

Ford Motor Company Q3 2025 earnings results

On 23 October 2025, Ford released its Q3 2025 financial results. The key figures are as follows:

- Revenue: 50.53 billion USD (+9%)

- Net profit (non-GAAP): 1.82 billion USD (–7%)

- Earnings per share (non-GAAP): 0.45 USD (–8%)

- Ford Blue revenue: 28.0 billion USD (+7%)

- EBIT: 1.54 billion USD (–5%)

- Ford Pro revenue: 17.4 billion USD (+11%)

- EBIT: 1.99 billion USD (+9%)

- Ford Model e revenue: 1.8 billion USD (+52%)

- EBIT: –1.4 billion USD (compared with a loss of 1.23 billion USD a year earlier)

- Ford Credit revenue: 3.3 billion USD (+7%)

- EBIT: 645 million USD (+16%)

- Total vehicle sales: 545,522 units (+8%)

- Electric vehicles: 30,612 units (+30%)

- Hybrids: 55,177 units (+15%)

- ICE vehicles: 459,733 units (+6%)

Ford reported record quarterly revenue of 50.5 billion USD, with adjusted EBIT of 2.6 billion USD and earnings per share (EPS) of 0.45 USD. Revenue came in slightly above forecasts, while profit was broadly in line with expectations, showing a modest improvement.

The Ford Blue segment (traditional vehicles) generated 28.0 billion USD in revenue and 1.54 billion USD in EBIT profit. The Model e segment (electric vehicles) increased revenue to 1.8 billion USD but posted a loss of 1.41 billion USD, as the shift to EV production continues to require substantial investment.

Management has lowered its full-year guidance, now expecting adjusted EBIT in the range of 6.0–6.5 billion USD, free cash flow between 2.0 and 3.0 billion USD, and capital expenditure of around 9 billion USD. The company warned that the fire at aluminium supplier Novelis would negatively affect Q4 results, estimating a reduction in EBIT of 1.5–2.0 billion USD and free cash flow of 2–3 billion USD, with about 1 billion USD of this impact expected to be recovered in 2026.

Fundamental analysis of Ford Motor Company

Below is the fundamental analysis of Ford (NYSE: F) based on the results for Q3 2025:

- Liquidity and debt: Ford maintains a solid financial position. At the end of the quarter (excluding Ford Credit), the company held 32.9 billion USD in cash and total liquidity of around 54 billion USD. Total debt (excluding finance leases) stood at 20.9 billion USD, resulting in a net cash position of +12 billion USD, providing a strong buffer against potential market shocks. Ford Motor Company confirmed a dividend of 0.15 USD per share, payable on 1 December, which reflects management’s confidence in the stability of its cash flows.

- Cash flow and free cash generation: operating cash flow totalled 7.4 billion USD, while adjusted free cash flow (FCF) reached 4.3 billion USD – a strong result even amid tariff pressure. Capital expenditure totalled 2.1 billion USD. Thanks to disciplined investment management and a positive working-capital contribution, free cash flow remains robust.

- Profitability and earnings: adjusted EBIT came in at 2.6 billion USD on revenue of 50.5 billion USD, yielding a 5.1% margin. Excluding the impact of tariffs, profit increased by 0.7 billion USD y/y, underscoring the resilience of the core business.

The main profit driver remains Ford Pro, with EBIT of about 2 billion USD and revenue of 17.4 billion USD (margin 11.4%). The number of paid software subscriptions increased to 818 thousand, strengthening recurring revenue streams. The Ford Blue segment remains profitable, while Model e is still loss-making but steadily expanding its revenue base.

- Balance sheet and stability: the company maintains a net cash position of about 12 billion USD and total liquidity of 54 billion USD. Pension obligations are well-balanced and do not weigh on the balance sheet. Subsidiary Ford Credit reported pre-tax profit of around 0.63 billion USD, remaining stable and supporting the group amid low credit losses and steady used-car prices.

Conclusion – fundamental view on Ford (F): Ford’s balance sheet is strong, liquidity remains high, and cash generation is solid, providing ample resilience even considering the temporary impact of the Novelis plant incident. The main source of profit remains the Ford Pro segment, along with its associated software and service operations. Ford Blue remains stable, while Model e continues to weigh on overall margins.

A key factor for the coming quarters will be the pace of aluminium supply recovery and the restoration of production volumes in 2026. If the company delivers on its plan and retains tariff advantages, Ford should be able to maintain strong financial stability and continue generating consistent free cash flow.

Impact of Trump’s policies on Ford Motor Company

The impact of Donald Trump’s policies on Ford is mixed. The company’s traditional operations – including pickups, commercial vehicles and the Ford Pro ecosystem – benefit from the new measures, while the electric vehicle (Model e) segment faces more challenging conditions. Stronger tariff protection, relaxed environmental regulations and expanded incentives for local production create a favourable environment for conventional internal combustion and hybrid models, supporting the margins and cash flows of Ford Blue and Ford Pro.

However, the removal of federal EV subsidies and stricter local-content requirements worsens the economics of the electric vehicle business and increases the costs of transitioning to new technologies.

Higher import tariffs on vehicles and key auto components enhance the price competitiveness of the F-Series and Super Duty ranges, but simultaneously raise production costs if imported parts remain in the supply chain. Detroit automakers have been granted temporary exemptions, though these only partially offset the increase in expenses. Risks of retaliatory action from Canada and Mexico persist, as does uncertainty surrounding a potential review of the USMCA trade agreement. Looser environmental standards ease pressure on petrol and hybrid models – a positive for Ford Blue and Pro – while the elimination of the federal EV tax credit sharply reduces demand for electric vehicles, undermining their profitability.

Additional support is provided through tax incentives for the local production of vehicles, engines and commercial platforms. These help offset part of the cost burden and strengthen Ford Pro’s position in the US market.

Overall, the effect of Trump’s policies on Ford is moderately positive for its traditional businesses and negative for the EV segment. Tariff protection and deregulation enhance the company’s ability to maintain margins and steady cash flow in 2025–2026. However, this comes at the cost of higher production expenses for imported components and a slower pace of EV-business development until battery and component manufacturing are fully localised.

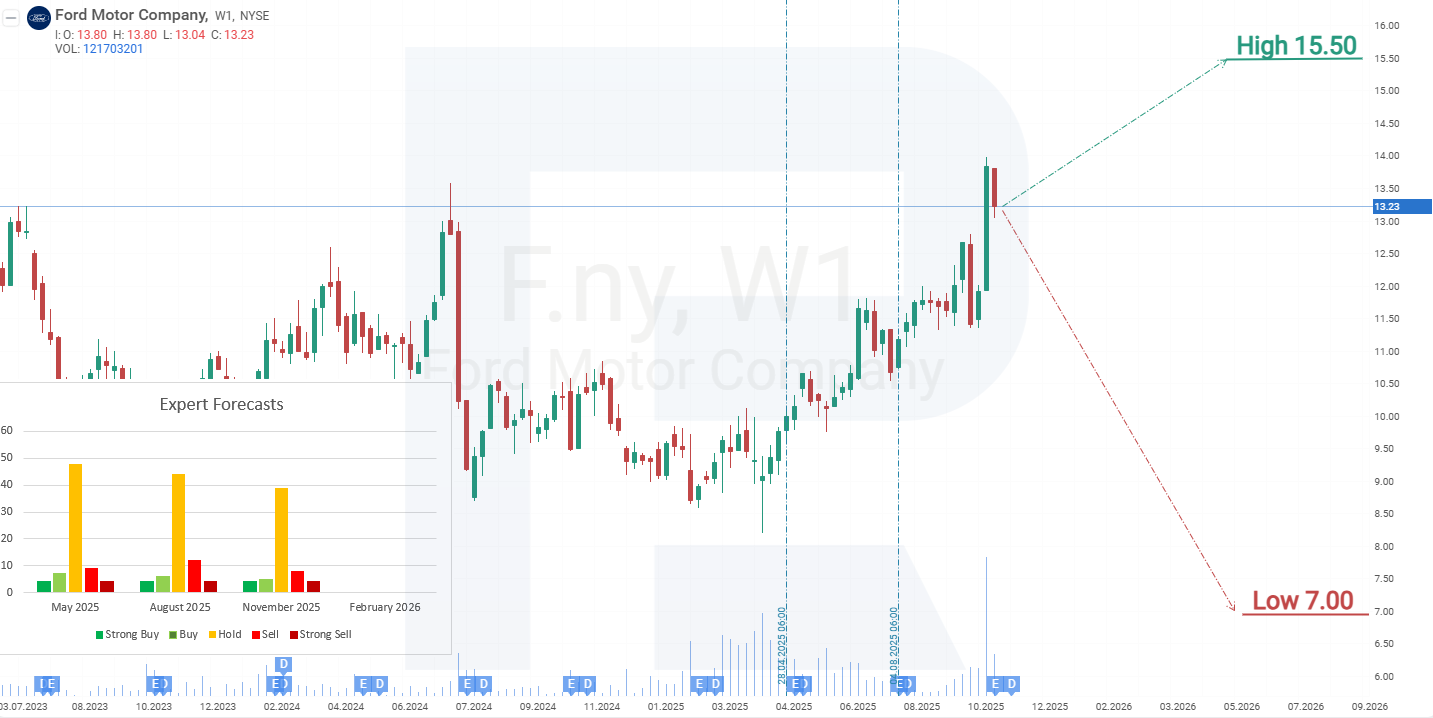

Expert forecasts for Ford Motor Company stock for 2025

- Barchart: 3 out of 25 analysts rated Ford Motor Company shares as Strong Buy, 17 as Hold, 1 as Sell, and 4 as Strong Sell. The upper forecast limit is 14.50 USD, while the lower is 8.00 USD.

- MarketBeat: 2 out of 17 specialists rated the stock as Buy, 13 recommended Hold, and 2 as Sell. The highest forecast is 15.50 USD, and the lowest is 7.00 USD.

- TipRanks: 2 out of 14 analysts rated the shares as Buy, 10 as Hold, and 2 as Sell. The top forecast level is 15.00 USD, while the bottom is 8.30 USD.

- Stock Analysis: 1 out of 15 experts rated the stock as Strong Buy, 1 as Buy, 9 as Hold, and 3 as Sell. The upper forecast limit is 14.00 USD, and the lower is 7.00 USD.

Ford Motor Company stock price forecast for 2025

On the weekly timeframe, Ford’s shares have traded between 8.60 and 13.10 USD since 2022. In April 2025, F briefly broke below the lower boundary of this range, leading to the formation of a MACD convergence, signalling a potential price increase. As a result, Ford’s stock rose by 69% between April and November. Following the publication of the quarterly report, investor demand for Ford shares remained strong, raising the likelihood of further price growth. Based on the current performance of Ford Motor Company’s share price, the possible scenarios for 2025 are as follows:

The base-case scenario suggests further growth in F’s share price, targeting the next resistance level at 16.50 USD. This outlook is supported by the internal combustion engine (ICE) segment, which benefits from more relaxed federal environmental standards under the Trump administration. This reduction in cost pressures allows the company to maintain the profitability of its key models. At the same time, the easing of regulatory constraints provides Ford with additional time to gradually transition to electric vehicles, without a sharp rise in capital expenditure, thereby improving medium-term forecasts for free cash flow and dividend yield.

The alternative forecast for Ford Motor Company shares envisions a correction towards support at 10.60 USD. A rebound from this level would signal the resumption of an upward trend, with the target resistance level again at 16.50 USD.

Ford Motor Company stock analysis and forecast for 2025Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.