JPMorgan stock forecast for 2026: fundamental and technical analysis

JPMorgan reported revenue growth in Q4 2025, but signals of a potential correction are emerging on the chart. We analyse the key support and resistance levels for JPMorgan shares in 2026.

JPMorgan Chase & Co. (NYSE: JPM) reported strong earnings for Q4 2025. Revenue on a managed basis reached 46.77 billion USD, reflecting a 7% increase year-on-year, while net interest income rose to 25.1 billion USD, also up by 7%. However, the bottom line was affected by a one-off credit reserve of 2.2 billion USD related to the future purchase of the Apple Card portfolio.

Under GAAP, the bank reported earnings of 13.0 billion USD, or 4.63 USD per share. Excluding the one-time reserve, net income would have been 14.7 billion USD, and earnings per share would have been 5.23 USD. This result exceeded market expectations, as analysts had forecasted earnings of around 4.85 USD per share, while overall revenue matched consensus estimates.

Revenue growth was driven by key business segments. The Commercial & Investment Bank segment posted revenue of 19.38 billion USD, reflecting a 10% year-on-year increase. Consumer & Community Banking saw its revenue grow to 19.40 billion USD, up by 6%. Asset & Wealth Management also performed strongly, increasing revenue to 6.52 billion USD, a 13% rise from the previous year.

The outlook for 2026 suggests continued strong net interest income, alongside rising expenses. JPMorgan expects net interest income of 103 billion USD, or around 95 billion USD excluding Markets, operating expenses of 105 billion USD, and a moderate deterioration in credit quality for cards, with an expected net charge-off rate of approximately 3.4%.

This article provides an overview of JPMorgan Chase & Co., presents a fundamental analysis of JPM stock, and outlines key metrics from the Q3 and Q4 2024 reports, as well as Q1, Q2, Q3, and Q4 2025, enabling a comparison of the bank's financial performance across different periods. Additionally, based on the recent performance of JPMorgan Chase & Co.'s shares, a technical analysis of JPM is provided, from which a stock forecast for JPMorgan Chase & Co. for 2026 is developed.

About JPMorgan Chase & Co.

JPMorgan Chase & Co. traces its origins to the Bank of the Manhattan Company, founded in 1799. The modern conglomerate was shaped by a long history of consolidation, culminating in the 2000 merger between Chase Manhattan Corporation and J.P. Morgan & Co. The company did not undergo an IPO, having been formed through successive mergers and acquisitions. Nevertheless, JPMorgan Chase shares are listed on the New York Stock Exchange under the ticker symbol JPM.

JPMorgan Chase provides a broad range of financial services, including investment and commercial banking, retail banking services, asset and wealth management, and risk and payment management solutions. It is the largest US bank by assets and one of the leading investment, commercial, and retail banking institutions. Globally, the company holds a prominent position in investment and financial services and is classified as a systemically important financial institution.

Image of JPMorgan Chase & Co.’s nameJPMorgan Chase & Co.’s main revenue streams

JPMorgan Chase & Co.’s revenue comes from several key sources:

- Consumer & Community Banking: the largest revenue segment, comprising income from retail banking, including interest on loans and deposits, credit card fees, ATM charges, and other banking services for individuals and small businesses.

- Corporate & Investment Bank: revenue generated from investment banking services, such as commissions on stock and bond offerings, advisory fees for mergers and acquisitions, and income from capital markets trading activities, including fixed income and equities.

- Commercial Banking: income from services provided to medium and large businesses, including loans, cash flow management, and other commercial banking services.

- Asset & Wealth Management: revenue from managing investments for institutional and individual clients, including asset management fees, withdrawals from deposit accounts, and other investment-related income.

- Net Interest Income: profit derived from the difference between interest earned on loans and investments and interest paid on deposits.

JPMorgan Chase’s revenue is highly diversified across a wide range of financial services, from retail to investment banking. This diversification enables the bank to maintain a stable revenue stream even amid changing market conditions.

JPMorgan Chase & Co. Q3 2024 results

Banks are traditionally the first to report earnings at the end of each quarter. JPMorgan Chase & Co.’s Q3 2024 results are outlined below, compared with the corresponding period in 2023:

Revenue: 43.3 billion USD (+6%)

Net Income: 12.9 billion USD (–2%)

Earnings per Share (EPS): 4.37 USD (+1%)

Net Interest Income: 23.5 billion USD (+3%)

Consumer & Community Banking revenue: 17.8 billion USD (–3%)

Commercial & Investment Bank revenue: 17.0 billion USD (+8%)

Asset & Wealth Management revenue: 5.4 billion USD (+9%)

Corporate Revenue: 3.1 billion USD (+97%)

Assets under Management: 3.9 trillion USD (+23%)

Client Assets: 5.7 trillion USD (+23%)

In its commentary on the results, JPMorgan Chase’s management emphasised that the bank continues to deliver stable performance despite a challenging economic environment. Q3 2024 revenue exceeded expectations, although net income declined slightly due to higher provisions for credit losses. CFO Jeremy Barnum noted that consumers remain in a strong financial position and that the increase in provisions was driven by growth in the loan portfolio rather than any deterioration in credit quality.

The bank anticipated a gradual decline in net interest income (NII) during Q4 2024, potentially reaching a trough in mid-2025, followed by a recovery supported by loan portfolio expansion and higher credit card turnover. The bank identified the deteriorating geopolitical landscape, the sizable US budget deficit, and changes to existing trade agreements as potential risks.

JPMorgan Chase & Co. Q4 2024 results

JPMorgan Chase & Co. released its Q4 2024 results on 15 January 2025. As forecast by the bank’s management, quarterly net interest income declined by 2%. Key highlights of the report are outlined below in comparison with the corresponding period in 2023:

Revenue: 42.8 billion USD (+11%)

Net Income: 14.0 billion USD (+50%)

Earnings Per Share (EPS): 4.81 USD (+58%)

Net Interest Income: 23.0 billion USD (–2%)

Consumer & Community Banking revenue: 18.4 billion USD (–6%)

Commercial & Investment Bank revenue: 17.6 billion USD (+18%)

Asset & Wealth Management revenue: 5.8 billion USD (+13%)

Corporate Revenue: 2.0 billion USD (+13%)

Assets under Management: 4.0 trillion USD (+18%)

Client Assets: 5.9 trillion USD (+18%)

The bank’s Chair and CEO, Jamie Dimon, noted that all business segments performed strongly. The Corporate and Investment Bank (CIB) saw strong client activity. There was also a double-digit increase in payment fees for four consecutive quarters, contributing to a record annual payment income. Retail banking continued to attract new clients across all areas, from consumer banking to asset management, resulting in nearly two million new accounts opening in 2024.

Dimon noted that the bank maintains a resilient balance sheet, including a loss-absorbing capacity of 547 billion USD and 1.4 trillion USD in cash and marketable securities. He assessed the US economy as steady, with a low unemployment rate and stable consumer spending. However, he highlighted two main risks: the potentially inflationary effects of future expenditure and geopolitical instability.

JPMorgan Chase & Co. projected net interest income (excluding markets) of approximately 90 billion USD in 2025, a decrease of 2 billion USD compared to 2024.

The bank anticipated expenses of approximately 95.0 billion USD, representing an increase of 3.9 billion USD compared with 2024. The rise in costs was attributed by management to inflation.

JPMorgan Chase & Co. Q1 2025 results

JPMorgan Chase & Co. released its Q1 2025 results on 11 April 2025. The key highlights are provided below in comparison with the corresponding period in 2024:

Revenue: 45.3 billion USD (+8%)

Net Income: 14.6 billion USD (+9%)

Earnings per Share (EPS): 5.07 USD (+58%)

Net Interest Income: 23.4 billion USD (+1%)

Consumer & Community Banking Revenue: 18.3 billion USD (+4%)

Commercial & Investment Bank Revenue: 19.7 billion USD (+12%)

Asset & Wealth Management Revenue: 5.7 billion USD (+12%)

Corporate Revenue: 2.3 billion USD (+5%)

Assets under Management: 4.1 trillion USD (+15%)

Client Assets: 6.0 trillion USD (+15%)

JPMorgan Chase & Co. delivered strong results for Q1 of the 2025 financial year, exceeding Wall Street expectations. The primary growth drivers were the Investment Banking division and trading operations, with Investment Banking fees up 12% and trading revenue rising by 21%, including a record 3.8 billion USD in the equity markets segment.

However, Jamie Dimon warned of significant turbulence on the horizon, mentioning geopolitical tensions, persistent inflation, the elevated budget deficit, and the threat of global trade wars. The bank also increased its provisions for potential credit losses to 3.3 billion USD, indicating rising risks of non-payment from consumers.

The increase in credit loss reserves is a signal of a dual nature. On the one hand, JPMorgan is demonstrating excellent financial results and resilience in its key businesses. On the other hand, growing macroeconomic risks could exert pressure on future profits.

Since the start of the year, JPMorgan’s share price has fallen by more than 5%, despite a strong quarterly report, indicating market caution. However, there were several advantages to long-term investment.

Firstly, JPMorgan remains a systemically important bank with a global network, resilient cash flow, and a diversified business model. It is one of the few banks capable of generating profits in any phase of the economic cycle – whether expansion, stagnation, or recession.

Secondly, JPMorgan’s dividend yield remains consistently high – as of April 2025, it stands at around 2.5-3% per annum. The company follows a policy of regular dividend increases, making the shares attractive to income-focused investors.

Thirdly, the bank is actively repurchasing its own shares. In Q1 2025, JPMorgan Chase & Co. pursued an active capital return policy, executing a buyback program worth 7.1 billion USD. This reflects confidence in its prospects and provides effective support for the share price. Buybacks not only return capital to shareholders but also reduce the number of shares in circulation, thereby increasing earnings per share over time.

JPMorgan Chase & Co. Q2 2025 results

JPMorgan Chase & Co. released its financial results for Q2 2025 on 15 July 2025. Below are the key figures compared with the same period in 2024:

Revenue: 45.7 billion USD (–10%)

Net Income: 15.0 billion USD (–17%)

Earnings Per Share (EPS): 5.24 USD (–14%)

Net Interest Income: 23.3 billion USD (+2%)

Consumer & Community Banking Revenue: 18.8 billion USD (+6%)

Commercial & Investment Bank Revenue: 19.5 billion USD (+9%)

Asset & Wealth Management Revenue: 5.8 billion USD (+10%)

Corporate Revenue: 1.5 billion USD (–85%)

Assets Under Management: 4.3 trillion USD (+18%)

Client Assets: 6.4 trillion USD (+19%)

Despite declines in both revenue and net income, JPMorgan Chase & Co.’s results for Q2 2025 exceeded analyst expectations. The bank reported net income of 15 billion USD and EPS of 5.24 USD, compared with market expectations of around 4.96 USD, while revenue of 45.7 billion USD came in slightly above consensus.

Two business segments stood out: the Commercial and Investment Banking division recorded a 9% increase in revenue, with net income reaching 6.7 billion USD, supported by a 15% rise in trading income and a 7% increase in investment banking fees. This performance was particularly notable amid heightened market volatility. Asset and Wealth Management also continued to perform strongly, with assets under management rising 18% to 4.3 trillion USD and fee income growing at a double-digit pace, underscoring the strength of the bank’s diversified revenue base beyond interest income.

In terms of shareholder returns, management announced a dividend increase to 1.40 USD per share following Q2 results, with a further rise to 1.50 USD per share implemented in Q3 2025. The bank also repurchased shares worth approximately 7 billion USD and reaffirmed its intention to pursue selective M&A opportunities and organic growth, while maintaining a disciplined capital allocation approach.

One of the key positive signals was the upward revision to full-year net interest income (NII) guidance. CFO Jeremy Barnum raised the forecast to 95.5 billion USD from 94.5 billion USD, citing steady loan growth across mortgages, auto lending, and credit cards. Credit card charge-offs were expected to remain around 3.6%, suggesting a controlled risk profile and supporting the outlook for interest income. The increase in the dividend to 1.50 USD in Q3 further reflects management’s confidence in the stability of cash flows.

The decline in reported revenue and profit was largely attributable to the high base effect. In Q2 2024, JP Morgan recorded a significant one-off gain related to its acquisition of First Republic. Additionally, net interest margins began to normalise as deposit costs increased and loan growth moderated.

The sharp decline in the corporate segment revenue reflects the absence of such one-off gains in Q2 2025. In 2024, the bank reported a bargain purchase gain of over 8 billion USD, meaning current results represent a more normalised earnings level for this division.

Nevertheless, management remained cautious. CEO Jamie Dimon once again highlighted several risks, including tariff-related tensions, fiscal deficits, geopolitical uncertainty, and signs of overheating in certain asset classes. Non-performing assets also remained elevated at around 11.4 billion USD, particularly within credit card and corporate lending segments.

JPMorgan Chase & Co. Q3 2025 results

On 14 October 2025, JPMorgan Chase & Co. released its Q3 2025 financial results. The key figures compared with the same period in 2024 are as follows:

Revenue: 47.1 billion USD (+9%)

Net Income: 14.4 billion USD (+12%)

Earnings Per Share (EPS): 5.07 USD (+16%)

Net Interest Income: 24.1 billion USD (+2%)

Consumer & Community Banking Revenue: 19.5 billion USD (+9%)

Commercial & Investment Bank Revenue: 19.9 billion USD (+17%)

Asset & Wealth Management Revenue: 6.1 billion USD (+12%)

Corporate Revenue: 1.7 billion USD (–45%)

Assets Under Management: 4.6 trillion USD (+18%)

Client Assets: 6.8 trillion USD (+20%)

JPMorgan’s Q3 2025 results came in above market expectations. Net income totalled 14.4 billion USD, with EPS at 5.07 USD (versus a consensus forecast of roughly 4.85 USD). Revenue reached 47.1 billion USD, up 9% year-on-year, mainly supported by strong trading and investment banking activity. Compared with the previous quarter, profit was slightly down (−4%), primarily due to higher expenses and increased provisions for potential credit losses.

The Commercial and Investment Bank division generated 19.9 billion USD (+17% y/y), driven by a 16% rise in fees and 25% growth in trading income. The Consumer & Community Banking segment contributed 19.5 billion USD (+9% y/y), with card spending up 9% and the charge-off rate falling from 3.4% in the previous quarter to 3.15%. The Asset & Wealth Management business also delivered solid growth: assets under management rose to 4.6 trillion USD (+18%), and segment profit reached 1.7 billion USD.

The bank continued to actively return capital to shareholders: during the quarter, it paid out 4.1 billion USD in dividends and repurchased 8 billion USD worth of shares. The return on tangible common equity (ROTCE) was 20%, indicating strong business efficiency.

Management upgraded the forecast for net income for 2025 to 95.8 billion USD. In Q4, the bank projected approximately 25 billion USD in interest income and around 24.5 billion USD in expenses. The forecast for charge-offs on cards was also slightly improved.

The main issues in Q3 were related to the increase in credit expenses: for the past quarter, these amounted to 3.4 billion USD, including charge-offs and the creation of new reserves. Part of the expenses was related to losses following the bankruptcy of the auto lender Tricolor (around 170 million USD). Management noted that future results could be impacted by geopolitical tensions, potential new tariffs, high inflation, and worsening credit quality.

JPMorgan Chase & Co. Q4 2025 financial results

On 13 January 2025, JPMorgan Chase & Co. released its Q4 results for the 2025 financial year. Below are the key figures compared with the same period in 2024:

Revenue: 46.8 billion USD (+7%)

Net income: 13.0 billion USD (–7%)

Earnings per share (EPS): 4.63 USD (–4%)

Net interest income: 25.1 billion USD (+7%)

Consumer & Community Banking revenue: 19.4 billion USD (+6%)

Commercial & Investment Bank revenue: 19.4 billion USD (+10%)

Asset & Wealth Management revenue: 6.5 billion USD (+13%)

Corporate revenue: 1.5 billion USD (–26%)

Assets under management: 4.8 trillion USD (+18%)

Client assets: 7.1 trillion USD (+20%)

For Q4 2025, JPMorgan Chase reported strong revenue. However, the bottom line was impacted by a one-off reserve related to the Apple Card transaction. Net income totalled 13.0 billion USD, earnings per share were 4.63 USD, and revenue reached 45.8 billion USD (46.8 billion USD on a managed basis, up 7% year-on-year).

Excluding the one-off factor, the results are significantly stronger. The bank set aside a 2.2 billion USD reserve for the future purchase of the Apple Card portfolio, which reduced EPS by 0.60 USD. Without this reserve, earnings per share would have been 5.23 USD, exceeding market expectations, while revenue met consensus estimates.

Income sources showed positive dynamics. Net interest income rose to 25.1 billion USD (+7% year-on-year), non-interest income reached 21.7 billion USD (+7%), and Markets revenue hit 8.2 billion USD (+17%) due to high client activity. Expenses increased to 24.0 billion USD (+5%), partially offsetting the positive impact of revenue growth.

Results varied by segment. Consumer & Community Banking generated 3.6 billion USD in profit on revenue of 19.4 billion USD (+6% year-on-year), but profit declined due to the Apple Card reserve and higher credit costs. The Commercial & Investment Bank segment performed better: profit of 7.3 billion USD (+10%), revenue of 19.4 billion USD (+10%), with markets offsetting weakness in investment banking fees. Asset & Wealth Management also saw growth: profit of 1.8 billion USD (+19%) and revenue of 6.5 billion USD (+13%).

Credit metrics worsened on paper, but the cause was mainly one-off. Credit costs were 4.7 billion USD, write-offs were 2.5 billion USD, with the main contribution coming from the 2.2 billion USD reserve for the Apple Card. The current card portfolio remains stable: net charge-offs was 3.14%.

On capital and shareholder returns, the bank was active. During the quarter, it paid out 4.1 billion USD in dividends (1.50 USD per share) and repurchased 7.9 billion USD worth of shares.

The 2026 forecast indicates steady income growth alongside higher expenses. JPMorgan expects net interest income of around 103 billion USD, expenses to be around 105 billion USD, and a net charge-off for cards of approximately 3.4%. This implies strong income retention, but with cost growth already factored in.

Fundamental analysis of JPMorgan Chase & Co.

Below is a fundamental analysis for JPM based on the Q4 results of the 2025 financial year:

- Capital and resilience: at the end of Q4 2025, JPMorgan Chase maintained a high level of capital. The CET1 ratio stood at 14.5%, slightly lower than the previous quarter but still well above the minimum requirements. The decline was mainly due to active shareholder payouts, increased asset volume, and the upcoming Apple Card transaction, which separately reduced CET1 by 0.25 percentage points. Overall, the bank’s capital remains robust, and it is still able to both grow the business and return capital to shareholders, although pressure on the ratios has become more noticeable than a year ago.

- Liquidity and funding structure: the bank is well-positioned in terms of liquidity, with cash and high-quality liquid assets totalling 1.5 trillion USD. The funding is primarily deposit-based: deposits amounted to 2.56 trillion USD at the end of the quarter (+6% year-on-year), of which 620 billion USD were non-interest-bearing deposits, and 1.94 trillion USD were interest-bearing. A significant portion of the deposits does not generate interest, reducing funding costs. Long-term debt stands at 435 billion USD, meaning the bank is not reliant on short-term borrowings and is not vulnerable to financial market disruptions.

- Dividends and buybacks: in Q4, JPMorgan actively returned capital to shareholders by paying 4.1 billion USD in dividends and repurchasing 7.9 billion USD worth of shares during the quarter. In total, shareholder returns for the last 12 months amounted to 82% of earnings. This level is sustainable as long as profits remain high, but it gradually reduces the capital buffer and makes future buybacks more dependent on regulatory decisions and the state of the credit cycle.

- Profit quality: excluding one-off factors, the performance appears stable. Revenue on a managed basis amounted to 46.8 billion USD, with income growth in both interest and fees/markets, and a moderate rise in expenses. GAAP net income was lower due to a one-off 2.2 billion USD reserve related to the Apple Card transaction. Without this reserve, net income would have been higher, and return on capital would have remained around 20%. This suggests that the bank’s core business is operating steadily, and the reported profit weakness for the quarter was due to a one-off adjustment, not a deterioration in operating performance.

- Credit quality and risks: in the last quarter, credit costs amounted to 4.7 billion USD. Of this, 2.5 billion USD were write-offs, with approximately 2.1 billion USD allocated to increased reserves. Almost all of the growth in reserves is tied to the one-off 2.2 billion USD reserve for the Apple Card transaction. For the card business, the delinquency and write-off rates remain stable: the net charge-off rate stood at 3.14%, with no sharp deterioration. For 2026, management expects this ratio to increase to around 3.4%, implying a moderate deterioration, which is reasonable given the late stage of the credit cycle and the expanding card portfolio.

Fundamental analysis for JPM – conclusion

JPMorgan Chase enters 2026 with a strong financial position. The bank has a high capital buffer (CET1 of 14.5%), significant liquidity of around 1.5 trillion USD, and a broad, diversified deposit base of 2.56 trillion USD. The main risks in the near term are the rate of capital returns, which are noticeably reducing CET1, the dynamics of credit losses in the card portfolio, and the impact of integrating the Apple Card portfolio, as the credit cycle tends to be the first to exert pressure on a bank’s resilience.

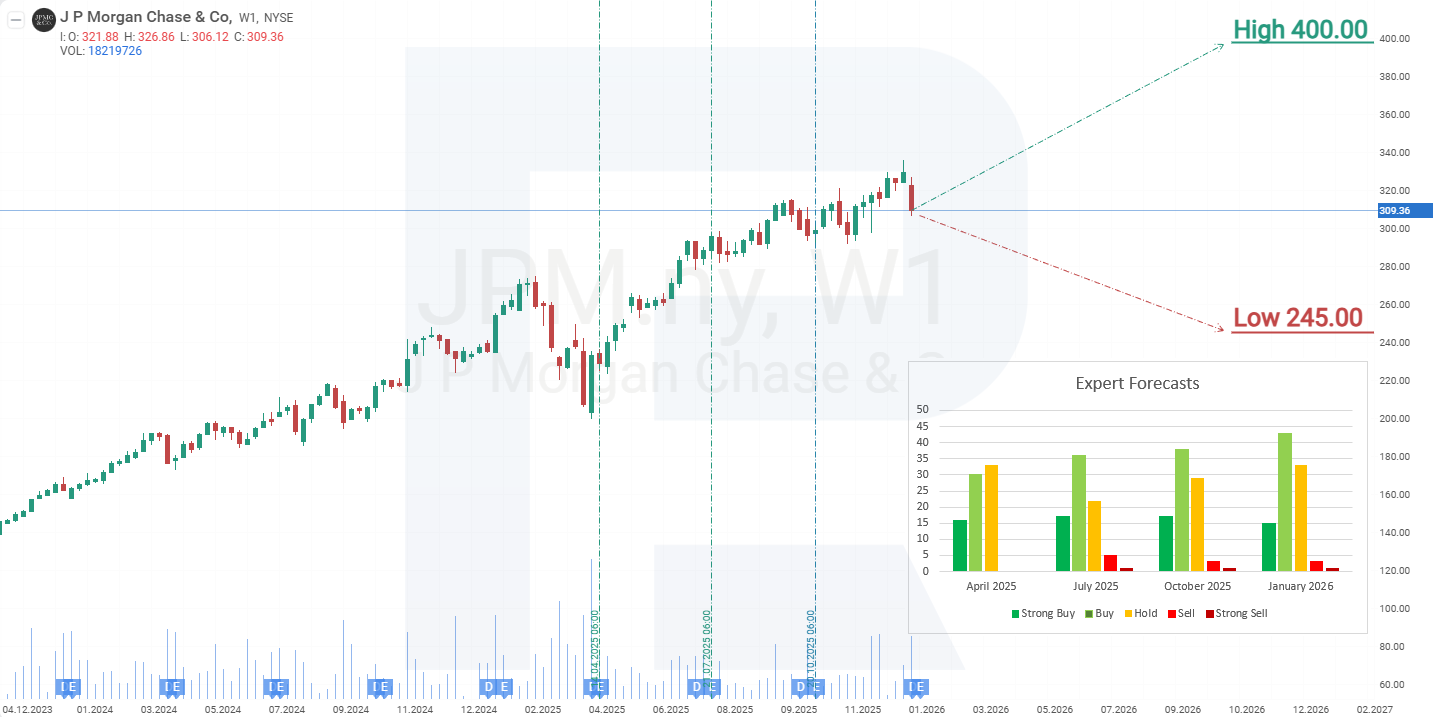

Analyst forecasts for JPMorgan Chase & Co.’s stock for 2026

- Barchart: 12 of 27 analysts rated JPMorgan Chase & Co. shares as Strong Buy, 3 as Moderate Buy, 11 as Hold, and 1 as Strong Sell. The upper price target is 400 USD, and the lower bound is 245 USD.

- MarketBeat: 15 of 29 analysts assigned a Buy rating to the shares, 12 issued Hold recommendations, and 2 rated them Sell. The upper price target is 391 USD, and the lower bound is 245 USD.

- TipRanks: 13 of 21 professionals recommended Buy, 7 as Hold, and 1 as Sell. The upper price target is 400 USD, and the lower bound is 280 USD.

- Stock Analysis: 3 of 13 experts rated the shares as Strong Buy, 7 as Buy, and 3 as Hold. The upper price target is 391 USD, and the lower bound is 285 USD.

JPMorgan Chase & Co. stock price forecast for 2026

On the weekly timeframe, JPMorgan shares are trading in an upward trend; however, a divergence has formed on the MACD indicator, suggesting a risk of a corrective decline. Based on the current performance of JPMorgan Chase & Co. shares, the potential price scenarios for JPM in 2026 are as follows:

The base-case forecast for JPMorgan shares suggests a decline towards support at 270 USD. Around this level, the correction is expected to end, and the upward trend may resume. The first target for growth would be the 360 USD level, calculated using Fibonacci retracements. If this level is confidently breached, the next target for JPM shares could be 400 USD, a level frequently cited by analysts.

The alternative forecast for JPMorgan stock suggests a break below the 270 USD support level and a close beneath it. In this scenario, the stock price could decline towards the trendline near 200 USD. A rebound from this trendline would signal the resumption of the upward trend, with the 360 USD target in sight.

JPMorgan Chase & Co.’s stock analysis and forecast for 2026Risks of investing in JPMorgan Chase & Co. stock

Investment risks for JPMorgan Chase’s shares include the following factors:

- Resurgence of inflation: if inflation begins to rise again, the Federal Reserve may be forced to delay interest rate cuts or, worse, raise rates further. This could lead to a wave of loan delinquencies, requiring higher provisions for credit losses and resulting in increased write-offs under this line of expense.

#. Rising deposit interest rates: if policy rates increase, the bank will also need to raise deposit rates to stay competitive or risk customer attrition. The resulting rise in interest payments on deposits would negatively impact the bank’s profitability.

- Decline in stock indices: as investment banking currently generates the strongest revenue growth, a fall in stock indices could adversely affect JPMorgan Chase’s investment operations. This could also impact the credit sector, as stocks are often used as collateral for loans.

- Trade War: The tariffs imposed by the Trump administration could negatively impact JPMorgan's revenue. Increases in tariffs typically lead to higher business costs, reduced consumer demand, and a slowdown in economic activity. This, in turn, lowers demand for banking services as companies become more cautious, reducing their activity in the capital markets and scaling back mergers and acquisitions, which diminishes JPMorgan’s fee income. Furthermore, if trade tensions persist, the bank’s global clients may scale back investment plans, freeze export flows, and reduce overall activity, which would negatively impact all areas of the bank’s operations – from hedging and foreign exchange to traditional lending.

Risks associated with inflation, interest rates, and trade wars pose significant threats to JPMorgan Chase’s earnings. These factors should be carefully considered when assessing the investment appeal of the bank’s shares.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.