Micron stock forecast for 2026: scenarios and key levels for MU

Micron is at the peak of the memory cycle and is delivering record financial results. This article analyses the resilience of Micron’s business, the valuation of MU shares, and the outlook for 2026.

Micron Technology, Inc. (NASDAQ: MU) reported results for Q1 of the 2026 financial year that came in well above market expectations. Non-GAAP revenue reached 13.64 billion USD, net income totalled 5.48 billion USD, and earnings per share amounted to 4.78 USD. Profitability and cash generation improved sharply. Operating cash flow reached 8.41 billion USD, with the company directly linking the surge in results to accelerating demand for memory used in AI workloads, rising prices, and a more favourable product mix.

Management’s guidance for Q2 of the 2026 financial year was also significantly above market expectations. The company forecasts non-GAAP revenue of around 18.7 billion USD, a gross margin of approximately 68%, and earnings per share of about 8.42 USD. Micron also announced a capital expenditure plan of around 20 billion USD for 2026, aimed at expanding manufacturing capacity to meet strong demand.

In the second half of 2025, the rally in MU shares accelerated, and by the end of 2025, Micron stock had risen by approximately 230%, with gains of around 20% recorded in December 2025 alone. The market had already priced in sustained strong demand for memory and robust financial performance, and the company’s subsequent guidance for 2026 only reinforced these expectations. As a result, MU’s upward momentum continued into early 2026.

This article examines Micron Technology, Inc., outlines the sources of its revenue, summarises Micron’s quarterly performance, and presents expectations for the 2026 financial year. It also includes a technical analysis of MU shares, on the basis of which a forecast for Micron stock for the 2026 calendar year is developed.

About Micron Technology, Inc.

Founded in 1978, Micron Technology Inc. is a US-based company that develops and manufactures memory chips (DRAM, NAND) and provides technology solutions for data storage. Micron is one of the world’s largest producers of electronic memory, with its products used in cars, computers, mobile devices, servers, and other electronic equipment. The company was listed on the New York Stock Exchange in 1984 and trades under the ticker MU.

Today, Micron continues to develop and deploy advanced memory modules and data storage technologies for the artificial intelligence, 5G networks, autonomous vehicle, and cloud computing markets.

Image of the company name Micron Technology, Inc. for 2025Micron Technology, Inc.’s main revenue streams

Micron’s business model centres on developing, producing, and selling semiconductor memory modules and data storage solutions. The company’s segments are categorised by the product markets listed below:

- Personal computers and devices: this includes revenue from the sale of memory used in PCs, laptops, and workstations.

- Mobile devices: memory chips for smartphones and tablets, where Micron competes against companies producing comparable products for high-performance devices.

- Storage devices: products and solutions for NAND flash memory-based data storage.

- Embedded systems: memory components and modules for integration into systems used in the automotive and healthcare sectors, as well as the manufacturing industry.

The company provides detailed data for each segment and aggregates them into two major sectors in its report. The first sector is DRAM (Dynamic Random-Access Memory), which accounts for a substantial share of the company’s revenues (about 70%). DRAM is used in personal computers, servers, smartphones, graphics cards and other devices. The second sector, NAND (flash memory), accounts for about 25-30% of revenues. NAND products are used in SSDs (solid-state drives), mobile devices, data storage systems and other products requiring rapid and reliable access to information.

Micron Technology Inc. Q4 2024 financial results

On 25 September 2024, Micron released its Q4 2024 report, which covered the period ended 25 August. The company’s financial performance surprised investors and exceeded forecasts. Below is the reported data:

- Revenue: 7.75 billion USD (+93%)

- Net income: 1.34 billion USD compared to a loss of 1.17 billion USD

- Earnings per share: 1.18 USD compared to a loss of 1.07 USD

- Operating profit: 1.74 billion USD compared to a loss of 1.20 billion USD

Revenue by segment:

- DRAM: 5.33 billion USD (+69%)

- NAND: 2.36 billion USD (+31%)

- Compute and Networking: 3.01 billion USD (+152%)

- Mobile: 1.87 billion USD (+55%)

- Storage: 1.68 billion USD (+127%)

- Embedded: 1.17 billion USD (+36%)

After announcing the Q4 2024 financial results, Micron’s management underscored an impressive 93% revenue growth from the previous year, driven by strong demand for DRAM products for data centres and record NAND sales, which exceeded 1 billion USD per quarter for the first time.

Micron’s CEO, Sanjay Mehrotra, noted that Micron has the best competitive positioning in its entire history and forecasted record revenue and profitability figures in Q1 2025. He also emphasised the importance of demand for artificial intelligence solutions, which helps strengthen the company’s position in the market.

Micron expects record revenue in Q1 2025, forecasting income of 8.70 billion USD (plus or minus 200 million USD) and a gross margin of 39.5%. The anticipated earnings per share will amount to 1.74 USD. These figures are considerably higher than in previous quarters, indicating growth in demand for the company’s products, particularly in the artificial intelligence and cloud computing segments.

Micron also noted that it continues to benefit from rising prices in memory and data storage markets related to increased demand for AI servers.

Micron Technology Inc. Q1 2025 financial results

On 18 December 2024, Micron published its Q1 results for the 2025 financial year, covering the period ended 28 November. Below are the report highlights:

- Revenue: 8.70 billion USD (+84%)

- Net income: 2.04 billion USD versus a loss of 1.05 billion USD

- Earnings per share: 1.79 USD versus a loss of 0.95 USD

- Operating profit: 2.39 billion USD versus a loss of 0.95 billion USD

Revenue by segment:

- DRAM: 6.40 billion USD (+73%)

- NAND: 2.32 billion USD (+26%)

- Compute and Networking: 4.40 billion USD (+153%)

- Mobile: 1.50 billion USD (+16%)

- Storage: 1.70 billion USD (+160%)

- Embedded: 1.10 billion USD (+6%)

Sanjay Mehrotra noted that data centres accounted for over 50% of revenue for the first time in the company’s history, driven by strong demand for AI memory chips. He also acknowledged the weakness in consumer segments such as PCs and smartphones but expressed confidence that growth would resume in the second half of the fiscal year.

For Q2 fiscal 2025, Micron issued guidance below Wall Street expectations, forecasting revenue of 7.90 billion USD (± 200 million USD) and EPS of 1.43 USD (± 0.10 USD). This forecast reflects the anticipated decline in DRAM and NAND revenue due to oversupply and sluggish consumer demand.

Investors reacted negatively to the outlook, with Micron’s stock falling by over 13% after the report results were published.

Micron Technology Inc. Q2 2025 financial results

On 20 March 2025, Micron released its Q2 results for the 2025 financial year, covering the period ended 27 February. Below are the report highlights:

- Revenue: 8.05 billion USD (+38%)

- Net income: 1.78 billion USD (+273%)

- Earnings per share: 1.56 USD (+323%)

- Operating profit: 2.01 (+800%)

Revenue by segment:

- DRAM: 6.12 billion USD (+47%)

- NAND: 1.85 billion USD (+18%)

- Compute and Networking: 4.60 billion USD (+153%)

- Mobile: 1.10 billion USD (+16%)

- Storage: 1.40 billion USD (+160%)

- Embedded: 1.00 billion USD (+6%)

Sanjay Mehrotra noted that revenue from DRAM for data centres reached a new record, while income from high-bandwidth memory (HBM) chips rose by more than 50% from the previous quarter, exceeding 1 billion USD. He emphasised Micron’s strong competitive position and the company’s success in high-margin product categories, attributing this to an effective strategy and growing demand for memory solutions used in artificial intelligence applications.

For Q3 fiscal 2025, Micron forecast revenue of between 8.6 and 9.0 billion USD with expected EPS of between 1.47 and 1.67 USD. The company also projected a decline in gross margin to 36.5%, a 1.5 percentage point decrease from the previous quarter. This decrease was attributed to a rise in sales of lower-margin consumer products and ongoing oversupply in the NAND market, which continues to put downward pressure on prices.

Investor reaction was mixed. Following the release of the earnings report, Micron’s shares initially rose by more than 5% in after-hours trading, reflecting optimism over the strong results. However, concerns regarding the level of gross profit and rising inventory levels later led to a drop of more than 8%, making Micron one of the worst-performing stocks in the S&P 500 following the earnings release.

Micron Technology, Inc. Q3 2025 financial results

On 25 June 2025, Micron released its Q3 results for the 2025 financial year, covering the period ended 29 May. The key figures, compared with the same period of the previous fiscal year, are as follows:

- Revenue: 9.30 billion USD (+37%)

- Net income: 2.18 billion USD (+210%)

- Earnings per share: 1.91 USD (+208%)

- Operating profit: 2.49 billion (+164%)

Revenue by segment:

- DRAM: 7.07 billion USD (+50%)

- NAND: 2.15 billion USD (+4%)

- Compute and Networking: 5.06 billion USD (+97%)

- Mobile: 1.55 billion USD (–2%)

- Storage: 1.45 billion USD (+7%)

- Embedded: 1.22 billion USD (-5%)

Micron reported strong Q3 FY2025 results, significantly outperforming market expectations. Revenue reached 9.3 billion USD, up 37% year-on-year, while adjusted earnings per share rose to 1.91 USD, versus a consensus forecast of 1.60 USD. The main driver was steady growth in demand for memory used in AI systems. HBM shipments increased by approximately 50% quarter-on-quarter, and revenue from data centres more than doubled.

During the earnings call, CEO Sanjay Mehrotra noted the accelerated adoption of advanced technological solutions. Production of 1-gamma DRAM using EUV lithography began ahead of schedule, and mass shipments of HBM3E were expected as early as Q4. The company also reported the start of HBM4 testing, with plans to begin volume production in 2026. These initiatives, together with expanded manufacturing capacity in the US and government support under the CHIPS Act, were shaping Micron’s strategic advantage in the AI memory segment.

Profitability also improved, with gross margin reaching 39%, exceeding the upper end of guidance. A further increase to around 42% ±1% was expected in Q4. The company planned to allocate approximately 1.2 billion USD to operating expenses in the following quarter, with R&D in HBM and next-generation memory technologies remaining a key priority.

The Q4 outlook reflected management’s optimism. Expected revenue stood at 10.7 billion USD (+38% year-on-year), and earnings per share were projected at 2.50 USD (+111% year-on-year) – both well above analysts’ consensus estimates.

Micron Technology, Inc. Q4 2025 financial results

On 23 September 2025, Micron published its Q4 results for the 2025 financial year, covering the period ended 28 August. The key figures compared with the same period of the previous fiscal year are as follows:

- Revenue: 11.31 billion USD (+46%)

- Net income: 3.47 billion USD (+158%)

- Earnings per share (EPS): 3.03 USD (+156%)

- Operating profit: 3.96 billion USD (+126%)

Revenue by segment:

- Cloud Memory Business Unit: 4.54 billion USD (+213%)

- Core Data Center Business Unit: 1.58 billion USD (–23%)

- Mobile and Client Business Unit: 3.76 billion USD (+24%)

- Automotive and Embedded Business Unit: 1.43 billion USD (+17%)

Micron’s Q4 FY2025 results came in ahead of market expectations. The company reported record revenue of 11.32 billion USD, while adjusted EPS stood at 3.03 USD – both figures exceeding the analyst consensus of 11.2 billion USD in revenue and 2.86 USD in EPS. Revenue growth was driven by exceptionally strong demand from AI-focused data centres, which became the primary source of expansion and are now the core of Micron’s business. For FY2025, data centres accounted for 56% of the company’s revenue at high gross margins, confirming a structural shift towards higher-value, higher-margin server memory and HBM modules.

In Q4 2025, Micron improved its product mix, with more shipments of server DRAM and HBM for AI systems and fewer low-cost configurations. This shift raised average sales prices and pushed margins higher. The memory price cycle also recovered: there was a supply shortage in DRAM, and prices for NAND also rose.

In Q4, Micron generated a positive adjusted free cash flow of around 803 million USD despite significant capital expenditures. For the 2025 financial year overall, FCF exceeded 3.7 billion USD. At the same time, management had previously warned that CapEx would rise in FY2026 as the company expands DRAM and HBM capacity to capture growing AI-driven demand.

Micron issued strong guidance for the next quarter. Revenue was expected to be around 12.5 billion USD (±300 million USD), adjusted EPS around 3.75 USD (±0.15), and gross margin in the range of 50.5–52.5%. This guidance indicated that management expected continued strength in both pricing and product cycles, particularly in server DRAM and HBM, with further potential to increase profitability as AI memory accounts for an ever-larger share of total sales.

Micron Technology, Inc. Q1 2026 financial results

On 17 December 2025, Micron released its Q1 results for the 2026 financial year, covering the period ended 27 November. Below are the reported figures compared with the same period from the previous financial year:

- Revenue: 13.64 billion USD (+57%)

- Net income (non-GAAP): 5.48 billion USD (+169%)

- Earnings per share: 4.78 USD (+167%)

- Operating profit: 6.42 billion USD (+168%)

Revenue by segment:

- Cloud Memory Business Unit: 5.28 billion USD (+100%)

- Core Data Center Business Unit: 2.38 billion USD (+4%)

- Mobile and Client Business Unit: 4.26 billion USD (+63%)

- Automotive and Embedded Business Unit: 1.72 billion USD (+49%)

Micron Technology delivered exceptionally strong results. Revenue reached 13.64 billion USD, reflecting a 57% year-on-year increase. Net income reached 5.48 billion USD, with earnings per share at 4.78 USD. The company specifically highlighted that revenue, margins, and earnings per share were above the upper end of its own guidance. The market was equally pleased, as analysts had expected revenue of approximately 12.9 billion USD and earnings per share of around 3.96 USD, and Micron exceeded both.

The quality of the quarter is evident in the strong margins. Non-GAAP gross margin grew to 56.8%, operating margin rose to 47.0%, and operating profit reached 6.42 billion USD. For the memory and storage business, these levels are very high, reflecting strong pricing power and an advantageous product mix.

Revenue growth was broad-based across all segments. DRAM revenue totalled 10.81 billion USD, growing by 69% year-on-year, while NAND revenue totalled 2.74 billion USD, up 22% year-on-year. In the quarter, DRAM prices increased by approximately 20% quarter-on-quarter, and NAND prices grew by low double digits, indicating that both price increases and product mix contributed to the profit growth. The Cloud Memory segment grew fastest, reaching 5.28 billion USD (+100% year-on-year). Mobile & Client reached 4.26 billion USD (+63% year-on-year), Automotive & Embedded reached 1.72 billion USD (+49% year-on-year), while Core Data remained at around 2.38 billion USD (+4% year-on-year).

Management's guidance for Q2 of the 2026 financial year is even stronger. The company expects non-GAAP revenue of approximately 18.7 billion USD, a gross margin of 68%, and earnings per share of around 8.42 USD – significantly above analysts' expectations, which had factored in much more modest figures. Looking further ahead, Micron expects continued improvement in key metrics throughout the 2026 financial year, with capital expenditures of around 20 billion USD, focused on the second half of the year. The company also noted that demand from AI infrastructure and limited production capacity remain key market drivers.

Market drivers for memory and Micron’s role in the current cycle

A key driver of memory demand growth in 2025–2026 will be the active construction and expansion of AI data centres. Modern servers for training and running AI models require more memory per server and faster data transfer rates, directly increasing the demand for HBM, next-generation server DRAM, and SSDs for data centres. Micron Technology explicitly states that its clients’ plans for expanding AI infrastructure have significantly raised forecasts for memory and storage system demand, with requirements for server capacity and performance continuing to grow with each generation.

Another factor is the limited supply. Micron expects that the memory shortage in the industry will persist not only in 2026 but also beyond. The growth in HBM production further tightens the supply of conventional server DRAM, as some production capacity is being switched to more complex and costly solutions. The company also notes that ramping up production is not possible due to the need for cleanroom expansions and the long construction and commissioning timelines for new facilities.

Demand is also supported by broader markets. Micron highlights the PC refresh cycle amid the end of Windows 10 support and the growth of the AI-PC segment. In smartphones, the amount of memory per device is increasing, particularly in flagship models. In the automotive segment, demand is growing as driver assistance systems at the L2+/L3 levels become more widespread, and the volume of memory needed for in-car electronics increases.

As a result, Micron has become a key focus for investors, as it is one of the few manufacturers of HBM, alongside SK Hynix and Samsung Electronics, which is a key component for modern AI accelerators. The HBM market is effectively oligopolistic, with limited supply, and demand from data centres is growing faster than supply can keep up. Investors are therefore closely watching each supplier capable of scaling production. In this context, Micron stood out by providing one of the strongest revenue, margin, and HBM demand forecasts, which has increased interest in the company’s shares.

Moreover, the company has provided the market with rare visibility into future demand in the memory sector. Micron has stated that it has agreed on prices and volumes of HBM shipments for the entire 2026 calendar year and expects tight conditions for DRAM and NAND to persist beyond 2026. This alleviates concerns that memory prices will drop quickly.

Fundamental analysis for Micron Technology, Inc.

Below is a fundamental analysis for MU based on the Q4 results of the 2025 financial year:

- Liquidity and debt: as of 27 November 2025, Micron Technology held 9.73 billion USD in cash and 2.28 billion USD in marketable securities, totalling 12.01 billion USD in liquid assets. Current assets totalled 29.67 billion USD, with current liabilities at 12.06 billion USD, providing the company with a strong liquidity buffer. Total debt stood at 11.76 billion USD, placing Micron in a neutral position regarding net debt, with a slight net cash position of around 0.26 billion USD. Additionally, the company had an undrawn credit line of 3.50 billion USD, further strengthening its financial resilience.

- Cash flows and free cash flow: in the past quarter, Micron significantly increased its cash generation. Operating cash flow totalled 8.41 billion USD, up from 3.24 billion USD in the same period last year. Capital expenditure on equipment and construction was high at 5.39 billion USD, but government subsidies of 0.88 billion USD offset part of these costs. Consequently, net capital expenditures amounted to 4.51 billion USD. With these figures, the company achieved adjusted free cash flow of 3.90 billion USD for the quarter.

Looking ahead, Micron plans significant investment in the 2026 financial year, with capital expenditures expected to total around 20 billion USD, primarily concentrated in the second half of the year. As a result, free cash flow may fluctuate considerably from quarter to quarter.

- Profitability and earnings: for Q1, Micron Technology delivered a strong quarter on a non-GAAP basis. Gross margin stood at 56.8%, operating margin at 47.0%, with an operating profit of 6.42 billion USD, net income of 5.48 billion USD, and earnings per share of 4.78 USD. These figures marked a substantial improvement compared to both the previous quarter and the same period last year. This is crucial for financial stability, as such margins enable the company to fund large investments while maintaining a balanced financial structure without increasing debt.

- Balance sheet strength: the balance sheet appears robust. Assets totalled 85.97 billion USD, liabilities amounted to 27.17 billion USD, and shareholders' equity was 58.81 billion USD. The equity ratio is high, and the debt load is moderate. During the quarter, Micron reduced its debt by 2.94 billion USD, directing part of the increased profits and cash flows towards lowering financial risk. It is worth noting that some of the cash and investments are held in foreign subsidiaries, which may limit operational access to these funds in certain countries. There are also future commitments related to the investment programme, with high capital expenditure planned for the 2026 financial year.

Fundamental Analysis for MU – conclusion:

As of Q1 2026, Micron appears financially sound. Liquidity is high, net debt is practically non-existent, and both profit and operating cash flow have increased sharply. The primary risk is not related to the balance sheet, but to the cyclical nature of the market and the scale of investment, with around 20 billion USD in capital expenditure planned for the 2026 financial year. Should market conditions worsen, free cash flow could decline quickly, but the current liquidity reserve and access to the credit line provide the company with strong financial flexibility.

Analysis of key valuation multiples for Micron Technology, Inc.

Below are the key valuation multiples for Micron Technology based on the Q1 results of the 2026 financial year, calculated at a share price of 340 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 32 | ⬤ An exceptionally high valuation for a cyclical memory manufacturer: The market is paying over 30 times annual profits, relying on the continuation of the super-cycle. |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 9.2 | ⬤ An aggressive level for a business with historically volatile margins. |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 9.2 | ⬤ Even considering the almost zero net debt, the valuation based on revenue remains extremely high. |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 83 | ⬤ Micron appears very expensive based on free cash flow, as FCF lags reported profit by a wide margin due to high CapEx. |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 1.2% | ⬤ A low free cash flow yield, with the investment case relying on significant future FCF growth. |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 17.5 | ⬤ A high multiple for memory and NAND, even with record margins driven by AI demand. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 28 | ⬤ Minimal margin of safety based on profit. |

| P/B | Price to book value | 6.6 | ⬤ The balance sheet capital is valued with a very large premium, signalling high valuation for a capital-intensive and cyclical business. |

| Net Debt/EBITDA | Debt burden relative to EBITDA | 0.0 | ⬤ Net debt is almost zero relative to EBITDA, making the balance sheet very comfortable. |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | 32 | ⬤ Interest expenses are comfortably covered. |

Micron Valuation Multiples Analysis – conclusion

From the perspective of business quality and the current cycle, Micron is performing at its peak: record revenue, very high profitability, strong EBITDA, almost non-existent net debt, and massive demand for data centre HBM and DRAM. However, at the current valuation, the market is pricing the company as if this super-profitable phase will continue for a long time without any significant margin downturns.

Almost all price multiples (P/E, P/S, EV/Sales, EV/EBIT, P/FCF) are in the red zone for a cyclical semiconductor business. If Micron’s revenue and profits grow more slowly than the market expects, the 340 USD valuation could quickly prove too high, and the shares may decline significantly, even with otherwise solid earnings reports.

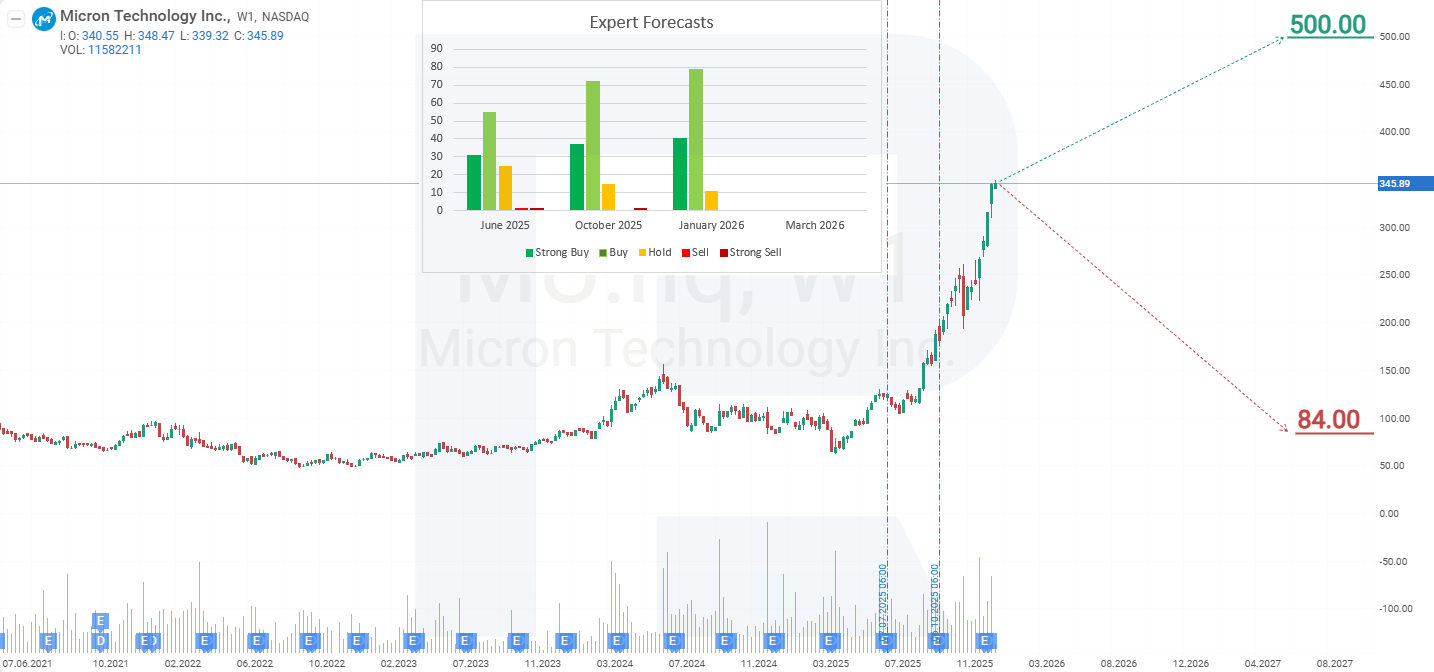

Expert forecasts for Micron Technology, Inc

- Barchart: 30 of 38 analysts rated Micron Technology shares as Strong Buy, 5 as Moderate Buy, and 3 as Hold. The upper price target is 500 USD, and the lower bound is 107 USD.

- MarketBeat: 34 of 37 analysts assigned a Buy rating to the shares, with 3 issuing Hold recommendations. The upper price target is 400 USD, and the lower bound is 84 USD.

- TipRanks: 24 of 26 surveyed analysts rated the shares as Buy, with 2 issuing Hold recommendations. The upper price target is 500 USD, and the lower bound is 235 USD.

- Stock Analysis: 10 of 29 experts rated the shares as Strong Buy, 16 as Buy, and 3 as Hold. The upper price target is 500 USD, and the lower bound is 84 USD.

Micron Technology, Inc. stock price forecast for 2026

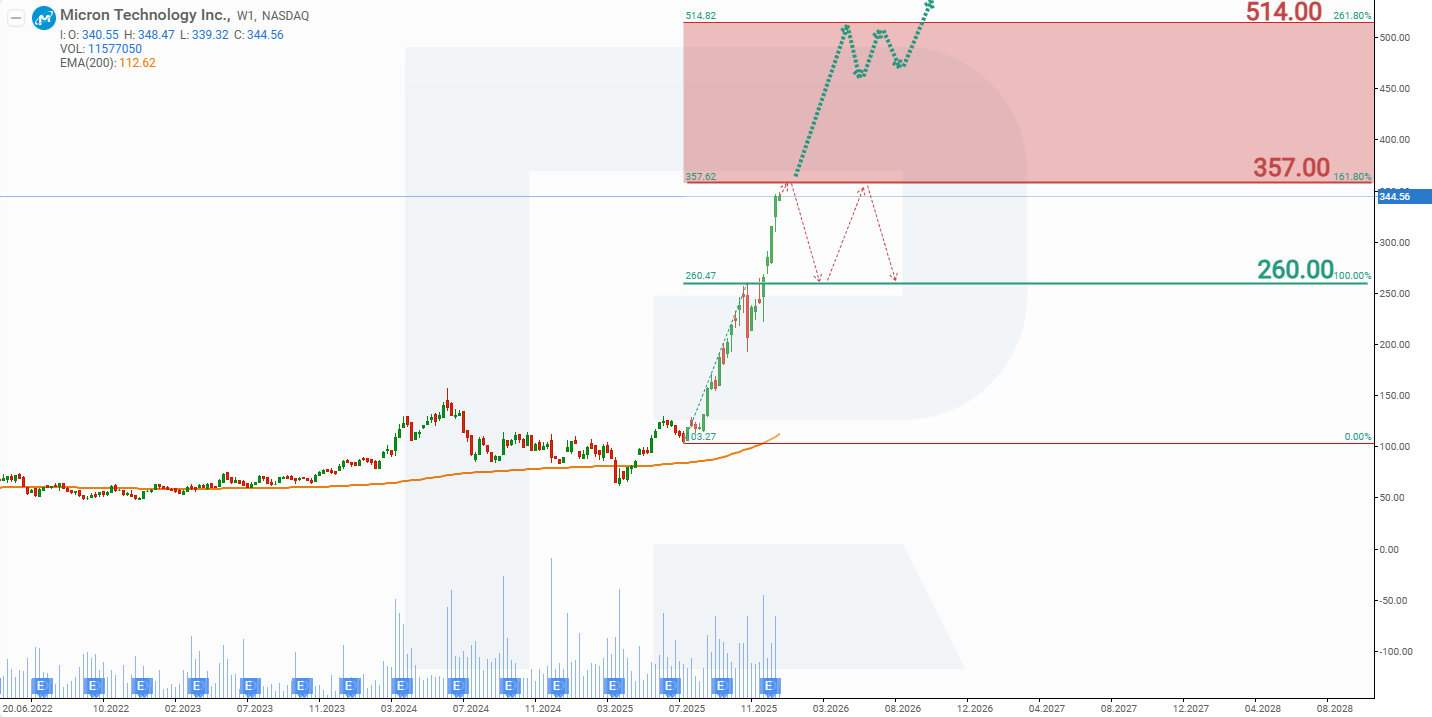

In the second half of 2025, amid rising demand for memory, investor attention shifted to Micron Technology, driving its share price up by more than 230% and bringing it closer to resistance at 357 USD. Based on the current performance of Micron shares, the potential price scenarios for 2026 are as follows:

The base-case forecast for Micron shares implies a breakout above resistance at 357 USD, followed by a move higher towards 514 USD. This scenario is supported by the company’s strong outlook for 2026, which anticipates sustained high demand for memory and a supply shortage due to the long timelines required for expanding production capacity. As a result, investor interest in Micron shares could remain elevated, leading to rapid achievement of the target price. Additionally, demand for the company’s shares could be supported by capital flows out of NVIDIA shares, as some investors look for a similar growth story in the AI infrastructure and memory segment.

The alternative forecast for Micron stock suggests a rejection at the 357 USD resistance level. In this case, shares could fall towards support at 260 USD, after which they may consolidate between 260 and 357 USD.

Micron Technology, Inc. stock analysis and forecast for 2026Risks of investing in Micron Technology, Inc. stock

Investing in Micron Technology’s stock involves several risks that may adversely impact the company’s income and revenue:

- Memory market cyclicality: the semiconductor industry, particularly the memory segment, is highly cyclical, with periods of fluctuating demand and pricing. A prolonged downturn in segments such as NAND and DRAM could lead to overstocking, falling prices, and reduced profitability.

- Intense competition in the industry: Micron faces fierce competition from major players like Samsung Electronics and SK Hynix. Constant investment in technology and innovation is vital in such a highly competitive environment. If the company fails to keep pace with industry developments, it may lose market share, leading to lower profitability.

- Geopolitical tensions and trade restrictions: Micron operates in the global market, generating significant revenue outside the US. Geopolitical tensions, trade disputes, and cybersecurity compliance checks may restrain sales and operations. For example, Micron’s products have been scrutinised in China, highlighting the risks tied to international markets.

Investors must carefully consider these risks when evaluating an investment in Micron Technology, as they could significantly impact the company’s financial performance and stock price.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.