Disney – resilient business with a focus on profit growth and capital returns in 2026

Disney delivered stable results and improved streaming margins, while its 2026 outlook points to higher earnings and an active share buyback program. A breakout above the 122 USD level could signal a continuation of the uptrend in 2026.

The Walt Disney Company (NYSE: DIS) has published Q3 results of the 2025 financial year. Revenue reached 23.65 billion USD (+2% year-on-year), slightly below market expectations, while adjusted earnings per share (EPS) came in at 1.61 USD, ahead of analyst forecasts. GAAP earnings rose to 2.92 USD, supported by a one-off tax benefit linked to Hulu.

For the first time, Disney’s streaming segment reported consistent profitability: the Direct-to-Consumer (DTC) division generated 346 million USD in profit, while its subscriber base expanded to 183 million. By contrast, linear television continued to decline, whereas the Experiences division strengthened its position, delivering 2.52 billion USD in operating profit (+13% year-on-year). The sports arm (ESPN) also improved performance, with operating profit climbing to around 1.04 billion USD (+29% year-on-year).

Management raised its forecast for adjusted EPS in FY2025 to 5.85 USD and expects streaming operating profit of about 1.3 billion USD by year-end. The company also confirmed the launch of ESPN-DTC on 21 August and announced several major partnerships, including a deal with WWE worth more than 1.6 billion USD and plans to expand cooperation with the NFL.

Following the earnings release, Disney’s shares fell by more than 2%, as investors reacted cautiously to the weaker revenue growth and deteriorating linear TV performance, despite strong profitability and an upgraded full-year outlook. The next day, selling pressure continued, driving the shares down to 112 USD and extending the overall decline to roughly 5% versus the pre-results level. Analyst commentary added to the pressure, highlighting risks associated with costly sports rights and the ongoing structural downturn in linear television.

By 22 August, however, the shares had fully recovered, closing at 119 USD. The rebound was supported by positive sentiment surrounding ESPN’s DTC launch on 21 August, along with a broader market rally after Jerome Powell signalled the possibility of interest rate cuts.

This article examines The Walt Disney Company and its business model, provides a fundamental analysis of Disney’s financial results, and offers a technical analysis of Walt Disney’s shares, assessing their current performance as the basis for a DIS stock forecast for 2025.

About The Walt Disney Company

The Walt Disney Company is one of the world’s largest media and entertainment corporations, founded on 16 October 1923 by brothers Walter and Roy Disney. The company is renowned for its live-action films and animated cartoons, including iconic creations such as ‘Snow White and the Seven Dwarfs’. Its portfolio includes Lucasfilm, Marvel Studios, Pixar, and 20th Century Studios. In addition to film production, Disney operates theme parks and resorts worldwide – Disney World and Disneyland – and broadcasts television through ABC, ESPN, and National Geographic. In 2019, the company launched the Disney+ streaming service. Another key business area is the production and licensing of merchandise related to its popular franchises. Disney went public on the New York Stock Exchange on 12 November 1957, trading under the DIS ticker.

Image of the company name The Walt Disney CompanyThe Walt Disney Company’s main financial flows

Walt Disney’s revenue is derived from several key sources, spanning a wide range of entertainment and media operations. Disney’s key revenue-generating segments are outlined below:

- Media Networks: television channels and cable networks (ABC, Disney Channel, ESPN, FX, National Geographic, and others). Revenue streams include advertising, licence fees, paid subscriptions, and the sale of broadcasting rights.

- Subscriptions and International Operations: streaming services (Disney+, ESPN+, and Hulu) and international trade. The main sources of income are subscriptions to streaming platforms and the sale of content and licences in foreign markets.

- Parks, Experiences, and Consumer Products: theme parks, resorts, cruises, and hotels. Revenue is generated through ticket sales, holiday packages, souvenirs, licensed toys, and other goods and services.

- Studio Entertainment: film production and distribution, home video sales, and music publishing. Revenue comes from cinema distribution, the sale of digital and physical content, and proceeds from music soundtrack and licensing.

In its financial reports, Disney categorises all revenue into three key segments:

- Entertainment: film production, TV programming, cinema distribution, content sales and licensing, soundtrack releases, and Broadway productions.

- Sports: operations related to the ESPN brand, including cable and digital sports broadcasts, broadcasting rights for sports events, the ESPN+ streaming platform, advertising, content licensing, and sports analytical programs and events.

- Experiences: theme parks (Disneyland, Disney World, and international parks), cruises (Disney Cruise Line), resorts and hotels, attractions, as well as events and client engagement activities related to the Disney brand (interactive shows and VIP tours).

- Eliminations: reflects fees paid by Hulu to ESPN and the Entertainment segment’s linear television business for the rights to broadcast their channels on the Hulu Live platform, as well as fees paid by ABC and Disney+ to ESPN for carrying certain sports content on the ABC channel and Disney+.

The Walt Disney Company Q4 2024 financial results

On 14 November, The Walt Disney Company released its financial results for Q4 of fiscal year 2024, which ended on 28 September 2024. Key report data is outlined below:

- Revenue: 22.57 billion USD (+6%)

- Net income: 0.95 billion USD (–6%)

- Earnings per Share: 1.14 USD (+39%)

- Operating profit: 3.65 billion USD (+23%)

Revenue by segment:

- Entertainment: 10.83 billion USD (+14%)

- Sports: 3.91 billion USD (unchanged)

- Experiences: 8.24 billion USD (+1%)

Segment operating income:

- Entertainment: 1.07 billion USD (+353%)

- Sports: 0.92 billion USD (–5%)

- Experiences: 1.66 billion USD (+6%)

All indicators (except net income) showed growth. The company’s management attributed the decline in net income to increased spending on content production and marketing, as well as higher costs for developing streaming services (Disney+, Hulu).

The company projected continued growth in its key financial indicators in 2025 but predicted a potential decline in the number of new Disney+ subscribers in Q1 2025 compared to Q4 2024.

Disney plans a share buyback program worth 3.00 billion USD and dividend distribution this year. Dividends will increase by 33% to 0.50 USD per share and will be paid in two instalments in January and July 2025.

In 2026, Walt Disney predicted a slower percentage growth rate in the Sports segment, with significant single-digit growth in the Experiences segment and double-digit growth in the Entertainment sector.

Based on the company’s 2025–2026 forecasts, key financial indicators were expected to rise further, which should positively impact dividend payouts and the share buyback program, ultimately leading to an increase in the stock price.

The Walt Disney Company Q1 2025 financial results

On 5 February, The Walt Disney Company released its financial results for Q1 of fiscal year 2025, which ended on 28 December 2024. Below are its key highlights:

- Revenue: 24.69 billion USD (+6%)

- Net income: 3.66 billion USD (+27%)

- Earnings per Share: 1.76 USD (+44%)

- Operating profit: 5.06 billion USD (+31%)

Revenue by segment:

- Entertainment: 10.87 billion USD (+9%)

- Sports: 4.85 billion USD (unchanged)

- Experiences: 9.41 billion USD (+3%)

Segment operating income:

- Entertainment: 1.70 billion USD (+95%)

- Sports: 247 million USD (vs a loss of 103 million USD)

- Experiences: 3.11 billion USD (+31%)

CEO Robert Alan Iger emphasised the company’s strong start to the new financial year and expressed confidence in its growth strategy. He highlighted significant successes in streaming services, including the integration of ESPN into Disney+, as well as consistently strong performance in the theme park and resort segment.

Looking ahead, Disney projected high single-digit growth in adjusted EPS compared to 2024. The company also expected operating income from the streaming segment (Disney+, Hulu, ESPN+) to increase by approximately 875 million USD. As previously projected, Disney planned to allocate 3.00 billion USD to share buybacks in 2025.

Although The Walt Disney Company exceeded revenue and income forecasts in Q1 2025, its stock drifted lower by the end of the trading session on the day the report was released. This was primarily driven by a decline of around 700 thousand Disney+ subscribers, which raised concerns about growth prospects across the streaming sector. Additionally, the company warned that subscriptions could decline further in Q2 following the recent price increase, adding to the negative sentiment in the market.

The Walt Disney Company Q2 2025 financial results

On 7 May, The Walt Disney Company released its financial results for Q2 2025 of fiscal year 2025, which ended on 29 March 2025. Key figures are as follows:

- Revenue: 23.62 billion USD (+7%)

- Net income: 3.09 billion USD (+369%)

- Earnings per share: 1.45 USD (+20%)

- Operating profit: 4.43 billion USD (+15%)

Revenue by segment:

- Entertainment: 10.68 billion USD (+9%)

- Sports: 4.53 billion USD (+5%)

- Experiences: 8.89 billion USD (+6%)

- Eliminations: (484) million USD (compared to a loss of 418 million USD in the prior year)

Segment operating income:

- Entertainment: 1.26 billion USD (+61%)

- Sports: 0.69 billion USD (–12%)

- Experiences: 2.49 billion USD (+9%)

Walt Disney’s Q2 2025 financial report provided clear evidence that the company was successfully regaining momentum. Earnings per share rose 20% year-on-year, exceeding analyst expectations, while revenue advanced 7%. Following the release, the share price climbed 11%. Yet the most significant takeaway was not only the improvement in financial metrics, but also the firm confirmation that Disney’s relaunch strategy was beginning to deliver results.

One of the most notable announcements was the planned construction of a new theme park in Abu Dhabi. Importantly, Disney is not investing in the project itself – Miral covers all costs, while Disney provides the creative input and will collect royalties. This asset-light strategy, with minimal capital expenditure, enables Disney to expand its international footprint without adding to its debt burden.

Despite the negative outlook expressed in the Q1 2025 report, Disney’s streaming platforms – particularly Disney+ and Hulu – added 2.5 million subscribers, bringing the total to 180.7 million. This growth contributed significantly to an increase in operating income. The success of theatrical releases such as Moana 2 and Marvel’s Thunderbolts not only boosted box office revenues but also increased streaming engagement and theme park attendance.

As of 29 March 2025, the company’s cash and cash equivalents stood at 5.85 billion USD, up from 5.48 billion USD on 28 December 2024. The increase in liquid assets highlights consistently positive cash flow and effective working capital management.

Total borrowings, including short-term obligations, declined to 42.9 billion USD at the end of Q2, down from 45.3 billion USD three months earlier.

Free cash flow for the reporting quarter amounted to 4.89 billion USD, underlining the company’s strong operating efficiency and ability to generate substantial liquidity to fund investment, service debt, and return cash to shareholders through dividends.

For Q3 2025, management guided to further subscriber growth and strengthening across all key segments. The full-year 2025 EPS forecast was raised to 5.75 USD, representing a 16% increase from 2024. Operating profit is expected to grow at a double-digit rate in Entertainment, by around 18% in Sports and by 6–8% in Experiences.

The Walt Disney Company’s Q3 2025 financial results

On 7 August, The Walt Disney Company released its financial results for Q3 of fiscal year 2025, which ended on 28 June 2025. The key figures are as follows:

- Revenue: 23.65 billion USD (+2%)

- Net income: 3.21 billion USD (+4%)

- Earnings per share: 1.61 USD (+16%)

- Operating profit: 4.57 billion USD (+8%)

Revenue by segment:

- Entertainment: 10.70 billion USD (+1%)

- Sports: 4.30 billion USD (–5%)

- Experiences: 9.08 billion USD (+8%)

- Eliminations: (448) million USD (vs a loss of 369 million USD in the prior year)

Segment operating income:

- Entertainment: 1.02 billion USD (–15%)

- Sports: 1.03 billion USD (+29%)

- Experiences: 2.51 billion USD (+13%)

In Q3 FY2025, Disney delivered modest growth, with revenue up 2% versus Q3 FY2024 and broadly flat compared with the previous quarter. Adjusted EPS rose to 1.61 USD, beating analyst expectations. On a GAAP basis, EPS reached 2.92 USD, though this was inflated by a one-off tax benefit linked to Hulu. Total operating profit across segments climbed 8% to 4.58 billion USD, indicating improved margins.

The Disney Entertainment segment reported revenue of 10.70 billion USD (+1% year-on-year), but operating profit fell 15% to 1.02 billion USD. The main pressure came from the decline in traditional TV and weakness in content sales and licensing, which did not match the prior-year success of Inside Out 2, as well as higher film write-offs. Streaming was the key growth driver: Disney+ and Hulu, together with ESPN+, lifted revenue to 6.18 billion USD (+6% year-on-year) and delivered their first profit of 346 million USD versus a loss a year earlier. The subscriber base continued to expand: Disney+ reached 127.8 million (+1.8 million in the quarter), Hulu 55.5 million (+0.8 million), while ESPN+ remained steady at 24.1 million.

The Sports segment, led by ESPN, generated 4.31 billion USD in revenue (-5% year-on-year due to the removal of Star India), but operating profit rose 29% to 1.04 billion USD. In the US, ESPN was hit by higher NBA broadcasting rights costs, but overall results improved thanks to the absence of losses from Star India and stronger advertising revenue.

The Experiences segment, covering parks, resorts, and cruises, again proved the main cash generator. Revenue climbed to 9.09 billion USD (+8% year-on-year), while profit rose to 2.52 billion USD (+13% year-on-year). US parks and cruises delivered particularly strong growth, driven by higher guest spending and fleet expansion. International parks recorded moderate revenue growth, though profits edged lower. Consumer Products revenue increased 3% to 0.99 billion USD, with profit of 444 million USD (+1% year-on-year).

For Q4, Disney projected subscriber growth of more than 10 million across Disney+ and Hulu and expected adjusted EPS for full-year 2025 of around 5.85 USD (+18% year-on-year). Operating profit growth was expected across all segments: Entertainment in the double digits, Sports around 18%, and Experiences around 8%. In the longer term, the company is betting on expanding its parks (including a new project in Abu Dhabi), growing its cruise business, and leveraging strong franchises such as Star Wars, Marvel, and Pixar. For ESPN, the emphasis has shifted towards digital services and partnerships, although management does not currently plan to spin off the division as a separate listed company.

The Walt Disney Company Q4 2025 financial results

On 13 November, The Walt Disney Company released its financial results for Q4 of fiscal year 2025, which ended on 27 September 2025. The key figures are as follows:

- Revenue: 22.46 billion USD (0%)

- Net income: 2.04 billion USD (+115%)

- Earnings per share (non-GAAP): 1.11 USD (–3%)

- Operating profit (non-GAAP): 3.48 billion USD (–5%)

Revenue by segment:

- Entertainment: 10.21 billion USD (+1%)

- Sports: 3.98 billion USD (+2%)

- Experiences: 8.77 billion USD (+6%)

- Eliminations: (490) million USD (vs a loss of 409 million USD a year earlier)

Segment operating income:

- Entertainment: 0.69 billion USD (–15%)

- Sports: 0.91 billion USD (–2%)

- Experiences: 1.88 billion USD (+13%)

Disney’s Q4 2025 report was mixed: the company beat profit expectations but slightly missed revenue forecasts. Adjusted earnings per share came in at 1.11 USD, above the market consensus of 1.03–1.07 USD, resulting in modest outperformance. Revenue reached 22.5 billion USD, just below analysts’ expectations of 22.7–23.0 billion USD, remaining broadly unchanged from the prior year.

Total segment operating income (non-GAAP) declined by 5% year-on-year to 3.48 billion USD, primarily due to weakness in the Entertainment segment, which includes film, linear television and content sales. The Sports division was broadly flat, while Experiences (parks, cruises and consumer products) posted a 13% increase in operating income to 1.88 billion USD on 6% higher revenue of 8.77 billion USD.

The Direct-to-Consumer (streaming) segment performed notably better: revenue rose 8% to 6.25 billion USD, while operating profit surged 39% to 352 million USD – evidence that streaming is now consistently profitable.

Management issued an upbeat outlook for the next fiscal year. In FY 2026, Disney expects double-digit growth in adjusted earnings per share versus 2025, operating cash flow of about 19 billion USD, capital expenditures of around 9 billion USD, and plans to double its share buyback program to 7 billion USD (from 3.5 billion USD in 2025). The annual dividend will also rise by 50% to 1.50 USD per share.

The company further aims to sustain double-digit EPS growth in FY 2027, implement a 10-year investment plan totalling 60 billion USD to expand its parks and cruise businesses, and achieve around 10% profit margins in streaming by 2026.

However, management also cautioned about risks. Revenue from traditional TV and film continues to decline, there is an ongoing distribution dispute with YouTube TV, and an additional 400 million USD in costs – mainly marketing for major releases – is expected. Moreover, comparisons will be challenging due to a strong content line-up in 2024.

Overall, the quarter was moderately positive: profit and streaming performance exceeded expectations, while revenue was flat and operating income remained under pressure from weaker film and TV results. The 2026 outlook is encouraging, with the company targeting profit growth, greater efficiency, higher dividends and substantial capital returns to shareholders.

Fundamental analysis of The Walt Disney Company

Below is the fundamental analysis of The Walt Disney Company based on Q4 2025 results

- Liquidity and balance sheet: at the end of Q4 2025, Disney held around 5.7 billion USD in cash and equivalents. Current assets totalled 24.3 billion USD, while current liabilities stood at 34.2 billion USD, giving a current ratio of roughly 0.7×. Although formally low, this is a typical level for a large media and entertainment company with stable forward cash flows (from subscriptions, ticket sales and bookings).

Total borrowings (short- and long-term) amounted to 42.0 billion USD, while total assets stood at 197.5 billion USD and shareholders’ equity at 109.9 billion USD. This indicates a moderate but manageable debt load, a stable balance-sheet structure, and equity growth compared with the previous year.

- Cash flow: for the 2025 financial year, Disney generated 18.1 billion USD in operating cash flow and about 10.1 billion USD in free cash flow (after capital expenditure of 8.0 billion USD on parks, cruises and other assets). Both figures rose year-on-year, driven by higher operating profit in the Experiences segment, lower write-downs and some benefit from deferred tax payments.

Free cash flow remains consistently positive – now approaching 10–11% of annual revenue – indicating that the company can fund its elevated level of capital expenditure internally without increasing debt.

- Earnings diversification: in Q4 2025, total segment operating income (non-GAAP) came in at 3.48 billion USD (–5 % y/y). The profit mix was well balanced: Entertainment contributed 691 million USD (–35 % y/y, reflecting a weak quarter for film and linear TV), Sports 911 million USD (–2 % y/y), and Experiences 1.88 billion USD (+13 % y/y – a record quarter for parks, cruises and consumer products).

Within Entertainment, the Direct-to-Consumer segment posted an 8% revenue increase and a 39% rise in operating profit to 352 million USD, confirming that streaming is now a profitable business rather than a loss-making one. Overall, Disney’s earnings are well diversified: weaker film and TV performance is partly offset by strong, stable profits from parks and cruises and improving streaming economics.

- Capital returns: in FY 2025, Disney returned about 5.3 billion USD to shareholders – including 1.8 billion USD in dividends and 3.5 billion USD in share buybacks. At the same time, the company reduced total debt (from 45.8 billion USD to 42.0 billion USD) while maintaining positive free cash flow.

Management has targeted an increase in annual share repurchases to 7 billion USD and a higher annual dividend of 1.50 USD per share in FY 2026, signalling its readiness to raise capital returns as cash flows strengthen.

Fundamental analysis of Disney (DIS) – conclusion

As of Q4 2025, Disney appears financially solid. The balance sheet is not over-leveraged, net debt remains moderate relative to equity and assets, and both operating and free cash flow comfortably cover capital expenditures, dividends, and buybacks.

Earnings are well diversified: while legacy segments (film and linear TV) are under pressure, streaming is already profitable, and the parks and cruises division continues to deliver double-digit operating-profit growth, remaining the company’s primary cash generator.

From a financial-stability standpoint, risks are moderate and stem more from business conditions than from liquidity or balance-sheet constraints.

Analysis of key valuation multiples for The Walt Disney Company

Below are the main valuation multiples for Walt Disney based on the Q4 2025 financial results, calculated at a share price of 105 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 15.3 | ⬤ Typical level – the stock looks neither cheap nor expensive. For Disney, this represents an average valuation. |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 2.0 | ⬤ Normal – investors are paying roughly twice the company’s annual revenue; this level appears neither particularly cheap nor overvalued. |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 2.4 | ⬤ Slightly higher than P/S due to debt, but still within a reasonable range for a large media group with parks. |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 18.9 | ⬤ Around 19 times annual FCF, which is acceptable for a large, stable company with improving cash generation. |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 5.3% | ⬤ An attractive level for long-term investment. |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 12.0 | ⬤ Borderline – not cheap, but not extreme either. A normal multiple for a quality, moderately growing business. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 16.6 | ⬤ Slightly above the comfort zone but reasonable for a company with rising margins and profit growth. |

| P/B | Price to book value | 1.66 | ⬤ A moderate level – investors pay about 1.7 USD for every 1 USD of equity. For Disney, this is a healthy, not excessive, ratio. |

| Net Debt/EBITDA | Debt burden relative to EBITDA | 2.1 | ⬤ Noticeable debt, but within a normal range. |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | 10.6 | ⬤ Interest is comfortably covered – debt servicing remains in a very safe zone. |

Valuation analysis of The Walt Disney Company – conclusion

Disney’s financial position remains stable: profit and EBITDA are growing, free cash flow has recovered, and debt levels are moderate and easily serviced.

From a valuation perspective, the stock appears fairly priced at around 105 USD. The key valuation multiples are within the mid-range, while a free cash flow yield of about 5% makes the shares attractive for long-term investment.

Considering the ongoing weakness in film and television, but the strong performance of parks and streaming, a price near 105 USD looks like a reasonable entry point for those who believe in further profit and cash flow growth in 2026–2027.

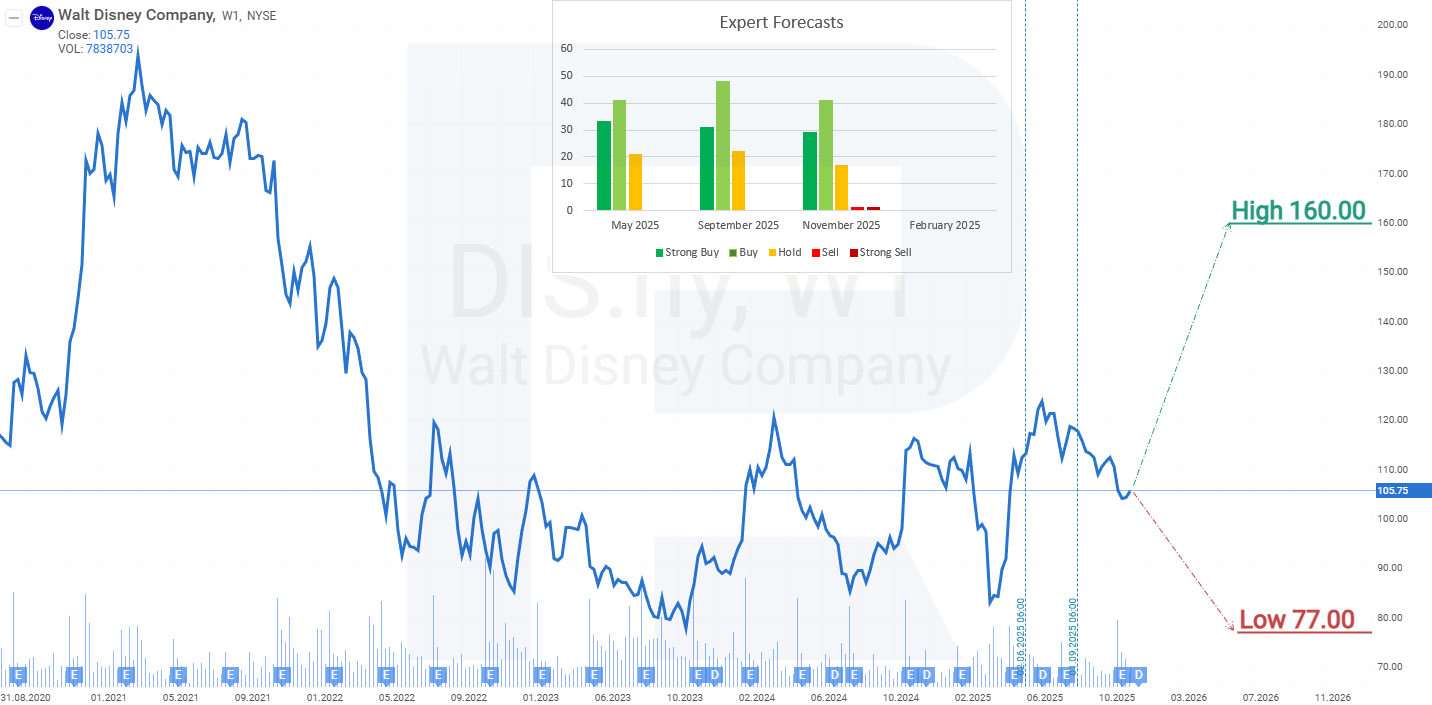

Expert forecasts for The Walt Disney Company shares for 2026

- Barchart: 21 out of 30 analysts rated Walt Disney shares as a Strong Buy, 3 as a Moderate Buy, 5 as Hold, and 1 as a Strong Sell. The upper-end forecast is 160 USD, with the lower-end forecast at 77 USD.

- MarketBeat: 18 out of 27 analysts gave the stock a Buy rating, 8 recommended Hold, and 1 advised Sell. The upper-end forecast is 152 USD, and the lower-end forecast is 110 USD.

- TipRanks: 14 out of 17 analysts rated the shares as Buy and 3 as Hold. The upper-end forecast is 152 USD, with the lower-end forecast at 123 USD.

- Stock Analysis: 8 out of 15 experts rated Walt Disney shares as a Strong Buy, 6 as Buy, and 1 as Hold. The upper-end forecast is 152 USD, and the lower-end forecast is 110 USD.

The Walt Disney Company stock price forecast for 2026

The decline in Disney’s share price, which began in March 2021 from around 200 USD, ended only in October 2023 near 80 USD. Previously, the stock had fallen to this same support level from 150 USD during the height of the COVID-19 pandemic, when governments imposed lockdowns and closed borders, sharply reducing attendance at Disney’s theme parks. Clearly, this level represents a key support zone where investors tend to step in as buyers.

As of December 2025, Walt Disney shares continue to trade within a broad range between 80 USD and 122 USD. In June, there was an attempt to break above the upper boundary of this range, but demand for the stock proved insufficient to sustain a breakout. The publication of the Q3 FY2025 report was viewed negatively by investors and led to a decline in DIS shares, although the drop was not steep: during the quarter, the stock temporarily fell by about 8%, but by the time the Q4 results were released, the decline had narrowed to roughly 1%. This indicates that investor demand for the stock remains resilient despite the company’s ongoing challenges.

After the Q4 FY2025 report, the share price again moved lower, but as it approached the 100 USD level, the decline slowed and then reversed into an upward move. Based on the current performance of Walt Disney Company shares, the potential price movements for 2026 are as follows.

The base-case forecast for Disney shares assumes an advance from current levels towards resistance at 122 USD. A breakout above this resistance could act as a catalyst for further gains, potentially pushing the price up to 165 USD. Supporting this scenario are the company’s fair value estimate of around 105 USD per share, its relatively high dividend yield given its financial strength, and the planned 7 billion USD share buyback program for 2026.

The alternative forecast for Disney stock envisions continued trading within the established range – a decline towards support at 80 USD, followed by a rebound from that level and a subsequent rise towards the upper boundary of the range at 122 USD.

The Walt Disney Company stock analysis and forecast for 2026Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.