Fibonacci Retracements Analysis 26.06.2014 (EUR/USD, USD/CHF)

26.06.2014

Analysis for June 26th, 2014

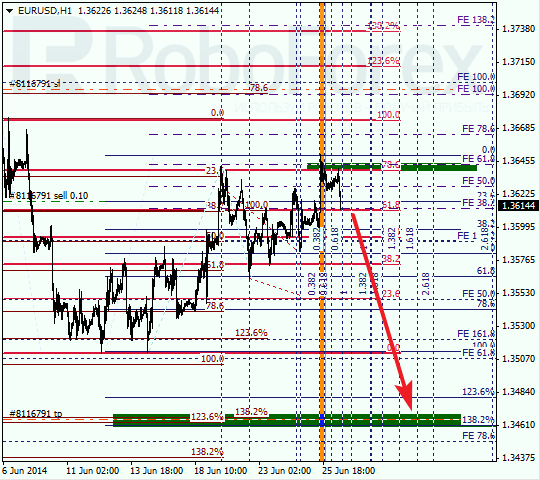

EUR USD, “Euro vs US Dollar”

EURUSD had tested 78.6% level (1.3640) recently. As we’ve seen pullback from this level, descending trend can be resumed. Target is considered to be around Fibo levels congestion (1.3470 – 1.3465).

At H1 chart, we see that 78.6% is confirmed by local retracement 61.8%. Pullback from that area has happened inside of timing Fibo zone. It increases the odds of possible reversal to the downside.

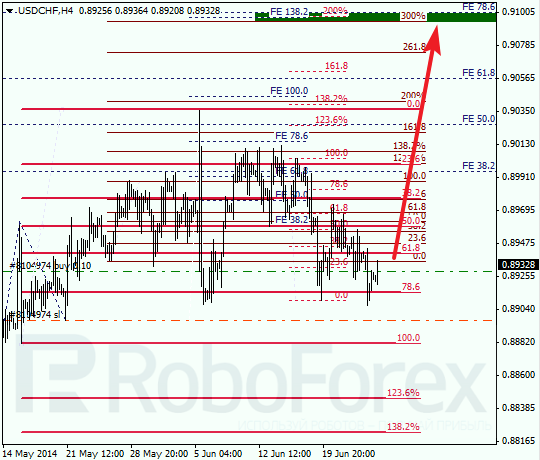

USD CHF, “US Dollar vs Swiss Franc”

USDCHF is testing 78.6% (0.8915) once again. Possibly, another pullback from this level will allow buyers to drive the market up to higher Fibo levels congestion (0.9100 – 0.9095).

At H1 chart we see that apart from 78.6%, support to the market was provided by local Fibo level 61.8%. I have now just one long trade with stop below recent low. Subsequently, if ascending trend will be confirmed, I will add to my long position.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.