Fibonacci Retracements Analysis 10.02.2015 (EUR/USD, EUR/JPY)

10.02.2015

Analysis for February 10th, 2015

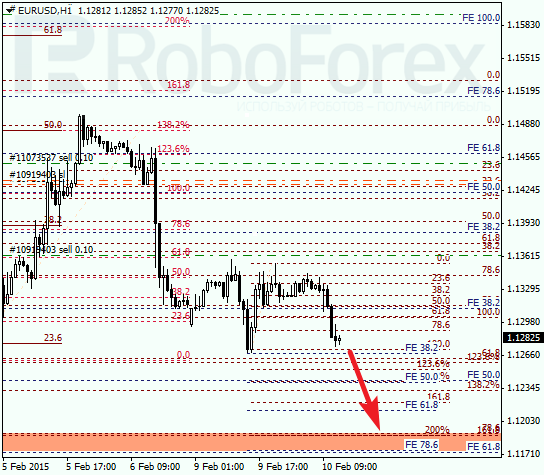

EUR USD, “Euro vs US Dollar”

After rebounding from the upper correctional levels for the second time, Eurodollar is trying to resume its descending movement. The closest target is the group of fibo-levels at 1.0940. I’m planning to stop trading after the pair reaches the above-mentioned area.

As we can see at the H1 chart, the intermediate group of fibo-levels (1.1180) is also important. Possibly, the pair may start a new correction from this area, thus giving an opportunity to open another sell order later.

EUR JPY, “Euro vs Japanese Yen”

The pair is trying to complete the current correction near retracement 61.8%, which is confirmed by several less important fibo-levels. If the pair rebounds from this area, the market may start a new descending movement.

As we can see at the H1 chart, the predicted target area of this correction is confirmed by local retracements. Probably, the price may rebound from these levels quite soon. After that, I’m planning to open another sell order.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.