Technical Analysis & Forecast 01.09.2023

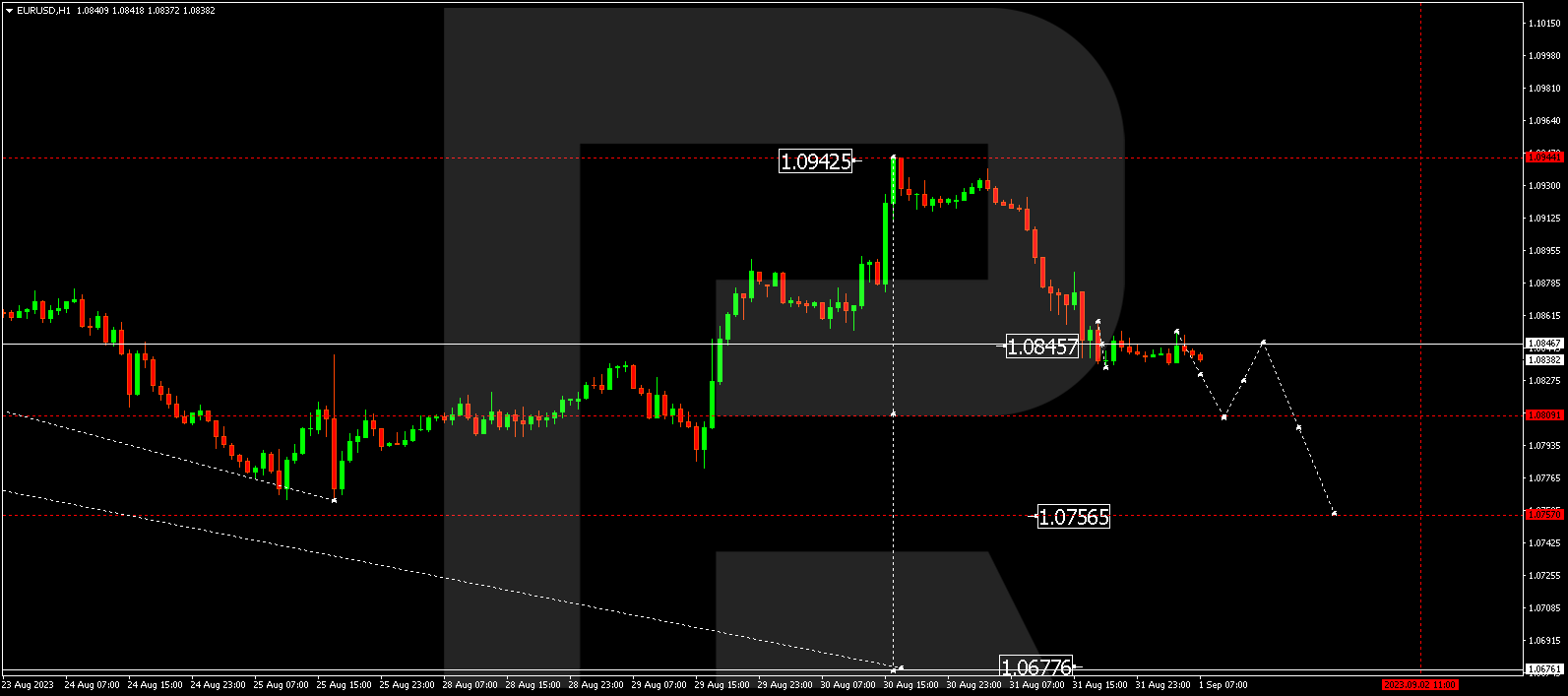

EURUSD, “Euro vs US Dollar”

EURUSD has completed a wave to the 1.0846 level. Today the market is forming a consolidation range around this level. With an upward breakout, a link of growth to 1.0880 could follow. A downward breakout will open the potential for a movement to 1.0808, with the trend potentially continuing to 1.0756. This is a local target.

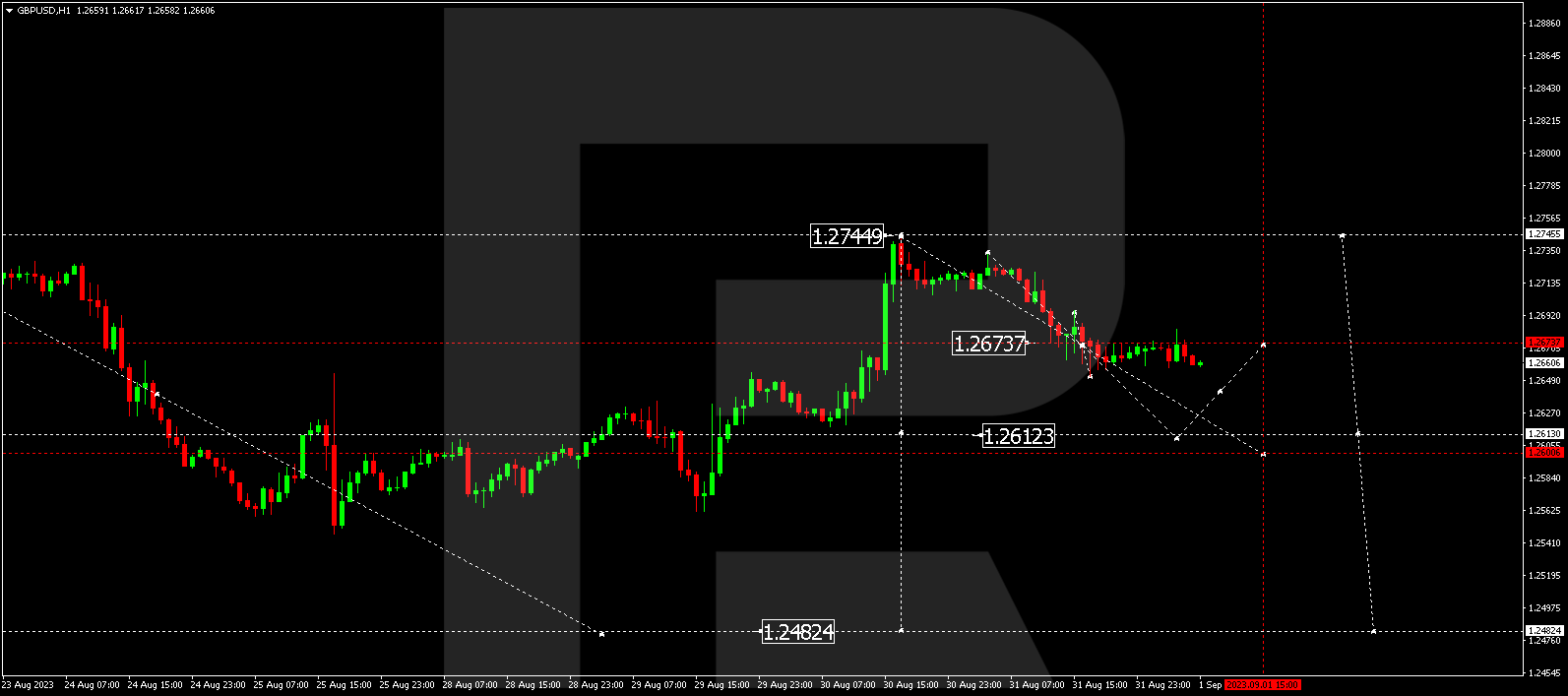

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed a wave of decline to the 1.2674 level. Today a consolidation range is forming around this level. A downward breakout will open the potential for a movement to 1.2612, from where the trend could continue to 1.2484. This is a local target.

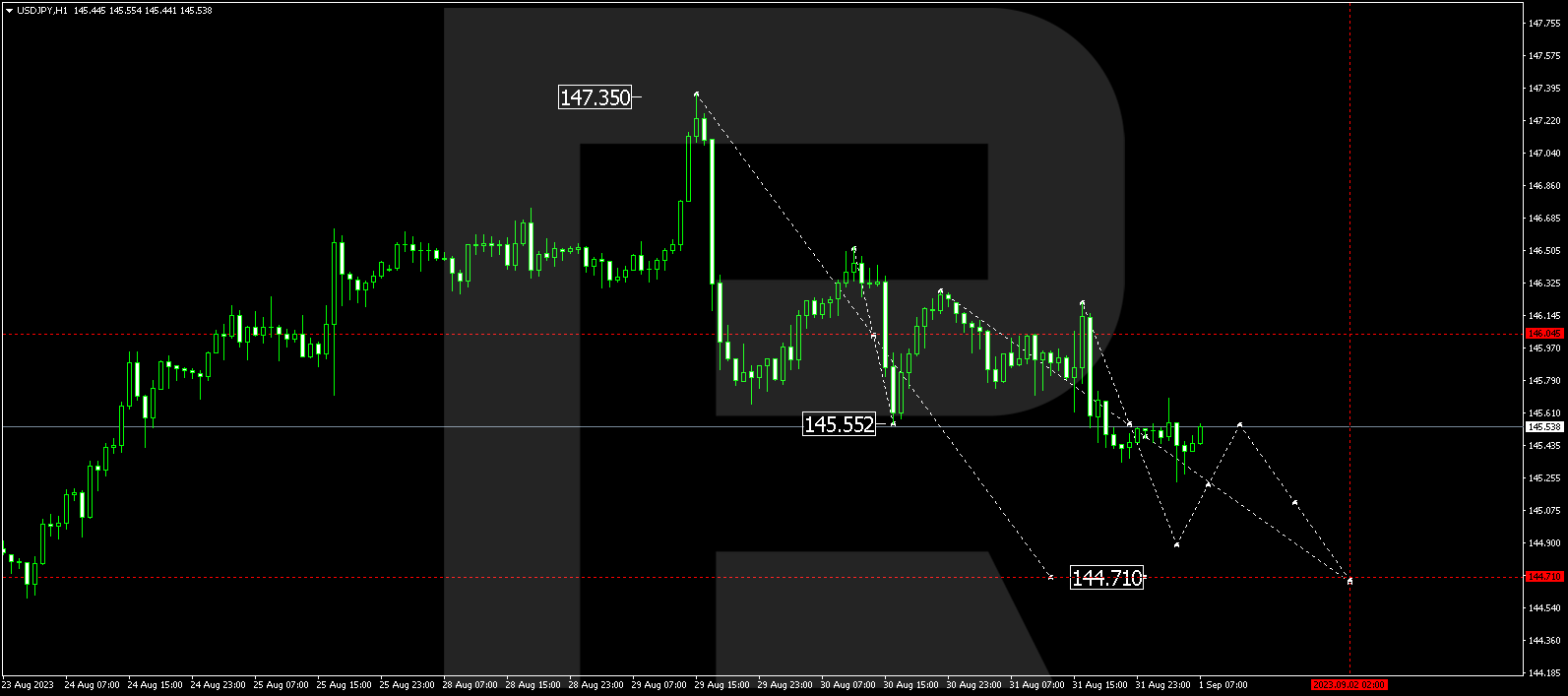

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a structure of decline to the 145.45 level. Today the market is forming a narrow consolidation range around this level. A downward breakout is expected with the wave continuing to 144.70

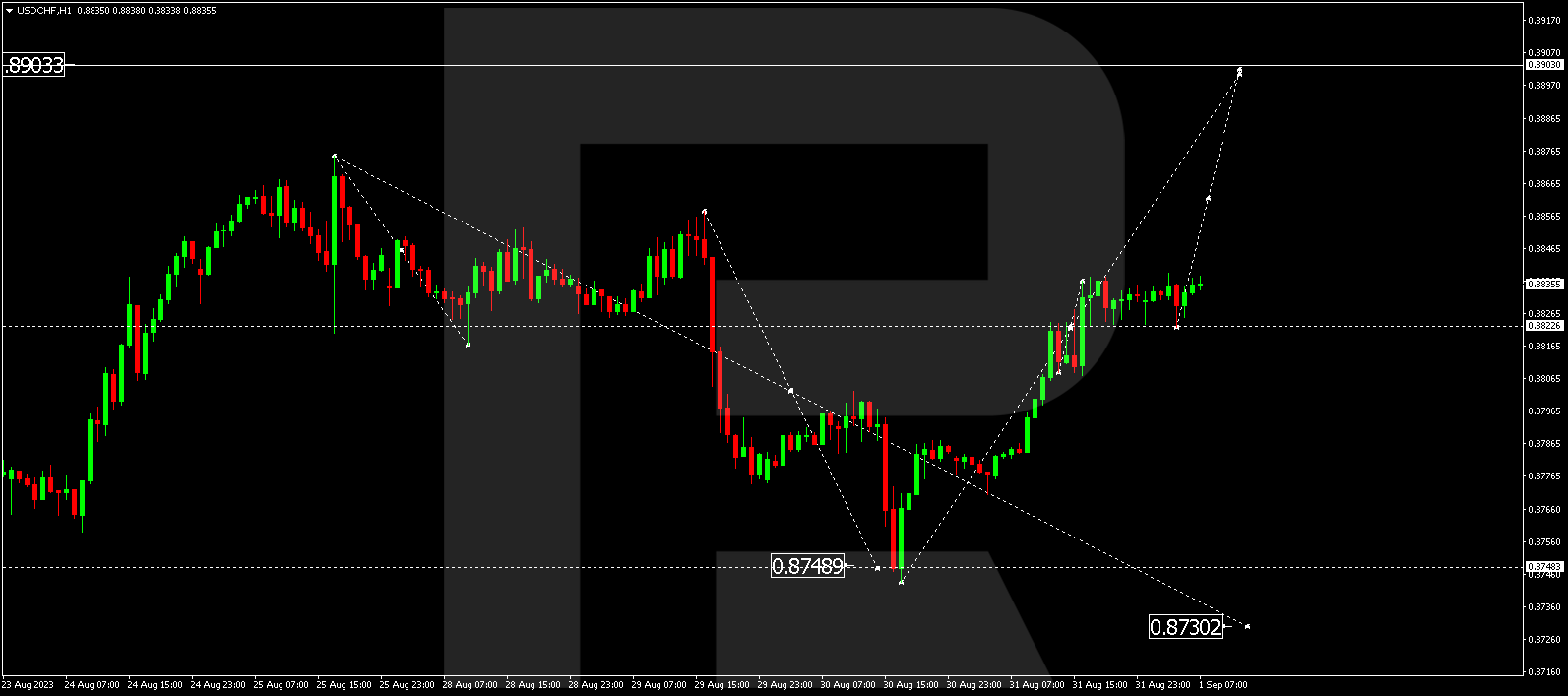

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed a wave of growth to the 0.8828 level. Today a consolidation range could develop around this level. With a downward breakout, a link of decline to 0.8787 could follow. An upward breakout will open the potential for a movement to 0.8900. This is the first target.

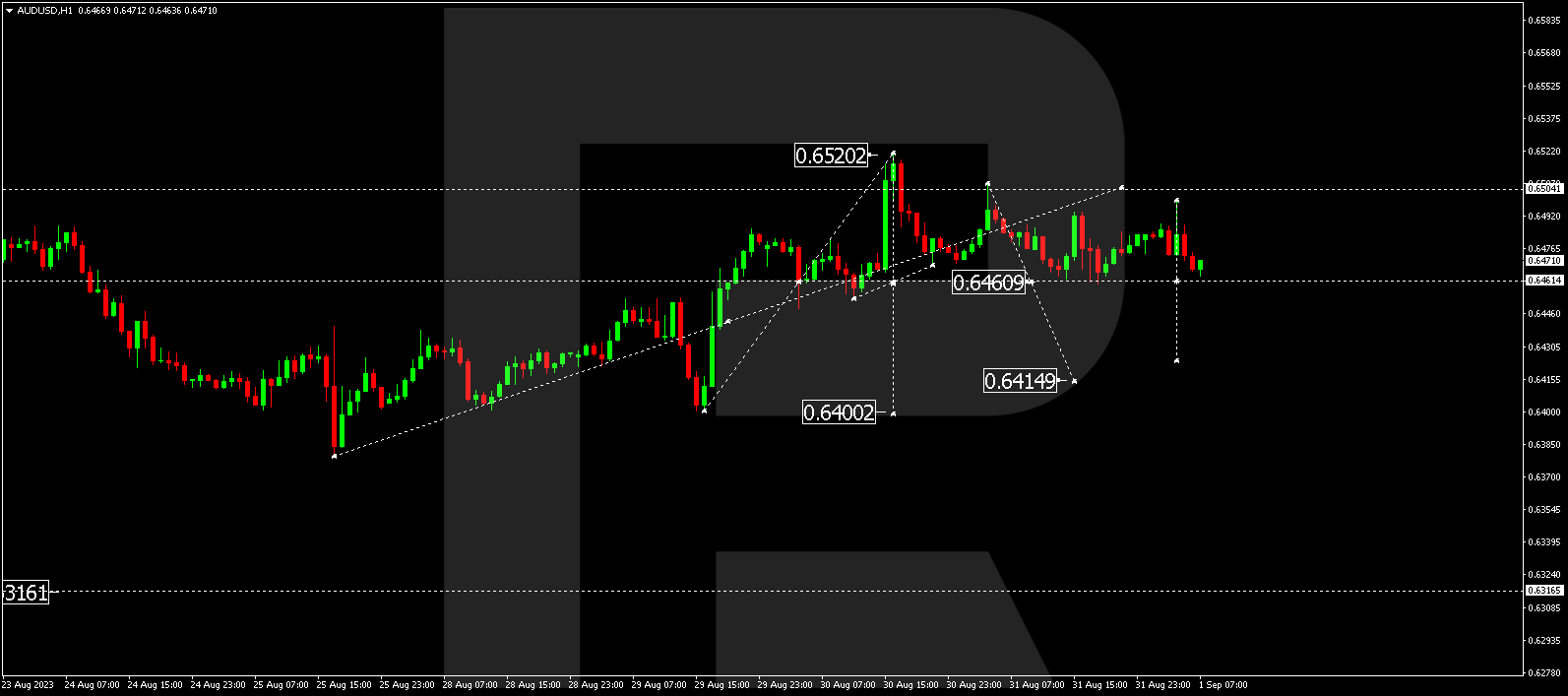

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD continues to develop a consolidation range around the 0.6460 level. With a downward breakout, a new wave of decline to 0.6414 could follow with the trend potentially developing to the 0.6316 level. This is a local target.

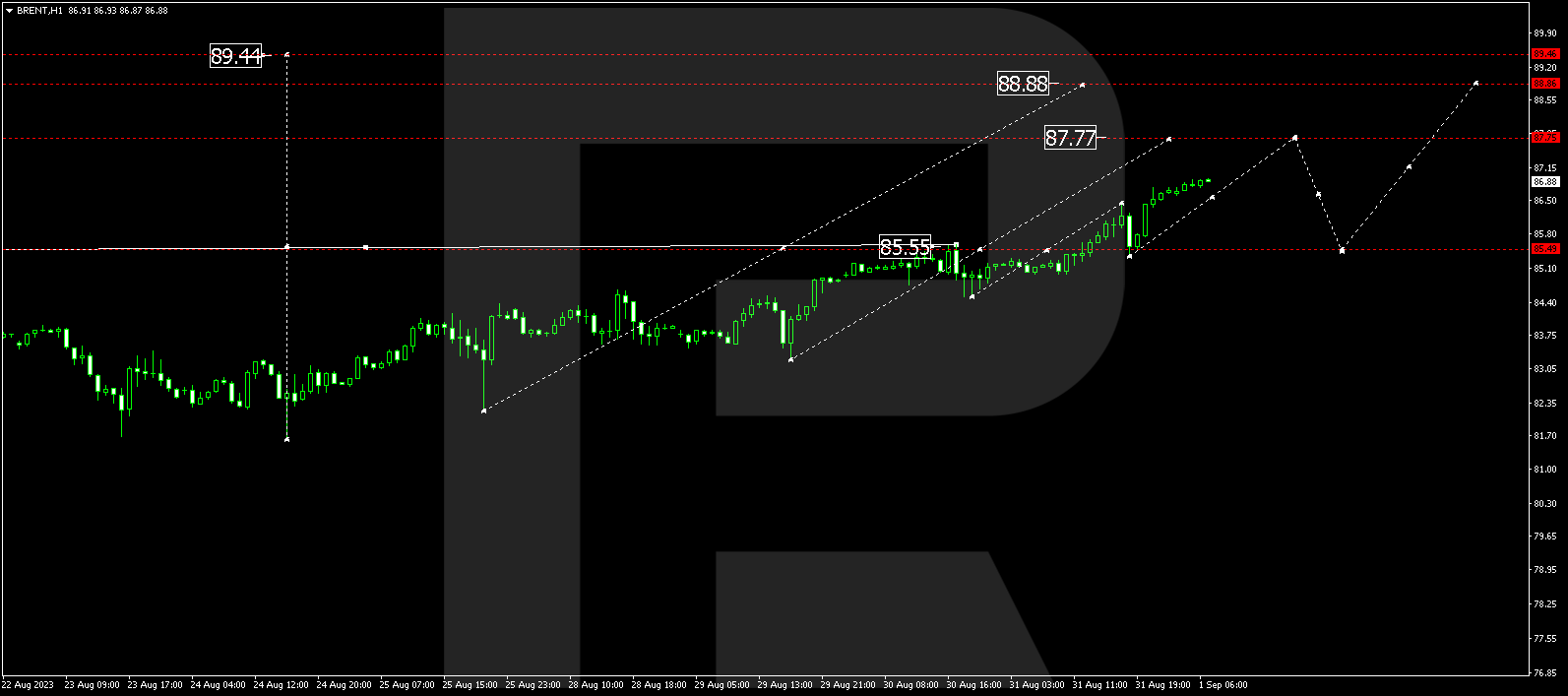

BRENT

Brent has received support at the 85.55 level and continues its upward movement to 87.77. Once the price hits this level, a link of correction to 85.55 could develop (a test from above), followed by growth to 88.88, from where the trend could continue to 89.50.

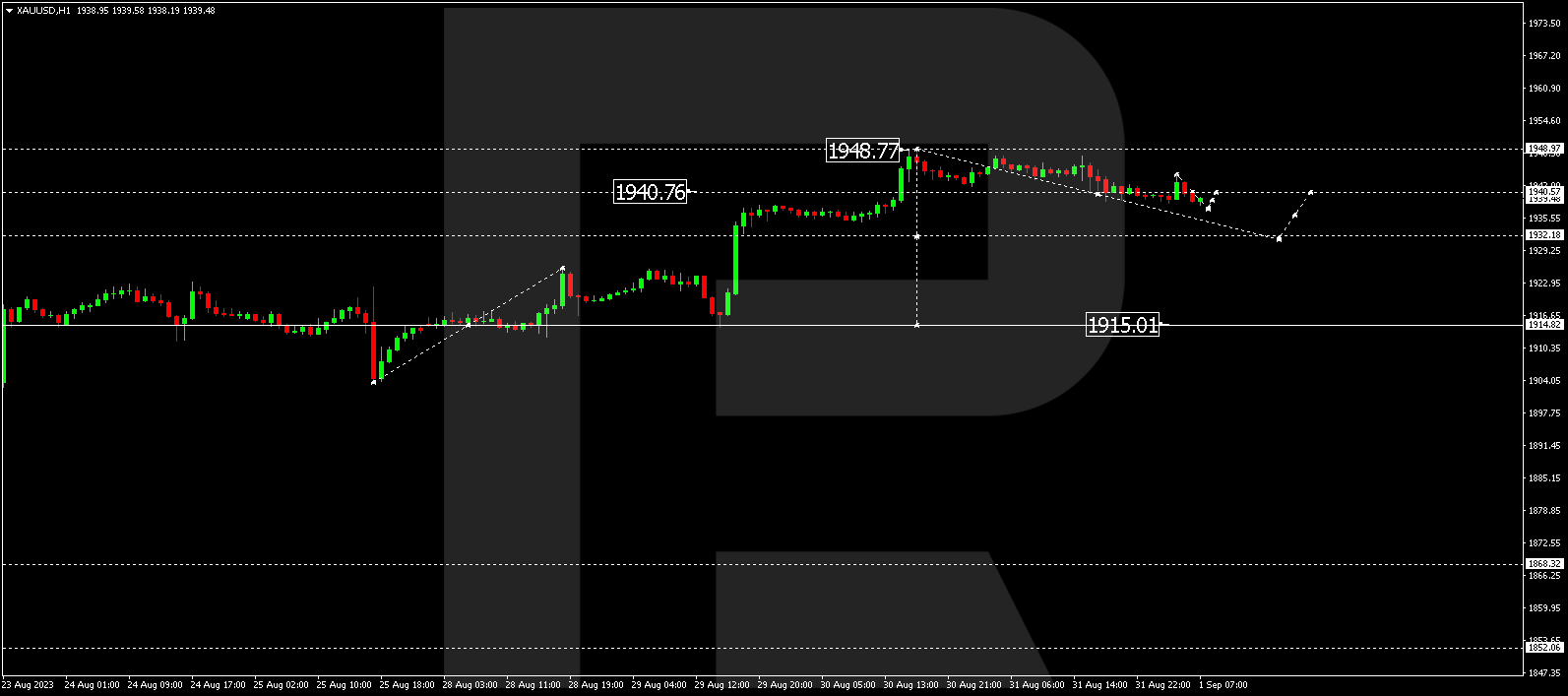

XAUUSD, “Gold vs US Dollar”

Gold has completed a wave of growth to the 1948.00 level. Today the market started to develop a wave of decline and made a movement to 1940.55, forming a consolidation range around this level. A downward breakout to 1932.20 is expected next, followed by a link of correction to 1940.00. Then the price could continue its movement by the trend to 1915.00.

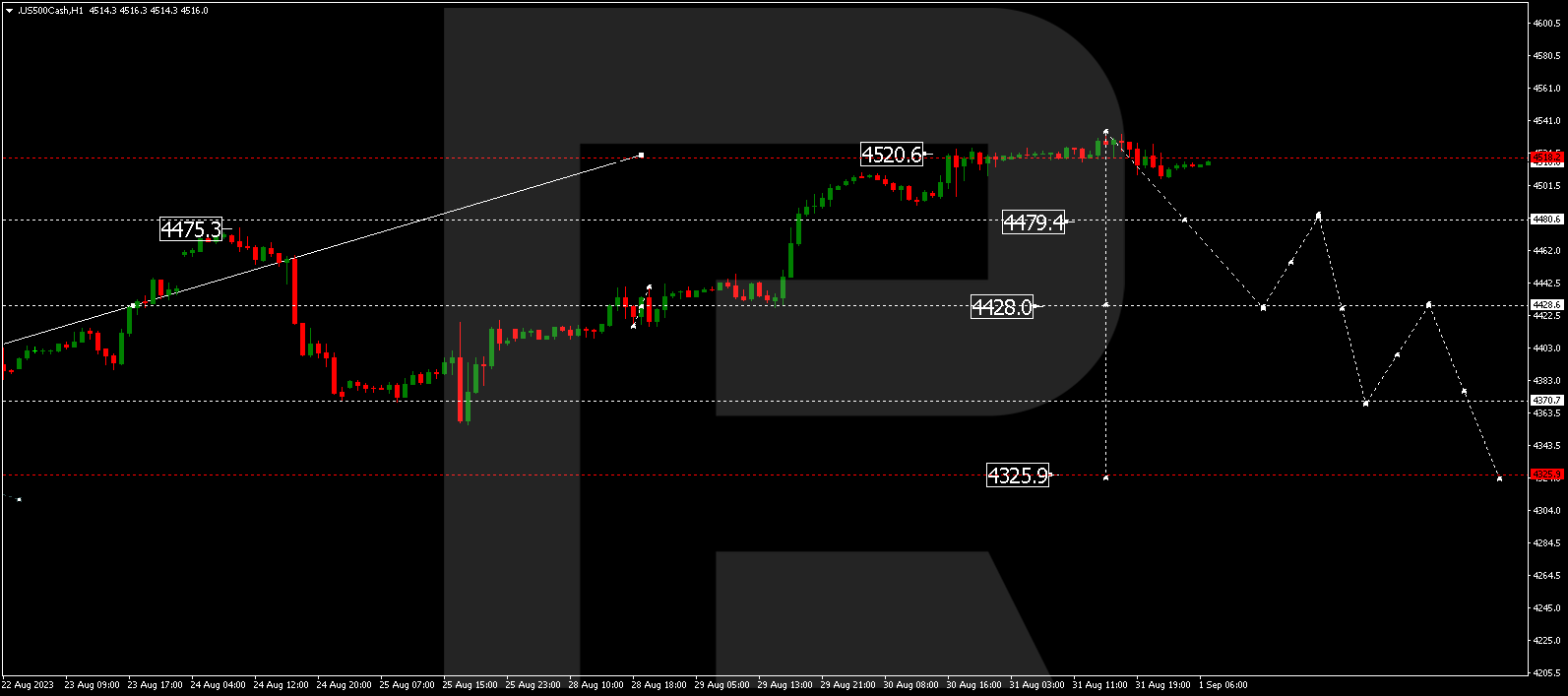

S&P 500

The stock index is forming a consolidation range around the 4518.0 level. With a downward breakout of the range, a new wave of decline to 4428.0 could follow with the trend potentially developing to 4370.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.