Forex Technical Analysis 2012/01/03 (EUR/USD, EUR/GBP, USD/JPY, AUD/USD) Forecast FX

29.02.2012

Forecast for March 1st, 2012

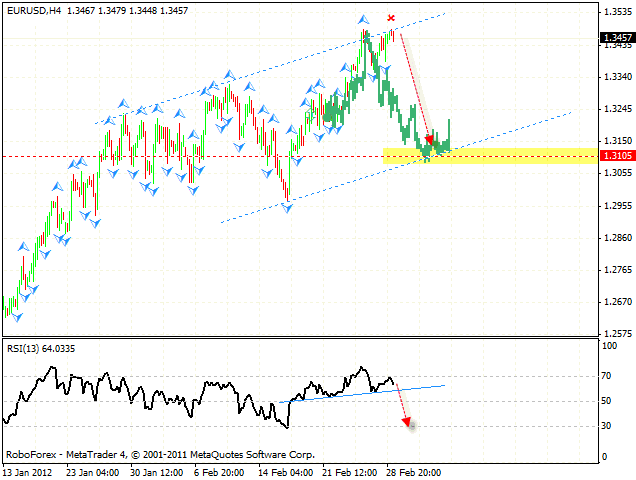

EUR/USD

Although the EUR/USD currency pair reached the closest targets of the fall, it didn’t continue moving downwards. Currently the pair is testing local maximums. At the RSI we can see the formation of “head & shoulders” reversal pattern. We should expect Euro to fall from the current levels, the target of the fall is the area of 1.3105. One can consider selling the pair with the tight stop. If the price breaks the descending channel’s upper border, this case scenario will be cancelled.

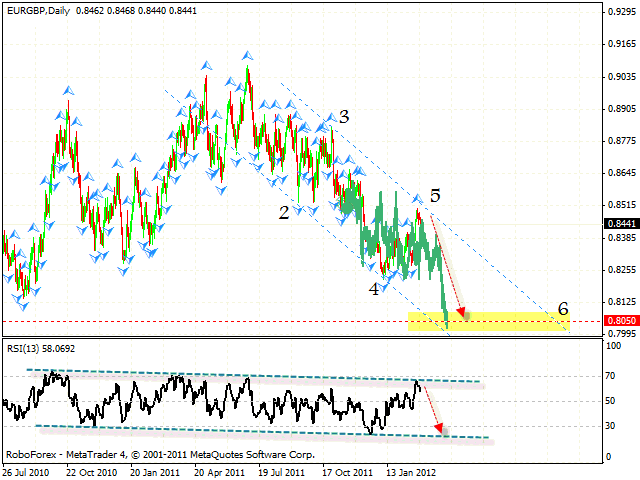

EUR/GBP

In general, the fall of Euro may be connected with the descending movement of the EUR/GBP currency pair. The price is forming a descending symmetrical pattern with the target in the area of 0.8050. By now, the pair has already defined the area of the 5th pivot point, we should expect it to start falling down from the current levels. The test of the trend’s descending line at the RSI is an additional signal to sell the pair. If the price breaks the descending channel’s upper border, this case scenario will be cancelled.

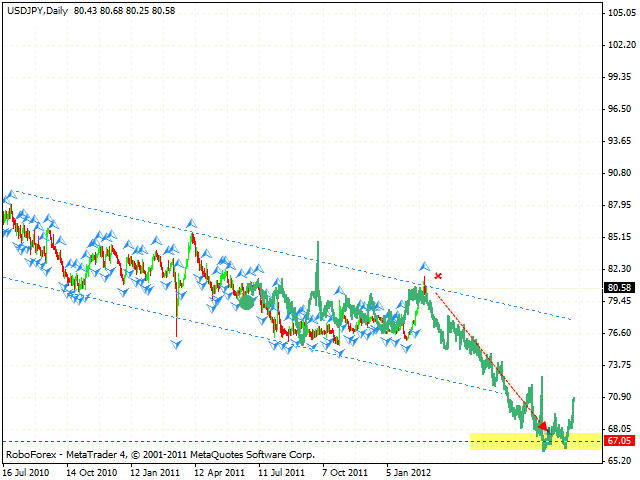

USD/JPY

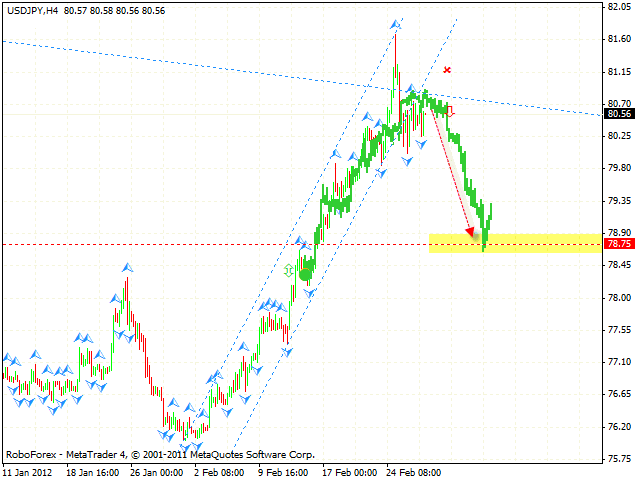

The prospects of the USD/JPY currency pair also indicate that the price is going to move downwards. The target of the fall is the area of 67.05. Currently the price is testing the descending channel’s upper border, one can consider selling the pair with the tight stop. However, in order to enter the market, one should wait for signals at shorter time frames.

At the H4 chart, the price left the rising channel. One can consider selling the pair with the tight stop above 81.15 and increase the amount of sales only after the price breaks the level of 80.00.

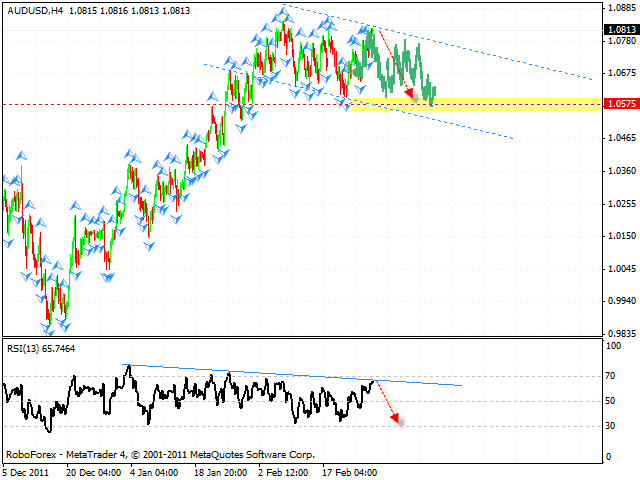

AUD/USD

Australian Dollar continues testing maximums. The RSI indicator faced the resistance from the trend’s descending line, we should expect a rebound from the current levels. One can consider selling the AUD/USD currency pair with the tight stop. The target of the fall is the area of 1.0575.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.