Forex Technical Analysis & Forecast 05.10.2021

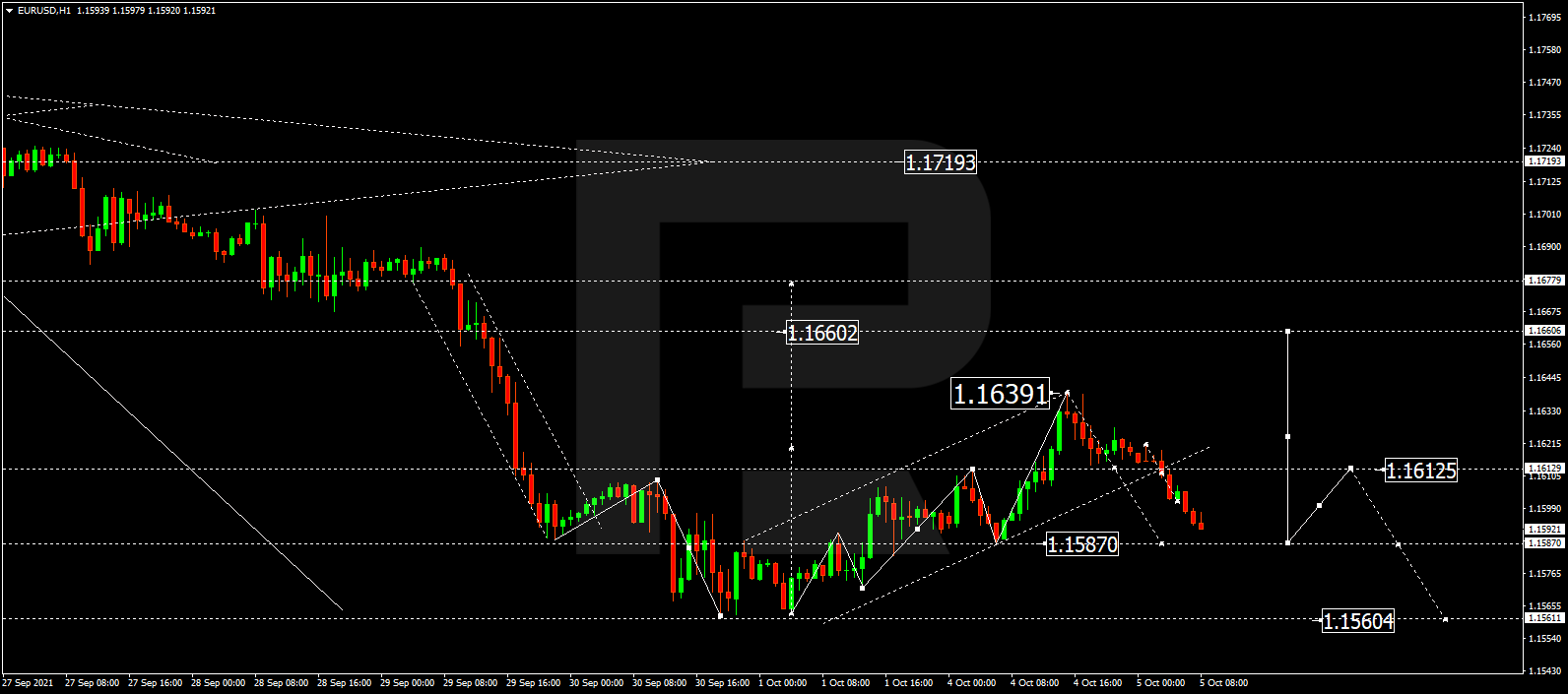

EURUSD, “Euro vs US Dollar”

After completing the ascending structure at 1.1639, EURUSD is correcting downwards to reach 1.1587. Later, the market may resume trading upwards with the target at 1.1660.

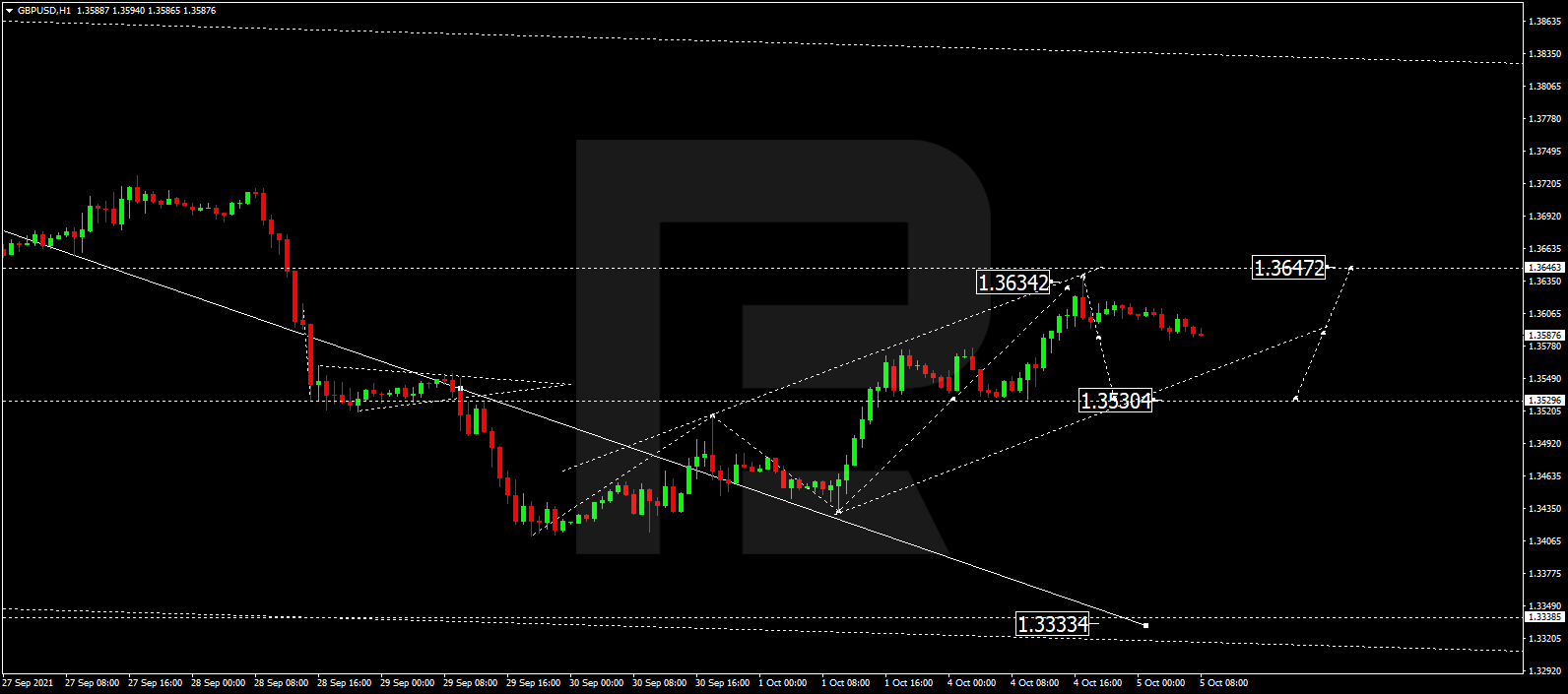

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has finished the ascending structure at 1.3634. Possibly, today the pair may start another decline to reach 1.3530 and then form one more ascending structure towards 1.3647. Later, the market may resume trading downwards with the target at 1.3530.

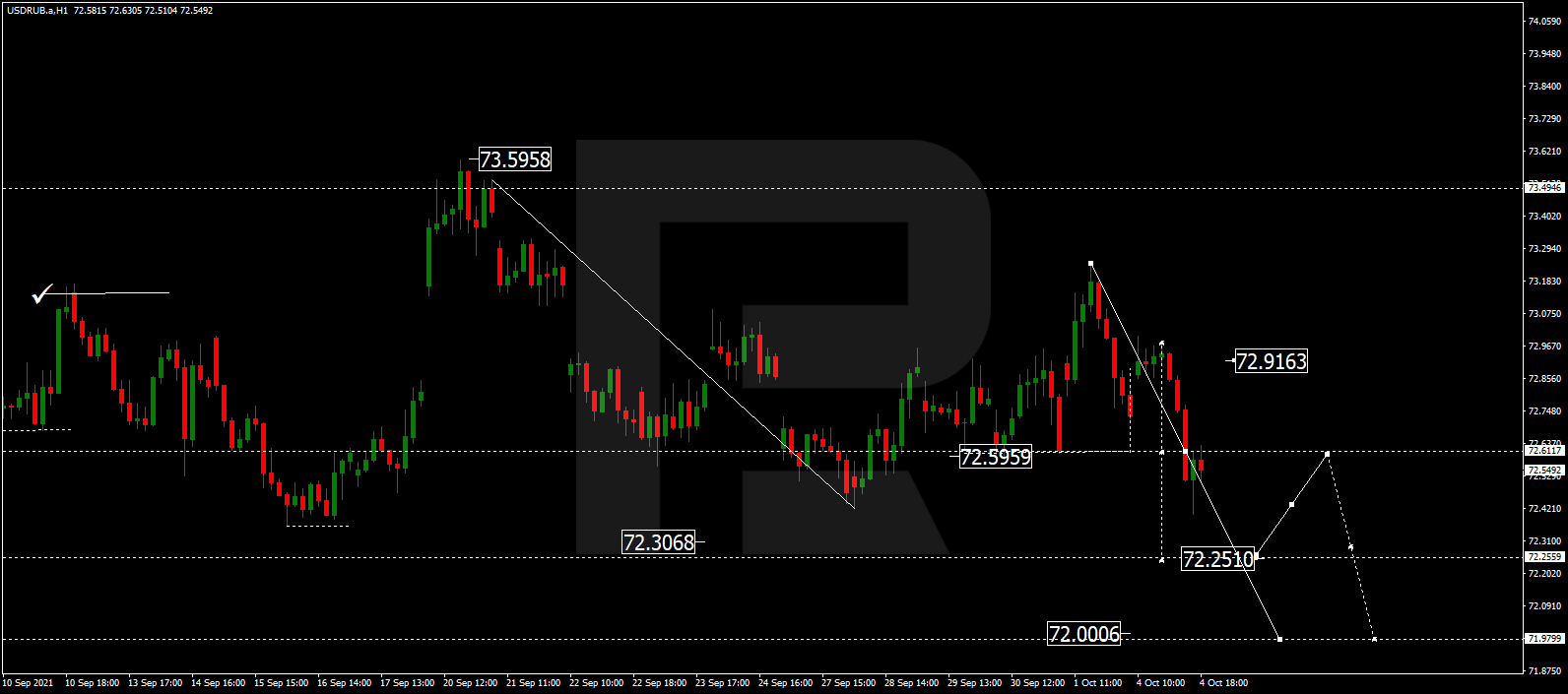

USDRUB, “US Dollar vs Russian Ruble”

After breaking 72.60 to the downside, USDRUB is expected to fall and reach 72.25. After that, the instrument may grow to test 72.61 from below and then resume trading downwards with the target at 72.00.

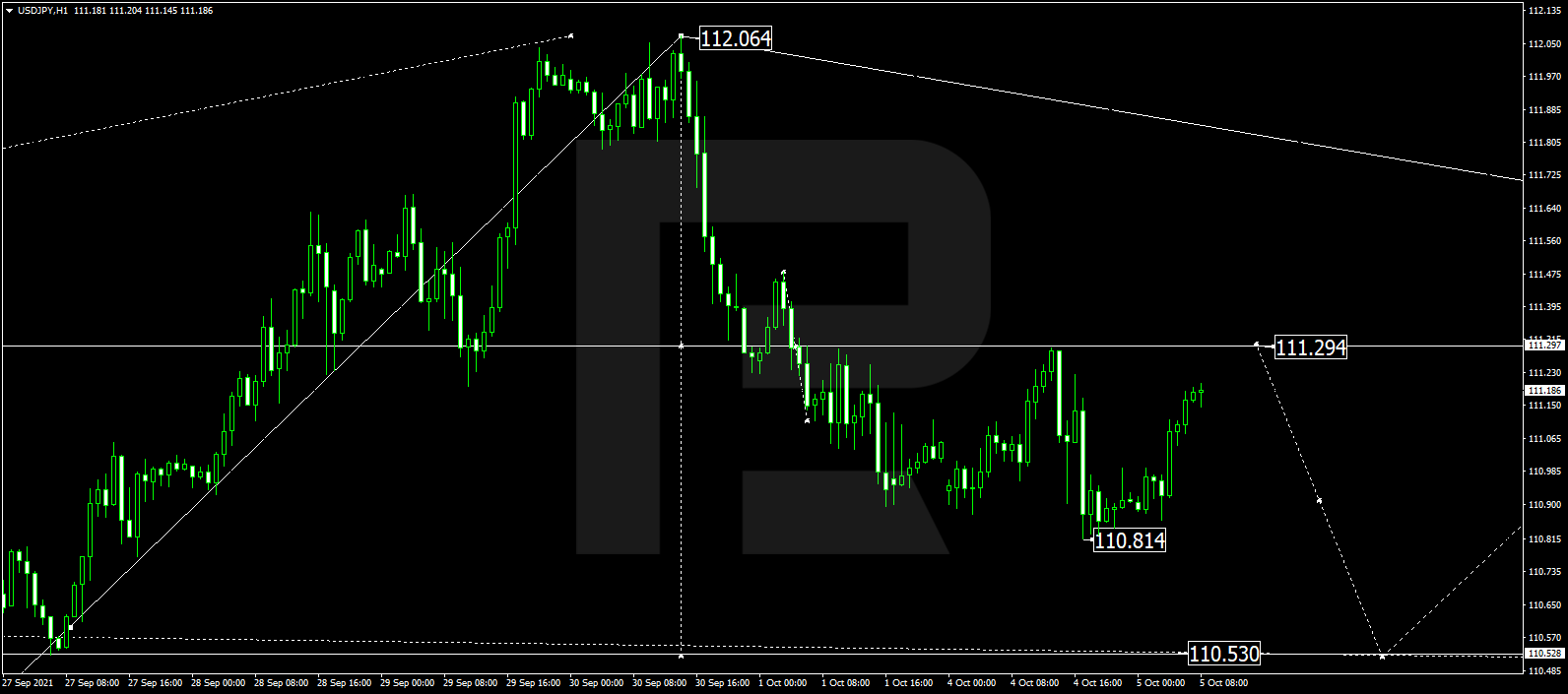

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is still consolidating below 111.29. Today, the pair may resume falling to reach 110.53 and then start a new correction with the target at 111.29.

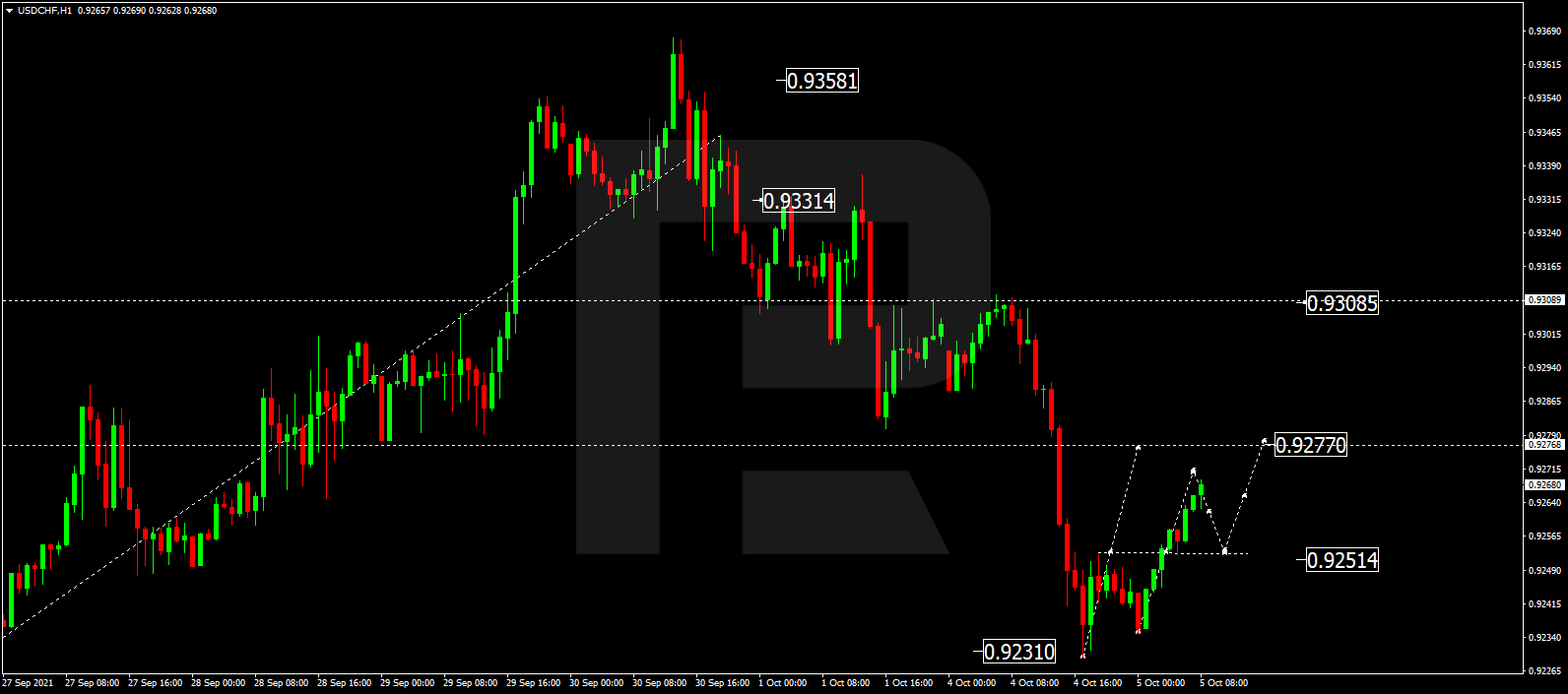

USDCHF, “US Dollar vs Swiss Franc”

After rebounding from 0.9308 to the downside, USDCHF has finished another descending structure at 0.9231; right now, it is correcting upwards. Possibly, the pair may form one more ascending structure towards 0.9277 and then start a new decline with the target at 0.9251.

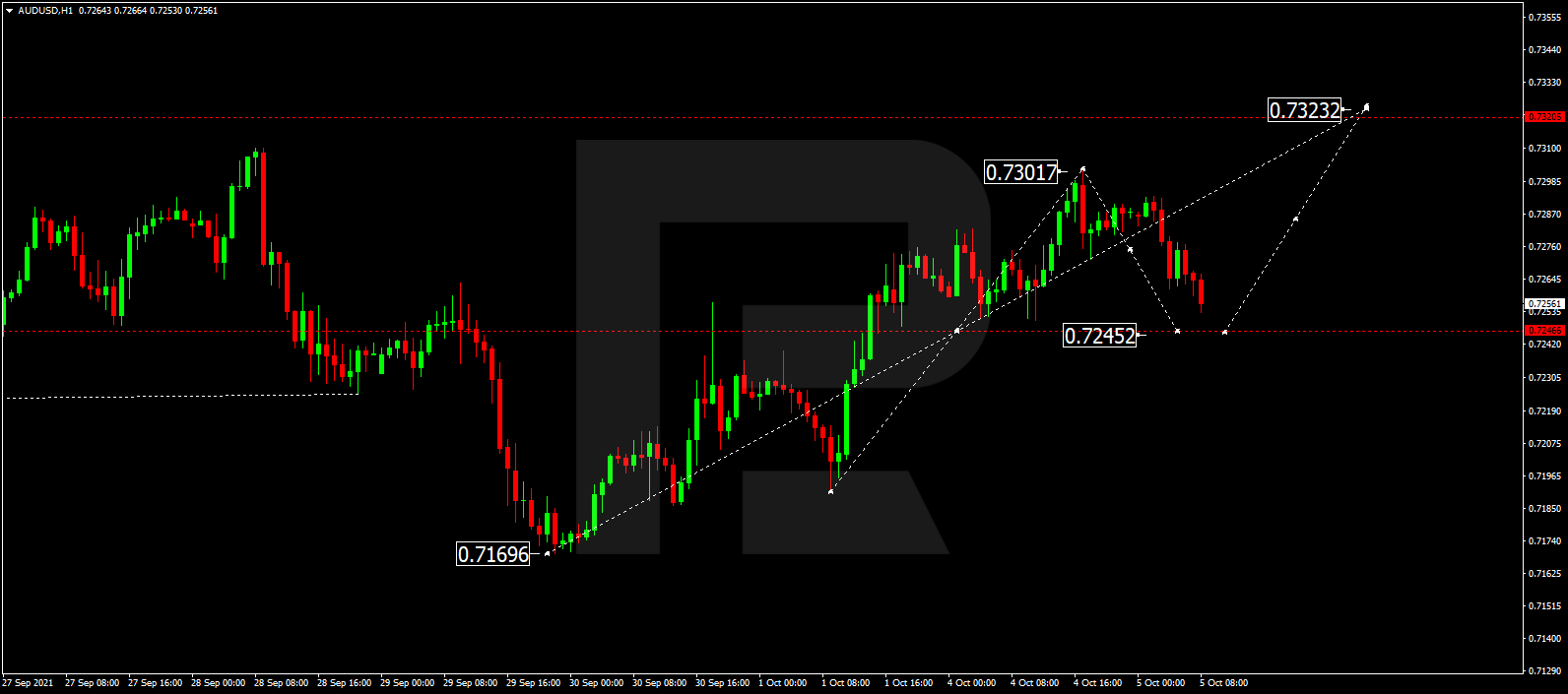

AUDUSD, “Australian Dollar vs US Dollar”

After completing the ascending structure at 0.7301, AUDUSD is trading downwards to reach 0.7245. Later, the market may start another growth to reach 0.7323 and then resume moving within the downtrend with the target at 0.7245.

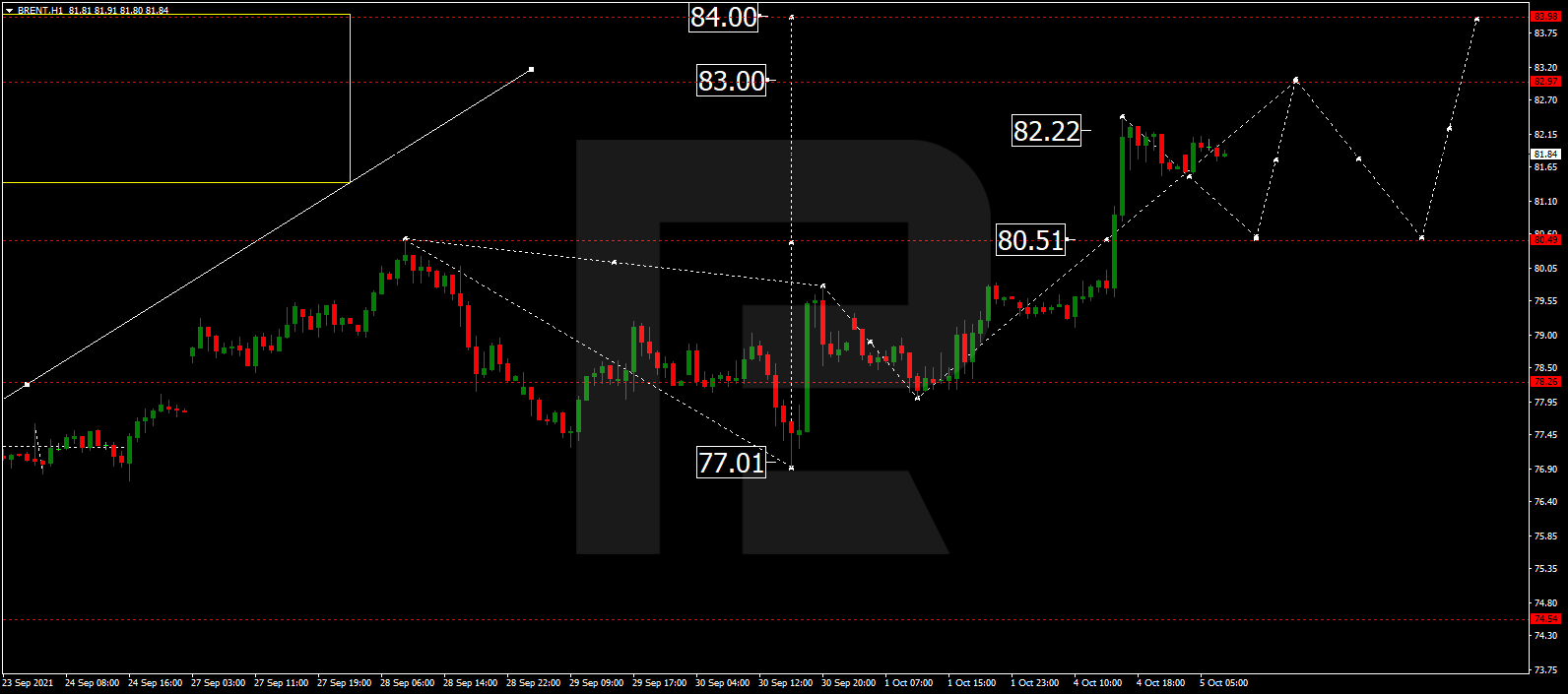

BRENT

After finishing the ascending structure at 82.22, Brent is expected to consolidate below this level. If later the price breaks this range to the upside, the market may grow to reach 83.00 and then correct to test 80.50 from above. After that, the instrument may resume trading upwards with the target at 84.00.

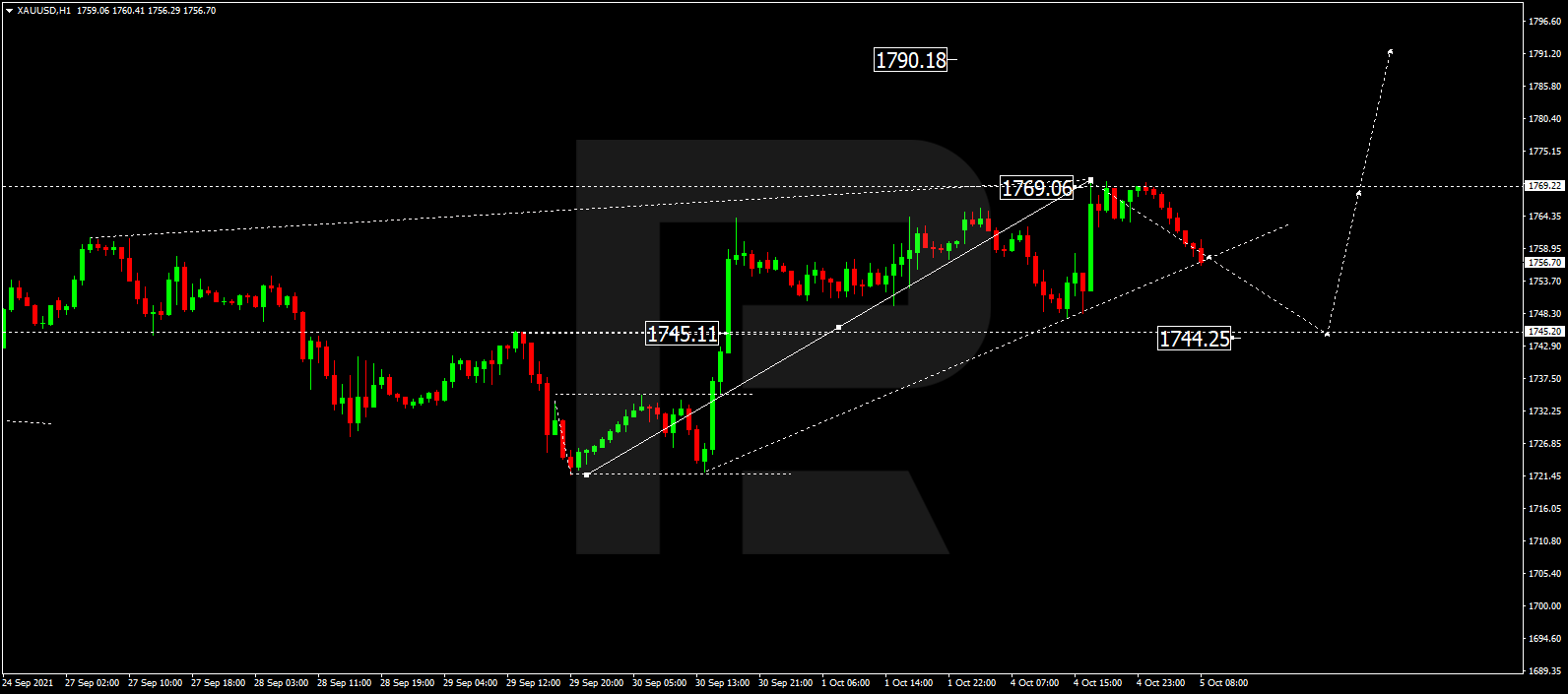

XAUUSD, “Gold vs US Dollar”

After completing the ascending wave at 1769.06, Gold is correcting downwards to reach 1744.25. After that, the instrument may form one more ascending structure with the target at 1790.18.

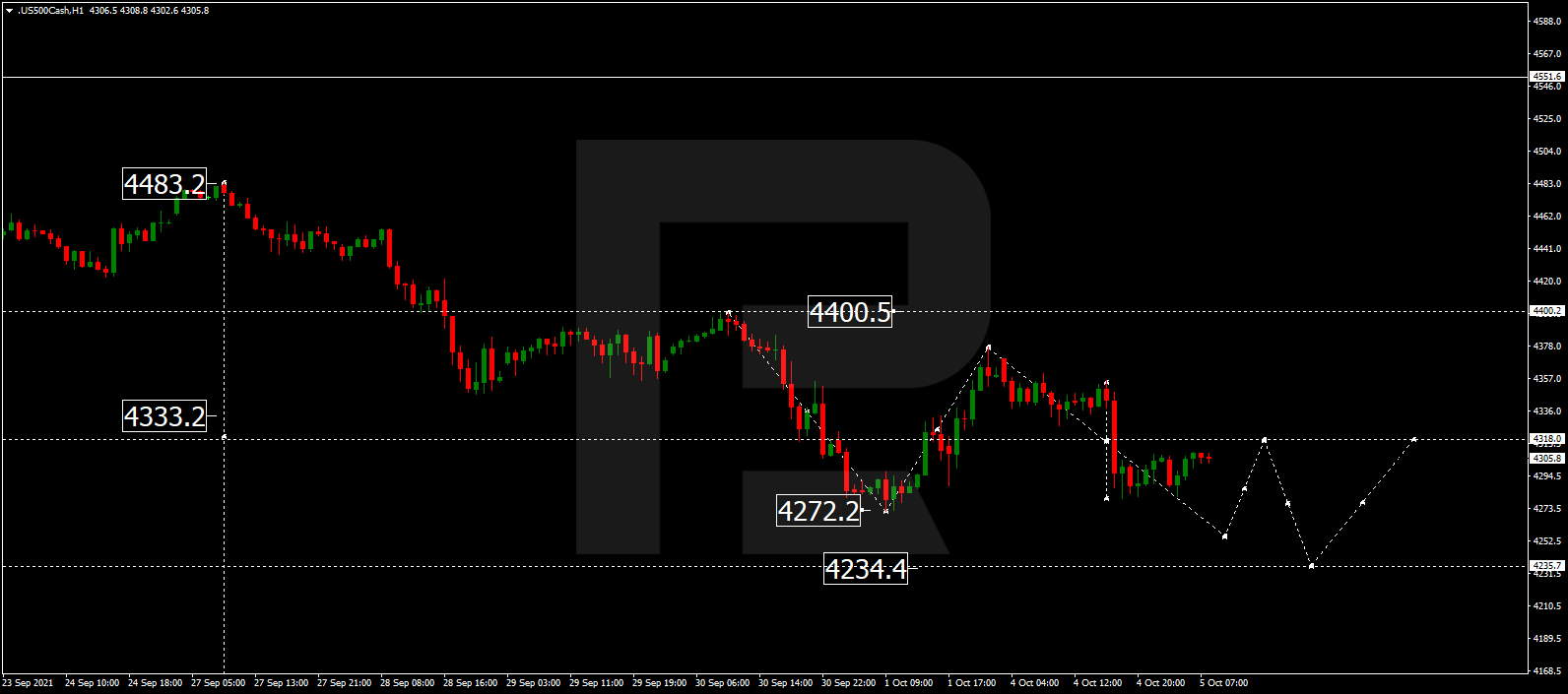

S&P 500

After completing the descending structure at 4333.3 and breaking this level to the downside, the S&P index is expected to continue falling. Possibly, today the asset may reach 4234.4 and then correct to test 4333.3 from below. Later, the market may resume trading downwards with the target at 4158.3

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.