Technical Analysis & Forecast 09.06.2023

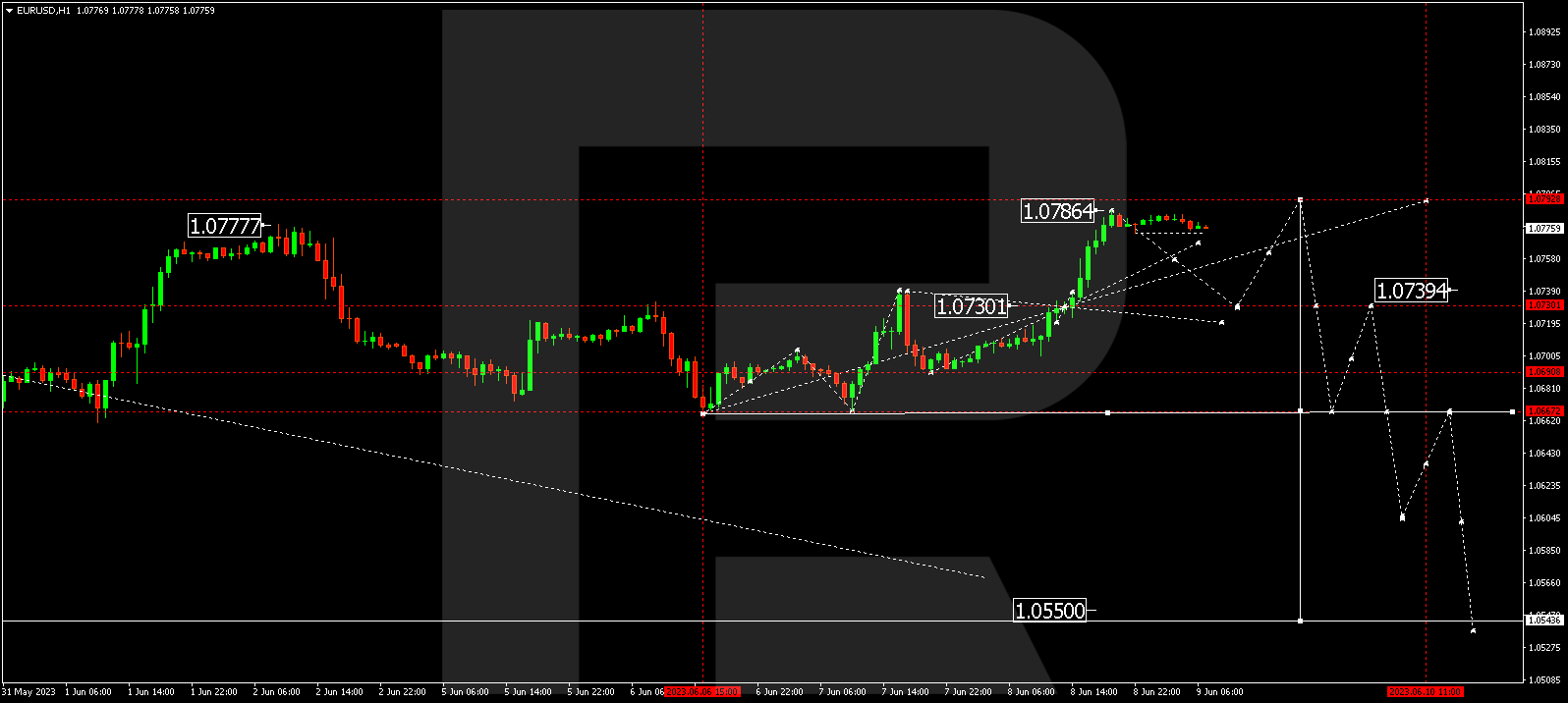

EURUSD, “Euro vs US Dollar”

The currency pair has formed a consolidation range around the 1.0730 level and, exiting it upwards, continued developing a wave of correction. Today, the market reached the 1.0786 level. A narrow consolidation range is expected to form at these highs. With an exit downwards, a link of decline to the 1.0730 level (test from above) could follow. Another pattern of growth to the 1.0793 level could develop next, followed by a decline by the trend to the 1.0660 level.

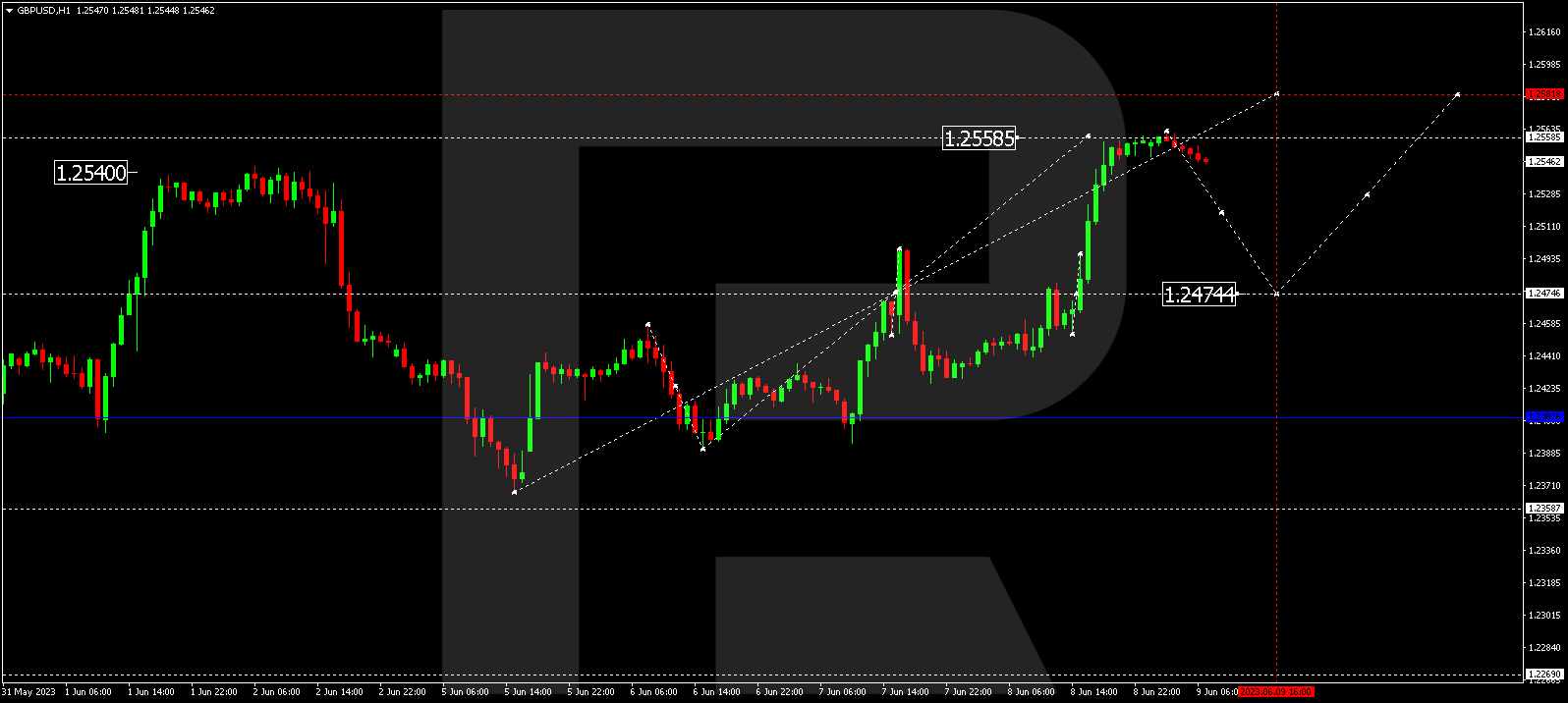

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has formed a consolidation range around the 1.2474 level and, exiting it upwards, reached the 1.2555 level. A consolidation range could develop at the current highs. With an exit downwards, a tie of decline to the 1.2474 level (test from above) is expected, followed by another link of growth to the 1.2580 level. Next, the price could decline to the 1.2350 level.

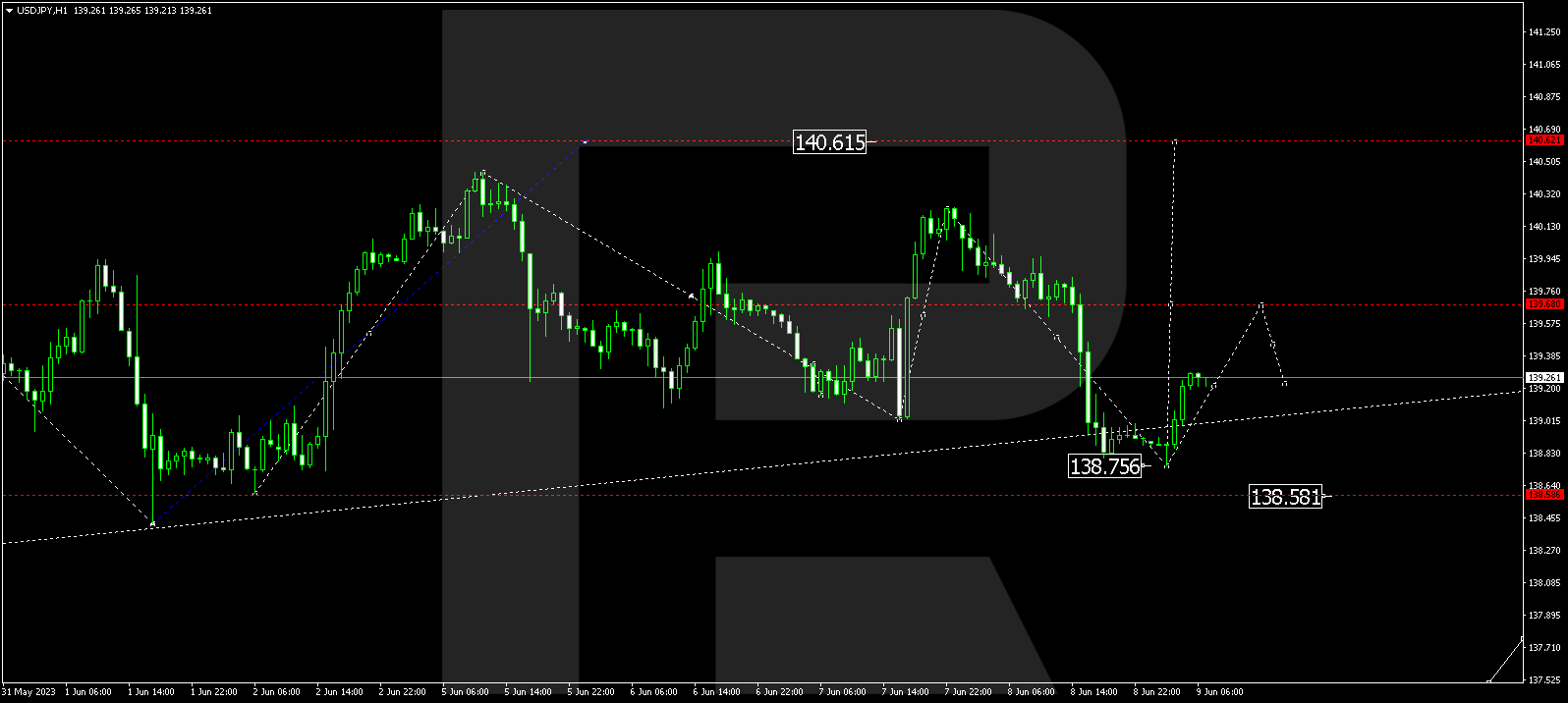

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has extended a consolidation range down to the 138.75 level. Today, the market is forming a link of growth to the 139.68 level (test from below). A decline to the 139.20 level could follow next. The market is continuing to develop a consolidation range around the 139.68 level. A breakout upwards will open the potential for growth to the 140.66 level, while a breakout downwards will open the potential for a wave of decline to the 137.77 level.

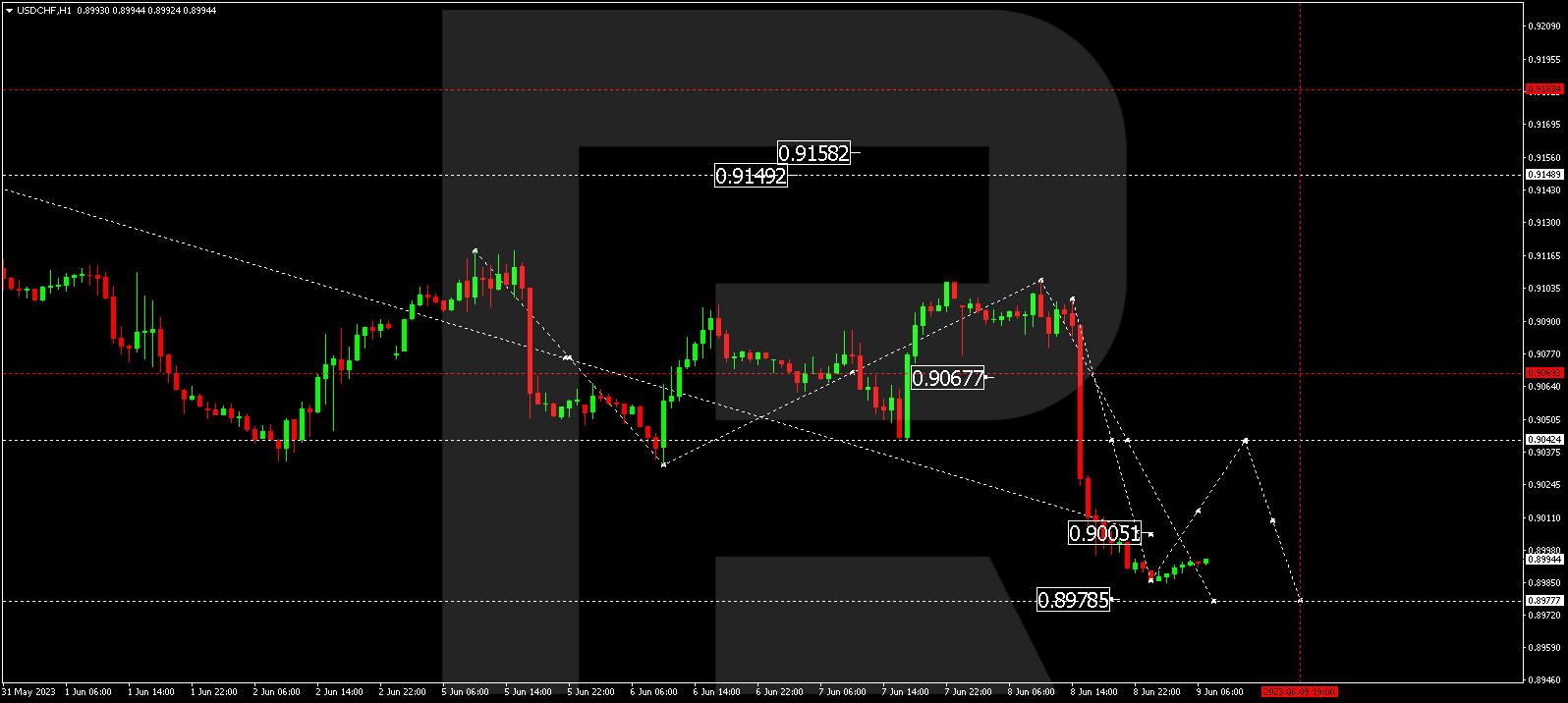

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has broken a consolidation range down and reached the 0.8989 level. A link of growth to the 0.9044 level (test from below) could follow. Another structure of decline to the 0.8978 level could develop next, followed by growth to the 0.9150 level.

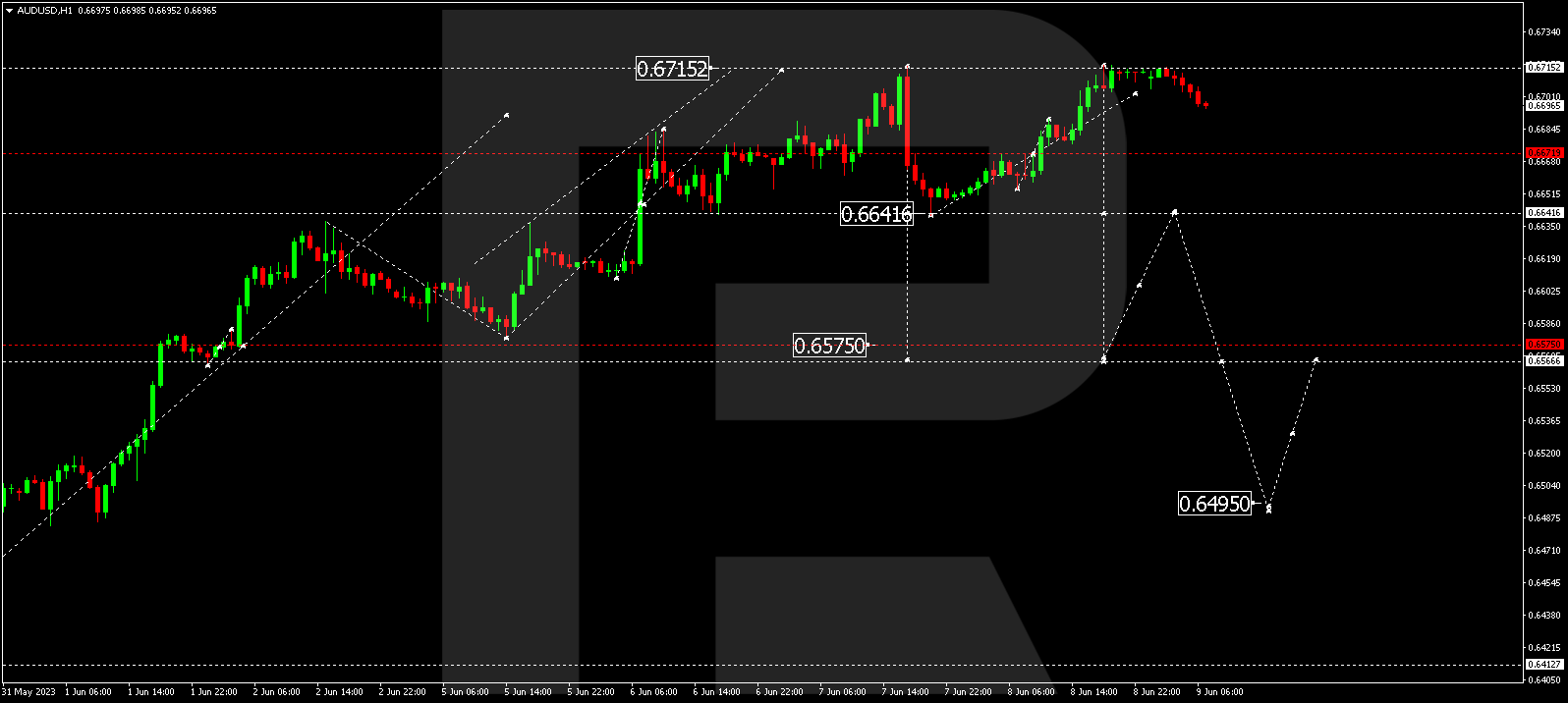

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair continues forming a consolidation range around the 0.6672 level. A tie of growth to the 0.6715 level is now completed. Today, a tie of decline to the 0.6642 level is expected, followed by growth to the 0.6672 level (test from below). An exit from this range downwards will open the potential for a wave of decline to the 0.6555 level.

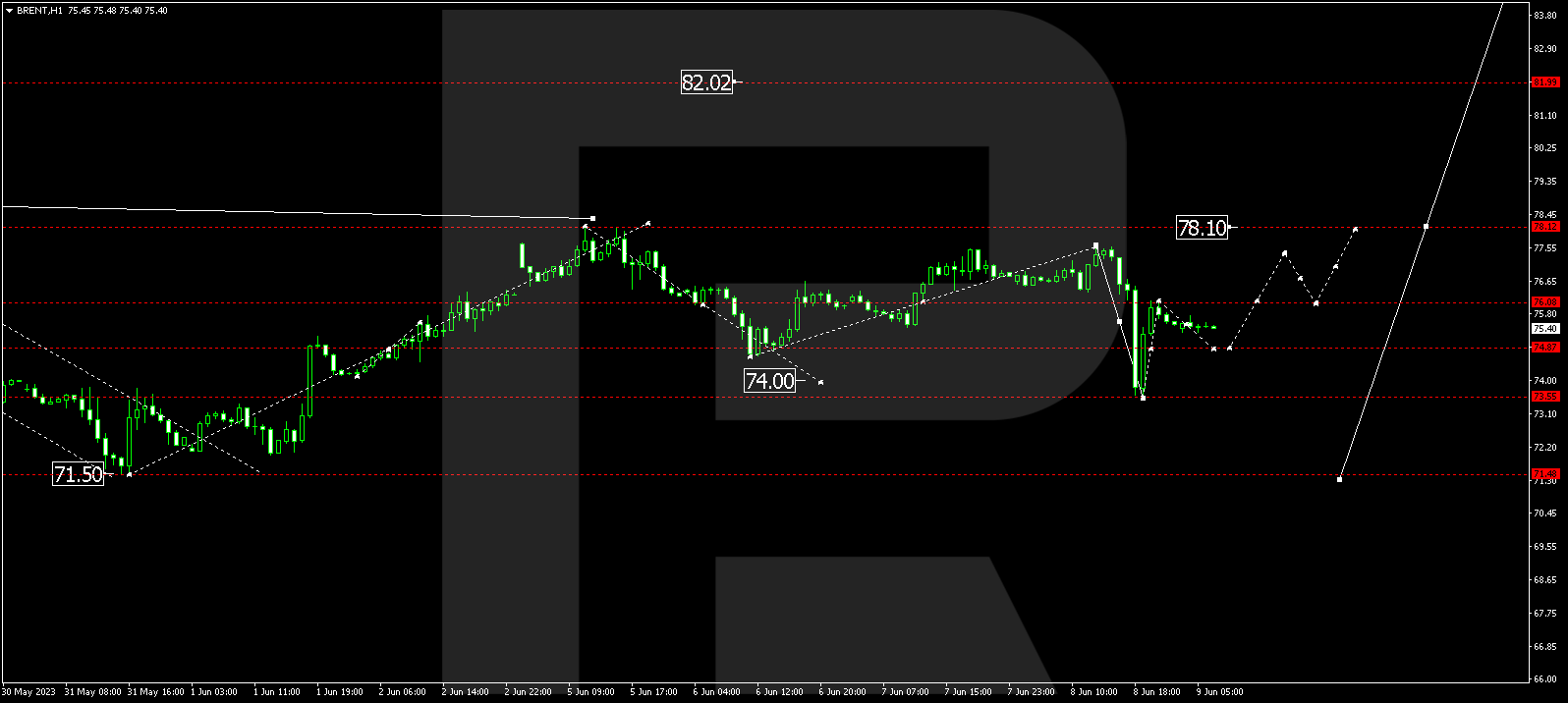

BRENT

Brent has completed a wave of correction to the 73.55 level. Today, the market completed a growth momentum to the 76.08 level and is now correcting this impulse to the 74.87 level. Following the completion of the correction, a wave of growth to the 78.10 level could start with the prospect of a wave continuation to the 80.20 level.

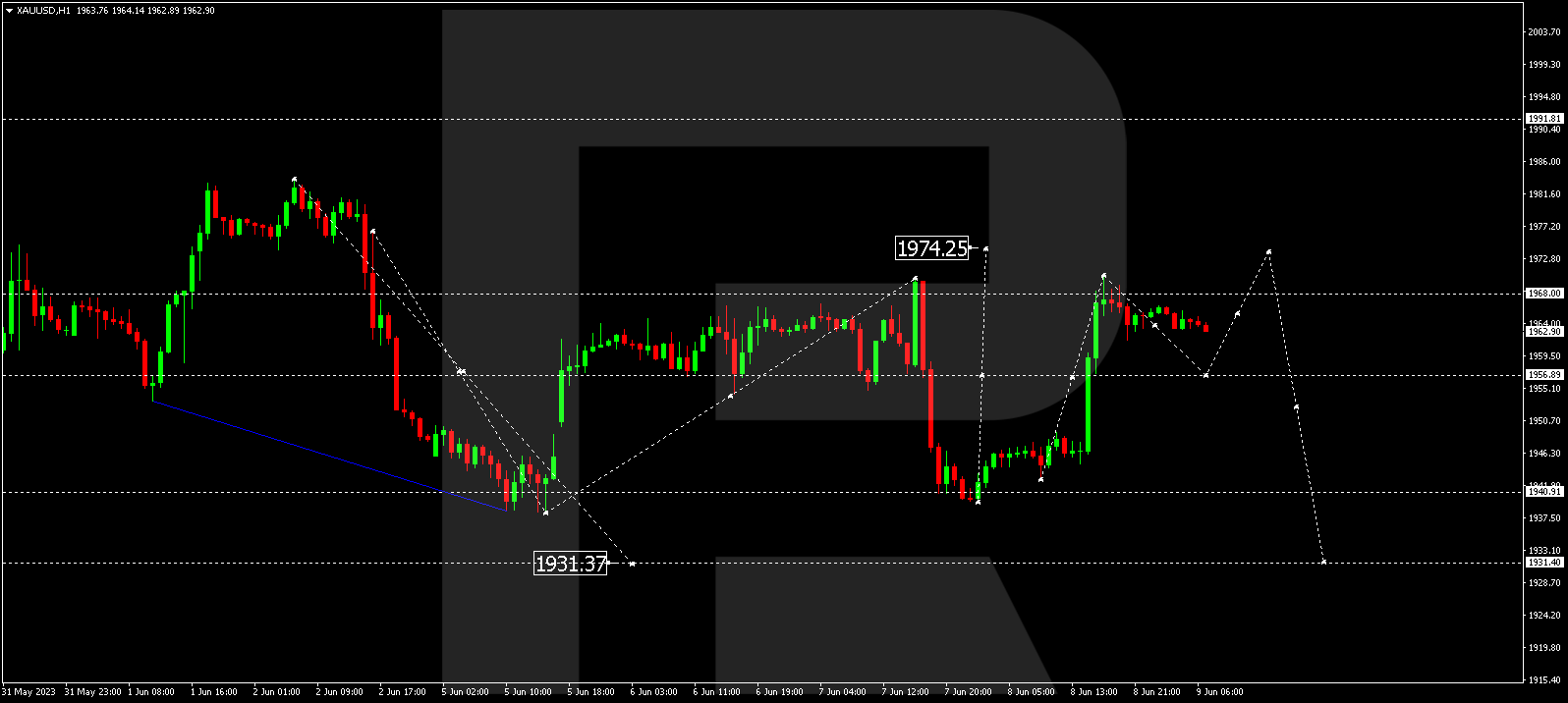

XAUUSD, “Gold vs US Dollar”

Gold continues forming a consolidation range around the 1956.90 level. Today, the range was extended down to the 1940.90 level earlier and up to the 1970.00 level. A decline to the 1956.90 level (test from above) is expected. After this level is reached, another pattern of growth to the 1974.00 level could develop. A decline by the trend to the 1931.00 level could follow next.

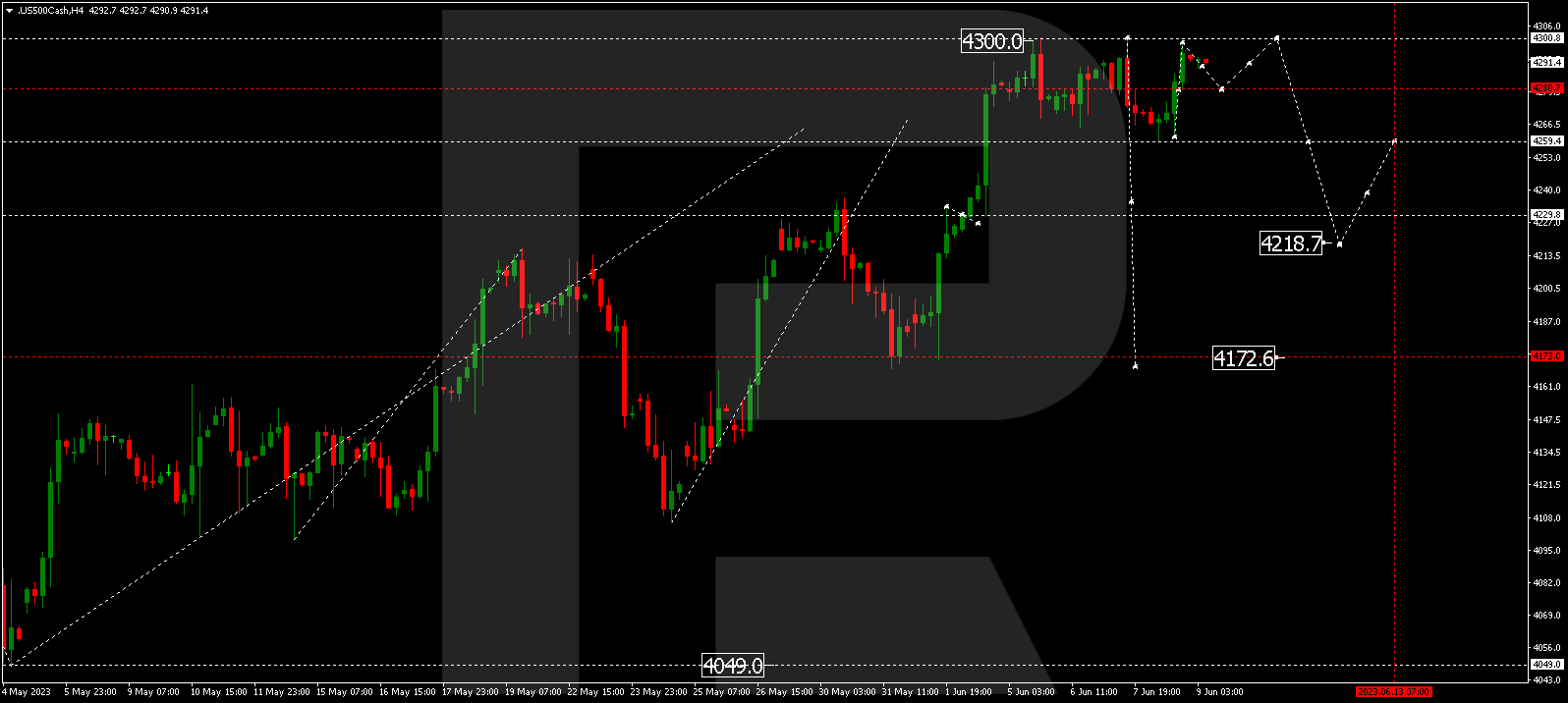

S&P 500

The stock index continues developing a consolidation range around the 4280.0 level. Today, this range could be extended upwards to the 4300.0 level, followed by a decline to the 4259.0 level. An exit from this range downwards will open the potential for a wave of decline to the 4218.0 level with the prospect of trend continuation to the 4172.0 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.