Technical Analysis & Forecast 10.03.2023

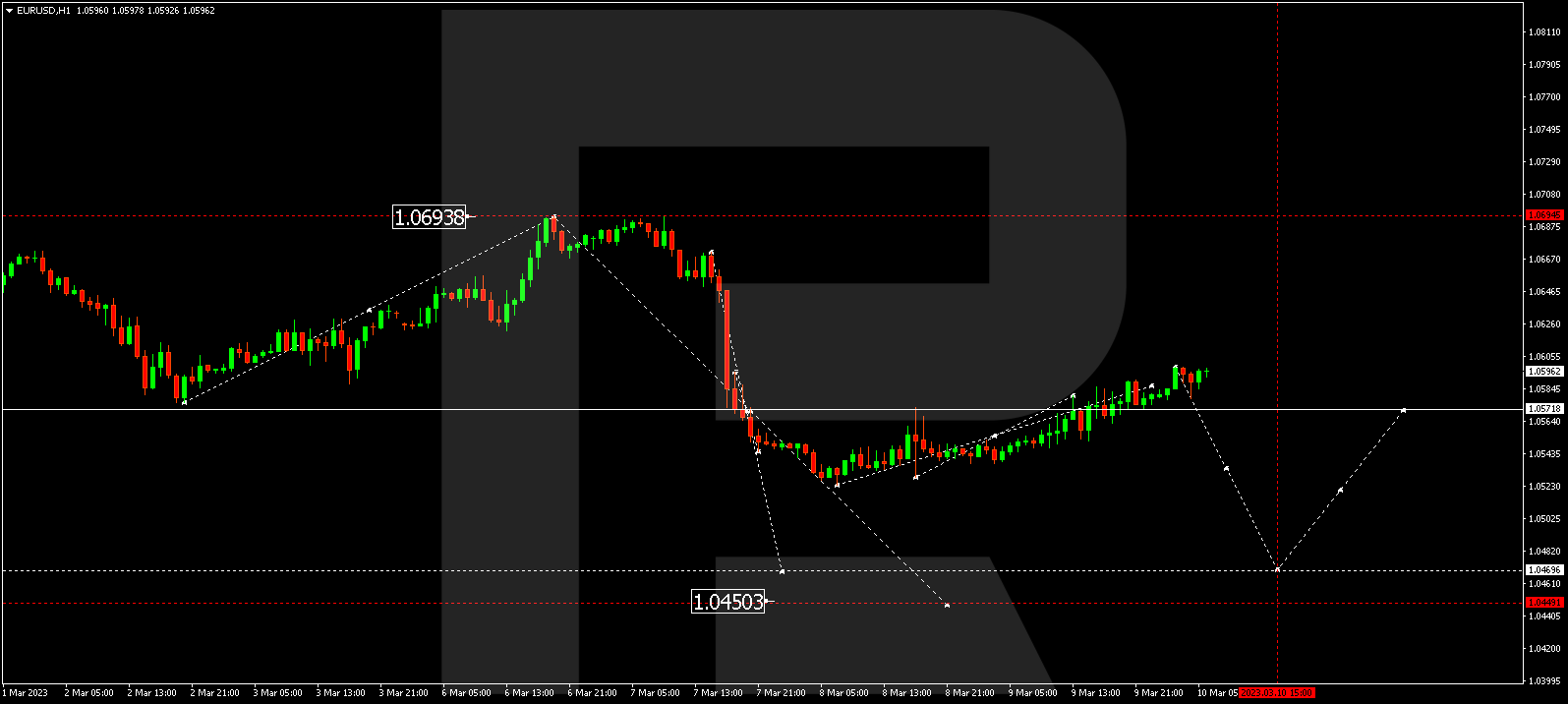

EURUSD, “Euro vs US Dollar”

The currency pair has completed a wave of correction to 1.0589. At the moment, a consolidation range is forming around this level. An escape downwards and further development of the wave to 1.0470 is expected. The target is local. After this level is reached, a link of growth to 1.0570 is not excluded, followed by a decline to 1.0450.

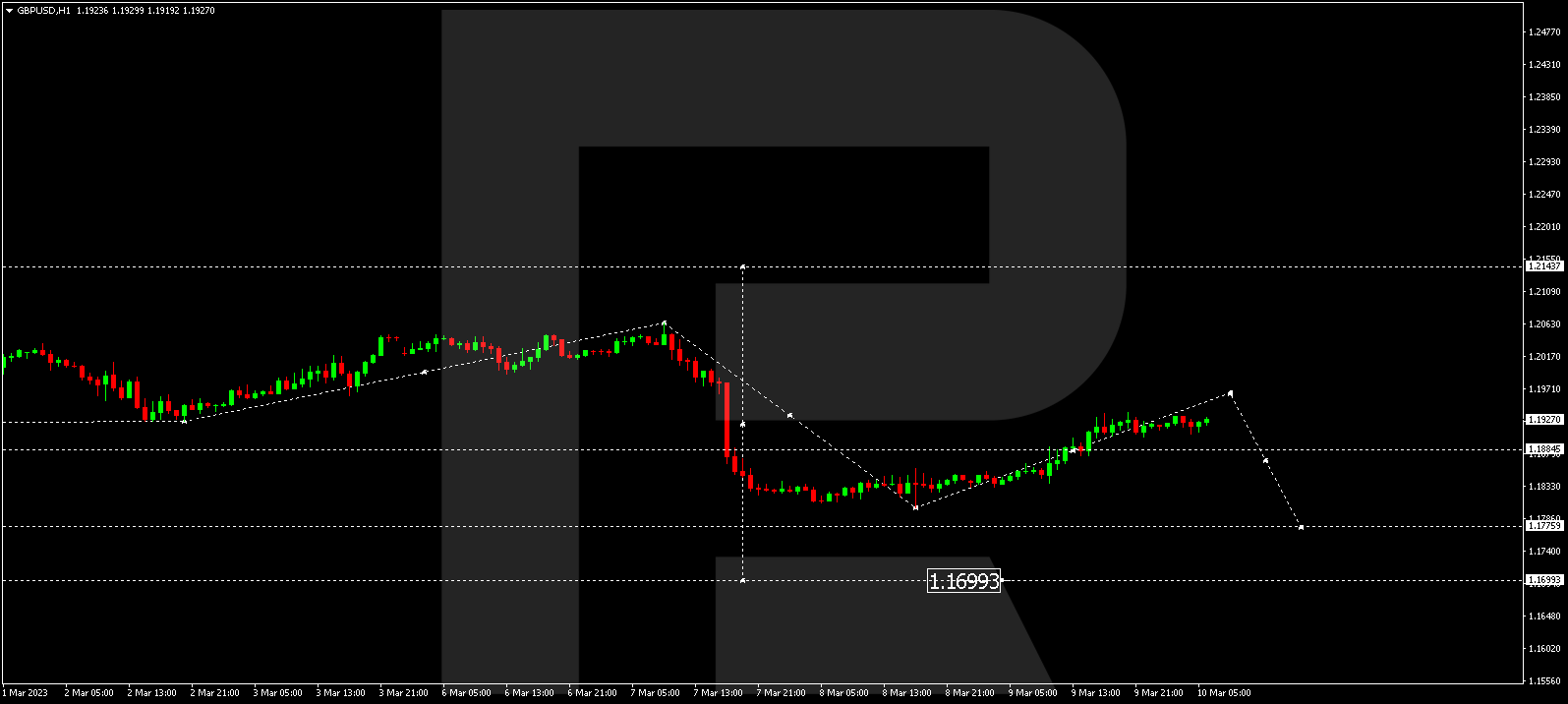

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair continues developing a correction to 1.1964. After this level is reached, a consolidation range should develop. After an escape from the range downwards, the wave should develop to 1.1775, and a structure of the declining wave should form to 1.1700.

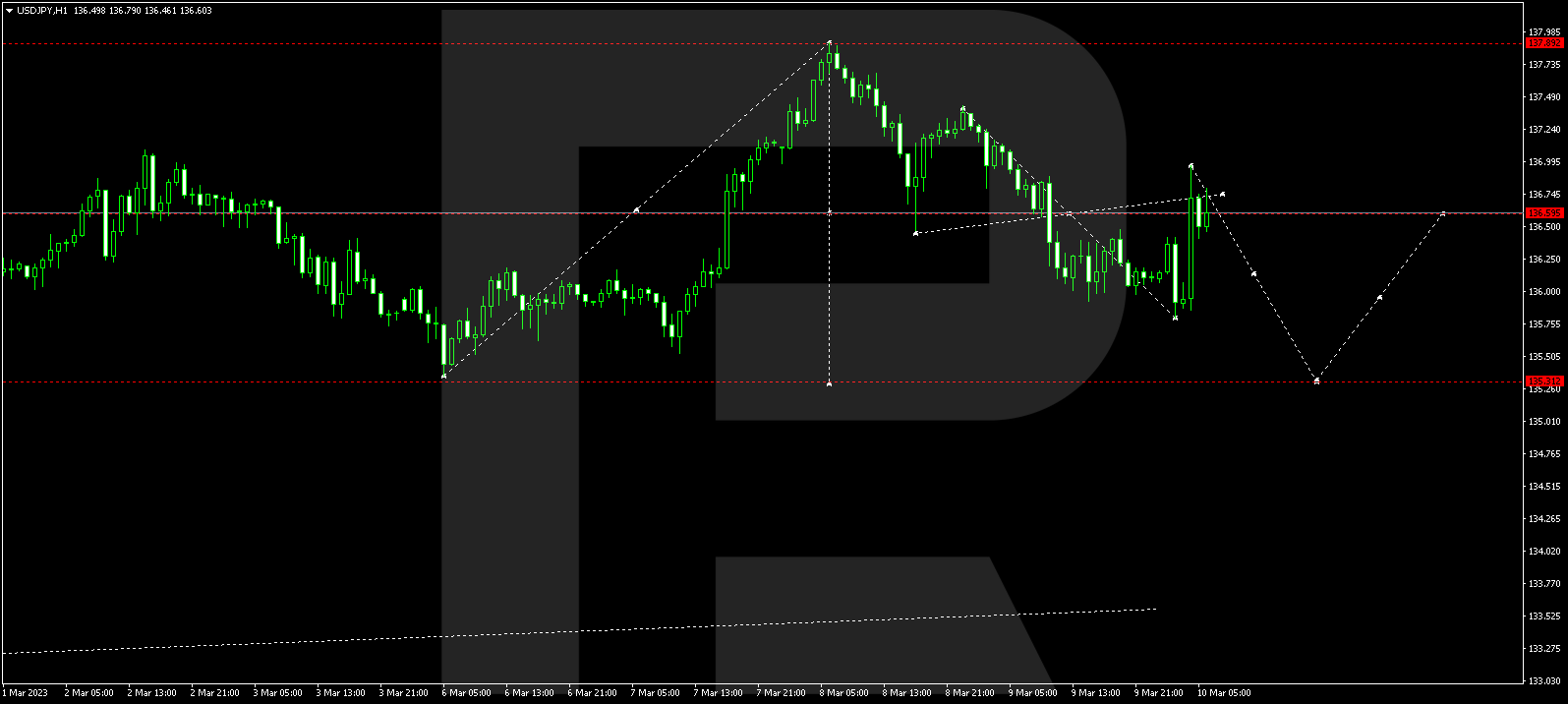

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a wave of decline to 135.80. Today the market has corrected to 136.96. At the moment, it is forming a consolidation range around this level. With an escape downwards, a pathway to 135.30 should open. After the price reaches this level, it might form a link of correction to 135.55.

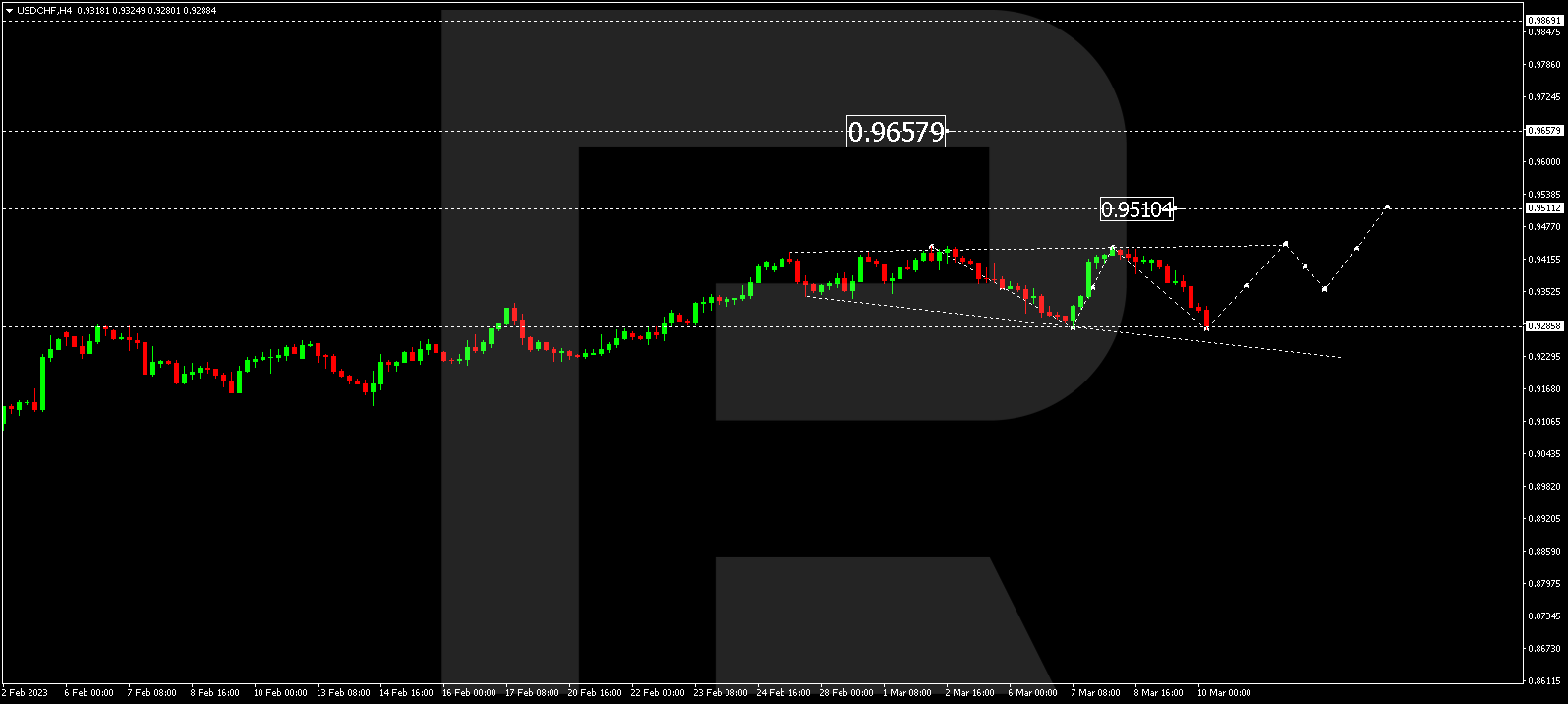

USDCHF, “US Dollar vs Swiss Franc”

The currency pair continues developing a consolidation range above 0.92380. An escape upwards to 0.9660 and continuation of the wave to 0.9870 are expected. After the price reaches the latter level, it might begin a correction to 0.9200.

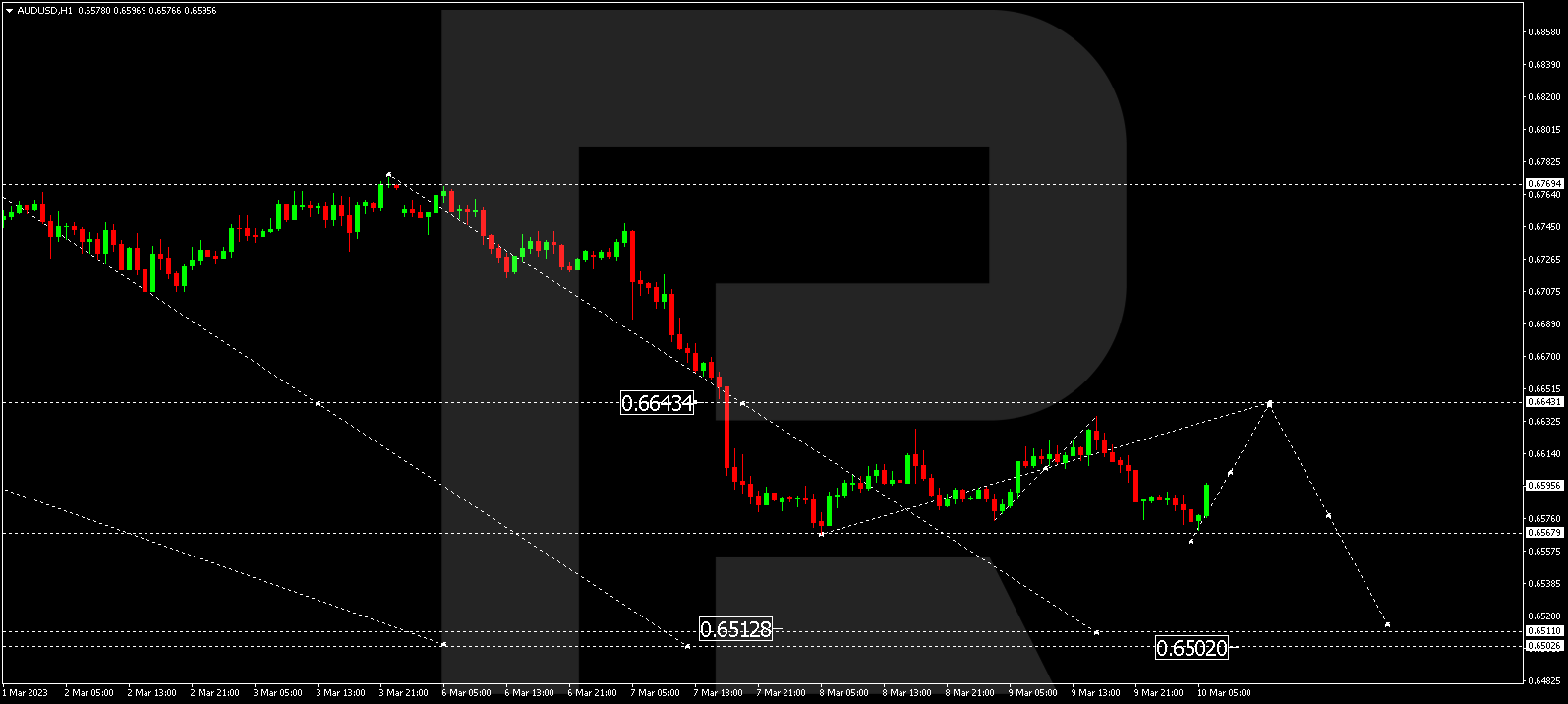

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has completed a structure of a declining wave to 0.6560. Today the market continues forming a consolidation range above this level. A link of growth to 0.6644 is not excluded, followed by a decline to 0.6510. The target is local.

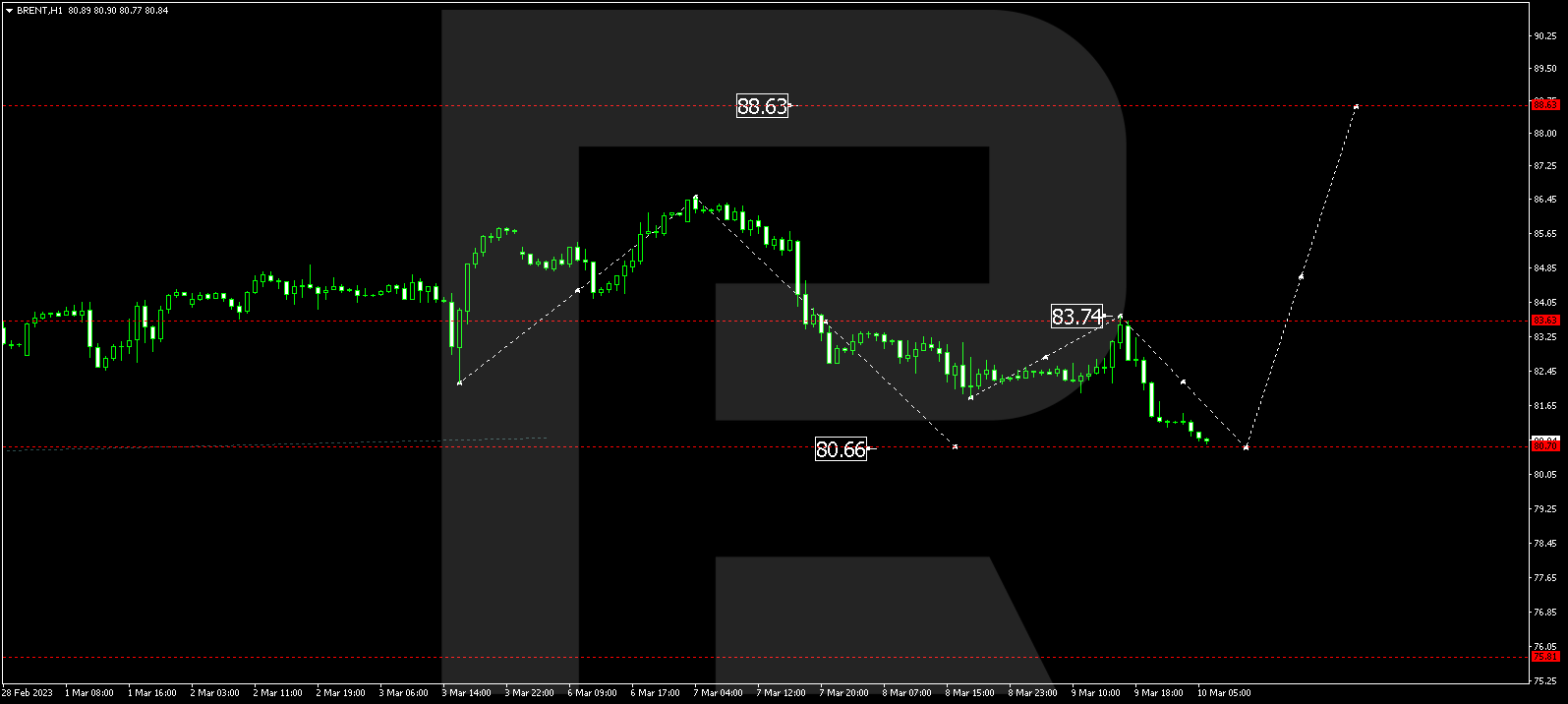

BRENT

Brent has completed a link of growth to 83.74. Today the market is forming a new link of decline to 80.70. After the price reaches the level, a consolidation range might form above it. With an escape upwards, the price might grow to 85.25. And if this level also breaks, a structure to 87.87 might form, from where the wave might further develop to 89.77. The target is local.

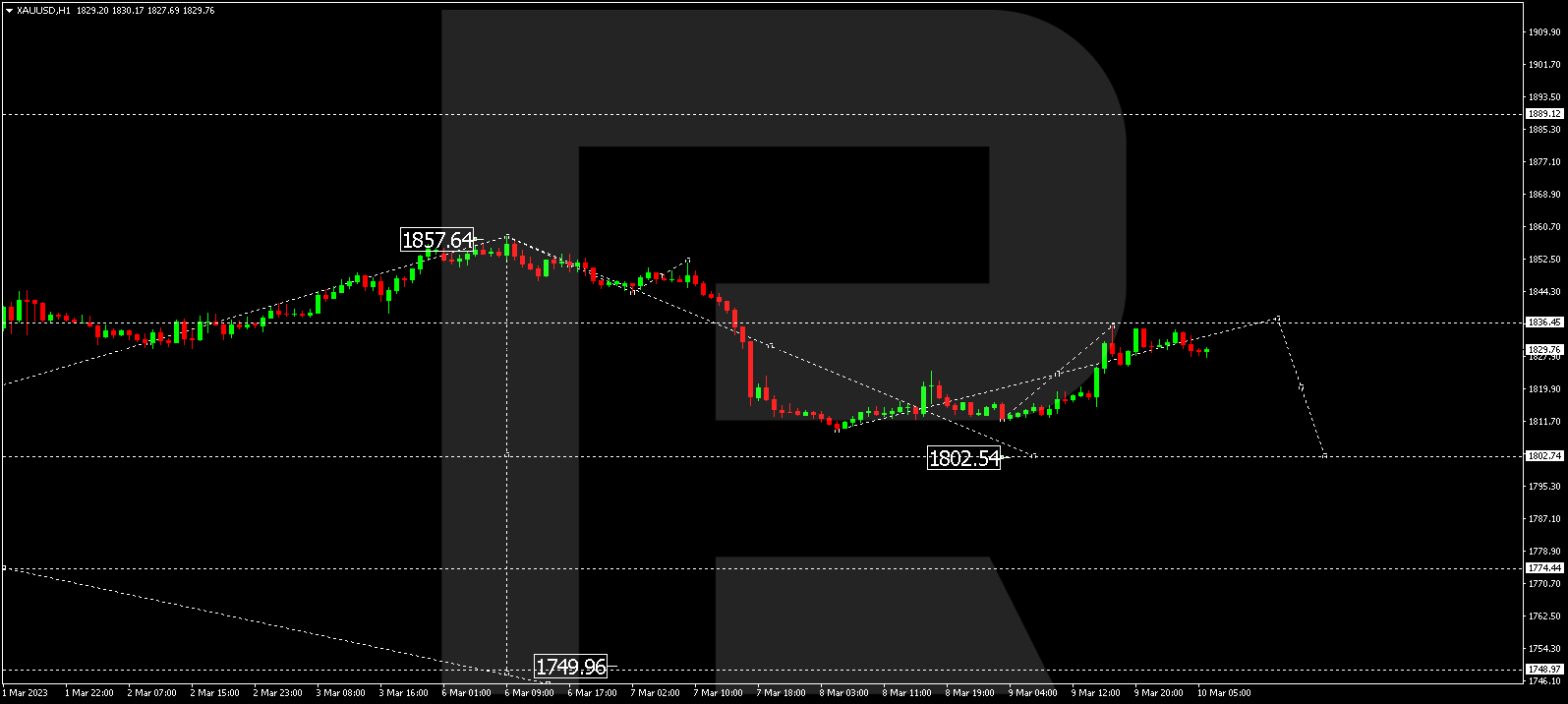

XAUUSD, “Gold vs US Dollar”

Gold continues developing a structure of correction to 1837.50. After the price reaches this level, a link of decline to 1802.50 might form, from where the wave might develop to 1774.44. The target is local.

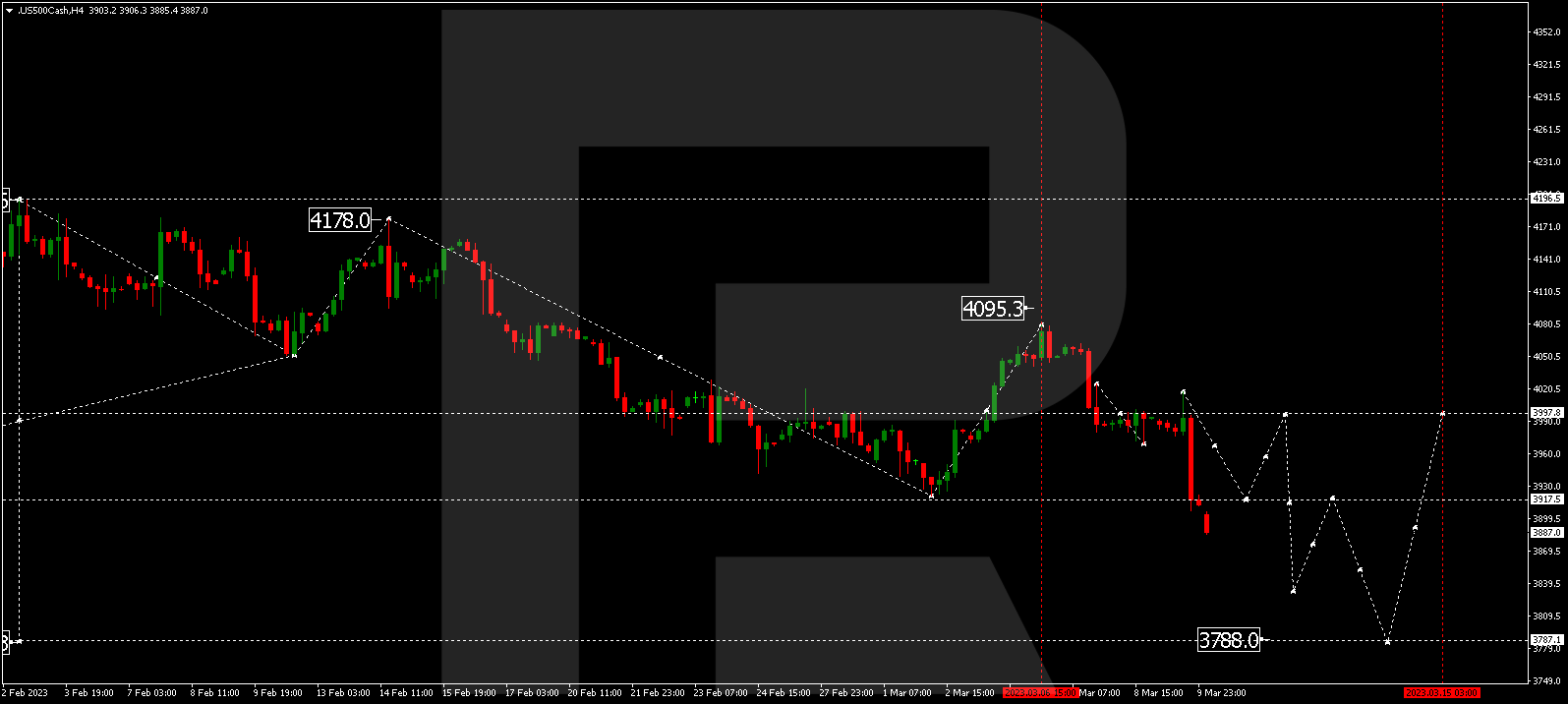

S&P 500

The stock index has demonstrated an impulse of decline to 3907.0. At the moment, the market is forming a consolidation range around this level. The next structure of decline to 3832.5 is expected, from where the wave might continue to 3788.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.