Forex Technical Analysis 2011/24/10 (EUR/USD, USD/CHF, EUR/GBP, NZD/USD, NZD/JPY, DOW JONES) Forecast FX

21.10.2011

Forecast for October 24th, 2011h2

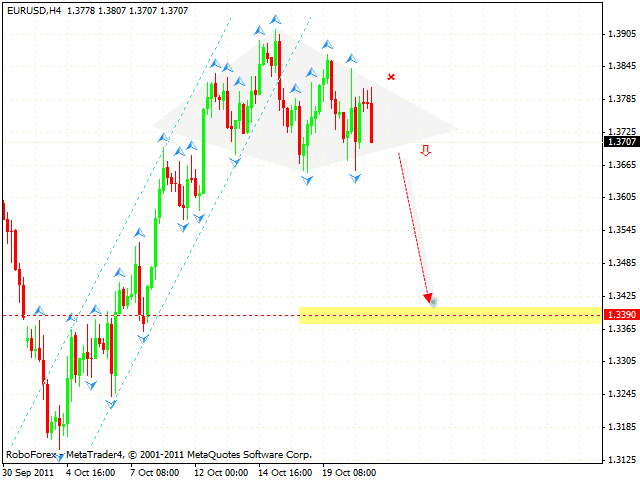

EUR/USD

The EUR/USD currency pair keeps moving inside “diamond” pattern, and there is a strong possibility that the price may break the pattern downwards. One can consider selling the pair with the stop above 1.3795. The target of the fall is the area of 1.3390. If the price breaks the pattern upwards, this case scenario will be cancelled.

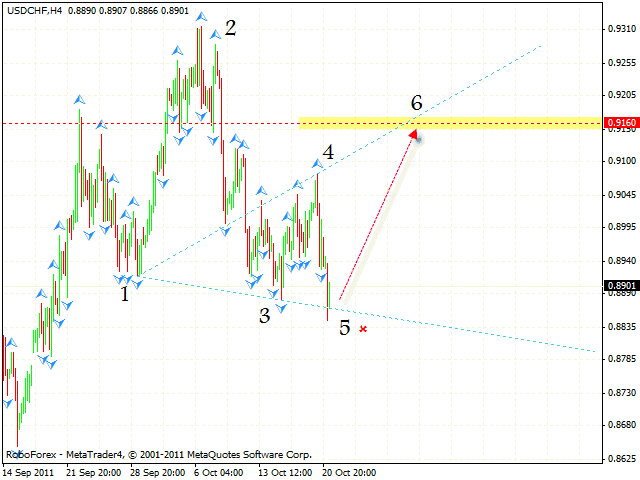

USD/CHF

At the H4 chart of the USD/CHF currency pair we can see the formation of the rising pattern with the target in the area of 0.9160. Currently the price is testing the area where we can try to buy the pair, one can consider opening long positions with the tight stop below 0.8835. If the price breaks the support level, this case scenario will be cancelled.

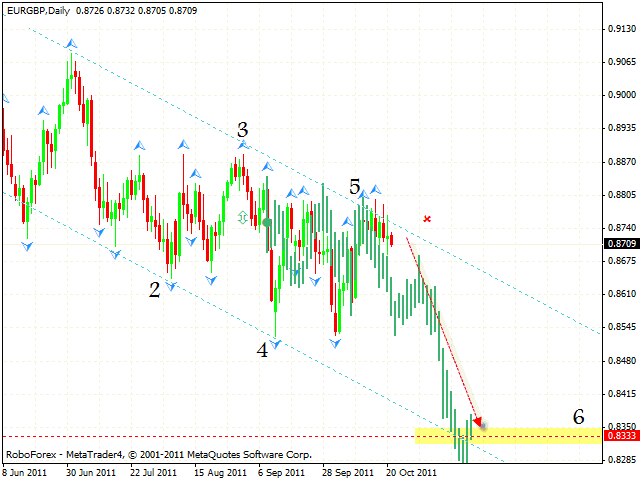

EUR/GBP

In case of the EUR/GBP currency pair we have a descending pattern forming with the target in the area of 0.8335. At the moment the price is testing the channel’s upper border, one consider selling the pair with the tight stop above 0.8805. If the price leaves the channel, this case scenario will be cancelled.

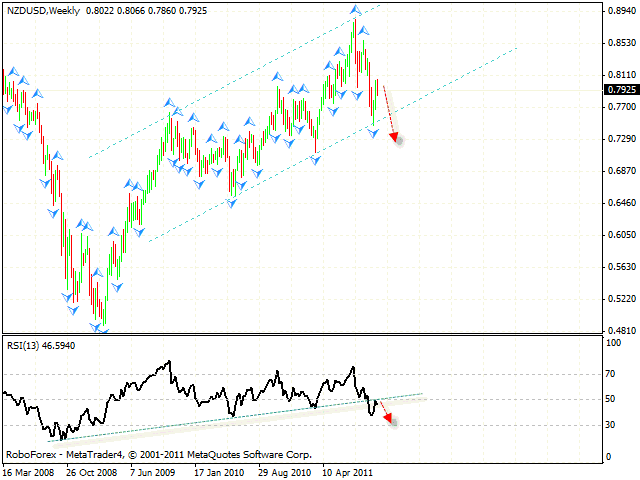

NZD/USD

New Zealand is also still falling down. The RSI indicator is testing the trend’s broken line, we should expect it to rebound from the line at start moving downwards. If the price leaves the rising channel, one can consider selling the NZD/USD currency pair during a long-term period. If the RSI grows higher than 50, this case scenario will be cancelled.

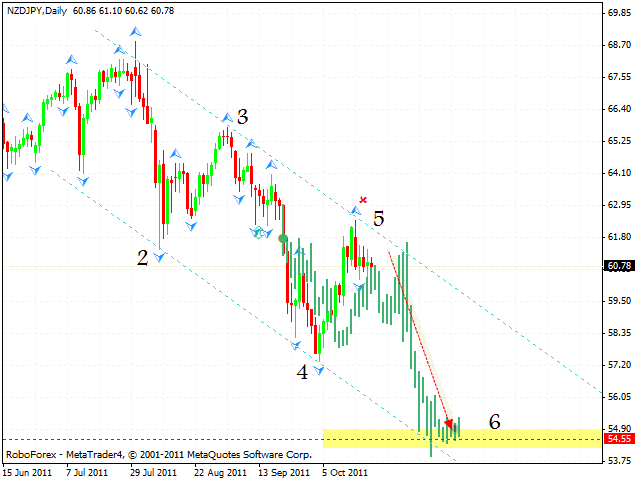

NZD/JPY

At the daily chart of the NZD/JPY currency pair we can see the formation of the descending symmetrical pattern with the target in the area of 54.55. One can consider selling the pair with the tight stop. If the price breaks the descending channel’s upwards and leaves it, we will recommend you to close short positions. Don’t increase the amount of short positions until the price breaks the level of 59.50.

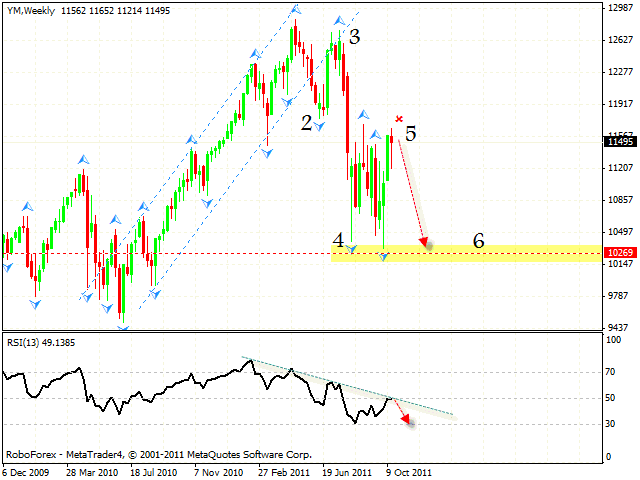

DOW JONES

Dow Jones is moving inside the descending pattern, currently the price is in the area of the 5th pivot point. We should expect the instrument to fall to the level of 10270. The price testing the trend’s descending line at the RSI is an additional signal of the fall. If the price reaches new local maximums, this case scenario will be cancelled.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.