Forex Technical Analysis & Forecast 11.01.2023

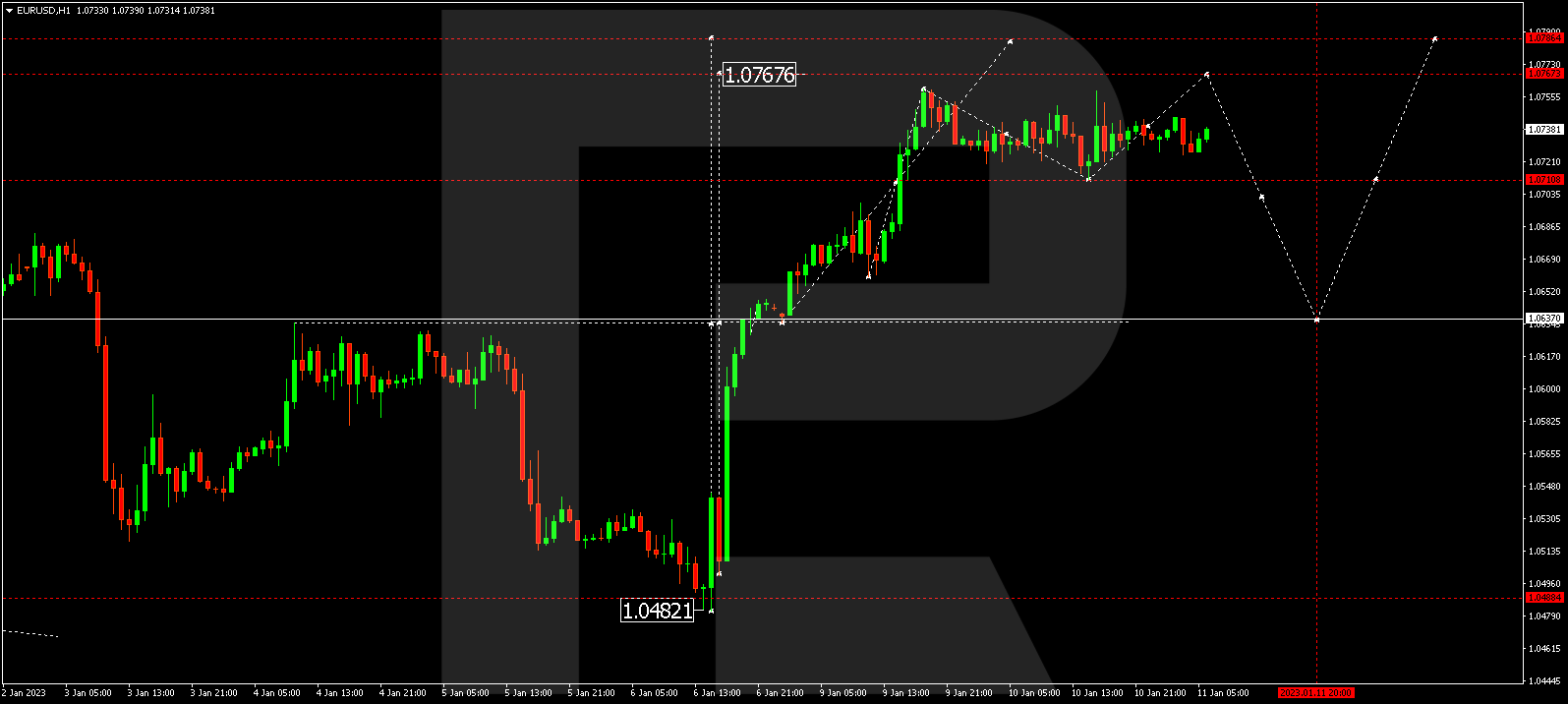

EURUSD, “Euro vs US Dollar”

The currency pair is consolidating near 1.0740. Today the price might spring to 1.0767. The goal is local. After this level is reached, correction to 1.0637 might start, followed by growth to 1.0788.

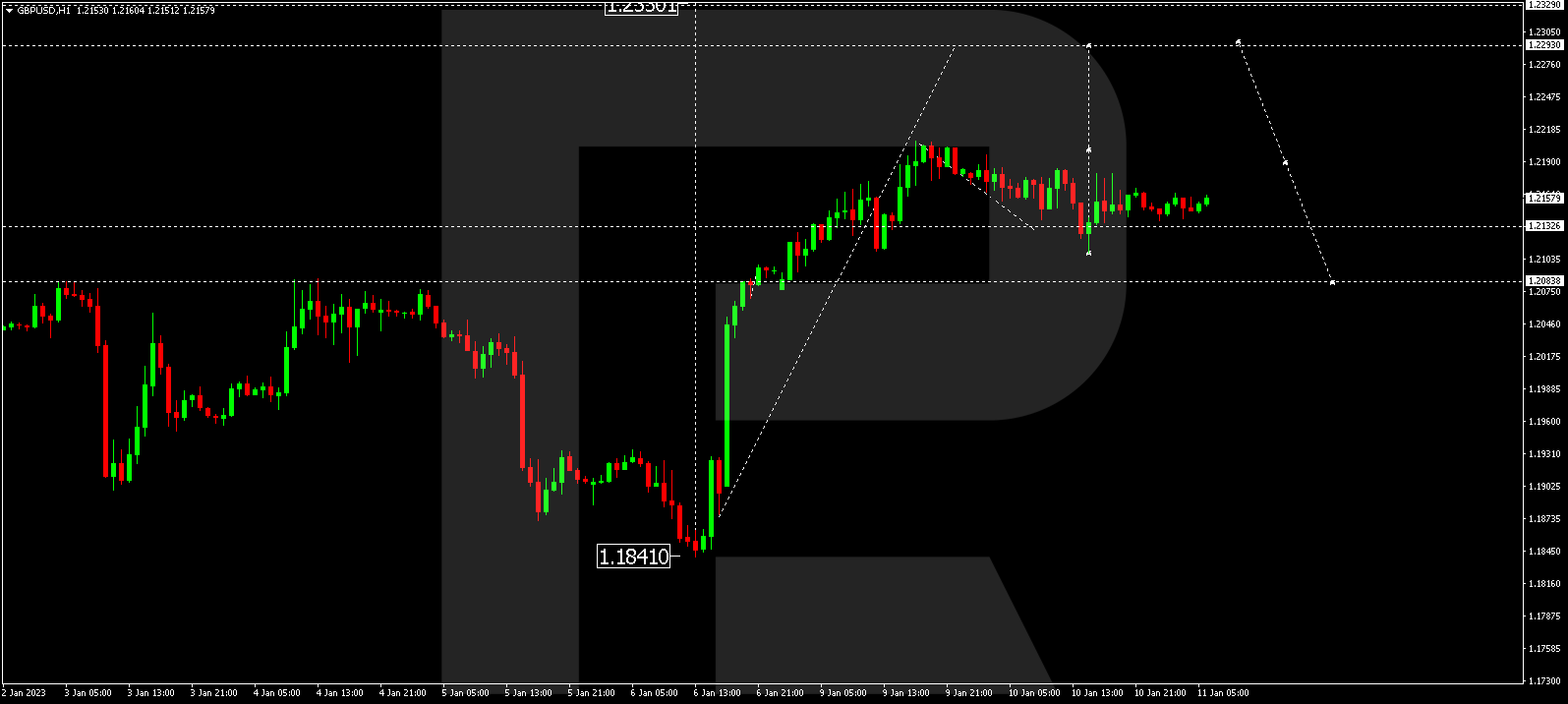

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair completed a wave of correction to 1.2110. Today the market has started to form a link of growth to 1.2220, and with a breakaway of this level is might reach 1.2292. The goal is local. Then a correction to 1.2084 (a test from above) and growth to 1.2330 should develop.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair is forming a consolidation range around 131.90. A link of growth to 132.70 is not excluded. After this level is reached, a decline to 129.70 might follow.

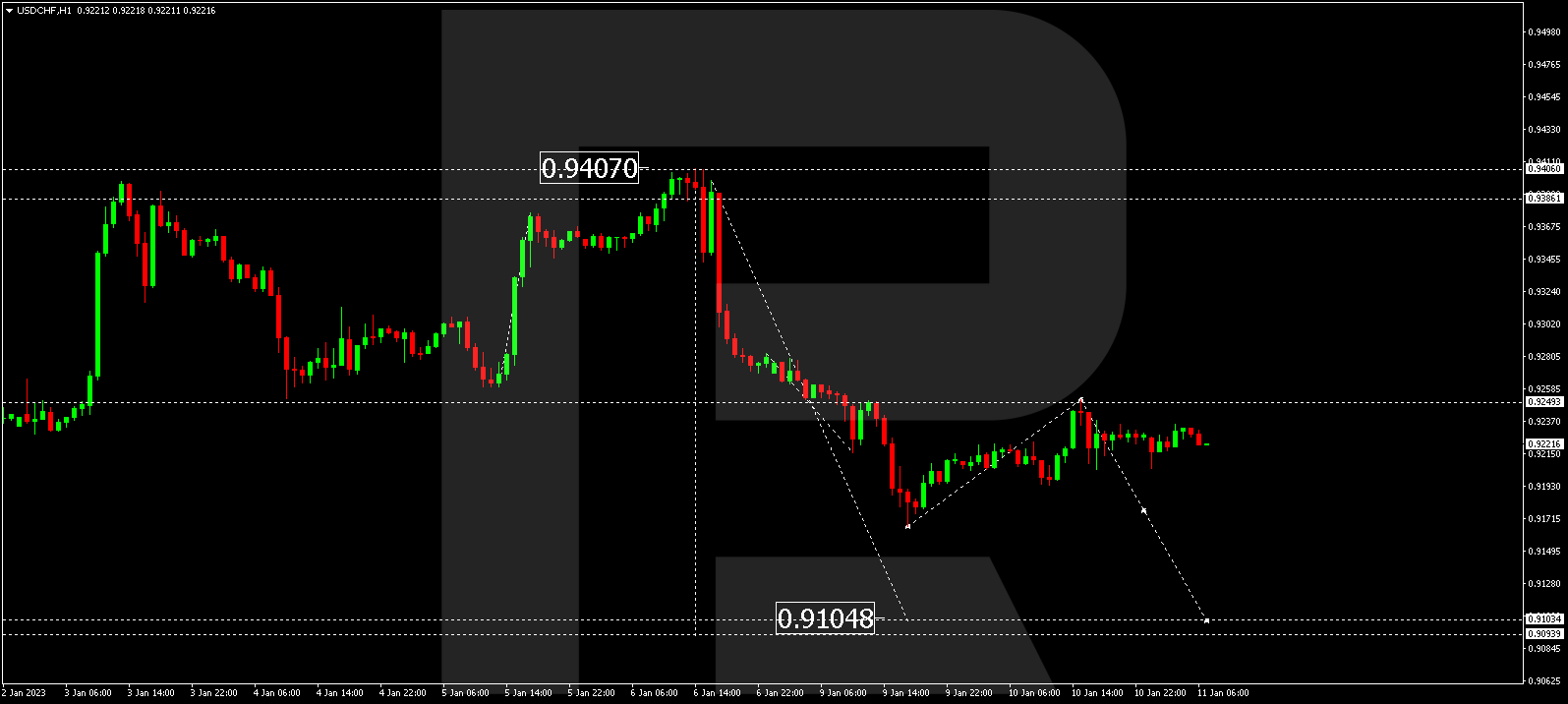

USDCHF, “US Dollar vs Swiss Franc”

The currency pair completed a structure of a correctional wave to 0.9250. Today the market might continue declining to 0.9105. After this level is reached, a link of correction to 0.9250 (a test from below) is not excluded, followed by a decline to 0.9094.

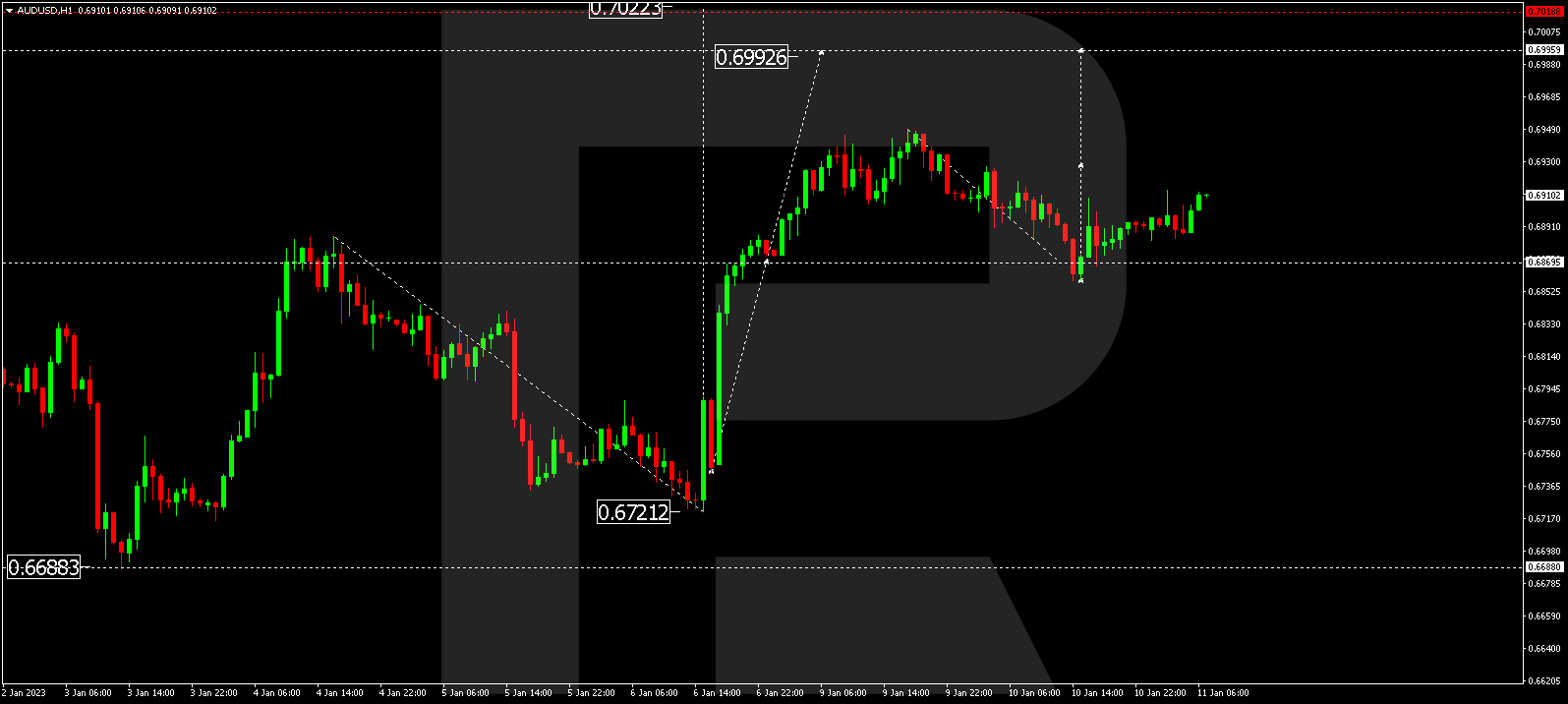

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair completed a wave of correction to 0.6850. Today the market might perform a link of growth to 0.6990. After this level is reached, a link of correction to 0.6872 is expected, followed by growth to 0.7020.

BRENT

Crude oil is forming a consolidation range around 80.00. A link of growth to 82.00 is not excluded, followed by a decline to 76.67. After this level is reached, growth to 86.00 might begin.

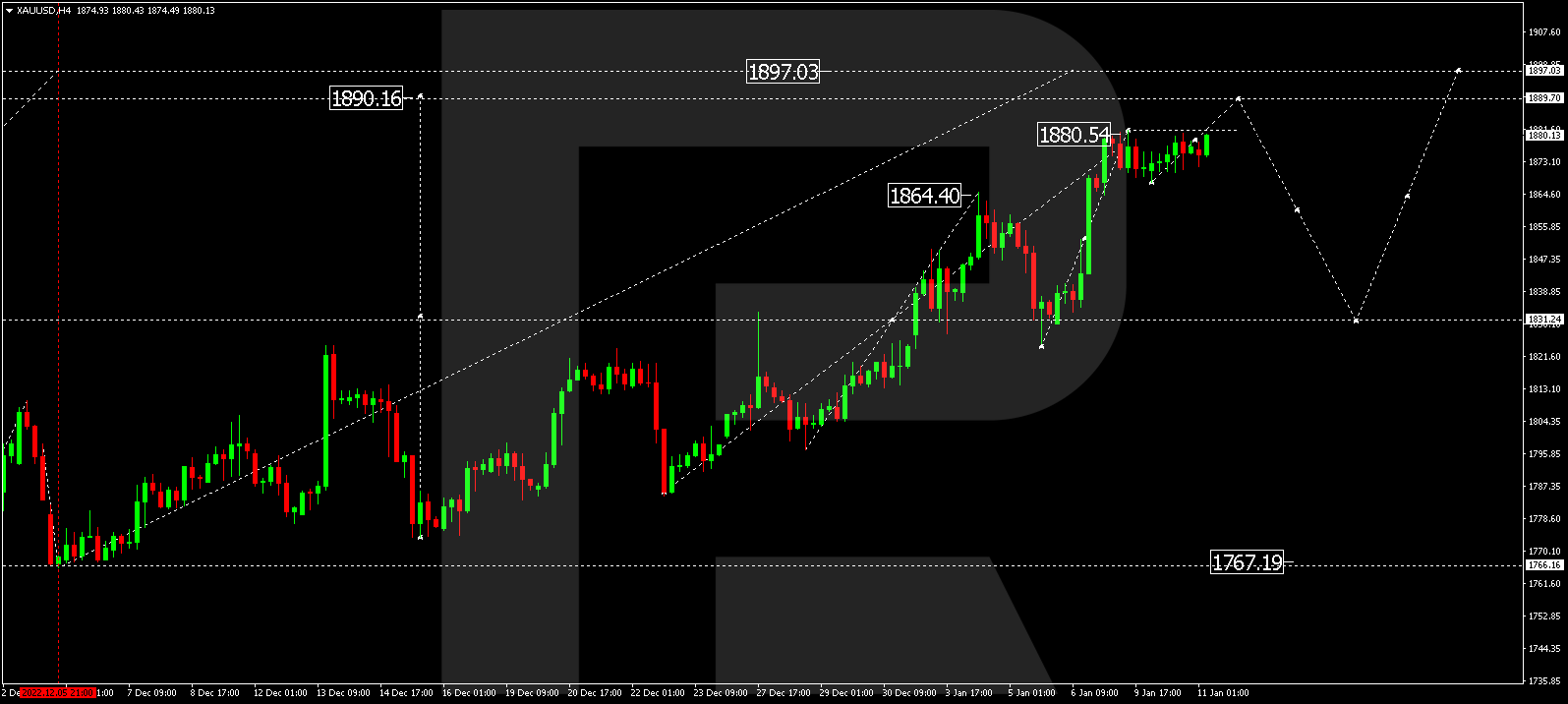

XAUUSD, “Gold vs US Dollar”

Gold is forming a consolidation range around 1877.77. Today the market might spring to 1890.00. The goal is local. After this level is reached, a correction to 1831.30 might develop, followed by growth to 1898.00.

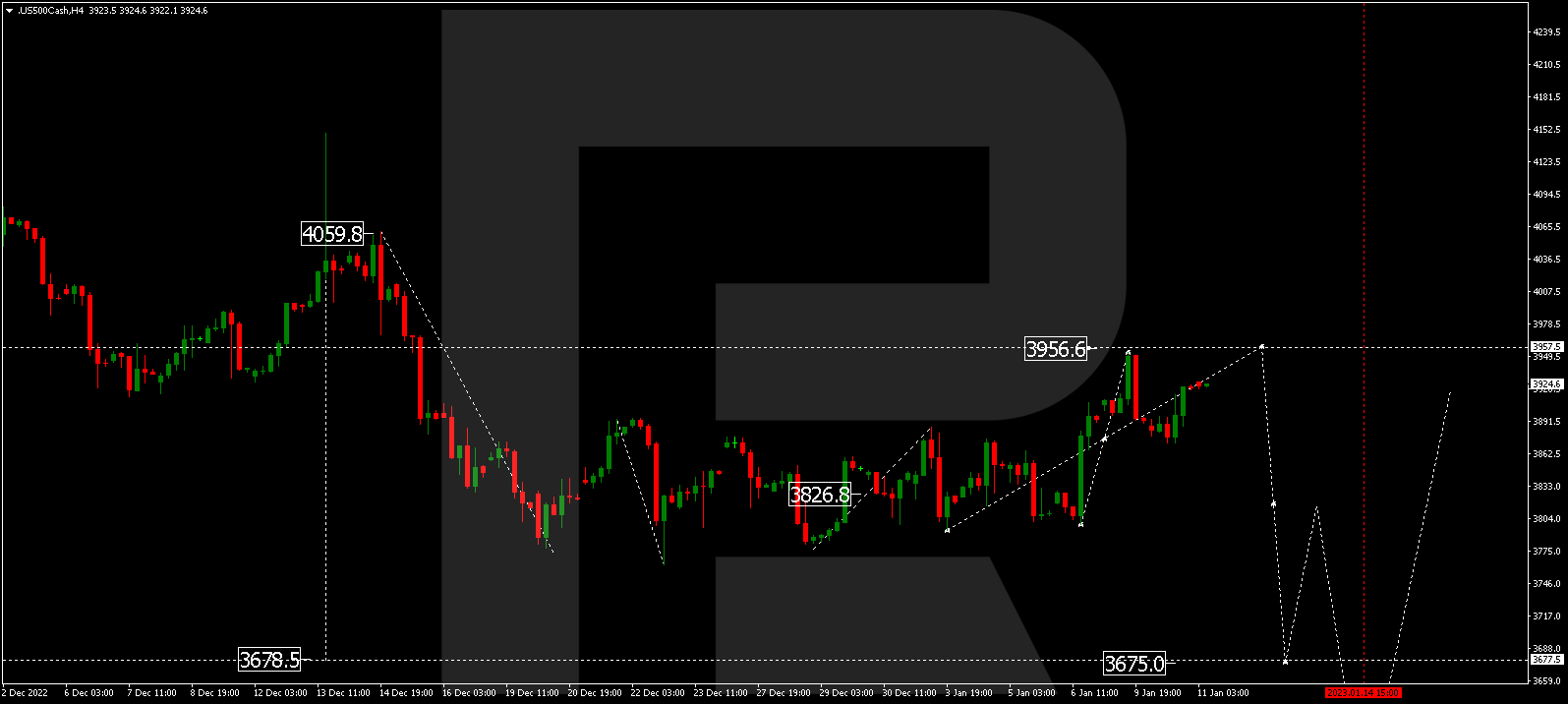

S&P 500

The stock index is forming a consolidation range around 3877.7. Today a link of growth to 3956.6 is not excluded, followed by a decline to 3800.0. With a breakaway of this level, a pathway down to 3675.0 might open.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.