Technical Analysis & Forecast 11.06.2024

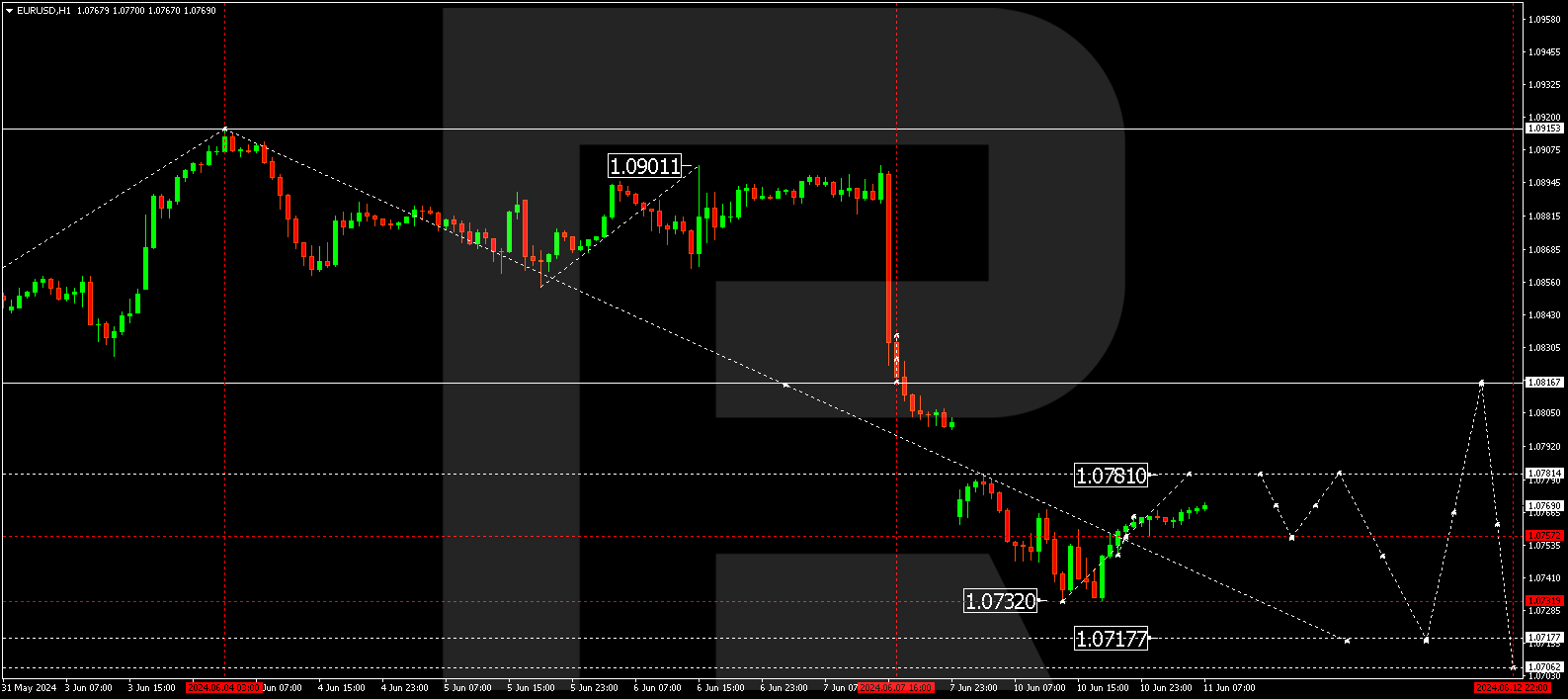

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a wave, reaching 1.0732, and started to form a consolidation range above this level. Today, the market has breached the range’s upper boundary and extended it towards 1.0770. A rise towards 1.0780 is possible, which is interpreted as a correction of the last decline wave. Another structure towards 1.0717 and a rise towards 1.0750 (testing from below) are expected.

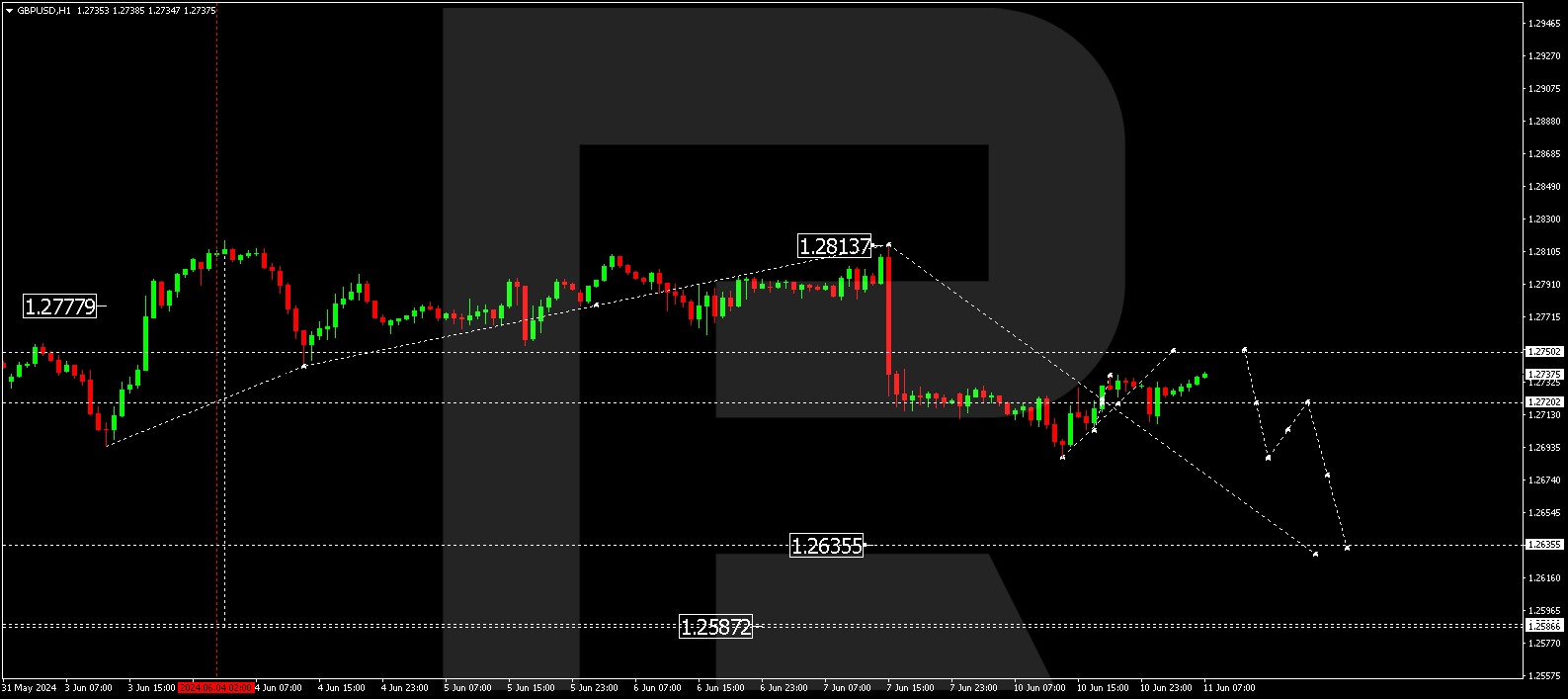

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has completed a decline wave, reaching 1.2688, and started to form a consolidation range above this level. Today, a rise towards 1.2750 is possible, followed by a decline to 1.2686 and a subsequent rise towards 1.2720. Practically, a wide consolidation range could form around this level. A downward breakout will open the potential for a movement by trend to the local target of 1.2636.

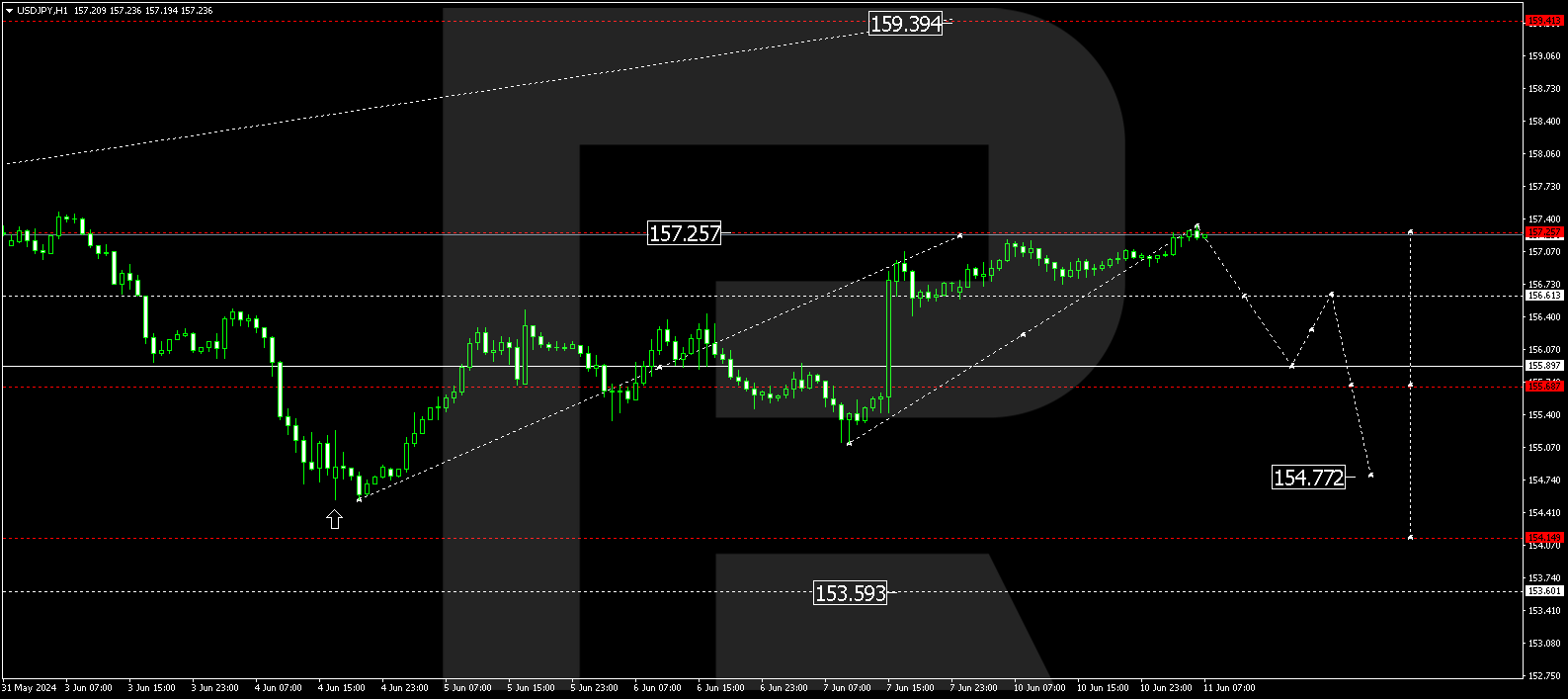

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has completed a growth wave, reaching 157.26. Today, a consolidation range is expected to develop below this level. With a downward breakout, the trend might continue to 155.88. If this level also breaks, it will open the potential for a wave towards 154.77, potentially expanding to 154.15.

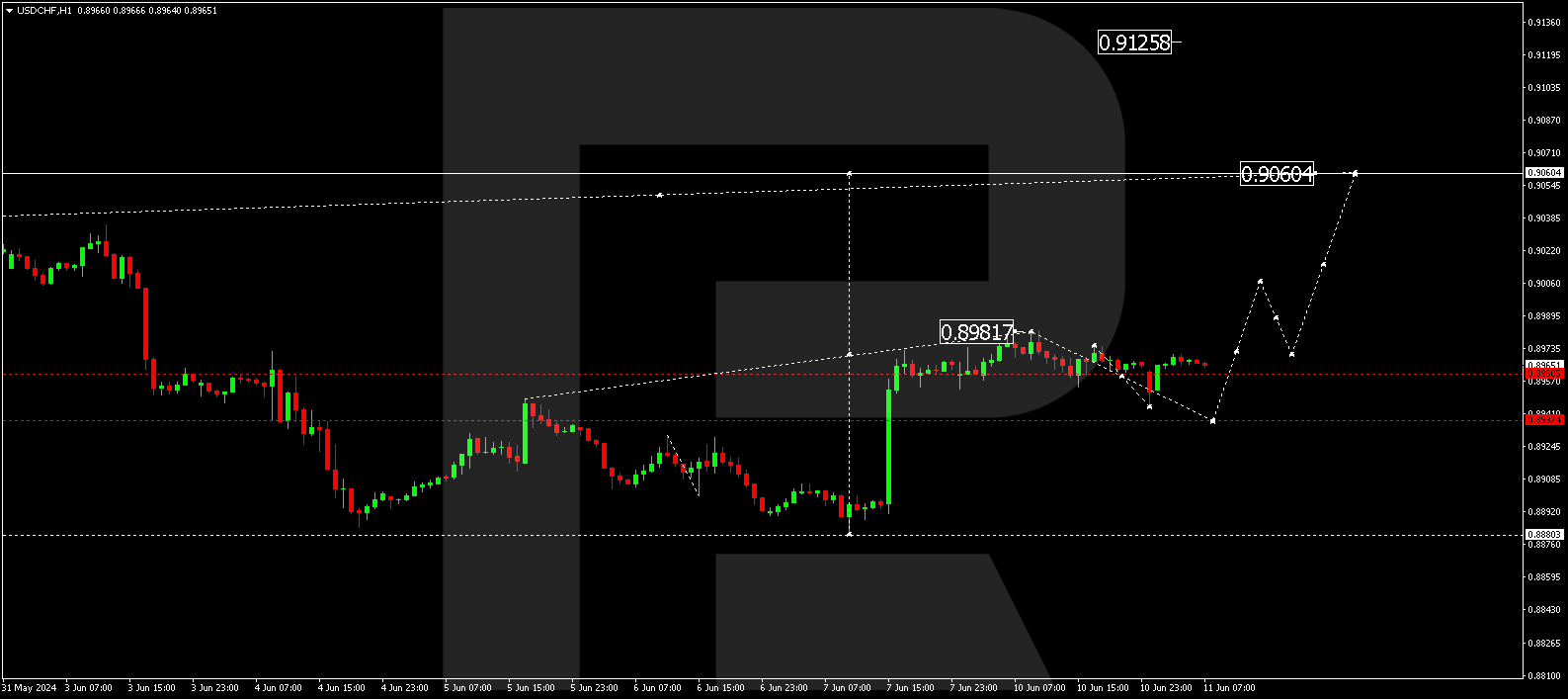

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair is currently in a consolidation phase around 0.8960. Today, a decline towards 0.8937 is possible, followed by a rise towards 0.9000 and a subsequent decline to 0.8960 (testing from above). With an upward breakout, the trend might continue to 0.9060, representing the uptrend’s first target.

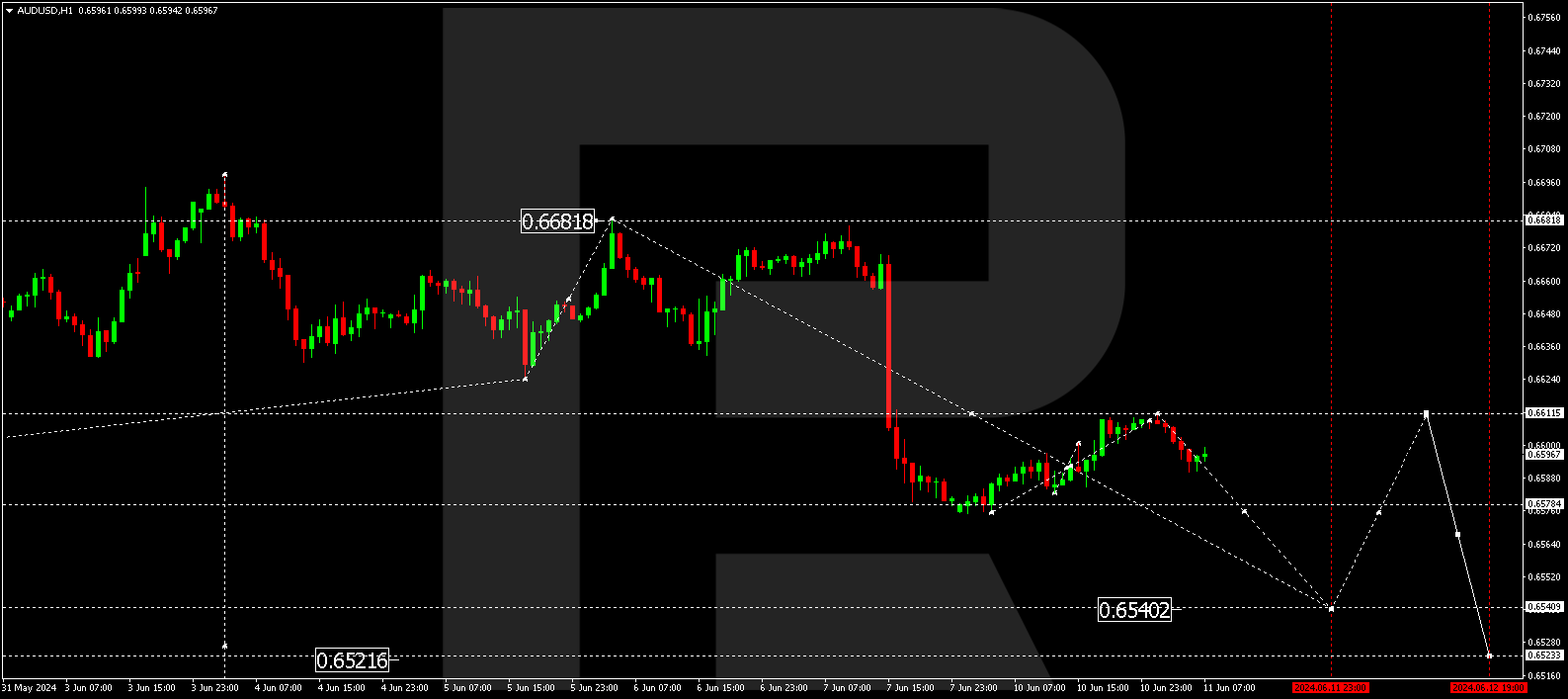

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD has completed a decline wave, reaching 0.6575. Today, the market is forming a consolidation range above this level. A rise towards 0.6615 is possible, followed by a decline to 0.6575. A breakout of this level will open the potential for a wave towards 0.6540, representing the downtrend’s local target.

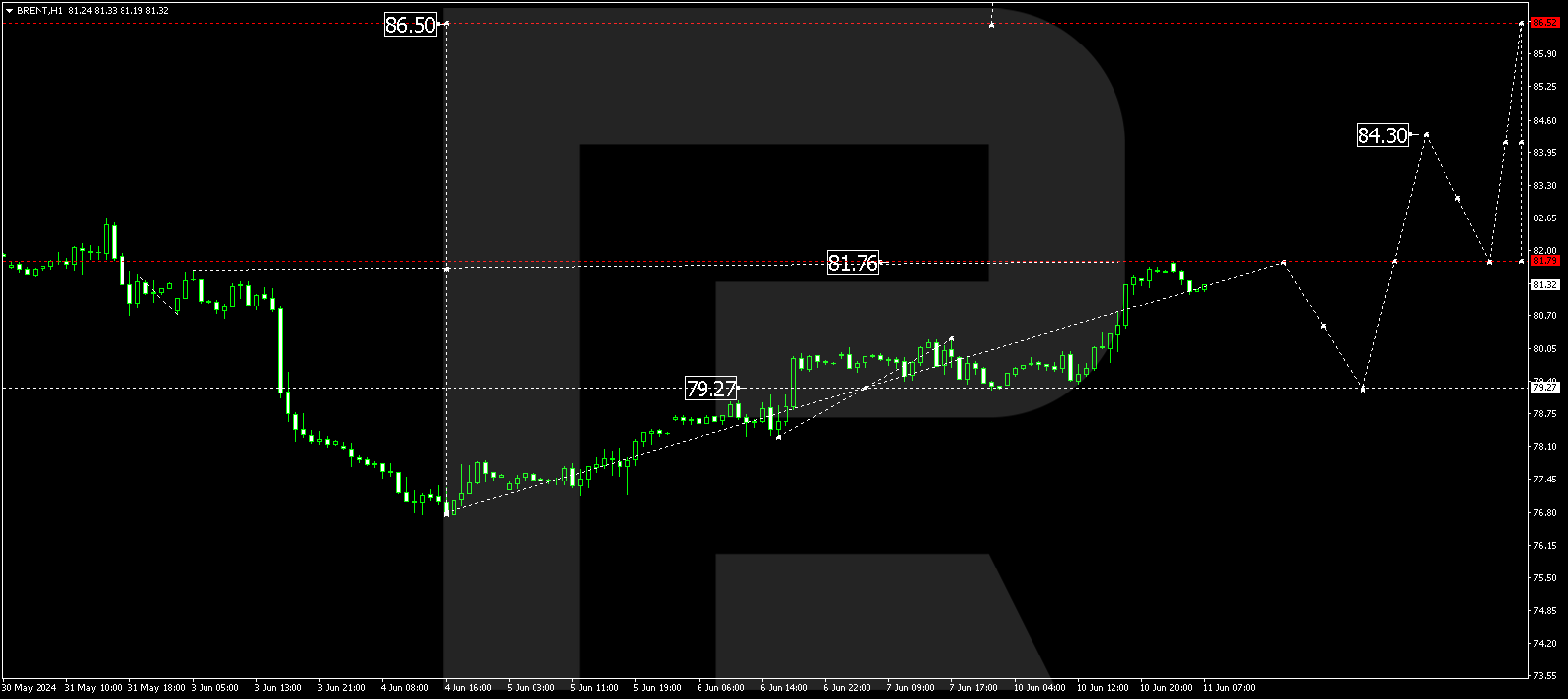

Brent

Brent has completed a growth wave, reaching 81.79. Today, a consolidation range is expected to develop below this level. With a downward breakout, a corrective phase might follow, targeting 79.29 (testing from above). Subsequently, a new growth wave could start, aiming for 84.30 as the uptrend’s local target.

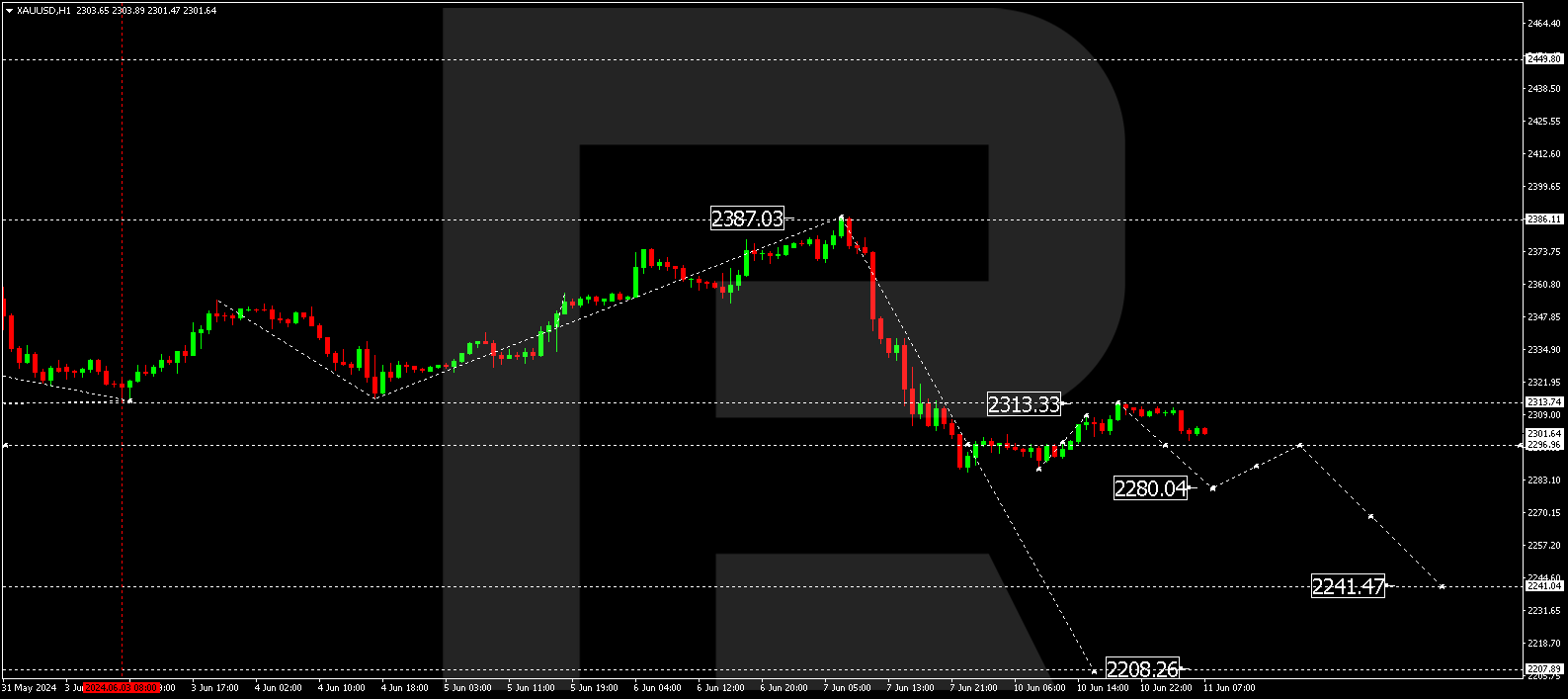

XAUUSD, “Gold vs US Dollar”

Gold is forming a consolidation range around 2296.96. Today, a downward breakout of the range towards 2280.00 is possible, followed by a rise towards 2296.96 (testing from below). Subsequently, the price might fall to 2241.50, representing the downtrend’s local target.

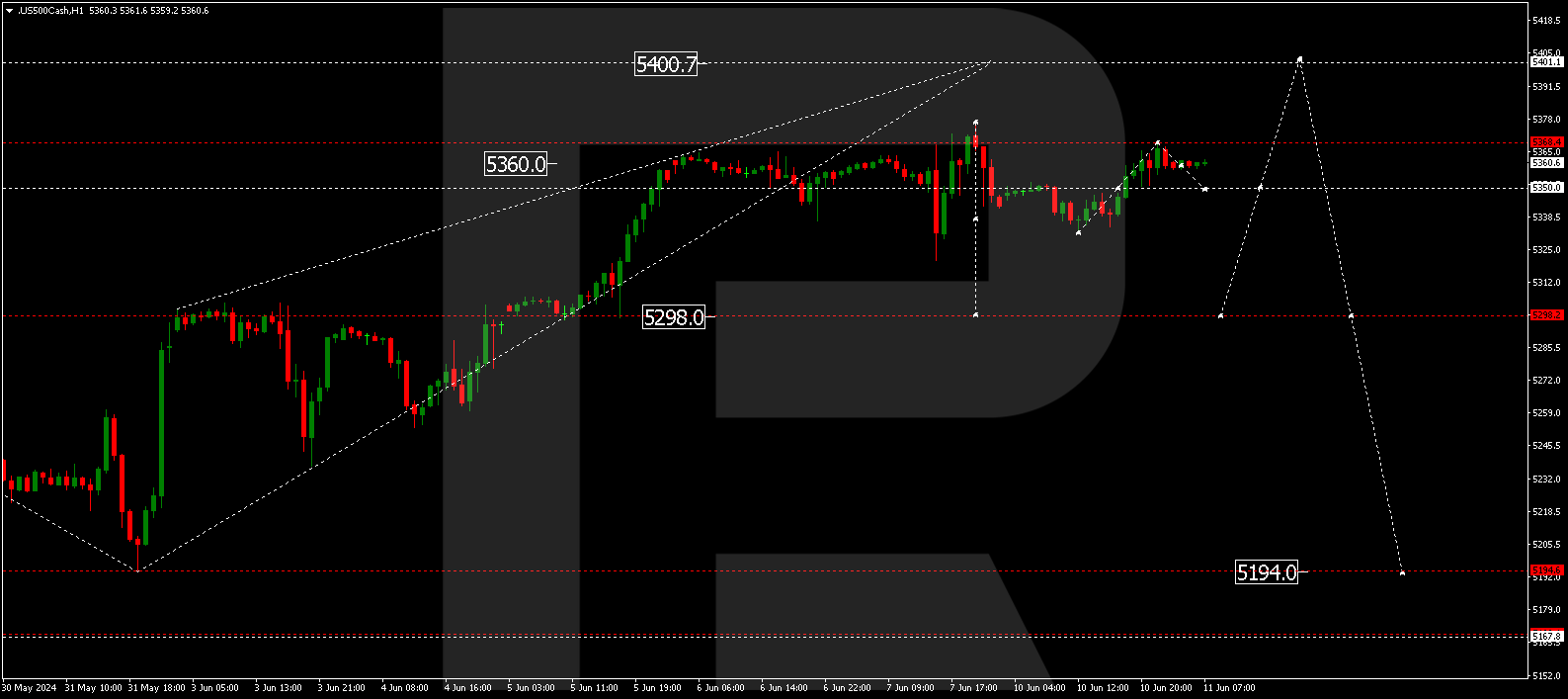

S&P 500

The stock index is currently in a consolidation phase around 5350.0 without any strong trend. With a downward breakout of the range, a correction towards 5298.0 (testing from above) is expected. Following this, another growth wave might start, aiming for 5400.0. After the price reaches this level, a decline wave could begin, targeting 5286.0 and potentially continuing to 5170.0, the first target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.