Forex Technical Analysis & Forecast for 12.08.2021

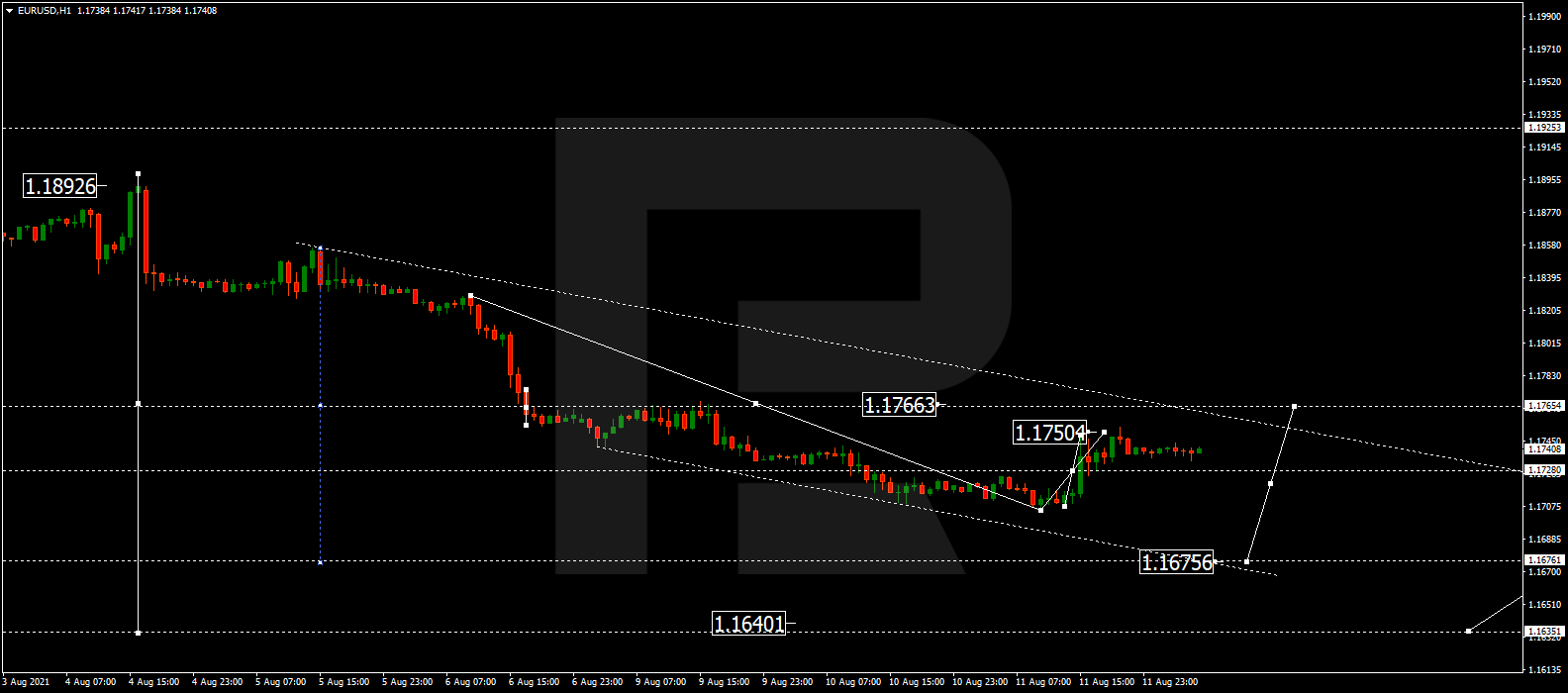

EURUSD, “Euro vs US Dollar”

The currency pair completed a wave of decline to 1.1705 and demonstrated a link of growth to 1.1750. Today we expect a consolidation range to form right under this level. It might then extend to 1.1766. Then the price should drop to 1.1720, break through it, and open a way to 1.1675.

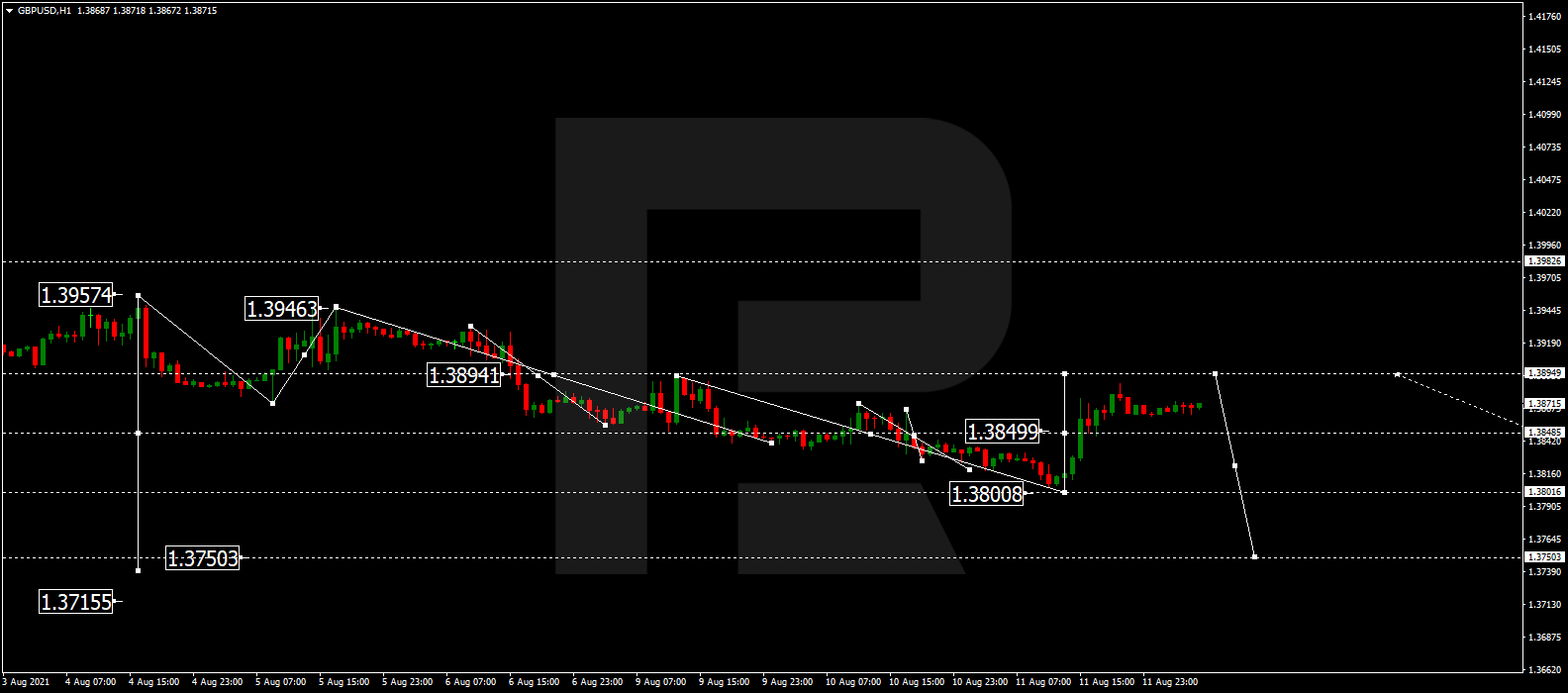

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair completed a wave of decline to 1.3802 and started developing a correction. Today the price might spring to 1.3894. Then another wave of decline to 1.3750 should start. The goal is local in this structure of decline.

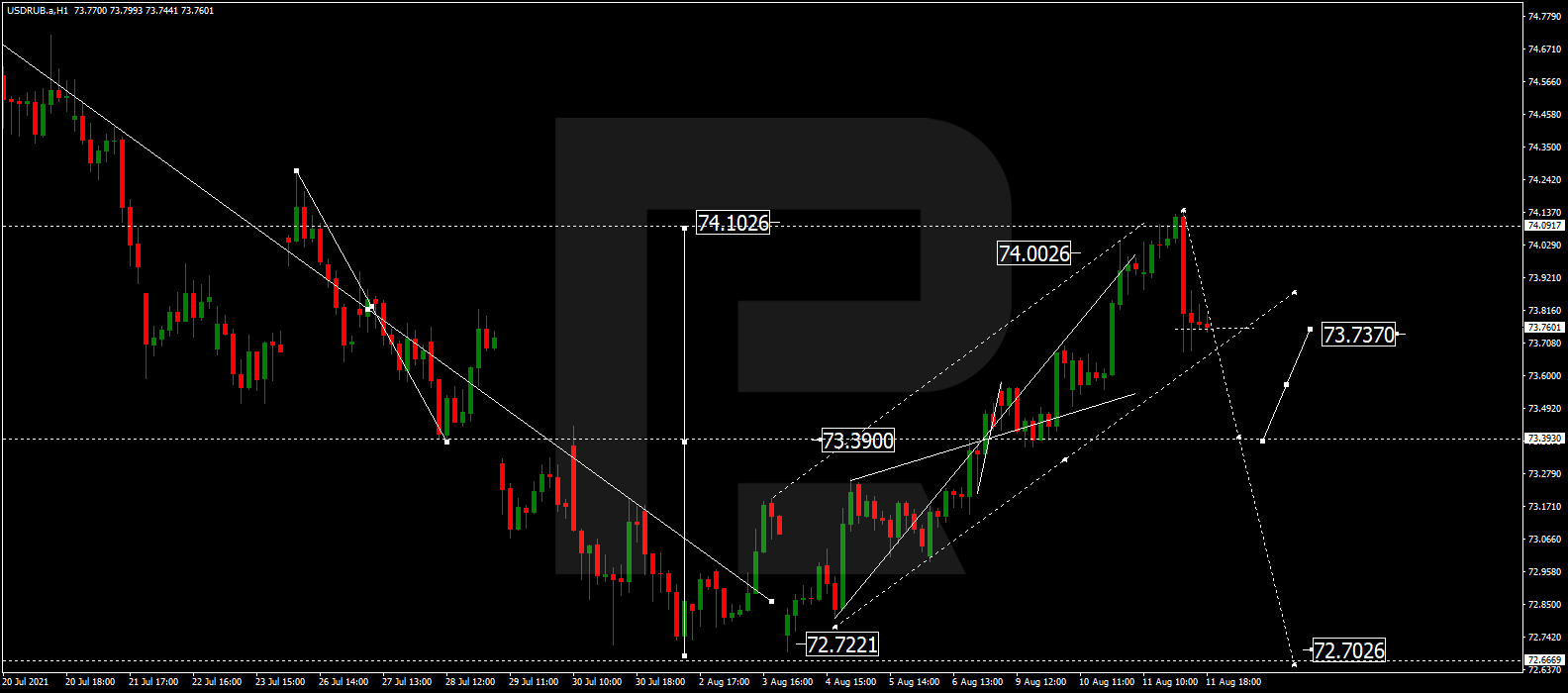

USDRUB, “US Dollar vs Russian Ruble”

The currency pair performed a correction to 74.10, bounced off it, and is now developing another wave of decline. Today it might reach 73.33. Then a consolidation range should form around this level. With an escape downwards, the price might decline to 72.70. With an escape upwards, a link of correction to 73.73 might follow, after which the trend should continue to 72.00.

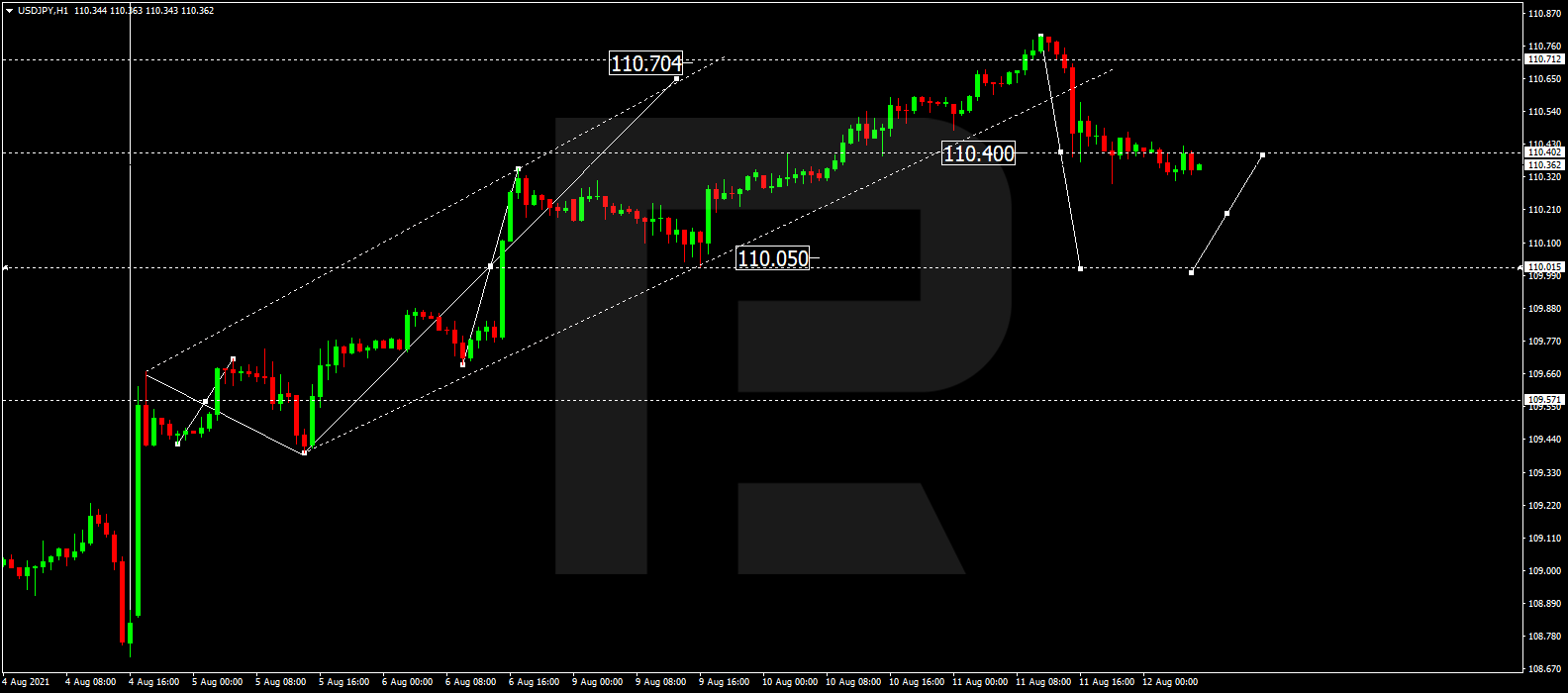

USDJPY, “US Dollar vs Japanese Yen”

The currency pair demonsttated a wave of growth to 110.70, bounced off it, and is now trading in a structure of decline to 110.05. Growth to 110.40 should follow. At these levels, we expect a consolidation range to form. With an escape upwards, we expect growth to 110.08. With an escape downwards, a pathway to 109.60 should open.

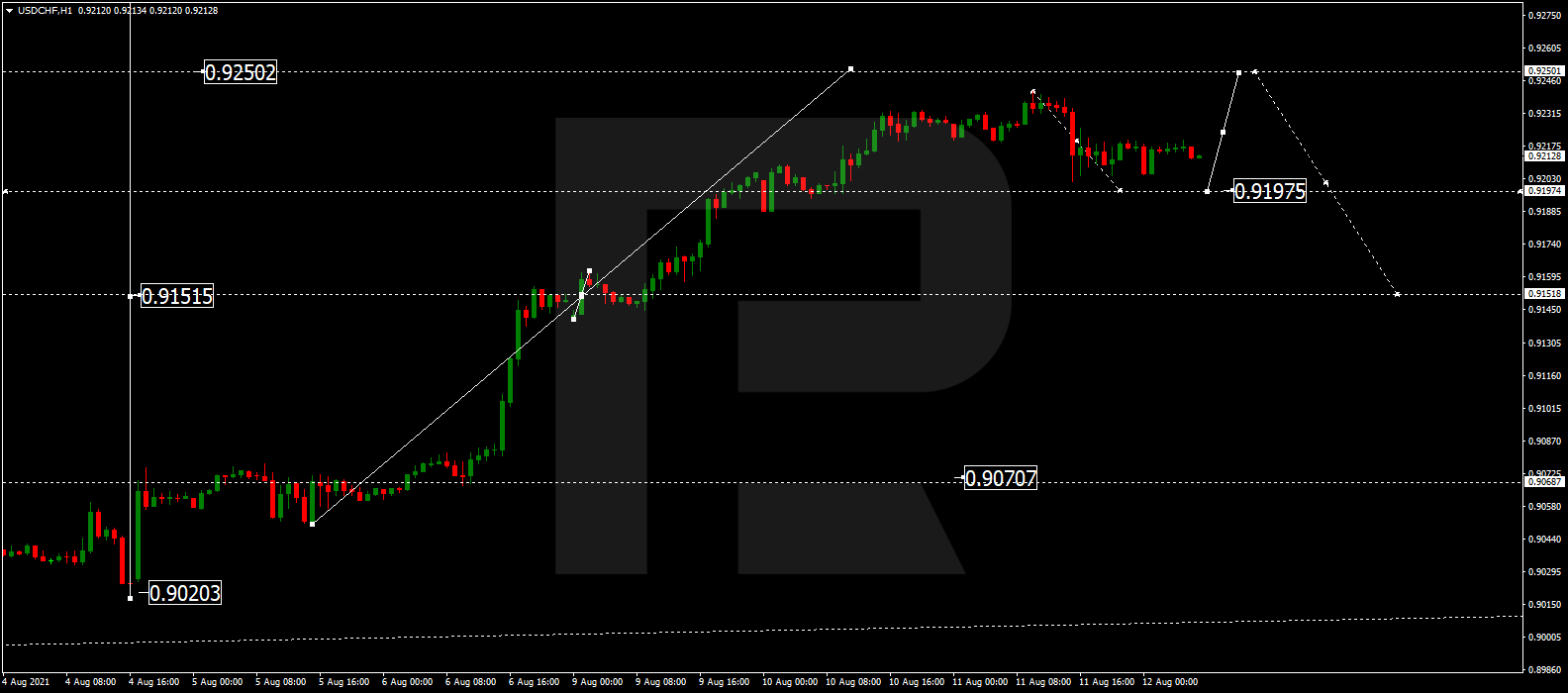

USDCHF, “US Dollar vs Swiss Franc”

The currency pair keeps developing a correction to 0.9198. After this level is reached, we expect a link of growth to 0.9250. The goal is local. Then the pair should correct to 0.9150, and when the correction is over, we expect growth to 0.9284. The goal is first.

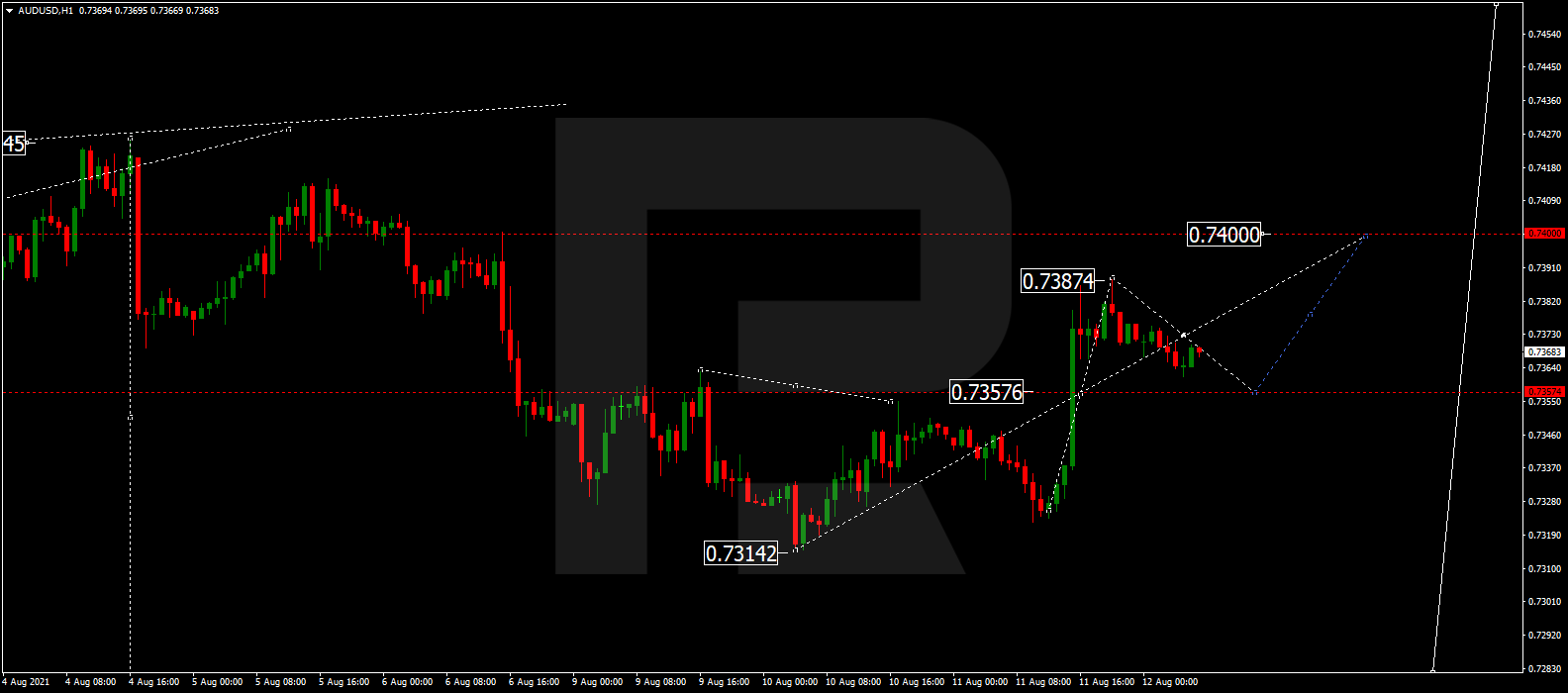

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has broken through the consolidation range upwards and suggests a correction to 0.7400. Today we expect a link of decline to 0.7356. With a bounce off this level, growth to 0.7400 seems possible. If the level of 0.7350 is broken downwards, the price might go deeper down to 0.7272.

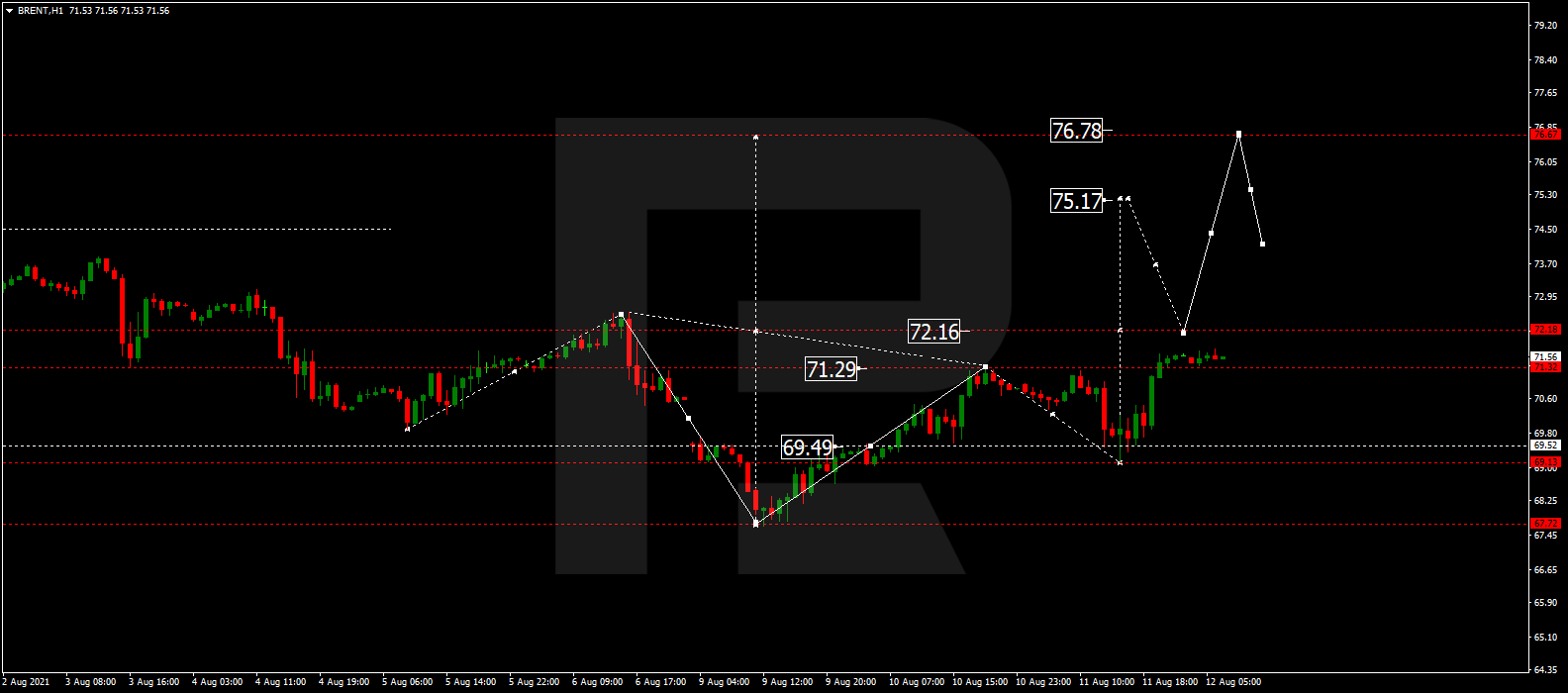

BRENT

Bouncing off 69.50 upwards, oil is developing a wave of growth. Today the market has demonstrated growth to 71.30 and at the moment is forming a narrow consolidation range above this level. We expect growth to continue to 75.17. The goal is local.

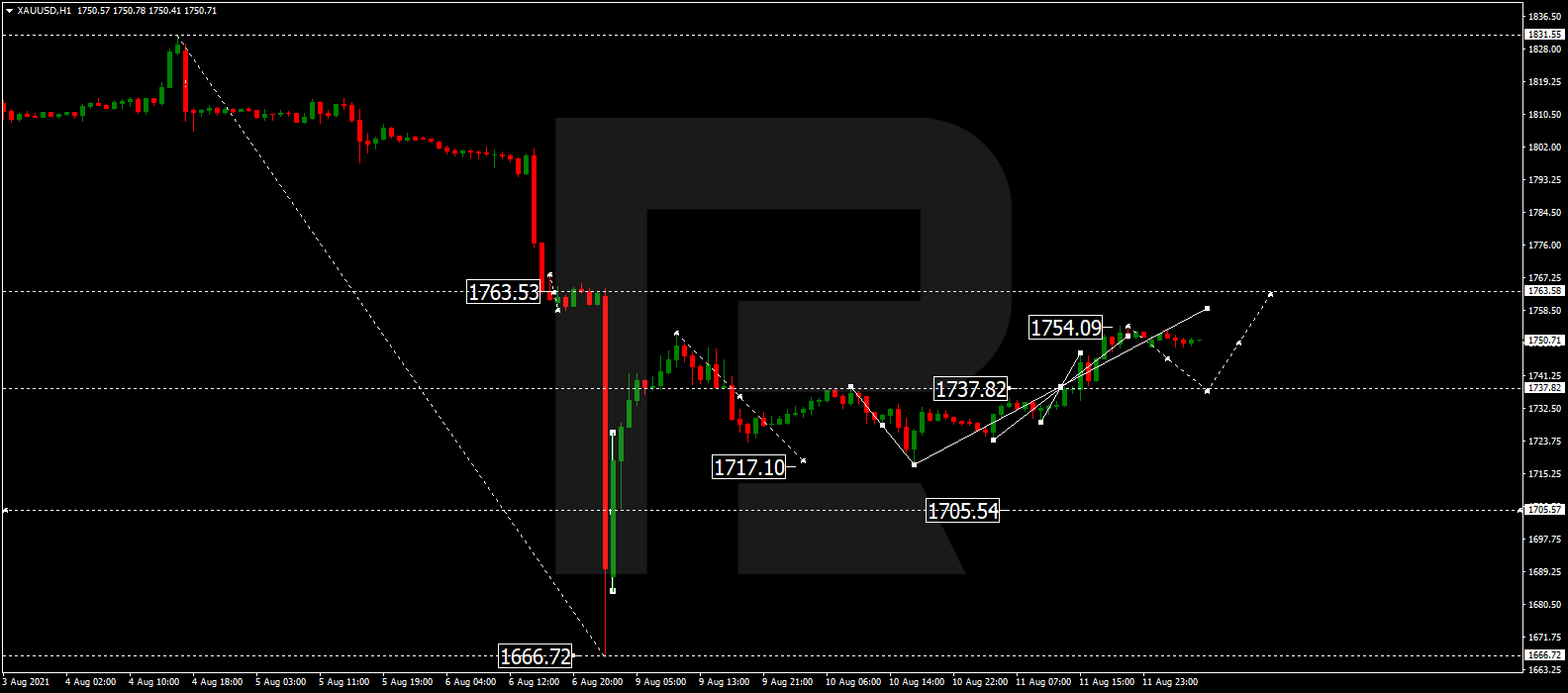

XAUUSD, “Gold vs US Dollar”

Gold has broken through 1737.82 upwards and suggests the development of the wave of growth to 1763.53. The structure of growth is looked upon as correctional. After this level is reached, we expect a decline to 1737.80. And after this one is also broken away, a pathway to 1700.00 should open.

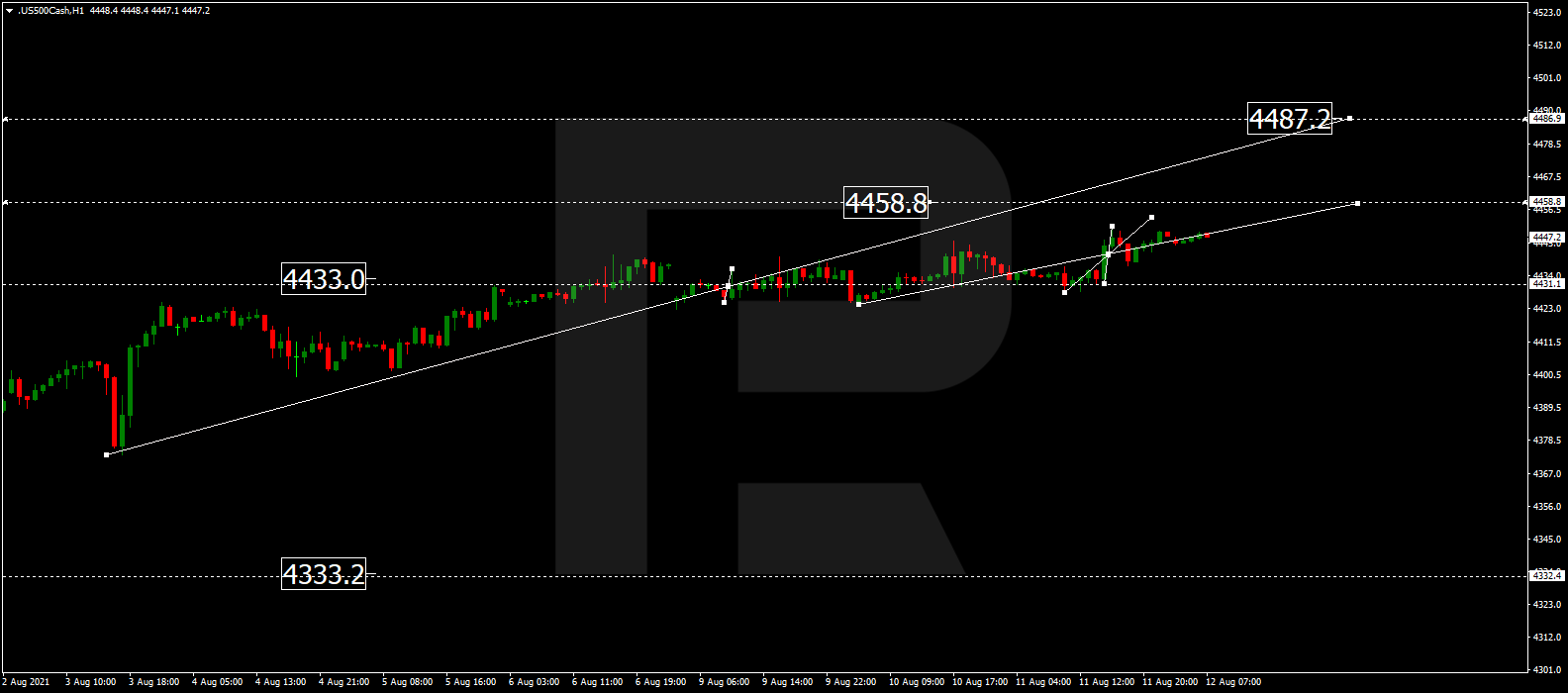

S&P 500

The stock index got supported at 4433.0 and extended the range to 4450.7. Today the market is trading at this high in a new narrow consolidation range. With an escape upwards, growth to 4500.0 might follow. With an escape downwards, the price might go down to 4433.0. And if this level is broken, the market might drop to 4000.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.