Forex Technical Analysis 2011/27/12 (EUR/USD, GBP/USD, USD/CHF, CHF/JPY) Forecast FX

26.12.2011

Forecast for December 27th, 2011

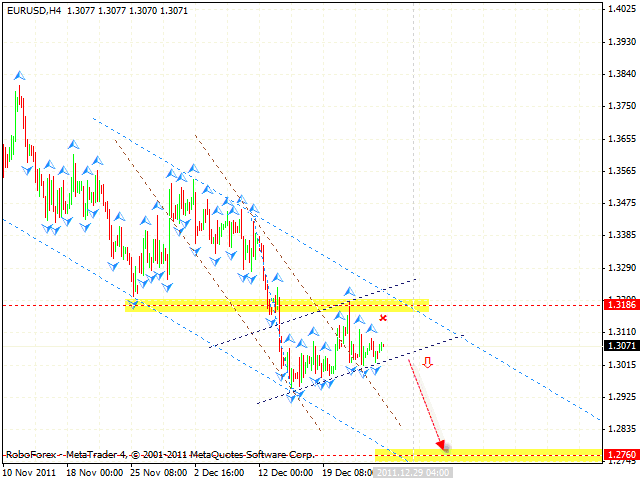

EUR/USD

The EUR/USD currency pair continues moving inside the descending pattern. We shouldn’t expect the price to make any serious movements on the New Year’s eve, however, one can try to sell the pair after the price leaves the rising channel. The 5th pivot point will be approximately formed on December 29th, but we can’t exclude the possibility that the price may break the channel’s lower border before this date. The target of the fall is the area of 1.2760. If the pair grows higher than 1.3190, this case scenario will be cancelled.

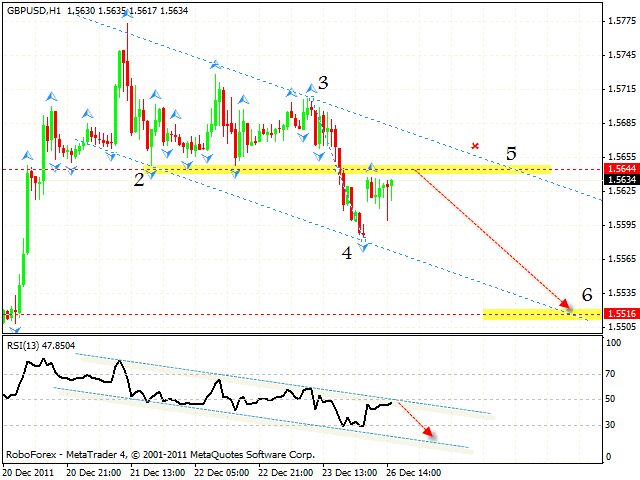

GBP/USD

Pound reached all the targets of “triangle” pattern. At the moment the price is forming the descending symmetrical pattern with the target in the area of 1.5516, one can consider selling the pair from the level of 1.5644. The test of the trend’s descending line at the RSI is an additional signal to sell the pair. If the price breaks the upper border and leaves the descending channel, this case scenario will be cancelled.

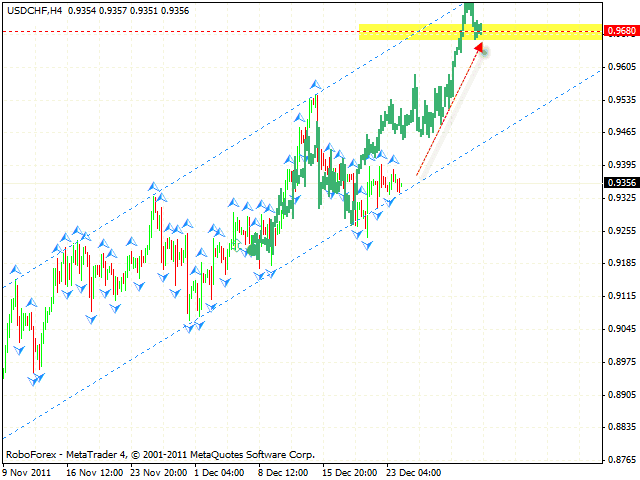

USD/CHF

Franc continues testing the rising channel’s lower border, one can consider buying the pair with the tight stop. The target of the growth is the area of 0.9680. We recommend you to increase the amount of purchases only after the price breaks the level of 0.9395. If the pair falls lower than 0.9255, this case scenario will be cancelled.

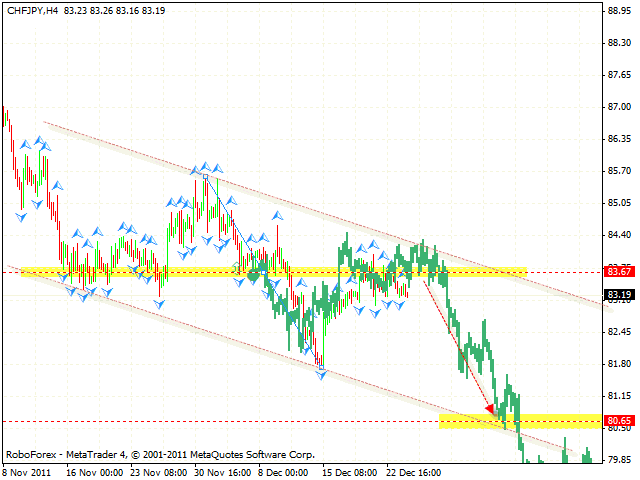

CHF/JPY

The CHF/JPY currency pair continues testing the resistance level. Judging by the price structure, we should expect the pair to fall down and test the channel’s lower border in the area of 80.65. If the price breaks the border, one can consider selling the pair. Currently one can try to open short positions near the level of 83.67. If the price breaks the channel’s upper border above 84.40, this case scenario will be cancelled.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.