Forex Technical Analysis & Forecast 15.01.2018 (EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, USD/RUB, GOLD, BRENT)

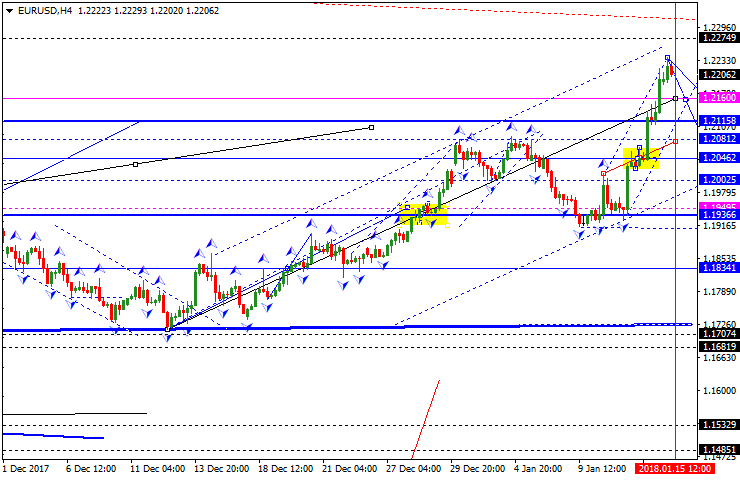

EUR USD, “Euro vs US Dollar”

The EUR/USD pair is moving upwards; it has completed the ascending wave. We think, today the price may consolidate at the top of it. Later, in our opinion, the market may break it downwards and then start another descending structure towards 1.1940. The first target is at 1.2081.

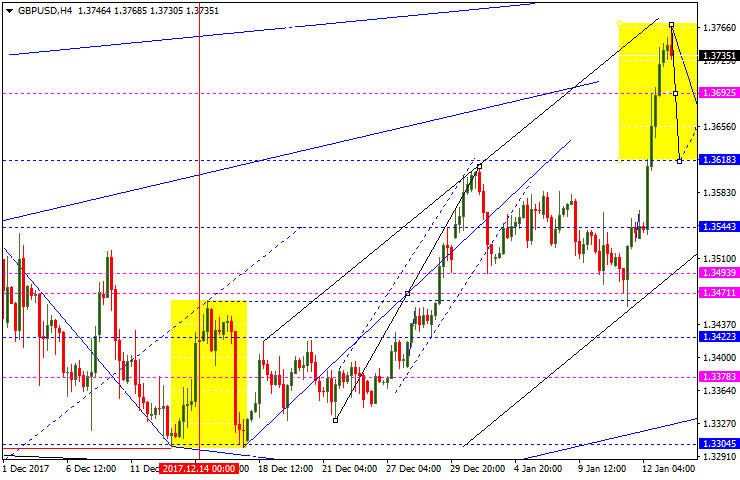

GBP USD, “Great Britain Pound vs US Dollar”

The GBP/USD pair is still moving upwards; it has reached the target of the five-wave structure. Possibly, today the price may form another consolidation range. In fact, the market is expected to form a new descending wave towards 1.3470. The first target is at 1.3618.

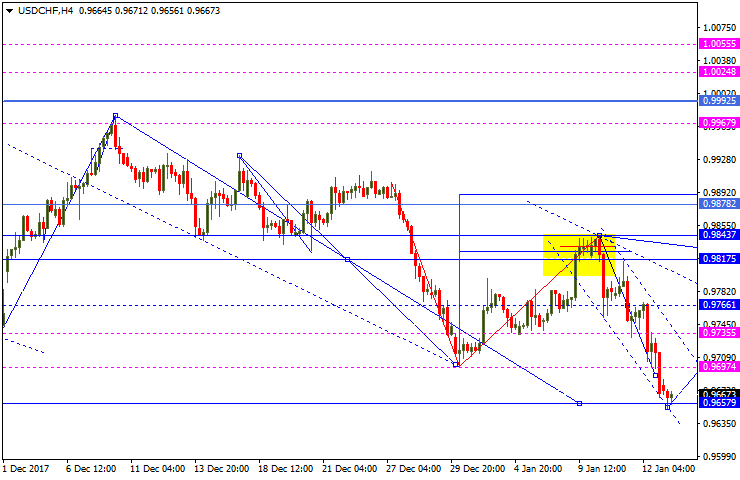

USD CHF, “US Dollar vs Swiss Franc”

The USD/CHF pair is trading downwards; it has almost finished another structure of the descending wave. We think, today the price may form another consolidation range at the lows and then start a new ascending wave towards 0.9817. The first target is at 0.9735.

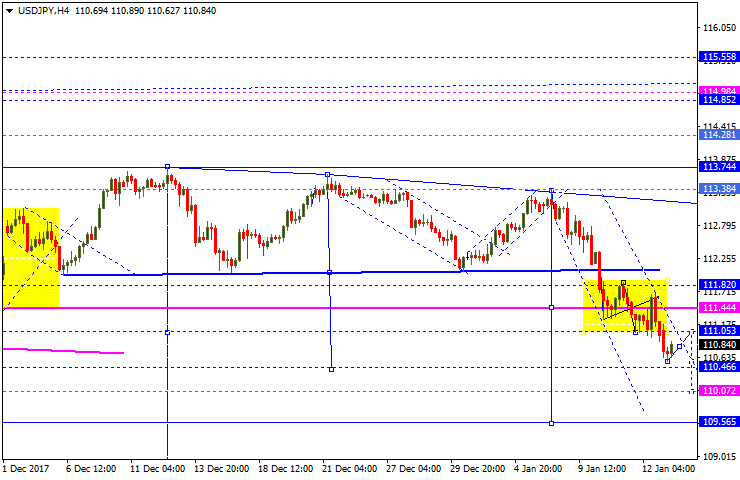

USD JPY, “US Dollar vs Japanese Yen”

The USD/JPY pair is moving downwards; it has broken another consolidation range to the downside. Possibly, today the price may grow towards 111.05 and then continue falling to reach 110.08.

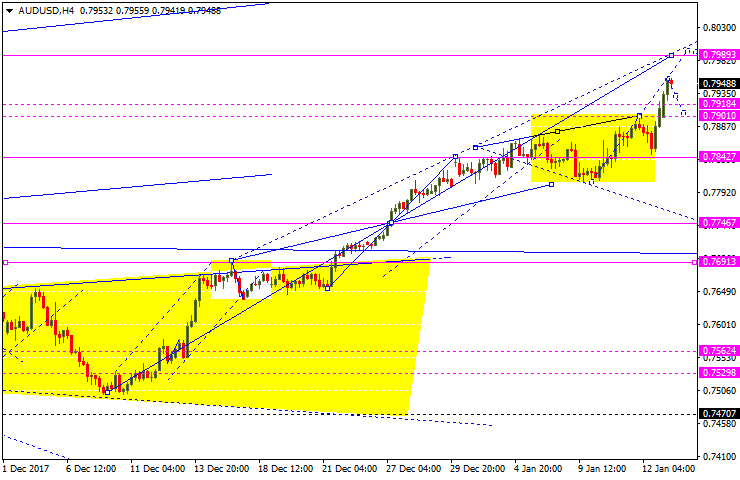

AUD USD, “Australian Dollar vs US Dollar”

The AUD/USD pair is trading upwards; it has broken another consolidation range to the upside. We think, today the price may fall towards 0.7900 and then form one more ascending structure with the target at 0.7960.

USD RUB, “US Dollar vs Russian Ruble”

The USD/RUB pair is moving downwards. Possibly, the price may reach 56.07 and then grow towards 56.35. After that, the instrument may fall with the target at 55.88.

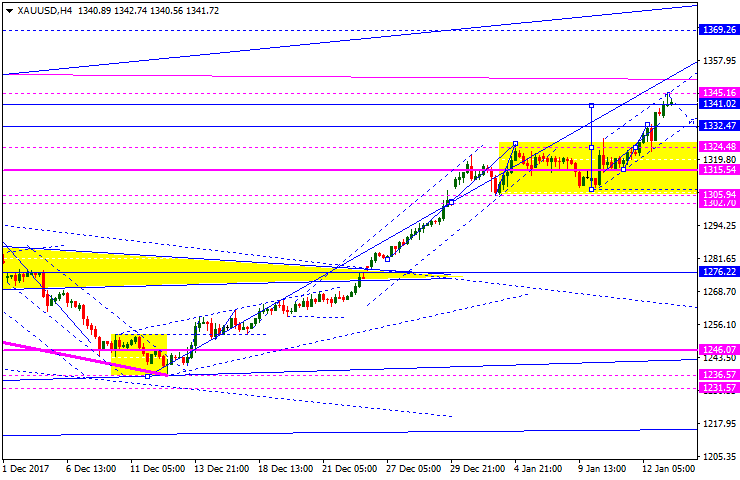

XAU USD, “Gold vs US Dollar”

Gold is moving upwards; it has expanded the consolidation range to the upside and reached the target. Possibly, today the price may fall towards 1324 and then grow to reach 1369.

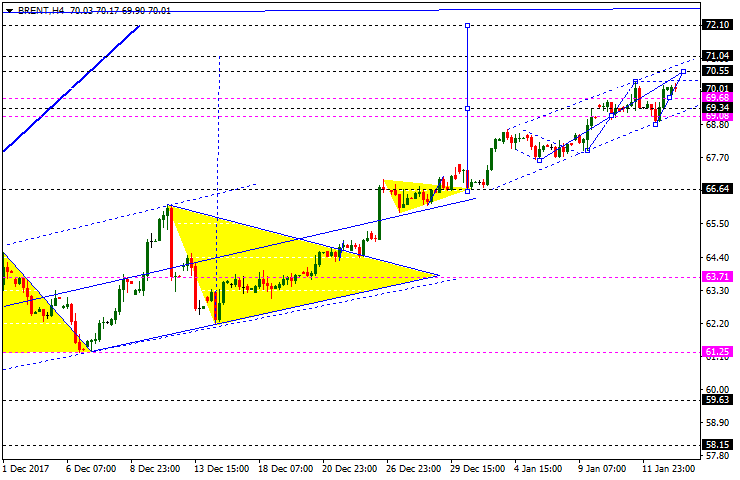

BRENT

Brent continues rising. Possibly, the price may reach 70.55. After that, the instrument may be corrected towards 69.65 and then continue growing inside the uptrend with the target at 71.70.

RoboForex Analytical Department

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.