Technical Analysis & Forecast 19.06.2023

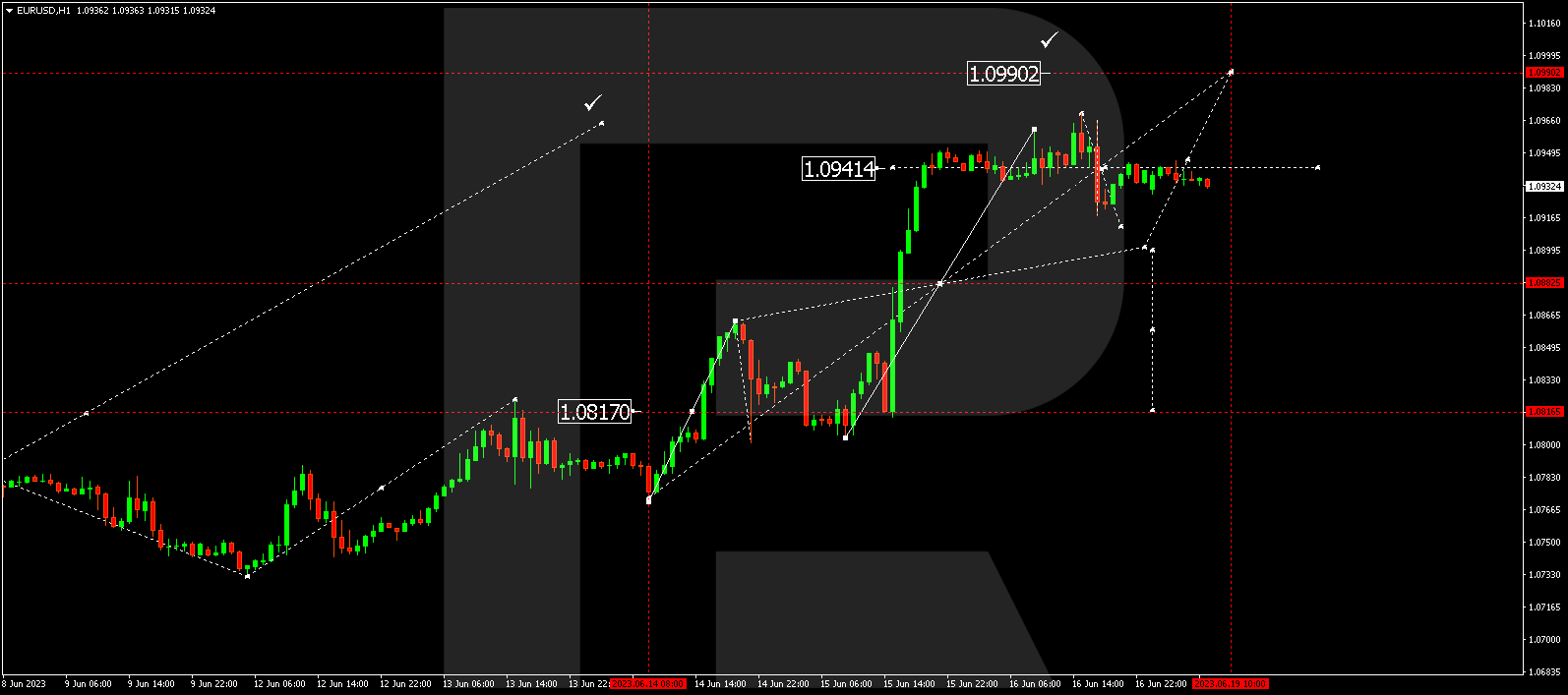

EURUSD, “Euro vs US Dollar”

The currency pair continues forming a consolidation range around 1.0944. Today the range is expected to extend downwards to 1.0910. Next, a rise to 1.0944 is expected (a test from below). If the price breaks the range downwards, the potential for a corrective decline to 1.0818 might open. With an escape from the range upwards, it could extend to 1.0990. Next, a decline to 1.0800 could follow.

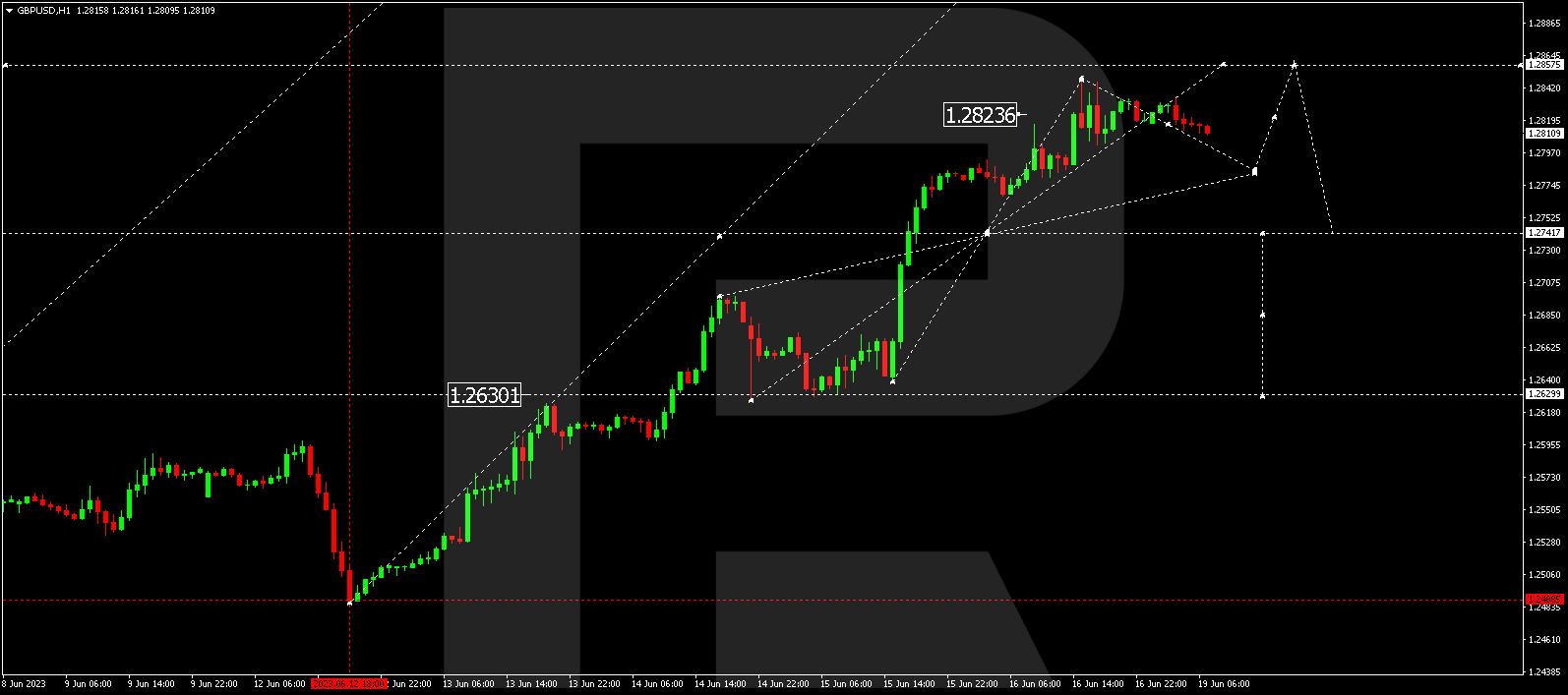

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair continues developing a consolidation range around 1.2823. Today the range could extend downwards to 1.2782. Next, a rise to 1.2823 could follow (a test from below). With an escape from the range downwards, the potential for a further correction to 1.2630 could open. With an escape upwards, a link of growth to 1.2857 is not excluded. Next, a drop to 1.2630 is expected.

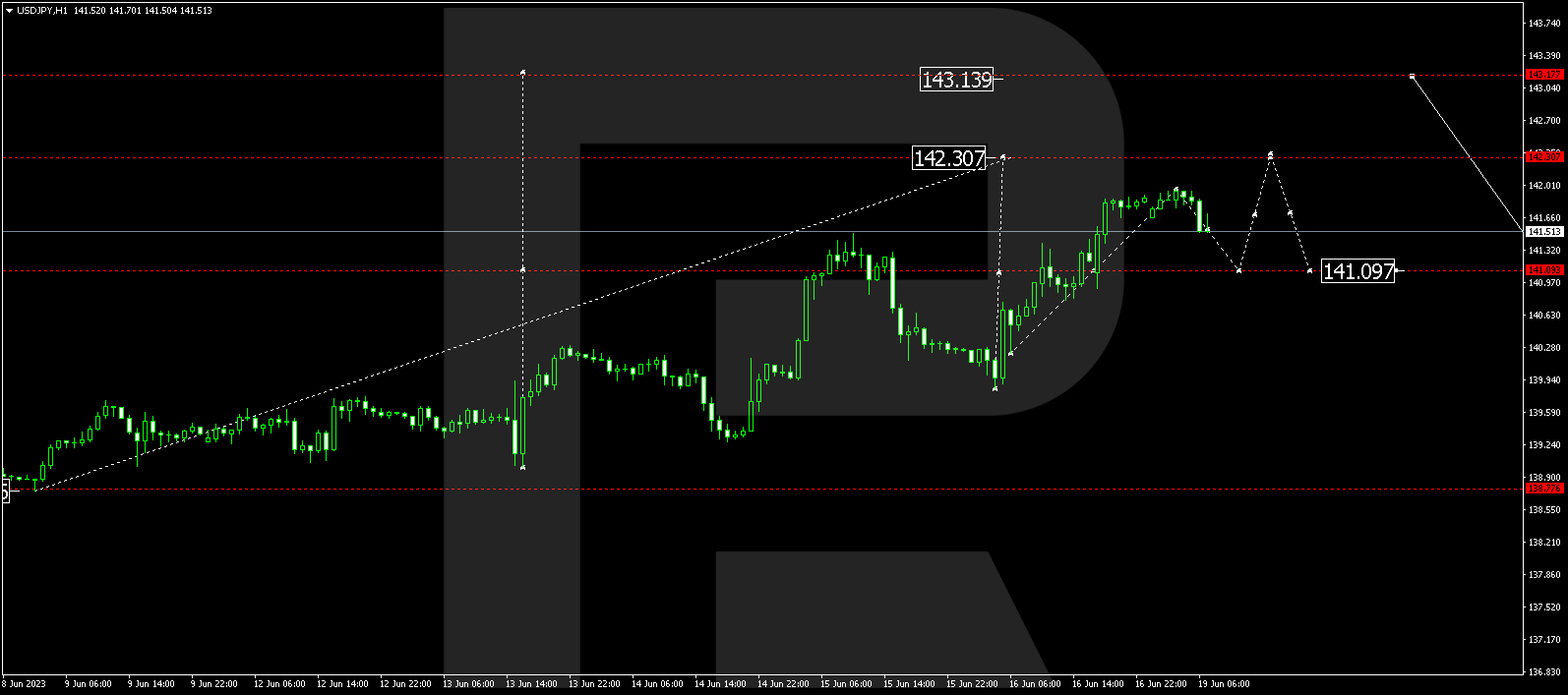

USDJPY, “US Dollar vs Japanese Yen”

The currency pair continues developing a consolidation range around 141.09. Today the market has extended it to 141.95. At the moment, a structure of decline to 141.09 is developing (a test from above). Next, a link of growth to 142.30 could follow. After the price reaches this level, a correction to 141.00 is expected.

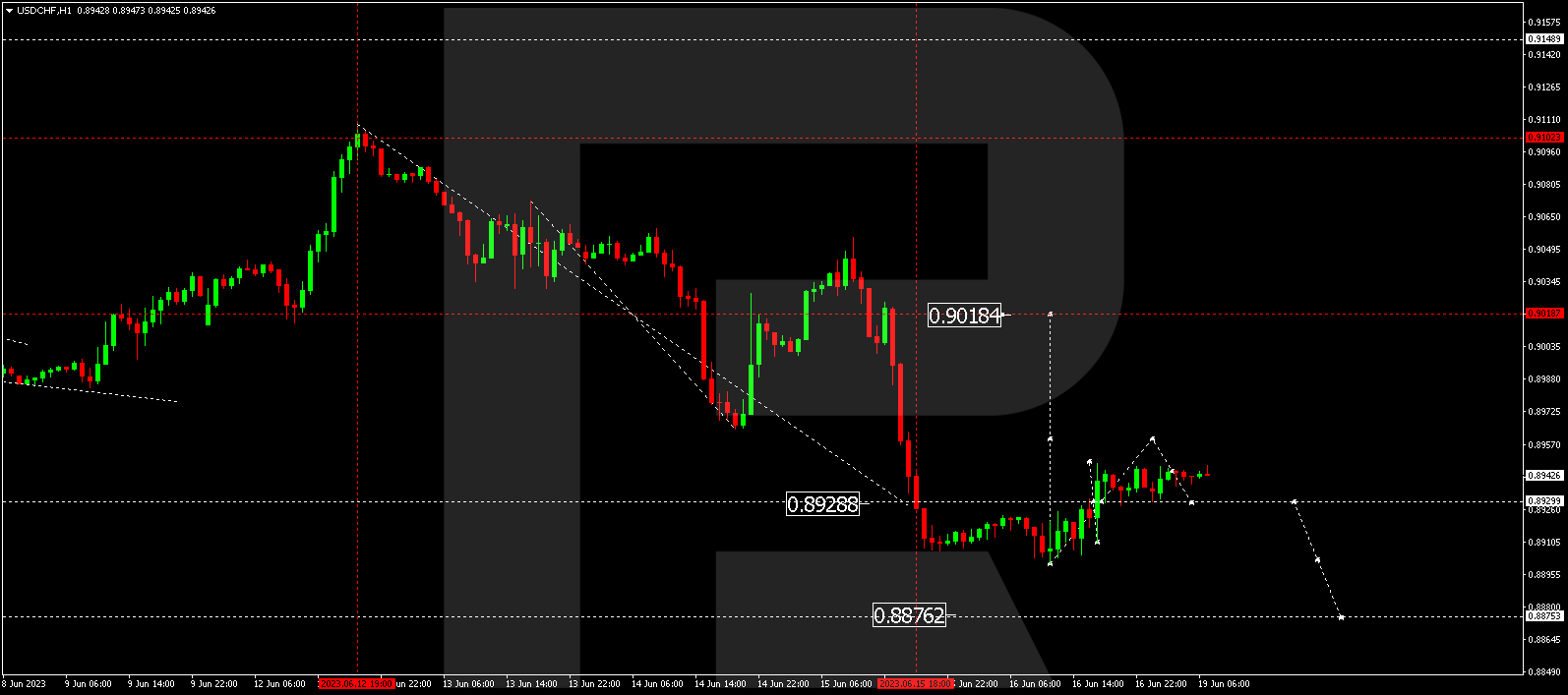

USDCHF, “US Dollar vs Swiss Franc”

The currency pair continues developing a consolidation range around 0.8930. Today the range is expected to extend to 0.8960, followed by a decline to 0.8930 (a test from above). With an escape from the range upwards, the potential for a wave of growth to 0.9019 is expected. With an escape downwards, a link of decline to 0.8875 is not excluded, followed by a rise to 0.9020.

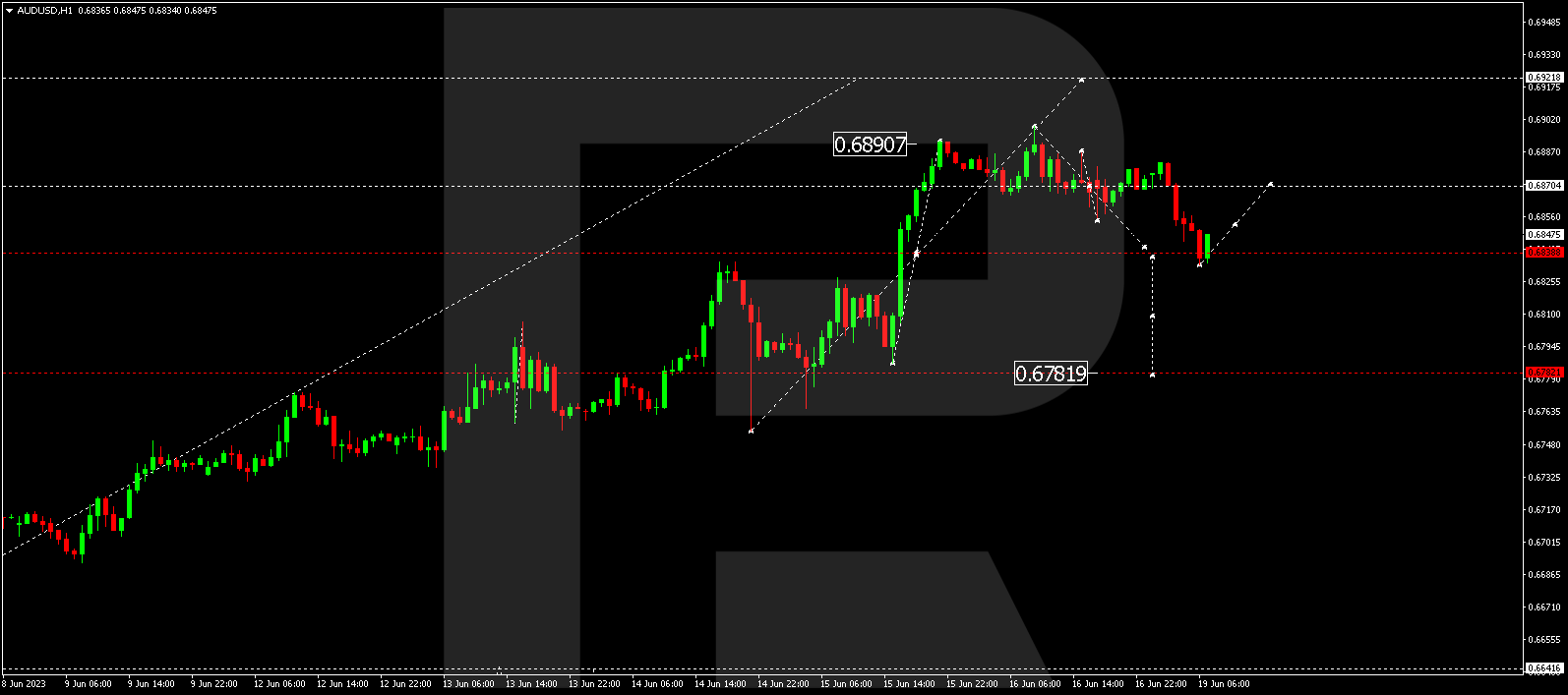

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has formed a link of decline to 0.6838. Today a rise to 0.6870 (a test from below) is expected. With an escape from the range downwards, the potential for a wave of decline to 0.6782 could open. Next, a new structure of growth to 0.6922 looks possible.

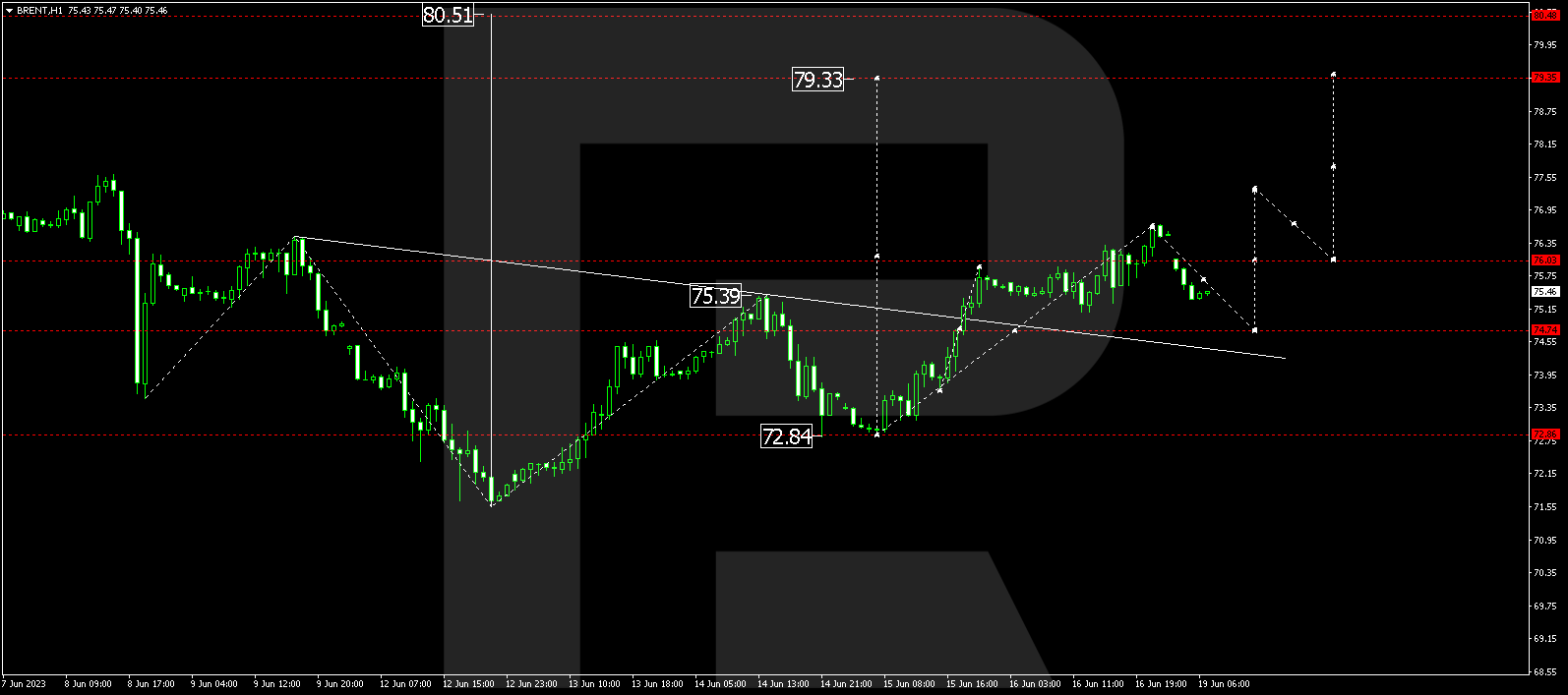

BRENT

Brent has completed a wave of growth to 76.66. Today a link of correction to 74.74 is not excluded. Next, a structure of growth to 77.55 could be expected, from where the trend might develop to 79.35. This is a local target.

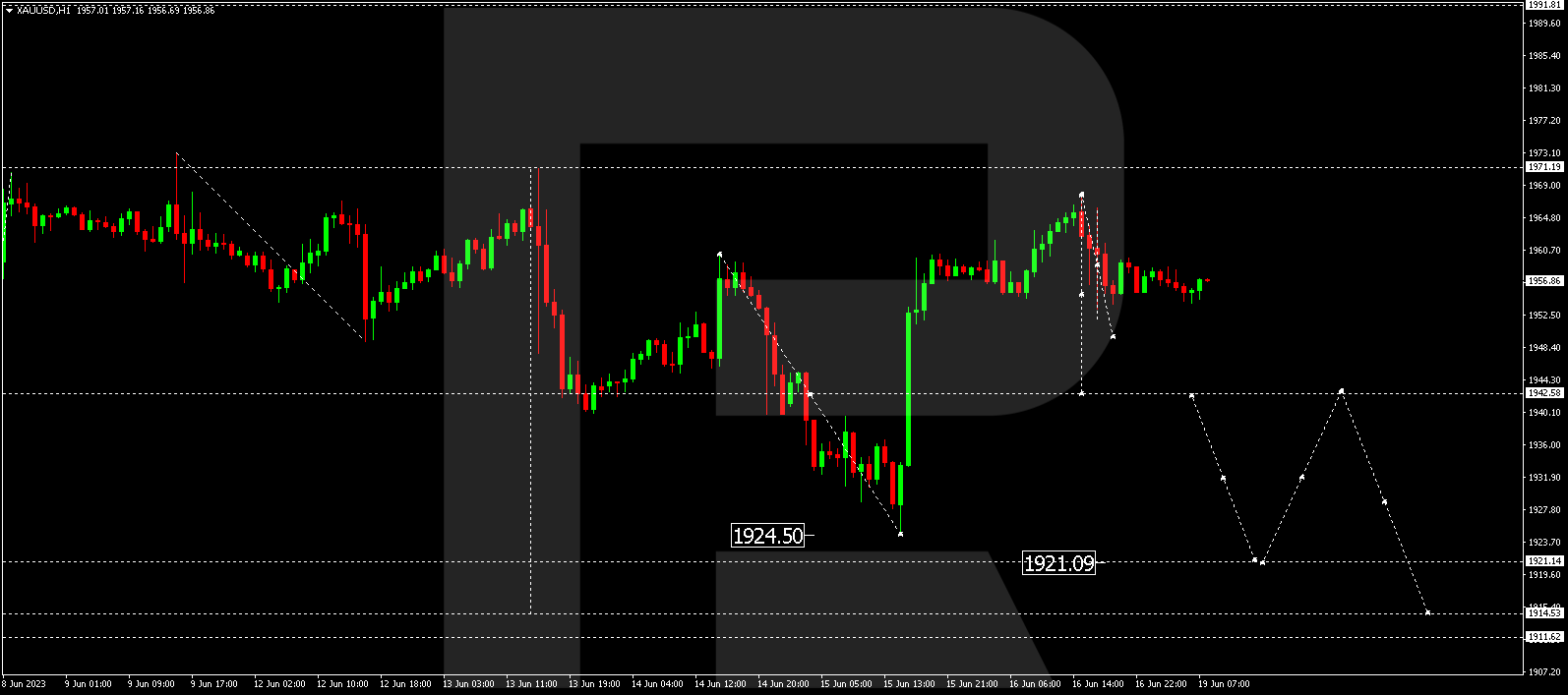

XAUUSD, “Gold vs US Dollar”

Gold continues forming a consolidation range around 1958.88. Today a decline to 1949.70 and a rise to 1958.88 (a test from below) might follow. With an escape from the range downwards, the potential for a wave of decline to 1921.09 could open. And with an escape from the range upwards, a link of growth to 1971.20 is not excluded, followed by a decline to 1921.09.

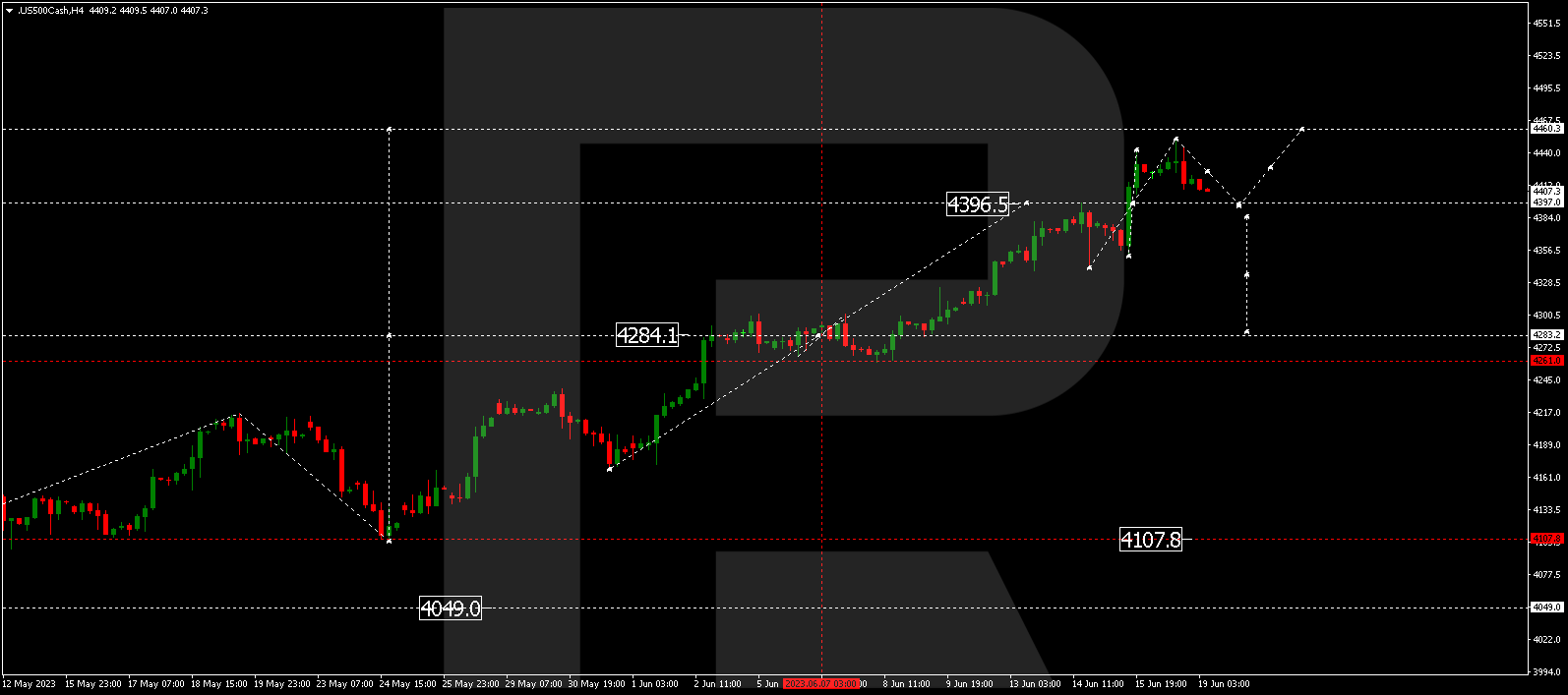

S&P 500

The stock index continues forming a consolidation range around 4396.5. At the moment, the market has extended the range upwards to 4451.4. Today a link of decline to 4396.5 is expected (with a test from above). With an escape from the range upwards, a link of growth to 4460.2 is not excluded, followed by a decline to 4282.0. This is the first target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.