Forex Technical Analysis & Forecast 26.05.2017 (EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, USD/RUB, GOLD, BRENT)

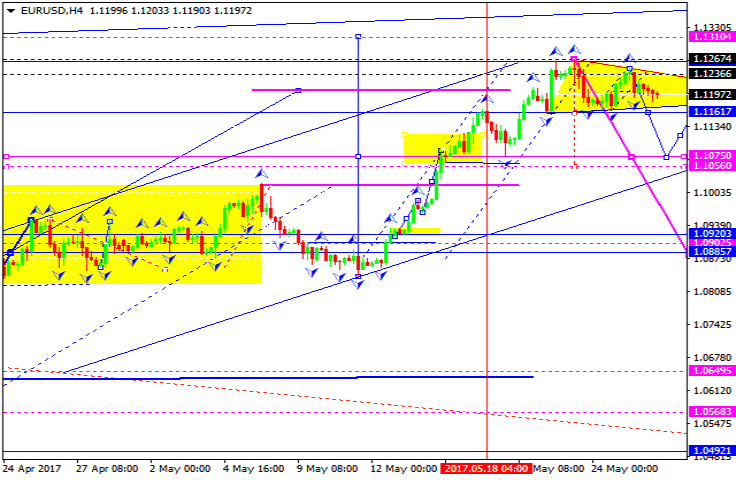

The EUR/USD pair is trading within a yet another descending structure. A consolidation "triangle" has been formed. For today, we'd consider a possible downside move towards 1.1162. Then a consolidation range can be formed. If the pair brokes down, a 3rd descending wave towards 1.1075 can be expected.

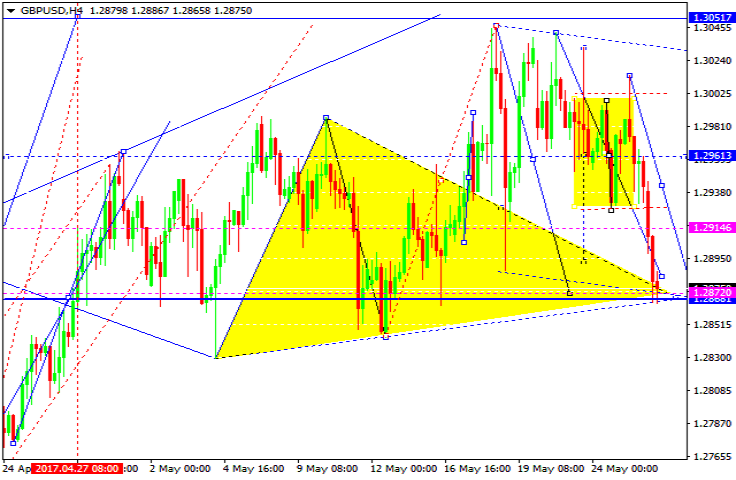

The GBP/USD pair has worked out its descending potential in the form of a correction move. For today we'd expect a consolidation range to be developed on the current lows. If price breaks down, the correction can move further towards 1.2700. An upside breakthrough will mean a possible growth towards 1.2960.

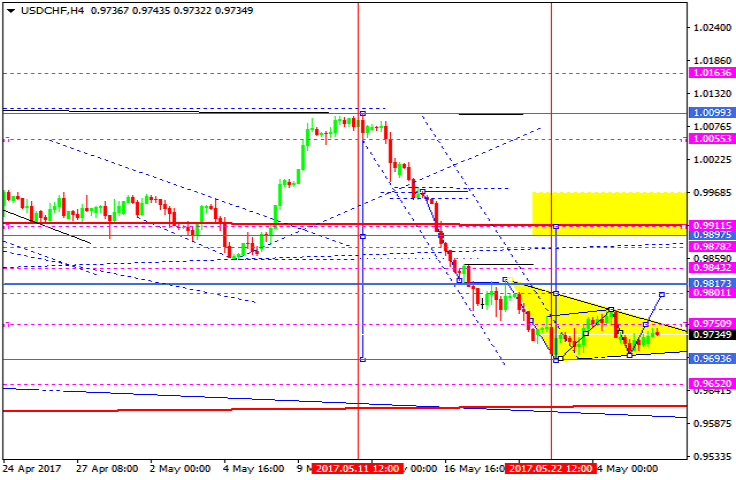

The USD/CHF pair is trading within a consolidation range. Practically, the market has formed a "triangle". For today, we'd consider a possible breakthrough and growth towards 0.9800. Then the pair can possibly form a new consolidation range. If this range is broken through upwards, the 3rd wave at 0.9895 can occur.

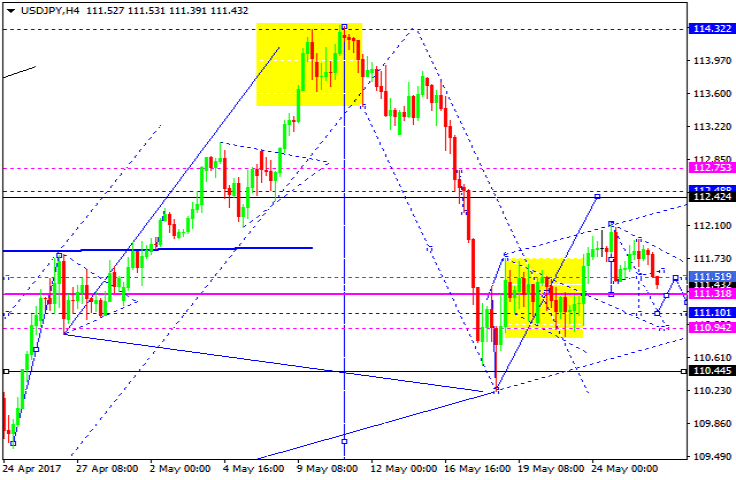

Today, the USD/JPY pair is trading within a correction move to reach the 110.94 level. For today, we'd consider a move towards 111.10. Then the pair can possibly rise to 111.52. Then it can lower to reach the said target.

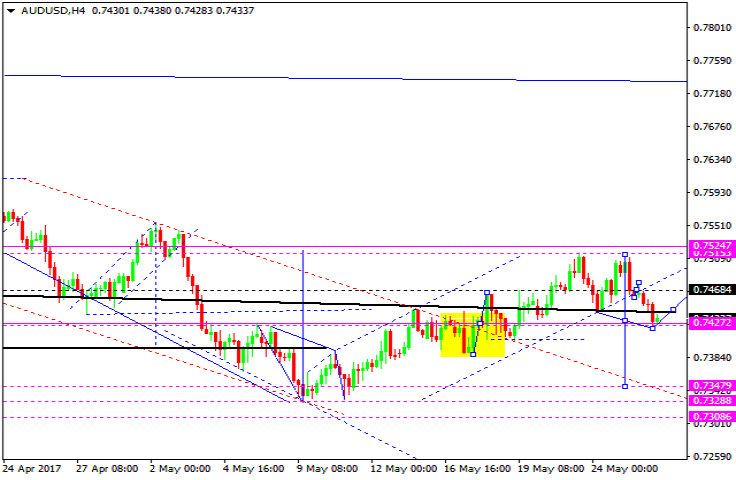

The AUD/USD has worked out its descending wave. For today, we'd expect the pair to rise to 0.7468. Then price can move downside to reach 0.7350.

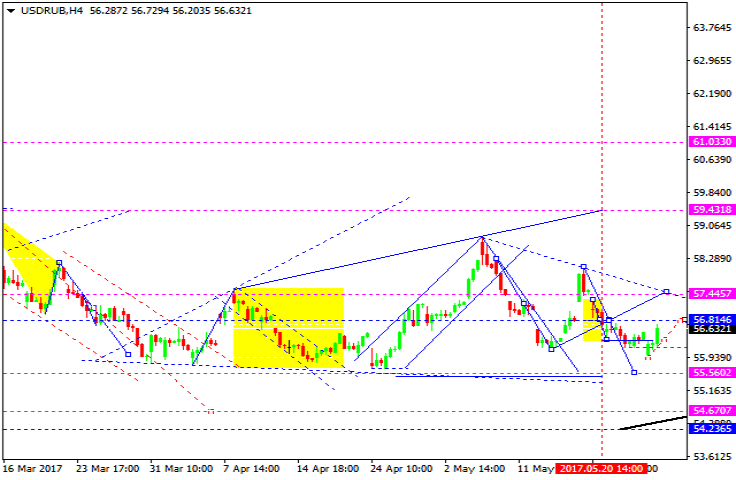

The USD/RUB pair is trading within a correction move towards 56.81. For today, we'd consider a correction to reach this level. A leg of growth to 57.40 can be expected. Then price can move lower to 55.50.

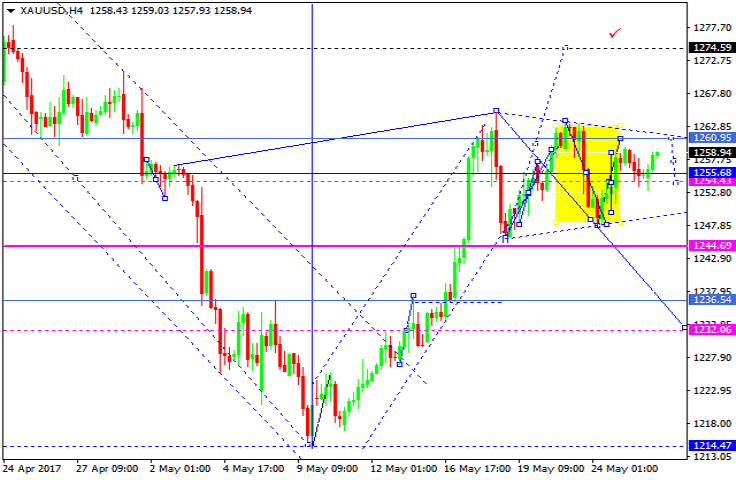

Gold is trading within the ascending move to 1260.95. Then the pair can move downwards to 1255.68. Practically, the market is being traded within the consolidation "triangle". If it breaks the range upwards, a rise towards 1274.60 can happen. If the lower edge of the range is broken, price can move to 1236.54.

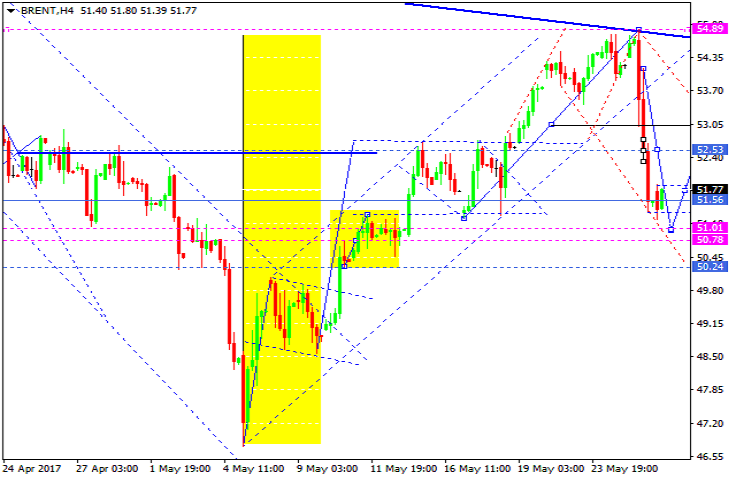

Oil continues to develop a correction move. For today, the market has worked its target for descending. Then the price can rise towards 52.50 level. After that, the fifth correction to 50.80 can be expected. And then - a rise towards 55.60.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.